Trump's hidden sting for share investors

Robert Gottliebsen

Trump's hidden sting for share investors

The Trump inauguration speech contains a hidden warning for Australian resident share investors.

Our franking credits are under threat. The drive to lower US tax rates is causing the likes of Malcolm Turnbull, the Business Council and many other groups to press for lower Australian tax rates to match the US.

But almost all the commentaries forget that our standard corporate tax rate is in fact much lower than the basic 30 per cent because it delivers a tax credit to local shareholders. No other major country does this, so simple comparisons are misleading. My great fear is that in the funding of any Australian tax cuts it will be small investors who will pay the price and lose the value of their franking tax credits. We will come back to that later.

Valuable lessons for Canberra

I will not cover the normal issues that come from the inauguration speech of Donald Trump because they will be covered by the general media. But I think there are two points that are worth underlining. I have been really encouraged by the team that Trump has put around him. He says that he has told his people to speak their mind in the Senate hearings to ratify their appointments, even though their opinion might be different to those of the President. In other words, he has not chosen “yes” men and women. All too often political leaders bring around them those that have similar opinions and the process can be dangerously sterile in a fast-moving world.

A great many of Trump's people do not have direct political experience, so they will need to try to adapt their business and other knowledge to the political environment. It will not be easy. But it gives the US a chance to relook at all the things that are usually never challenged in the political process. The US desperately needs that examination. But if there is one country that needs such an examination even more than the US, it is Australia where many of our politicians don't seem to have any idea of how to think outside the square.

My hope is that the new approaches that the Trump cabinet will bring to so many issues will start to spark new ideas amongst our own people. If President Trump was to do all the things on his agenda, and do them quickly, then we would face an inflationary situation in the US with much higher interest rates. In simple terms, the United States economy is actually performing fairly well and consumer demand and demand for labour is increasing and unemployment is low.

If you impose on that situation another stimulus, almost certainly inflation will break out. I will never forget that in opposition Gough Whitlam proposed a whole series of stimulatory actions about 12 to 18 months before the election. At the time they made sense. But in the nine months prior to the election Billy McMahon became Prime Minister and he set about his own set of stimulatory actions. Gough did not change his promises and the combination of the two sets of stimulation sent inflation through the roof.

Over the last week or so we saw the US dollar come off the boil and the American 10-year bond rate slip back a little, indicating the market believed the Trump measures would not all be undertaken and most would take longer to affect the economy than the market's initial expectation. But suddenly, at the end of the week, we saw the US 10-year bond rate jump again and bond prices fell. The market is changing tack.

It's no easy road

Nevertheless, to get tax cuts through the Congress will require a lot of negotiation and almost certainly will result in an outcome different to the initial plan. Businesses understand this and many will hold back their investment and/or delay in repatriating capital back to America until they see the actual rules. I will be surprised if we see any real effects from the tax cut stimulation come into the US much before 2018, and again it depends on exactly what is done.

But the bond market is not so sure. When it comes to infrastructure Trump is talking about harnessing the private sector. That will take two or three years for any major infrastructure project to get running – an income stream has to be organised, there will be community opposition, and a great many engineering and design drawings are required before there can be a start. That lead-up process could be two or three years away. It will be possible to ramp up investment in oil and gas production because the nature of the production can rise and fall at much shorter notice than conventional reserves. We will need to monitor whether the fast or slow track scenarios come to pass.

Franking and the banks

Now, returning to franking credits. Treasurer Paul Keating introduced franking credits despite opposition from Treasury. And Treasury is a bit like an elephant – it never forgets – and looks for every opportunity to reverse such decisions of politicians. The bottom-line of franking credits means that where shareholders are Australian, and there is sufficient cash to pay high dividends, then the effective local corporate tax rate is much lower than for overseas shareholders.

A fall in the tax rate benefits overseas shareholders but has very limited benefit to local shareholders if dividends are high. If companies pay out, say, a relatively small amount of their profits in dividends then franking credits accumulate while the company uses the money to reinvest in the business. They can be used later.

One of the reasons the Australian market has four banks as its largest listed companies by market capitalisation is that these businesses pay high dividends, which are fully franked. If the tax rate is lowered the benefits of those franking credits diminishes and there is a greater incentive to retain earnings.

My guess is that, all other things being equal, bank shares would fall in price because they are so driven by overall yield. And if it happened that the level of the stimulation in the US lifted world rates our bank shares would get quite a thump.

