US GDP, Bonds: It’s a Bubble, Records, Earnings, SMSF Revolution, and why did fund managers miss the rally?

Last Night's Markets

US GDP

Bonds: It’s A Bubble

The Record High

Earnings Season Preview

An SMSF Revolution

Why did fund managers miss the rally?

Boris and Bob

Research and Diversions

Ask Alan

Next Week

Last Week

Last Night's Markets

| Name | Price | % Change |

|---|---|---|

| Dow Jones Industrial Average | 27,192.5 | 0.19% |

| S&P 500 | 3,025.61 | 0.74% |

| Nasdaq Composite | 8,330.21 | 1.11% |

| The Global Dow USD | 3,104.67 | 0.31% |

| Gold | 1,416.40 | 0.15% |

| Crude Oil WTI | 56.15 | 0.3% |

| Australian Dollar / US Dollar | 0.6909 | - 0.42% |

| Bitcoin / US Dollar | 9,842.16 | - 0.35 % |

| U.S. 10-Year Bond Yield | 2.074 | - 0.1% |

US GDP

The headline number for America’s June quarter GDP, released last night, came in at 2.1%, better than the expected 1.8%.

“Not bad”, tweeted Donald Trump, “considering we have the very heavy weight of the Federal Reserve anchor wrapped around our neck. Almost no inflation. USA is set to Zoom!” “Underwhelming”, said a Democrat on the Congressional economics committee.

Economists quoted in the media generally said that it justifies a 25bp cut in rates by the Fed next week, but that the chances of a 50bp cut receded. The US dollar rose a bit.

If you look deeper into the numbers they are even less whelming than at first sight.

Government spending jumped at an annual rate of 5%, which is the strongest since the second quarter of 2009, when the Government was trying to pull the economy out of the deepest recession since the 1930s.

The only other thing to have expanded in the June quarter was real consumer spending, up 4.3% annual rate. But that was mostly due to a surge in credit and a reduction in savings, which means it’s unlikely to be repeated.

Together consumer spending and government grew 4.4% while the rest of the US economy – housing, non-residential investment, business capital expenditure, net exports and inventories - contracted at an annual rate of 12.1%!

Also GDP in 2018 was revised downwards: Q4 from 2.2% to 1.1%, Q3 from 3.4% to 2.9% and Q2 from 4.2% to 3.5%.

The other thing to note is that the Purchasing Managers Index (the key manufacturing indicator) fell from 50.6 to 50, which is the cut-off between expansion and contraction. Here’s what it looks like on a chart:

.png)

So “set to zoom”? No, just another empty Trumpism. One thing President Trump was right about: almost no inflation. The core deflator rose at a 1.8% annual rate and 1.5% year on year. Each of the last four or five quarters has seen inflation grind lower.

So the narrative of a weak US economy was reinforced by last night’s data. Next week the Fed will join 18 other central banks around the world, including the RBA, by cutting interest rates from not much to even less.

Bonds: It’s A Bubble

The All Ordinaries breaking above the previous record high set on November 1st 2007 was not the only new record set this week: the Australian 10-year bond yield also fell to a record low around the same time.

These two things are not correlated. Rising share prices predict economic growth and rising corporate earnings, falling bond yields predict the opposite, or at least they are supposed to.

It’s not just happening here of course. The stock of global debt yielding less than zero hit a new record of US$13.74 trillion yesterday. The US 10-year bond yield went below 2% early this month, but has since recovered to 2.07%.

Austria has just sold some 100-year bonds at a yield of 1.17%, which is pretty gob-smacking (investors apparently don’t think interest rates will rise for a 100 years), and its tranche of 5-year bond sold for a yield of minus 0.435%.

In general, developed world bonds are yielding less than 1% on average and seem headed back to the 2016 lows.

.png)

Two possibilities:

- The world is heading into a once-in-a-century economic storm.

- It’s the blow-off top of a bubble.

It’s a variation on the old “are bonds or equities right?” question.

Without wanting to dodge the question, I think they’re both right (and wrong). Equities are probably too optimistic, and bonds are definitely in a bubble.

I mean, the behaviour of the bond market is typically bubble-ish: investors are coming with all sorts of reasons to justify holding negative real yielding bonds, including that some other sucker will pay more for them later, that they are needed for safety, that the cycle is dead and inflation will never rise again, that it’s different this time.

If I’m right, and the bond bubble bursts at some point, money will rush into equities. It’s already happening to some extent as a result of the “hunt for yield”, but a reversal of the flight into bonds would turn that into a stampede.

The trouble with talking about bubbles and predicting their end is that, as John Maynard Keynes, said: “markets can remain irrational longer than you can remain solvent.” In other words, bubbles usually last longer than you expect.

Also there are good reasons for thinking that growth will slow and that low interest rates are justified:

- Debt is at record highs, clogging up economic systems;

- Trade is declining as the US and China go at it in a trade war that is the tip of a great technology rivalry iceberg;

- The car industry is hitting structural problems because of emissions and electrification;

- China is deleveraging;

- The transition to renewables is disrupting the energy sector.

