Top 3 for 3: The final stretch

Whether it was Brexit, President Trump or even the success of Leicester City and the Chicago Cubs, it is fair to say that 2016 has been a strange year.

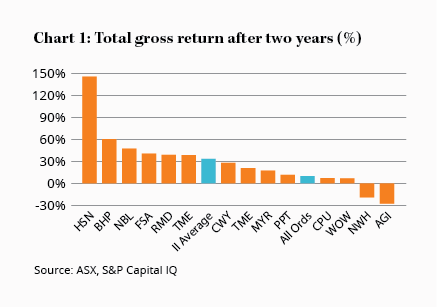

Despite the unpredictability, the All Ordinaries Accumulation Index increased by around 14% since we last checked in on our Top Three for Three competition and around 10% since we first started way back in December 2014.

With this as a backdrop, the analysts continued to do well with the original competitors generating an average return of 37% since the competition began, and that only drops to around 34% when you add in myself and James Greenhalgh who entered a year later – an outperformance of around 24%.

Firstly, the disclaimer. As always, three stocks are too few for a portfolio to be considered diversified and three years is too short a period to judge performance. Also, with all stocks weighted equally and no ability to buy or sell, the competition is very different to the decisions analysts would make in real life as you will see in their comments. However, with that out the way, let's get into the results.

With two years now in the bag and only one year to go, we have asked the analysts to not only comment on their selections but also share their top stock pick if the competition was starting again today.

Gaurav Sodhi

| Stock (ASX code) | Price at 7 Nov 14 | Price at 7 Dec 16 | Gross divs | Value at 7 Dec 16 | Total return |

|---|---|---|---|---|---|

| TPI (now CWY) | $0.910 | $1.120 | 0.0457 | $1.166 | 28.1% |

| TME | $3.600 | $4.630 | 0.3604 | $4.990 | 38.6% |

| HSN | $1.560 | $3.660 | 0.1792 | $3.839 | 146.1% |

| Average | 70.9% |

‘I'm pretty happy with how the portfolio has performed' says Gaurav. That's not surprising considering he is the current leader with an average return of 71%.

‘Hansen has performed better than expected but, to be honest, I would have found it difficult to hold this long. I'm a little uncomfortable with the acquisition strategy and it looks fully priced to me.

‘I said last year I would have sold Cleanaway (formerly Transpacific) and yet it has staged a remarkable turnaround and is now in the black. Was selling a mistake? I'm not sure. Cleanaway looked like a broken investment case and management, installed with great fanfare, left abruptly. I'm certain I would make the same sell decision again.'

‘Trade Me is a wonderful business that I would still happily hold. There are cheaper stocks and some tempting ideas – Flight Centre and News Corp for example – but I have learned to hold quality for longer. Few businesses are as resilient as Trade Me.'

For his top pick today, Gaurav has chosen mining service provider Austin Engineering.

‘Mining services has been a seductive area for us value hounds and Austin falls into this category. The business makes and sells consumable products like buckets, truck parts and tanks that are used in the mining and construction industry.

‘As miners have conserved cash, they have pushed out their maintenance and equipment is now overdue for replacement. Resuming the replacement cycle will help the revenue line while operating changes should ease margin pressure.

‘Austin had a terrible balance sheet but several capital raisings have cleaned that up. One risk here, apart from revenues not turning up, is the amount of working capital the business sucks up to fulfill new contracts but there appears to be enough cash to support growth. It doesn't look particularly cheap but if we assume a normalised revenue line it looks very cheap.'

Disclosure: Gaurav Sodhi owns shares in Austin Engineering.