I think it is time for smaller shareholders in Australia to stand up and be counted and not be bullied by groups like the Business Council and those that get in to the politicians' ears. Our politicians need to know that if they decimate our franking credits they make retirement in Australia that much more difficult. They have already meddled with superannuation, forcing younger people to go into negative gearing of housing. Now, the effectiveness of franking credits is in danger.

Few have recognised that the burden of funding tax cuts will be borne by the small investment community unless they make their opinions known in Canberra.

Readings and Viewings

As we go to "press", Donald Trump is only hours away from being sworn in as the 45th President of the United States. It has been a week of Trump-related events, and here are just a few.

In the final lead-up to his inauguration, all eyes were on events at the Trump International Hotel. One suite during inauguration week was offered for $500,000, with various perks.

And there was also keen interest in Trump's nominee to head the Treasury, Steven Mnuchin, who had to update his financial disclosures to include nearly $US100 million in previously unreported assets.

Glenn Greenwald says that while the Trump presidency “poses serious dangers”, at least he is standing up to the ‘Deep State' that President Eisenhower warned about some 60 years ago.

But in what could spark a classic Mexican stand-off, Trump sparked a sell-off in the company behind Corona beer.

It wasn't all bad news though. General Motors has jumped on the "Let's make America great again" bandwagon and announced a major investment program in Detroit as it finalises the end of Holden vehicle production in Australia. Separately, Korean auto makers Hyundai and Kia have also committed funds to expand their US operations.

Staying in the auto sector, Rolls-Royce's bribery shadow has an $800m silver lining: "The agreements are voluntary and spare the company prosecution as long as it fulfills the agreed-upon terms and financial penalty."

Meanwhile, in other news, Deutsche Bank finalised a $7.2 billion settlement over toxic mortgage-backed securities sold before the GFC.

But Venezuela is issuing new bank notes as it faces down hyperinflation.

In the corporate sector, pizza chain Chuck E Cheese has unveiled plans for an IPO.

By contrast, American Apparel is coming apart at the seams.

The billionaire founder of Luxottica, who vowed not have his children involved in his business, has secured his legacy with a $US53 billion merger with Essilor. Essilor CEO Hubert Sagnieres, 61, will be executive vice chairman and deputy CEO with powers equal to those of Del Vecchio, Italy's second-wealthiest person."

Now, meet the FANG stocks: After a bumper 2015, "the FANGs didn't even perform up to the Dow Jones industrial average, which rose 13 percent last year."

Neanderthals were people, too! New research shows they shared many behaviours that we long believed to be uniquely human.

On why poets have historically developed so many sleep-related idiosyncrasies: “Proximity to sleep carries us to the brink of our own psychic disintegration, and, contrary to Coleridge's formulation, forces us to look forward to a moment in the future when we aren't refashioning reality so that it accords with our own unique vision.”

Last Week

Investment markets and key developments over the past week

- The past week saw shares fall a bit, further correcting some of the large gains seen since November amidst nervousness ahead of Donald Trump's takeover as US President. Chinese shares managed to rise though. Bond yields backed up a bit, commodity prices were mixed and the $US was little changed.

- After large gains since the US election, shares, the $US and bond yields entered 2017 vulnerable to a correction or a consolidation with uncertainty about US policy under Donald Trump likely to provide a key trigger. This appears to be underway and may have further to run.

- Markets are now waiting for more evidence that Donald Trump will deliver on fiscal stimulus and deregulation but uncertainty remains high about what he will do on trade. The risk of a tit for tat trade war between the US and China is high, particularly if Trump formally brands China a currency manipulator. I remain of the view that when it comes to actual policy moves as opposed to bluster we will see more of Trump the pragmatist rather than Trump the populist. To be sure he will adopt a tough line on trade given that it was a key election platform and this will initially cause bouts of market angst. But he also has a focus on jobs and won't want to threaten this, which ultimately suggests pragmatic outcomes. But one thing is clear: with Trump as President we will have to get used to more bluster and noise (including tweets) than has been the case from previous US presidents.

- Trumps comments on the $US and Europe are worth a mention. It's understandable that he regards the $US as "too strong" given its huge gains. But unless the US economy slows relative to other countries and the Fed goes on another extended pause the risk is that the trend in the $US remains up.

- On one level Trump's negative comments about the European Union are a bit amusing because after all it is just a less politically advanced version of the United States, with the integration of both driven by similar motivations (in fact their names suggest the same: United (States of) America, United Europe). Maybe the Europeans will start encouraging California towards a Calexit! In fact, America's relative decline geopolitically, which may accelerate under Trump, is a powerful reason for Europe to stay together!