In the long term I think ultra-low interest rates are doing enormous damage, effectively destroying the time-honoured principle that capital provides its owner an income, without having to speculate.

One of the foundations of capitalism is that money has a time value as well as a risk value – that you can get an income from it by handing it over without risk for a fixed period.

Every year that goes past where the owners of capital have to increase the level of risk – to speculate - in order to get a return is doing damage to the structure of capitalism.

This can’t be good.

But on the other hand, as I wrote in this morning’s Australian, central banks have abolished recessions and bear markets to protect their independence.

No one talks about that, but central banks all have mandates to pursue low inflation (which they have decided is 2-3%) and full employment – not low unemployment, but full employment.

On Thursday, the European Central Bank kept its deposit rate at minus 0.4% but clearly flagged that it would be cut further next month. The Fed, according to markets, is an 84% chance to cut rates by 0.25% next week and a 16% chance to cut by 0.5%.

And the RBA Governor Philip Lowe made it clearer still this week that another rate cut or two is coming in Australia. Westpac’s Bill Evans says the cash rate will be 0.5% by February and that the RBA will support this with cheap loans to banks to make sure the cuts are passed on in full.

Each of these central banks is focused on something a bit different.

The RBA reckons the economic fundamentals are strong, but it wants to get inflation up to 2%; the ECB is battling depression and deflation – “Japanification”; and the Fed is trying to hold up the stockmarket.

Central bank independence is usually regarded as a force for toughness, since it’s the politicians who always want interest rates to be lower. In fact, it seems to me to be working the other way, as they attempt to preserve their independence.

Anyway, whatever the motivation, both the markets and central banks turned the corner when Mario Draghi said in 2012 that he would “do whatever it takes” to preserve the euro.

That, as it turned out, meant preserving the stockmarket. Likewise in January this year when Jerome Powell burned some rubber at the Fed and turned it 180 degrees around so the stockmarket would stop falling.

As I’ve been writing here, it means we are in a situation where economic growth – low as it is – is accompanied by zero or negative real interest rates. In other words, both earnings and multiples are being supported.

The Record High

Excuse me if I don’t leap for joy. The new All Ords high point again just means the capital return since November 2007 has been precisely zero. The average total market return over those 12 years has been 4.9% p.a. – that is, the dividends only.

Here’s a chart of the ASX200 index and the ASX200 accumulation. The latter is up 74%.

.png)

Zero capital growth is the definition of a bear market, so you could actually say the Australian stockmarket has been in a 12-year bear market, just as the US market is sometimes regarded as having been in a bear market from 2000 to 2013, when it finally made new highs before doubling over the following six years.

Will our market now double? Nah. But it could do better than America’s.

The technology stocks that have powered the US market are now under a lot of regulatory pressure and they are all priced for perfection, which may be harder to achieve now.

Meanwhile, the banks and miners that dominate our market have got some tailwinds, in the form of record-high iron ore prices and low interest rates.

Earnings Season Preview

The consensus expectation for FY19 earnings growth has come back from 4.7% after the February interim reporting season to 1% now, which is not very challenging.

The difficulty might be FY20 expectations, currently sitting around 8% earnings growth, with industrial average PEs at a decade high 17.5 times on a 12-month forward basis.

That means there is not much room for slippage in the forward guidance statements in the final profit reports that come out over the next month or so, so only the potential for downside surprises about that.

The potential for upside surprises I suspect will come from capital management – that is, dividends.

The election result has refocused investors and companies on franking and two rate cuts have rekindled the hunt for yield. Companies wanting to offset the effect of soft FY20 profit guidance will do it with cash … dividends that is.

The thing to watch will be first, FY20 guidance and whether DPS (dividend per share) bumps up against EPS (earnings per share).

An SMSF Revolution

The industry fund, HostPlus, has quietly kicked off a revolution in the way SMSFs are managed.

Earlier this month HostPlus “soft-launched” a series of six what it calls “Self-Managed Invest” options that give SMSFs direct access to its pooled superannuation trust.

I wouldn’t normally give such a plug to another investment firm, even if it is a not-for-profit, but I think what HostPlus is doing is a very big deal.

For a start, HostPlus is one of only a few industry funds that use a pooled trust structure instead of just pooling the assets in the super fund. It means its super fund owns units in the trust, not the portfolio assets.

It might sound like a small difference, but it was done so that external SMSFs could eventually also be given access to the same assets, which has now been done.

As CEO David Elia said: “Put simply, Hostplus’ SMI options enables SMSFs investors to pool their funds with ours, as unitholders in some of our most popular and well-performed investment options, through our Pooled Superannuation Fund (PST) structure.”

The six options launched this month are: balanced, index balanced, diversified infrastructure, diversified property, Industry Super Property Trust (ISPT) and Industry Funds Managed (IFM).