Graham Witcomb

| Stock (ASX code) | Price at 7 Nov 14 | Price at 7 Dec 16 | Gross divs | Value at 7 Dec 16 | Total return |

|---|---|---|---|---|---|

| HSN | $1.560 | $3.660 | 0.1792 | $3.839 | 146.1% |

| PPT | $48.150 | $46.650 | 7.0714 | $53.721 | 11.6% |

| FSA | $1.025 | $1.250 | 0.1929 | $1.443 | 40.8% |

| Average | 66.1% |

Next up is Graham, who has dropped down one spot after leading the competition at the one-year mark. His top performer, like Gaurav, was Hansen Technologies which is up 146% since the competition started. However, he has a slightly different view regarding its acquisition strategy.

‘Warren Buffett has said: "Buy into a company because you want to own it, not because you want the stock to go up." Hansen fits the bill. The company continues to shoot the lights out operationally, with captive utility customers providing steady revenues and management's knack for making sound acquisitions. The share price now reflects a lot of the competitive advantages we saw in Hansen a couple of years ago, but to say the stock is overvalued still strikes me as risky. Hansen will almost certainly be a bigger, better company 10 years from now and we're in it for the long haul.

‘FSA Group doesn't have the innate competitive advantages that Hansen has, but it's a well-run company, with this past year a case in point. Management let go of a poorly performing division and is now focused on the company's bread and butter: making loans and arranging debt agreements for people in financial distress. The company is investing heavily in sales and marketing in anticipation of future growth, which would be aided by a faltering Australian economy. With a price-earnings ratio of 12, we believe the market is undervaluing the stock's growth potential and it remains on our Buy list.'

For Perpetual, Graham notes that ‘fund performance has been lacking recently with the Aussie market only up slightly this year. Fund flows are down, though Perpetual is well placed to benefit from a strengthening economy and rising market. We're still long-term believers in the company, which currently sits on our But list.'

As for Graham's current top pick? ‘It's hard for me to look past Virtus Health,' he says.

‘It has its share of risks, but the IVF industry will almost certainly be a long-term growth story due to rising infertility and, with Virtus's dominant position, economies of scale, clean balance sheet and strong brand, we expect the company to do well over time. Virtus is exposed to short-term volatility in cycle numbers, but it churns out cash – and with a free cash flow yield of 8%, investors are getting a good company at a great price.'

Disclosure: Graham Witcomb owns shares in Hansen, Virtus and FSA Group.

James Carlisle

| Stock (ASX code) | Price at 7 Nov 14 | Price at 7 Dec 16 | Gross divs | Value at 7 Dec 16 | Total return |

|---|---|---|---|---|---|

| TME | $3.600 | $4.630 | 0.3604 | $4.990 | 38.6% |

| RMD | $6.030 | $8.060 | 0.3134 | $8.373 | 38.9% |

| AGI | $3.100 | $1.950 | 0.2857 | $2.236 | -27.9% |

| Average | 16.5% |

According to Research Director James Carlisle, his selections are a case of ‘two steps forward and one step back, with Trade Me and ResMed each gaining about a third, and Ainsworth Game Technology losing a similar amount'.

‘Since I picked Trade Me two years ago at $3.60, it's been down as far as $2.68 and up as far as $5.70, before settling at its current level around $4.63, so who knows what's in store for the final year of the contest.

‘I'm very happy with the stock, and hold it personally. It has a wonderful position, albeit in a small market, but there's every reason to believe that its classifieds businesses can increase the value that they add to end users, thereby expanding that market. Management is taking all the right steps to achieve that, by investing in its sites, apps and other services.

‘I'm less comfortable with ResMed, which I've sold personally and which has also been sold from our Growth and Equity Income Portfolios. In all three cases, though, the sales were less to do with the stock itself and more to do with better opportunities elsewhere.

'Our relative indifference has mostly been due to its markets being slower growing and more competitive than we anticipated when we upgraded the stock to Long Term Buy back in 2013. Add to that a management team that appears to be moving beyond its comfort zone to supplement the lacklustre growth, and the gloss has rubbed off a bit.

'Still, the company adds lots of value, has a strong position in a growing market and generates excellent cash flow. On a multiple of only 21 times earnings expected for 2017 it also doesn't look expensive and it remains a solid Hold – at least if you're not itching to buy something else. There are worse places to be for the final year of this competition.