- UK PM Theresa May's outline of Britain's Brexit terms suggest an element of the UK wanting to "eat its cake and have it too". Basically Britain wants free trade with the EU but at the same time control of its borders, laws and no more huge contributions to the EU budget. In other words, all of the benefits of being in the EU but none of the obligations. It's doubtful all or any of the other 27 EU members will agree to all of this so a "hard" Brexit continues to look likely. That said, there is a long way to go (two years of negotiations after Britain formally notifies it wants to leave) and allowing Parliament a vote on the final deal could still mean a softer final outcome. So Brexit is going to be background noise for investors for years to come. The key issue for global investors to remember though is that the UK is only 2.5 per cent of global GDP and what really matters is whether Brexit encourages countries to leave the Eurozone. So far there is not much evidence of that with post Brexit elections in Spain and Austria seeing increased support for pro-Europe parties and Italy's referendum telling us nothing on the issue. A hard Brexit would probably make it even less likely that Eurozone countries will seek to leave.

- Putting aside political bluster and uncertainty over Trump's policies the world has entered 2017 on a strong note fundamentally with strong readings on economic momentum - rising/solid business conditions PMIs, the OECD's leading economic indicators continuing to hook up, economic data surprising on the upside. And this is global not just in the US - so its more than just a Trump effect. Consistent with this, the IMF held its global growth forecasts unchanged (at 3.4 per cent for 2017 and 3.6 per cent for 2018) rather than downgrading them which has been the norm for years. Added to this there is ongoing evidence that the threat of deflation is receding with rising headline inflation readings in most regions. This is positive for nominal economic growth, corporate sales and hence profits. As a result, notwithstanding the likelihood of a further short term pull back in shares we remain positive on the outlook for them for this year.

Major global economic events and implication

- US economic data remains solid. Business conditions in the New York and Philadelphia regions remained strong in January, housing starts rose strongly, home builder conditions remain strong, industrial production rose more than expected in December and jobless claims fell remaining ultra low. And the Fed's Beige Book of anecdotal evidence was a bit more upbeat than in November. Meanwhile, headline inflation continued to rise to 2.1 per centyoy in December on the back of the rebound in oil prices, but core CPI inflation remains stuck in the same range just above 2 per centyoy it's been in for the last year. Consistent with all this Fed Chair Yellen indicated that employment and inflation are near the Fed's goals and that rate hikes can remain gradual, noting that the Fed expects to raise rates a few times a year until by the end of 2019 rates are back at the neutral rate of 3 per cent. There is nothing really new here than what was foreshadowed by the Fed in December. Our base case is for three hikes this year but fiscal stimulus could mean more.

- Its early days in the December quarter profit reporting season in the US, but so far so good with 74 per cent of companies beating expectations.

- There were no surprises from the European Central Bank at its January meeting, which is basically on autopilot having committed to maintaining quantitative easing out to the end of 2017 back in December. ECB President Draghi's comments were dovish indicating there were no signs as yet of a convincing uptrend in underlying inflation. If growth continues to hold up an ECB decision to start tapering its asset purchases in 2018 is likely, but not until around September or even later this year.

- Chinese GDP growth came in at 6.8 per cent in the December quarter and 6.7 per cent for 2016, pretty much as expected. Growth has clearly stabilised after the slowdown of recent years. December growth in industrial production and investment slowed slightly but retail sales picked up slightly. Solid growth momentum allows Chinese policy makers to focus a bit more on slowing growth in debt and property prices. For 2017 we expect Chinese GDP growth of around 6.5 per cent.

Australian economic events and implications

- Australian data was a mixed bag over the last week with consumer confidence remaining soft, housing starts falling again in the September quarter but housing finance and employment coming in stronger than expected. The December jobs data was particularly noteworthy as it was the third month in a row of solid jobs growth. Over the December quarter monthly jobs growth averaged a strong 22,000 a month, a big improvement from average job losses of 5000 a month in the September quarter, and most of it has been in full time jobs, all of which suggests that the jobs market has perked up a bit. While unemployment rose in December to 5.8 per cent this was only due to higher participation.

- Meanwhile, the further fall in housing starts in the September quarter confirms the message from approvals that we have likely seen the peak, but there is still a huge pipeline of work yet to be done which should hold up dwelling investment for a while to come.

Next Week

Savanth Sebastian, CommSec

All about inflation

In the coming week inflation dominates the Australian economic calendar. In the United States a raft of indicators is released including those covering economic growth, consumer confidence and home sales.