It’s the last of those that is potentially the biggest deal. IFM is a global infrastructure investor with an extraordinary performance record: 11.61% p.a. over 20 years, and 12.6% in the latest financial year (to June 2019).

Up to now, IFM has not been available to SMSF investors, either through advisers or direct. It’s only been open to its super fund owners. Now HostPlus has become the first industry fund to open up access to IFM to external investors. In two weeks, with no publicity at all, it has $34 million and 15 applications per day.

The investment fee for the IFM option is 42 basis points. HostPlus’s administration fee is a flat amount of $165 per year. In addition to that there are indirect costs of 15 basis points.

The investment fee for the index balanced SMSF option is near enough to zero – 2 basis points. Indirect costs are 5 basis points, for a total of 7, plus the $165 a year admin fee.

Basically, industry funds are starting to bring their investing power and low fee structure to bear beyond their own funds, to attack the adviser-led SMSF sector and the private fund managers.

HostPlus has 23 investment options in its PST and it sounds like they are going to eventually open up the other 17 to SMSFs as well.

Other industry will no doubt follow suit. Money is going to pour into IFM and the industry funds, and out of other fund managers, probably led by independent financial advisers trying to get their clients investment fees down and fulfil their “best interests” duty.

As I said, this is a big deal and has a long way to run.

Why did fund managers miss the rally?

There was an important question at the start of my #AskAlan session on video on Thursday:

“Sue: Hi Alan, this time last year I decided to give some very successful fund managers a go with a small part of my SMSF. So, WAM, FGX, Munro Global, Bennelong Concentrated Australian Equities Fund, Mirrabooka - all failed. However Loftus Peak made a small gain. Fortunately my ETF in the ASX 200 performed brilliantly. So my SMSF still has had a good year. Why did the funds perform so badly when the ASX did so well?

So I made some phone calls. Turns out a lot of fund managers went into their defensive shells in December, bruised and battered by the 20% correction from October.

As a result they missed the huge rally that started in January when the Fed did its about-face and moved to an easing bias, from tightening bias that was driven home in October and which caused the correction.

I think it’s fair to say that they are now mostly fully invested again, hoping like hell they haven’t bought into a cyclical top.

That’s the thing about index investing – you don’t miss the general market rallies by being under-invested (you don’t miss the corrections either, of course).

Boris and Bob

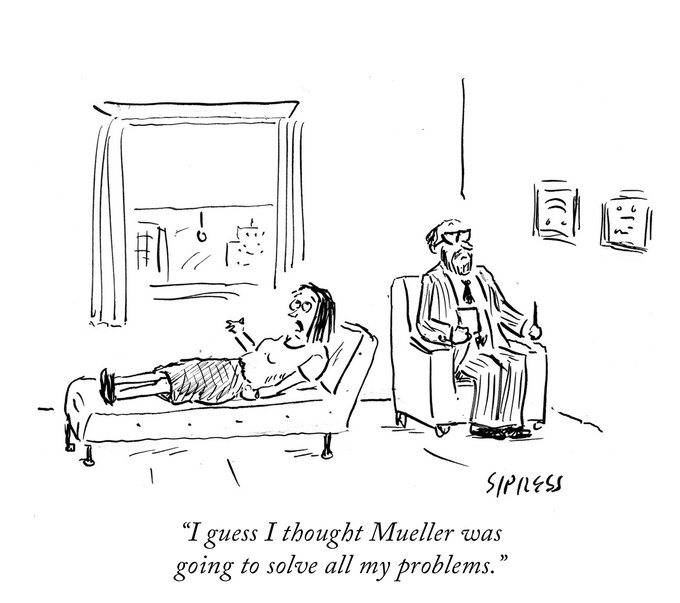

At about the same time as Boris Johnson was bowing to Queen Elizabeth before standing at the Prime Ministerial lectern outside Number 10 Downing Street, Robert Mueller was giving his much-awaited testimony to two US congressional committees.

I watched as much of both as I could, momentous events as they are.

Boris gave what amounted to a pep talk, a final quarter gee-up by the new coach, while Bob, in a sense, reinforced his failures. He failed to exonerate Trump when he should have (on collusion), and he failed to nail him where he deserved it (on obstruction).

The link between Boris and Bob is that in both the US and UK, the administration/executive is on a collision course with the Congress/Parliament.

In preparation for the ascent of Boris, the British Parliament passed a law designed to prevent him from unilaterally exiting the EU without a deal. So his declaration at the lectern that Brexit will happen on October 31, come what may, on top of his appointment of a Cabinet consisting entirely of Brexiteers, is essentially a declaration of war against Parliament.

In America, it’s about impeachment, and although the Democrats don’t seem to have the stomach for that, or at least their leader, Nancy Pelosi doesn’t, there is at least a Cold War going on. Maybe they’ll get to an impeachment proceeding, the divisions on both sides of the Atlantic are deeper than they have ever been.