‘One of those worse places might be Ainsworth Game Technology, which has had a pretty terrible run since we upgraded it around the time this contest began in 2014. The big hope back then was for growth in its international business and it has largely delivered on that. The problem is that at the same time its Australian business has crumbled.

'Worst of all, Len Ainsworth appears to have rubbed other shareholders' noses in it by selling his shares about 50% higher than current levels. The stock certainly looks cheap on a price-earnings ratio of about 12, but it looks unlikely to recover the ground already lost'.

If we were starting the competition again today, the first stock on James' list would probably be GBST.

‘It's had its problems since I first recommended the stock a couple of years ago (admittedly at too high a price), and with the business treading water the market is seeing the glass as half-empty. When its software is installed, though, it's for the long haul, and revenues should grow over the years as transactions and funds increase. In time, I think we'll see this flowing through, making today's share price look cheap. There are risks, though, and I'd therefore probably balance it out with some more reliable performers (the likes of Seek and Trade Me come to mind)'.

Disclosure: James Carlisle owns shares in Trade Me, Seek and GBST.

Jon Mills

| Stock (ASX code) | Price at 7 Nov 14 | Price at 15 Dec 15 | Gross divs | Value at 15 Dec 15 | Total return |

|---|---|---|---|---|---|

| AGI | $3.100 | $1.950 | 0.2857 | $2.236 | -27.9% |

| NWH | $0.680 | $0.550 | 0.0000 | $0.550 | -19.1% |

| TPI (now CWY) | $0.910 | $1.120 | 0.0457 | $1.166 | 28.1% |

| Average | -6.3% |

For Jon, the competition rules highlighted how different the ‘Three for three' competition is compared to the reality of investing.

‘As well as a 33% weighting in each stock being far too high, the inability to take advantage of volatility and buy (and sell) in stages – as we usually recommend members do – are unrealistic compared to the cut and thrust of everyday investing.'

He pointed to his selection of NRW Holdings as a good example. ‘Investing in stages has meant that my personal holding of NRW Holdings is up around 33%, even though it almost went bust – and really should have – after Samsung decided to exert its power over its subcontractors after losing $1bn on Roy Hill (see NRW ends dispute). As Gaurav noted then, if it survived, there was generous upside. It did – after tough negotiations with its banks and a timely big contract win – and there was: it has 14-bagged after reaching a low of $0.04 and recently took advantage of its resurrection to raise additional capital to ease its debt burden. It has also been helped by the apparent turnaround in the mining cycle and, with it, sentiment towards the sector.'

Ainsworth is another where Jon's personal approach has led to a different result than the competition.

'Investing in stages and using volatility to my benefit is also why I'm slightly ahead with my personal investment in Ainsworth. Ainsworth has continued to expand successfully overseas – especially in North America – but its Australian performance is currently worse than we expected due to Aristocrat's dominance here. We also retain concerns over Len Ainsworth's well-timed sale of most of his stake to Austrian gaming giant Novomatic. However, the company has a strong balance sheet and access to Novomatic's much larger R&D budget and game library, so a recovery of Australian market share – and perhaps in its share price – is possible in coming years.

‘Cleanaway too has experienced great volatility, falling 20% from its level two years ago but now being 27% ahead for those that hold it. Despite some management upheaval, its new CEO has successfully reorganised the business, reduced customer churn rates, cut costs and improved margins in all three of its divisions. Lower capital expenditure requirements, reduced remediation spending and the imminent closure of its lower-margin Clayton landfills will also cement the turnaround of this business'.

For his top pick this year, Jon is taking a different approach and focusing on quality after reading the thoughts of grizzled veteran of ‘Three for three' competitions, James Greenhalgh, in last year's update who said ‘selecting lower quality companies that are mathematically cheap is risky given the timeframe, the inability to sell and the lack of diversification. It's far better to select high-quality businesses'. Jon's selection is New Zealand classifieds business Trade Me.

