Two charts that show the world's economy is thriving

The world’s policymakers will have a lot to discuss when they gather this weekend for the Jackson Hole Conference. The Theme is “Re-evaluating Labour Market Dynamics”, and while that sounds extremely exciting, I think one of the key discussions they should be having instead, is why none of them seems to be able to read economic data!

US Federal Reserve vice-chairman Stanley Fischer gave a good insight into what will no doubt be the tone of the meeting. He bemoaned the weak and fragile state of the global economy and stated that the challenge for policymakers was to “restore growth, if that is possible”. “If”.

Now this all sounds very ominous but it’s not even close to being right. Take a look at the chart below.

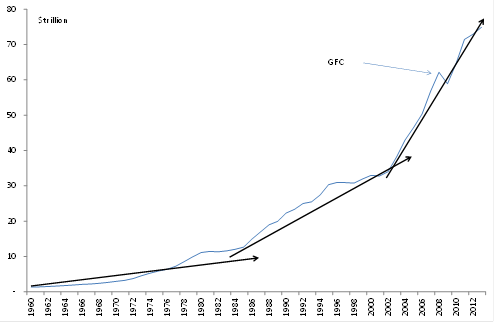

Chart 1: Global output is at a record -- well above pre-crisis peaks

Notice anything? That’s right -- global GDP is skyrocketing and at a record high. On World Bank figures, output was up near $US75 trillion last year, which is about 20 per cent higher than the pre-GFC peak -- with global gross national income about 25 per cent higher (on a purchasing power parity basis). Don’t go thinking real growth rates are weak either -- this is another statement that is misleading at best. Sure, if you only want to look at very short time period, 2004 to 2007, you could conclude that growth is weaker now. Real world GDP growth averaged nearly 4 per cent over those three years -- a strong outcome last seen in the late 1980s. But how representative or ‘normal’ was that period? As I noted in my piece (Take Australia's unemployment rate shocker with a grain of salt, August 13) the years immediately preceding the GFC were characterised by a number of booms. It wasn’t normal.

I actually get the sense this is where global policymakers are getting tripped up -- they’re simply not making the correct comparisons and are using a very small sample as their benchmark for what is normal or what should be. It’s the only explanation I can come up with for why they constantly describe the global recovery as weak, when it isn’t. History often gives a better sense of perspective and average growth in the 10 years before that was closer to 3 per cent, which as it happens is the post-GFC average as well. The fact is, global growth now is little different from those averages and from what we’ve seen since the 1980s. This puts all this fictitious nonsense about restoring growth “if” that’s possible into perspective. It’s a silly comment.

Note also that the general expectation is that growth will remain robust and even pick up over the next few years. The IMF forecast an above-trend rate of global growth next year, and the RBA noted yesterday in its minutes that “growth in Australia's major trading partners was expected to be a bit above its long-run average pace in both 2014 and 2015”.

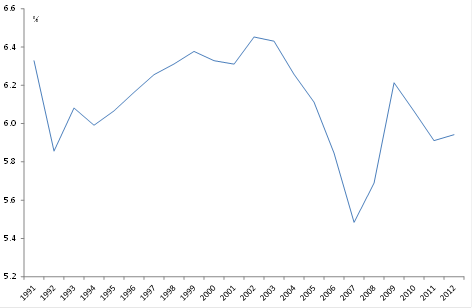

The second chart shows that the unemployment rate around the world is low at about 5.9-6 per cent and down from a post-GFC peak of 6.2 per cent. What’s interesting about that number is that it’s the average unemployment rate prior to the GFC boom. Again, comparing it to the 2007 trough is misleading. Credit orgy, remember?

Chart 2: World unemployment is falling -- and is low

When you actually compare the unemployment rate now to historical rates, it looks pretty good. As I noted on Tuesday (Global rates to rise in 2015? Not likely) central bankers speak with a forked tongue, you simply can’t trust them, or rather their assessments on the economy. They’ve got other things to think about, such as currency wars and monetising public debt. Meanwhile in the real world, the global economy looks just fine -- more than fine even.