Who wins? And what does it mean for investors?

Goldman Sachs has revised the chance of a no deal Brexit up from 15% to 20%, so more likely, but still not very likely, and bookmaker Paddy Power has it at 23/1. So the punters are predicting that Parliament wins, at least in the short term.

The chances of a 2019 election instead are higher – 40%, according to Goldman, 7/1 according to Paddy Power.

This leaves intact my call that Britain is a buy – that is, the pound is likely to strengthen, because it is deeply undervalued because of the Brexit and political uncertainty:

.png)

In the US, unless something surprising happens, Trump is going to win the 2020 election, so Congress loses – or rather the Democrats lose and Republicans win.

I think this is mainly because of immigration and abortion. The Left worldwide, including Australia, simply haven’t got their heads around the problem of how people smugglers are subverting the global refugee processes.

I said this to a refugee advocate I was sitting next to at lunch the other day, and he replied that the issue is the over-use of the word “illegal” – that people who cross a border seeking asylum are not illegal entrants until it has been properly determined whether they are refugees or not.

That’s true, but refugee processing is being overwhelmed by those who pay gangsters to get them across the border, or provide a boat to get them across the Mediterranean.

Anyway until the Left comes to grips with this, they won’t win. The Australian Labor Party has, but mucked up the election by promising to increase taxes, something the US Democrats are also promising to do, just to make doubly sure they lose next year.

In the US there is the extra layer of abortion. American Christians are holding their nose and voting for Trump because they want a conservative Supreme Court that will overturn Roe V Wade.

That’s probably an over-simplification, but this seems to be at least a part of the complex set of things that brought Trump to power and is likely to keep him there.

Research and Diversions

Research

Something terrifying is happening: the Arctic is burning. “Many of these fires have been burning since the start of June. As permafrost melts, large tracts of peat are unearthed. Fire ignites the peat, which burns down into the soil, stoking the blaze for months. In turn, this process releases enormous amounts of carbon dioxide into the atmosphere; since 1 June, around 100 megatonnes have been emitted into the surrounding environment – equivalent to the entire yearly emissions of Belgium.”

Boris Johnson was a plan that was years in the making.

“Brace yourself, Britain, for a long stint of bad government under Boris Johnson. Our new PM can be unfit for office but effective at staying there.”

Paul Taylor (Fidelity International): Aussie equities are the standout asset class. “I was actually really surprised how positive I was on the outlook for the calendar year 2019, and that wasn't because the world looked rosy, or things looked great, or earnings growth was coming through strongly, it was really based on expectations, expectations were so weak. You know, the outlook was so weak, I just thought, well, the market doesn't have to do much to actually deliver quite good returns.”

How to generate income without equity risk. “People living on income from their savings face with an uncomfortable truth. Any investment that is not a short-term bank deposit or government-guaranteed bond carries added risk. The TANSTAAFL, better known as ‘there ain’t no such thing as a free lunch’, is the reality of investing in a low interest rate world.”

Who is going to manage and control rooftop solar, batteries and electric vehicles? “Australia (will) lead the world in the switch away from the traditional centralised system, based around large coal and gas plants in Australia, to a more decentralised system.” But how will it run?

Facebook is a new kind of power. “This no longer resembles the power of a company monopolising a particular sector of the economy: Facebook is stretching into completely new territory, unrelated to its original product, with apparent plans to dominate that too. But the government analogy is not right either.”

Bills, banks and promises: What to expect as the Government gets going again.

Headline: One of the world’s most influential economists is on a mission to save capitalism from itself. I think this woman, Mariana Mazzucato, is very interesting. “The central premise of Mazzucato’s work is about the role of the state in innovation. She is an ardent believer that governments should do more than play a passive role in fixing market failures, and be allowed to embrace their entrepreneurial spirit to steer the direction of innovation and economic growth.”

I missed this one at the time: in October 2018, the US White House released this 72-page document about the risks of socialism, which suggests they were (are) worried about the rise in popularity of socialism, especially among young people. Indeed: “Coincident with the 200th anniversary of Karl Marx’s birth, socialism is making a comeback in American political discourse.”

This bloke reckons it’s a choice between two socialisms: “The good kind of socialism — and the bad kind. And that’s because capitalism has proven to be a ruinous failure as the sole (or highest) organizing principle of a society — which is what it’s been for the last thirty years or so now. I’ll make my case — and you judge if it carries any water.” Is there a good kind? Maybe it’s the kind Mazzucato is talking about.

“Almost everything you read about the blockchain is wrong. The blockchain only does one thing (and it doesn’t even do that very well). It provides a way to verify the order in which entries are made to a ledger, without any centralized authority. In so doing, blockchain solves what security experts thought was an unsolvable problem – preventing the double spend of electronic cash without a central monetary authority. It’s an extraordinary solution, and it comes at an extraordinary price. A large proportion of the entire world’s computing resource has been put to work contributing to the consensus algorithm that continuously watches the state of the ledger.”