‘Its share price has fallen due to worries over Facebook's new Marketplace service but as James notes in Trade Me and Facebook square off, the likelihood is that this service will have minimal effect on Trade Me. Trade Me is a place where Kiwis go to sell stuff whereas Facebook is for social contact. While free – Facebook will make money via advertising – Marketplace lacks many of the features of Trade Me's service such as facilitating payment and delivery and so serious buyers and sellers are still likely to prefer Trade Me. If history is any guide, it's likely Facebook retreats like other competitors have in the past in the face of Trade Me's strong network effects.'

Disclosure: Jon Mills owns shares in Ainsworth, NRW Holdings and Trade Me.

James Greenhalgh

| Stock (ASX code) | Price at 15 Dec 15 | Price at 7 Dec 16 | Gross divs | Value at 7 Dec 16 | Total return |

|---|---|---|---|---|---|

| CPU | $11.360 | $11.760 | 0.4131 | $12.173 | 7.2% |

| TME | $3.980 | $4.630 | 0.1841 | $4.814 | 21.0% |

| NBL | $0.950 | $1.400 | 0.0000 | $1.400 | 47.4% |

| Average | 25.2% |

With his previous advice influential in Jon's selection of Trade Me, how did he do in his first year back?

‘Having participated in four ‘Top 3 for 3' competitions, my motto has always been ‘Don't blow yourself up' rather than ‘Try to blow the lights out'. Thankfully I haven't blown myself up for the one year I've been in the competition (I re-joined Intelligent Investor mid-2015, so my version is a ‘Top 3 for 2').

‘Computershare's business looks becalmed but the stock still doesn't look expensive, despite our recent downgrade to Hold. With Donald Trump winning the US presidency, fears of inflation are stoking long-term interest rate rises, which might eventually benefit Computershare's business'.

‘While my Trade Me pick entered the competition at a higher price than I envisaged, the improvement in the business has become more evident since last year. The stock is not as cheap as it was but Trade Me has pricing power and it's still on our Buy list'.

‘Noni B was an unusual (that is, risky) pick for me in this competition but it has been my star performer. With the company making a substantial acquisition, the stock is no longer under-priced and I have been selling down my significant personal holding. I'm concerned Noni B could be my undoing in the final year of the competition, as things can change quickly year-to-year'.

‘My top pick right now is Crown Resorts. Looking out three years, not only should the business have shrugged off its current woes, but the demerger is likely to have realised significant value'.

Disclosure: James Greenhalgh owns shares in Computershare, Trade Me, Noni B and Crown.

Andrew Legget

| Stock (ASX code) | Price at 15 Dec 15 | Price at 7 Dec 16 | Gross divs | Value at 7 Dec 16 | Total return |

|---|---|---|---|---|---|

| MYR | $1.130 | $1.255 | 0.0714 | $1.326 | 17.4% |

| WOW | $22.490 | $22.910 | 1.1000 | $24.010 | 6.8% |

| BHP | $16.270 | $25.730 | 0.3989 | $26.129 | 60.6% |

| Average | 28.2% |

Rounding out the competition participants is myself who, along with James Greenhalgh, joined in the second year of the competition.

‘Myer has been a roller coaster, as you would expect for a discretionary retailer in the middle of a turnaround. Its share price has regularly risen above $1.20 but also just as often fell back below $1.10. In fact, only a few weeks ago, its share price was as low as $1.03. I expect this volatility to continue, but am happy to continue holding it as one of my three selections. Ever since the strategy update last year, more signs have shown that its new strategy is working ending in November where sales grew faster than old enemy David Jones for the first time in a while. Also, after visiting its first new-format store in Sydney's Northern Beaches I am finally seeing signs that Myer is getting its act together.