On Monday, the Australian Bureau of Statistics (ABS) releases figures on lending finance. The lending finance data shows the value of new loans taken out across housing, personal, lease and business loan categories. In October, new loans totaled $68.68 billion in October, down 5.8 per cent over the year.

Also on Monday, CommSec will release the quarterly State of the States report – an assessment of the economic performance of state and territory economies.

On Tuesday, there is just one indicator of note: the weekly series of consumer sentiment. Consumer confidence is holding just shy of four-month highs. But investors will also be interested in the reading on inflation expectations 2 years ahead, which is currently holding at a 13-month high.

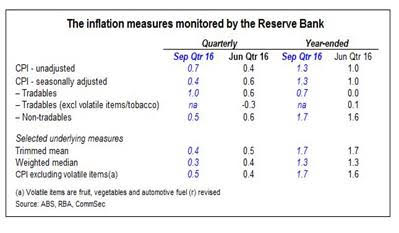

On Wednesday, the main measure of inflation in Australia – the Consumer Price Index (CPI) – is scheduled for release. And the indications are that another low reading of inflation is on the cards.

We are tipping a 0.7 per cent lift in the headline rate of inflation, lifting the annual inflation rate to near 1.6 per cent.

One factor that is an outlier and may actually boost overall price growth is the rising cost of petrol. Pump prices probably rose by 5.5 per cent in the December quarter, adding around 0.2 percentage points to the quarterly CPI.

During the quarter there are generally seasonal price increases in tobacco and the cost of domestic holidays and accommodation. Offsetting these price changes, lower prices are likely for pharmaceutical goods. Higher prices are likely for dwelling purchase while rents may have been flat or lower in the quarter.

The Reserve Bank attempts to keep inflation between 2-3 per cent over time. But when prices of goods like petrol are rising, the Bank tends to focus more on measures of 'underlying' prices. We suspect that underlying price measures probably grew around 0.5 per cent in the quarter will annual growth around 1.6 per cent.

Should prices move in line with forecasts – that is, inflation stays low – the Reserve Bank will maintain its neutral policy stance when it comes to interest rates. It is pretty clear that inflation has bottomed out and will be closely watched over 2017.

On Friday the (ABS) will release more data on prices, this time figures on import and export prices and the Producer Price Indexes (PPI). These international price measures tend to be dominated by changes in the Australian dollar and iron ore, coal and oil prices while the PPI focuses on business inflation.

Overseas: Raft of US indicators including GDP

There are no key indicators to watch in China in the coming week so the US hogs the limelight. Economic growth data and home prices are the highlights.

The week kicks off on Tuesday with the release of the influential Richmond Federal Reserve index, existing home sales and the flash Markit Manufacturing PMI. Existing home sales may have eased by around 1.5 per cent in December, while the manufacturing PMI should continue to show a healthy expansion with a reading around 54.0 in January.

On Wednesday, a key measure of home prices is released with the usual weekly data on mortgage applications. The Federal Housing Finance Agency index on home prices is likely to hold at around 5.5 per cent annual growth.

On Thursday, four key data releases are scheduled to take place. Of key focus will be the new home sales release alongside the leading index for December. In addition wholesale inventories, the Chicago Fed national activity index and the weekly data on claims for unemployment (jobless claims) are released.

On Friday data on durable goods orders (a measure of business investment) is released together with the 'flash' or advance measure of economic growth (GDP) in the US. Economists expect that the economy slowed to a 2.3 per cent annual pace in the December quarter, down from 3.5 per cent in the September quarter.

Also released on Friday quarterly data is released on personal consumption and consumer sentiment.

Sharemarkets, interest rates, exchange rates and commodities

The US earnings season moves into third gear in the coming week. On Monday, earnings are expected from 38 companies including McDonalds and Resmed.

On Tuesday, around 77 companies are to report including Johnson & Johnson, Alibaba Group, Procter & Gamble, Verizon, Alcoa and DR Horton.

On Wednesday, profit results are listed for 122 companies including AT&T, Boeing, Ebay, Fiat Chrysler and Novartis.

On Thursday, more than 190 companies are slated to release earnings including, Google, Amazon, Microsoft, Intel, Starbucks, Caterpillar, Unilever, PayPal, and Ford.

Closing out the week on Friday, just 28 companies are scheduled to report, including, Chevron, Colgate Palmolive and Honeywell

Savanth Sebastian is a senior economist at CommSec.