Google is leading in the race to dominate artificial intelligence. And Google is tracking all your locations, all the time.

China goes full Black Mirror: “Police officers in Zhengzhou, China have been spotted wearing sunglasses equipped with facial recognition software that allows them to identify individuals in a crowd.” And so on.

Why 1% won’t do it. It won’t be good either, according to Tracey McNaughton of Wilsons Advisory: “Easy money won’t work to lift inflation but that won’t stop central banks trying in the absence of any other alternative. For now, until governments realise what needs to be done, what easy money will do is increase asset prices at the expense of more sustainable growth in the future.”

The People’s Liberation Army is getting ready to take on the protesters in Hong Kong. Will it be Tiananmen Square again?

This is apparently video footage of the PLA heading to Hong Kong. I don’t know whether it is or not.

.jpg)

Diversions

Iceland’s letter to the future, on a plaque: “[Okjökull] is the first Icelandic glacier to lose its status as a glacier. In the next 200 years, all our glaciers are expected to follow the same path. This monument is to acknowledge that we know what is happening and what needs to be done. Only you know if we did it.”

Notes from a speech to American conservatives by alt-right tech billionaire Peter Thiel. “We’ve had this doctrine of American exceptionalism, but instead we are now exceptional in bad ways: We are exceptionally overweight, we are exceptionally addicted to opioids, it is exceptionally expensive to build infrastructure here, we are exceptionally un-self-aware, and we are exceptionally un-self-critical.”

This is an interesting piece about Trump’s refusal to hand over his tax returns to Congress, which is required by law. “There is no ambiguity. The words “shall furnish” are clear, leaving no room for manoeuvre. Trump supporters may not like that this is the law. But in fact, it is the law. There is no law that counters this law.”

This is a piece about Bob Dylan scholars in academia, and the headline is: “All Along the Ivory Tower”. Nice one!

The sublime Romanticism of the moon landing. “The first lunar landing was many things — a D-Day-like feat of planning and logistics, a testament to the power of man's will, an ostensible propaganda coup for NATO. It was also, I think, one of the most misunderstood events in the history of the world.”

Interesting piece about how the fake moon landing conspiracy theories got going. “Of all the fables that have grown up around the moon landing, my favorite is the one about Stanley Kubrick, because it demonstrates the use of a good counternarrative. It seemingly came from nowhere, or gave birth to itself simply because it made sense. (Finding the source of such a story is like finding the source of a joke you’ve been hearing your entire life.) It started with a simple question: Who, in 1969, would have been capable of staging a believable moon landing?”

There is no such thing as a sugar rush. In fact, “sugar consumption actually lowers people's alertness within 60 minutes after consumption, and it increases feelings of fatigue within 30 minutes after eating. That means chugging a Gatorade before a run or snacking on a Twix to combat the afternoon dip is an act of futility.”

The Wimbledon Men’s Final: “to be honest my mind is scrambled, buzzing in a million different directions, and I have to start somewhere if I really want to write about Sunday’s brilliant, stressful, joyous, melancholic and draining six and a half set marathon Wimbledon final between Novak Djokovic and Roger Federer.”

Britain and Iran: “An ill-planned military operation in a vital global shipping lane and a mistaken gamble on Washington’s response. Sound familiar?” – Britain doesn’t need another Suez.

“America is living James Madison’s nightmare.” “To prevent factions (his name for mobs) from distorting public policy and threatening liberty, Madison resolved to exclude the people from a direct role in government.” He didn’t count on how strong mobs would become.

How to stay awake in meetings.

Happy Birthday Mildred Alice Kohler (my mum) – 91 today. She shares her birthday with Teddy Whitten and Robert Holmes à Court, but no interesting singers. For that we must go to yesterday, when Mick Jagger turned 76. Here’s my favourite Stones song – Gimme Shelter.

Have you ever seen Neil Young do The Beatles’ Day In The Life? It’s pretty good. This film is not great, from a member of the audience holding up the phone. But it’s worth watching for Paul McCartney’s appearance.

.jpg)

.jpg)

.png)

.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Ask Alan

Alan Kohler answers the tough questions on InvestSMART’s share price, looks into why successful fund managers fail, and considers which property stocks are worth a closer look.

Don't forget the weekly Facebook #AskAlan livestream has migrated to a new platform on the InvestSMART website which can be found here. And if you would like to #AskAlan a question, please email it to askalan@investsmart.com.au.

Next Week

By Ryan Felsman, Senior Economist, CommSec

Australia: Inflation in focus

- The suite of inflation measures dominate in Australia in the coming week: data on consumer prices, producer prices and trade prices will all be released.

- The week kicks off on Monday whenCommSec releases the quarterly State of the States report, a report monitoring the performance of our State and Territory economies.

- On Tuesday the weekly series of consumer confidence will be released from Roy Morgan and ANZ. Consumers are generally feeling OK about the state of their finances and the state of the economy.

- Also on Tuesday, the ABS releases the June data on building approvals – the approvals granted by local councils to build new houses and apartments. Home building is easing in most states and territories following record home building over 2018.

- On Wednesday, Australia’s main inflation measure – the Consumer Price Index (CPI) – is slated for release. The June quarter data is expected to show prices rising by 0.6 per cent, lifting the annual rate of inflation from 1.3 per cent to 1.6 per cent.

- One of the main drivers of the CPI result is the cost of petrol. Petrol rose by 11 per cent in the quarter, adding around 0.3-0.4 percentage points to the quarterly CPI increase.

- In the June quarter, seasonal increases will be recorded for health (private health insurance) and tobacco (excise flow-through) while seasonal decreases in domestic travel and accommodation prices are expected.

- Stripping out volatile elements like petrol (trimmed mean measure), prices probably rose 0.4 per cent in the quarter and 1.6 per cent over the year.

- On Thursday the ABS releases the June quarter international price indexes (export and import prices). Also both AiGroup and the Commonwealth Bank release separate survey results for manufacturing purchasing managers. And CoreLogic releases July data on home prices.

- So far in July the 5 capital city aggregate measure of home prices is flat. Sydney and Melbourne prices have lifted 0.1 per cent with Brisbane prices up 0.2 per cent and Adelaide and Perth prices down 0.3 per cent.

- And on Friday the ABS releases the June quarter producer price indexes and June figures on retail trade. The producer price indexes will be affected by the 20 per cent lift in iron ore prices, 11 per cent rise in oil prices and the small fall in the value of the Aussie dollar.

Overseas: US Federal Reserve set to cut rates

- In the US, the two stand-out events in the coming week are the Federal Reserve rates decision and the employment report (non-farm payrolls). In China, the focus is on the surveys of purchasing managers.

- The week begins on Monday in the US, when the Dallas Federal Reserve manufacturing index is issued.

- On Tuesday, the personal income and spending data is released with pending home sales, consumer confidence, the S&P/Case Shiller home price index and the regular weekly data on chain store sales.

- The personal income data includes pivotal inflation data – the core personal consumption expenditure deflator – the measure tracked by the Federal Reserve. The core PCE deflator may have lifted 0.2 per cent in June to stay 1.6 per cent higher on the year.

- On Tuesday the Federal Reserve begins a two-day meeting. When the decision is announced at 4.00am AEST time on Thursday it is expected to contain a 25 basis point cut to the federal funds rate.

- On Wednesday, the weekly mortgage applications figures from the US Mortgage Bankers Association are due. The ADP measure of private sector payrolls is also slated for release on Wednesday together with the employment cost index and the Chicago purchasing managers index.

- In China on Wednesday the “official” manufacturing and services sector surveys of purchasing managers are issued by the National Bureau of Statistics. The private sector Caixin purchasing managers’ survey for manufacturing is released on Thursday.

- On Thursday in the US, the weekly figures on new claims for US unemployment insurance are issued, along with the ISM manufacturing survey, construction spending figures and data on new vehicle sales.

- On Friday in the US, the pivotal monthly employment report is released, containing data on non-farm payrolls (employment), average hourly earnings and the unemployment rate. Economists expect a healthy 160,000 lift in jobs in July.

- US data on consumer sentiment, international trade and factory orders are also issued on Friday.

Last Week

By Shane Oliver, Senior Economist, AMP Capital

Investment markets and key developments over the past week

- Share markets rose over the last week helped along by positive news on trade, a deal to resolve the US debt ceiling and reasonable US earnings. While Australian shares slipped on Friday, they rose through the week helped by the positive global lead with the All Ords finally surpassing its 2007 all-time high with strong gains in energy, consumer, industrial and financial shares. Bond yields fell further with the Australian ten-year bond yield falling to a new record low on RBA talk of lower for longer interest rates. While oil prices rose a bit as tensions with Iran continued, metal prices fell as did the iron ore price on the back of news that Vale will restart some production. Dovish RBA comments and a rising $US saw the $A fall.

- The past week saw ongoing softness in global business conditions PMIs for July and the IMF revise down its global growth forecasts again. IMF forecasts for the US were actually revised up, but due to downgrades for emerging markets the IMF revised down its global growth forecasts by 0.1% to 3.2% for 2019 & to 3.5% for 2020. However, the IMF is really just responding to the same risks that markets responded to last year, it’s following the same pattern of “initial optimism then revise down” seen for much of post GFC period and in any case 3% or so global growth is not that bad. And while global business conditions PMIs remain weak, they are still consistent with the slowdowns seen around 2012 and 2015-16 as opposed to something deeper. But they do need to bottom soon!

.png)

Source: IMF, AMP Capital

- And on this front, there was some good news on four key fronts over the last week. First, the US/China trade talks are finally resuming with face to face meetings in China in the week ahead and both sides offering goodwill gestures (with the US loosening restrictions on Huawei and China possibly stepping up agriculture purchases from the US). This is important as Trump’s trade war has played a major role in depressing manufacturing confidence.

- Second, the US debt ceiling looks to have been resolved relatively quickly (assuming the bi-partisan deal passes Congress). The weakening of the Tea Party, Trump being less concerned about debt and spending than many Democrats and no party wanting to be seen as a spoiler (after the lessons of 2011 and 2013) have made it easier this time. The key for the economy is that another debt ceiling debacle looks to have been avoided and the agreed increase in spending caps have removed a mini “fiscal cliff” that would have dragged on the economy next year. Of course, the details need to be agreed on spending to avoid another government shutdown in October.

- Thirdly, while earnings growth in the US has slowed, the much feared earnings recession hasn’t happened with June quarter earnings reports looking ok and earnings up around up 3% from a year ago.

- Finally, the ECB formally signalled it was on track to join the global reflation effort. While ECB President Draghi’s comments lacked detail his comment that the outlook is getting “worse and worse” and the ECB’s statement that it is expecting rates “at present or lower levels” at least through to first half 2020 and that it is looking at ways to reinforce forward guidance on rates, design a tiered system for negative interest rates and options for another round of quantitative easing all leave it track for more policy stimulus in September, with a key component likely to be a new €30bn a month QE program.

- Boris Johnson’s elevation to being the next UK PM was no surprise and ushers in Season 3 of the Brexit comedy. Johnson’s commitment to Brexit by October 31 with or without a free trade deal with the EU means that the risk of a no-deal Brexit has gone up as the EU is unlikely to revise the deal with former PM May much. But Parliament will likely continue to vote against a no-deal Brexit, meaning that the path is ahead is fraught for the UK with a constitutional crisis and new election and maybe (ideally) another Brexit referendum (where Britons would be better informed and could make a more useful decision). Remember that while this is a mess for the UK as roughly 46% of UK exports go to the EU and these are at risk in a no-deal Brexit, it’s only a drag for the EU as just 6% of EU exports go to the UK and it’s a side show for the global economy and markets (which ignored Johnson’s elevation).

- Australian share market hits an all-time high after nearly 12 years – but can it be sustained? The All Ords index has surpassed its record 1 November 2007 closing high of 6853.6 and the ASX 200 is not far from doing the same. Basically, the Australian share market is looking through short term uncertainties around the economy and focussing on lower interest rates and bond yields making shares relatively cheap, the likelihood that policy stimulus will ultimately boost economic growth, high iron ore prices boosting mining companies and a positive global lead. While US shares made it back to their 2007 high in 2013 and global shares did so in 2014, Australian shares took longer because of much tighter monetary policy after the GFC, the high $A until recent years, the collapse in commodity prices and the fact that the 2007 high was a much higher high for Australian shares than it was for global shares thanks to the resources boom last decade. Of course, once dividends are allowed for, the Australian share market surpassed its 2007 record high in 2013.

.png)

Source: Thomson Reuters, AMP Capital

- Is it sustainable? Going through past bull market highs after a long period below can attract investors into the market so it could push on for a bit. But after such a huge run – the market is now up 20% year to date – its vulnerable to a short-term correction and the August earnings reporting season may result in some volatility. However, the combination of low bond yields which means that the share market is comparatively cheap, monetary easing by the RBA and other central banks and a likely pick up in global growth by year end and Australian growth next year point to even higher share prices on a six to 12 month horizon.

Major global economic events and implications

- US economic data was a bit mixed with PMIs showing stronger services sector conditions but weaker manufacturing, a fall in existing home sales but stronger new home sales, rising underlying durable goods orders but soft house price growth. About 40% of US S&P 500 companies have reported June quarter results and they remain reasonably good with 78% beating on earnings, 59% beating on sales and earnings growth for the quarter looking like it will come in at around 3%yoy, which is up from expectations for a small fall a few weeks ago. Of course, this is well down from 27% earnings growth a year ago because growth has slowed and the tax cut boost has fallen out. But it’s not an earnings recession.

.png)

Source: Bloomberg, AMP Capital

- Eurozone business conditions PMIs fell in July as did the German IFO index and while bank lending continues to trend higher its only gradual all of which is consistent with the ECB moving towards further monetary easing.

- Fortunately, Japan’s business conditions PMIs rose in July.

Australian economic events and implications

- Australia data was softish with the CBA’s business conditions PMIs slipping in July and skilled job vacancies falling for the sixth month in a row in June pointing to softer jobs growth ahead.Meanwhile RBA Governor Lowe confirmed the RBA’s commitment to the 2-3% inflation target to be achieved “on average, over time”, reiterated the RBA’s easing bias and basically said a rate hike was a long way away and won’t be contemplated until the RBA is confident inflation is returning to “around the mid-point of the target range” (which is pretty strong forward guidance). Lowering the inflation target to say “1 point something” as some advocate makes no more sense than the calls to raise it to “4 point something” did just over a decade ago: changing the goal posts would weaken the credibility of inflation targeting, it would lock in permanently lower wages growth which is not good for wellbeing, it would reduce the room to cut interest rates as we would always be nearer the “zero bound” on interest rates and it would risk a slide into debilitating deflation each time there is a severe economic downturn. Our view remains that policy stimulus to date will help but won’t be sufficient to push unemployment below 4.5% as the RBA would like and so further monetary easing is likely after a brief pause with a cut to 0.75% in November and a cut to 0.5% in February next year likely.

What to watch over the next week?

- The next round of US/China trade negotiations in China and US/Iran tensions are important for markets in the week ahead. All eyes will also be on the Fed which is expected to cut interest rates by 0.25% taking the Fed Funds rate range to 2-2.25%. This will be the Fed’s first rate cut since December 2008 and follows nine 0.25% rate hikes between December 2015 and December last year. With underlying growth still solid and the jobs market tight this should be seen as the Fed taking out some insurance given various threats to growth including from the US/China trade war, tensions with Iran and slower global growth generally and a greater willingness by the Fed to take risks with higher inflation as opposed to deflation. Given that the Fed is taking out insurance rather than responding to a crisis a 0.25% cut is more likely than a 0.5% easing, but we expect it to signal that further easing is likely. So, we expect another 0.25% cut to come in September.

- On the data front in the US, expect July jobs data on Friday to show a 160,000 rise in payrolls, unemployment falling back to 3.6% and wages growth edging back up to 3.2% year on year. In terms of other data expect to see solid growth in June personal spending, a rise in core private consumption deflator inflation to 1.7% year on year from 1.6%, a rise in consumer confidence and stronger pending home sales (all due Tuesday), June quarter employment cost growth (Wednesday) to edge up slightly to 2.9%yoy, the July manufacturing conditions ISM (Thursday) to rise to 52 and the trade deficit (Friday) to fall slightly. The US June quarter earnings reporting season will also continue.

- Eurozone June quarter GDP growth due Wednesday is likely to have come in at around 0.2% quarter on quarter with annual growth at 1%yoy. Meanwhile, expect economic confidence (Tuesday) to soften a bit, unemployment to have remained at 7.5% in June and core CPI inflation (both Wednesday) to fall back to around 1%yoy.

- The Bank of England (Thursday) is expected to leave monetary policy unchanged.

- The Bank of Japan (Tuesday) is also expected to leave its ultra-easy monetary policy unchanged. Meanwhile on the same day expect June labour market data to remain strong and industrial production to fall slightly.

- Chinese PMIs for July to be released on Wednesday and Thursday are expected to show basically stable business conditions.

- In Australia, the focus in the week ahead will be back to inflation with June quarter CPI data on Wednesday likely to show that inflation remains soft. A 10% rise in petrol prices is likely to drive a rebound in headline inflation to 0.5% quarter on quarter and 1.5% year on year. But underlying inflation is likely to remain subdued at 0.4%qoq or 1.4%yoy reflecting weak consumer demand, ongoing spare capacity and intense competition. In other data expect a further fall in dwelling approvals (Tuesday), continuing modest credit growth (Wednesday), a 0.1% rise in July CoreLogic house prices (Thursday) and a 0.3% rise in June retail sales (Friday) with June quarter real retail sales up 0.3%. June half earnings reports will start to flow but with only a couple of major companies reporting of which RIO (Thursday) is likely to see a strong result due to the high iron ore price. Consensus expectations are for low single digit growth mainly due to resources.

Outlook for investment markets

- Share markets remain vulnerable to short term volatility and weakness on the back of uncertainty about trade, Middle East tensions and mixed economic data. But valuations are okay – particularly against low bond yields, global growth indicators are expected to improve and monetary and fiscal policy are becoming more supportive all of which should support decent gains for share markets over the next 6-12 months.

- Low yields are likely to see low returns from bonds, but government bonds remain excellent portfolio diversifiers.

- Unlisted commercial property and infrastructure are likely to see reasonable returns. Although retail property is weak, lower for longer bond yields will help underpin unlisted asset valuations.

- The combination of the removal of uncertainty around negative gearing and the capital gains tax discount, rate cuts, support for first home buyers via the First Home Loan Deposit Scheme and the removal of the 7% mortgage rate test suggests national average capital city house prices are at or close to bottoming. Next year is likely to see broadly flat prices as lending standards remain tight, the supply of units continues to impact and rising unemployment acts as a constraint.

- Cash and bank deposits are likely to provide poor returns as the RBA cuts the official cash rate to 0.5% by early next year.

- The $A is likely to fall further to around $US0.65 this year as the RBA moves to cut rates by more than the Fed does. Excessive $A short positions, high iron ore prices and Fed easing will help provide some support though with occasional bounces and will likely prevent an $A crash.