‘The same can't be said for Woolworths. Although it appears to have put a line through its Masters headache, a new one has arrived in the name of Big W which continues to underperform. Its supermarkets also continue to face aggressive competition from Coles and Aldi. One issue that has been resolved is the appointment of a new chief executive in Brad Banducci which at least gives the company some stability at the top. Despite the issues, the company still has one of the best supply chains and store networks and I still consider this a quality company and one I'm happy to hold.

‘Finally there is BHP, which was my top performer of the year and ironically a company I would usually avoid due to my dislike of resources companies. However, that is also the reason why I am not surprised at the result, as it would take a really cheap price and high quality to tempt me in the first place. Despite the 2016 headline loss of US$6.4bn, the mining operations have continued to perform well and the recovery in some commodity prices such as iron ore have helped bring investors back to the sector. The swings in its share price doesn't change the fact it is one of the highest quality miners in the world'.

For my top pick, I am echoing Graham Witcomb and choosing Virtus Health.

‘With people waiting longer to have kids leading to higher infertility rates, more people will need assisted reproductive services. With surrogacy laws in Australia still quite strict, this leaves IVF as a major option for potential parents. That's not to say there are no risks in Virtus, it is in a well-regulated industry and low-cost providers are taking market share. But the numbers such as its free cash flow yield, as mentioned by Graham, make me comfortable in taking the chance.‘

Finally, we have our newest additions to the analyst team in Alex Hughes, Mitchell Sneddon and Phil Bish. Rather than make them attempt the impossible and choose 3 stocks for one year, we have decided to be fair and instead asked them to share only their top picks.

Alex Hughes

Alex has kept to his favoured small caps sector and chosen a software company whose market cap is only $16m – Techniche – which he calls a ‘profitable software company valued as a cigar butt'.

‘Techniche owns two businesses. The first is European based ERST, which provides secure data transfer for 10,000 European fuel stations. Next is Urgent, a facilities management application used by 30,000 retail sites in 16 countries, and finally Statseeker, a 50% owned SAAS network monitoring tool used by numerous fortune 500 companies.

‘With an enterprise value around 4x earnings, it's superficially cheap and the dividend yield isn't bad either. Techniche also has $15m in tax losses which could add value by reducing future tax bills.

‘However, the situation has enhanced recently following a $10.6m takeover bid for Urgent. If the deal proceeds, Techniche's cash pile will expand, and when you deduct its excess cash from its market cap, its enterprise value falls close to zero. The remaining businesses, ERST and (50% owned) Statseeker are expected to generate earnings of around $2m going forward.'

‘So, assuming the Urgent sale proceeds, you are buying 1.5 software businesses for around 1x earnings. If it doesn't you are paying around 4x. Both are too cheap in my opinion.'

‘Such a low share price suggests the market believes the businesses are near worthless, or that management will destroy value with bad acquisitions. (I think the real reason is that Techniche is small so it is unknown or off the radar of most investors). I think both assertions miss the mark.

‘ERST has been around since 1996, and since Techniche bought it in 2008, it has been consistently profitable with earnings up 57% since. Its software is embedded into the daily operations of many fuel stations, so it's not easily replaced, but it does have customer concentration risk to BP. Statseeker has big markets and some big customers, and has been growing at a good clip. It recently reached profitability, and if growth continues, it could make a meaningful contribution going forward. These are not world class software businesses, but they're far from worthless.

‘Also, Techniche's history with capital allocation has been decent. For example, ERST paid itself off in a matter of years and Urgent has produced an IRR of around 14%. Management and the board own a lot of stock, so interests are aligned, and communication and governance have improved under the new CEO.

‘Being such a small company, Techniche comes with added risks (and I would never put 100% of my portfolio into it, as this competition implies), but I think a low entry price, a strong balance sheet, and aligned management bode well for a decent future.'

Disclosure: Alex Hughes owns shares in Techniche.

Mitchell Sneddon

‘My background has been in managed investments and specifically listed investment companies (LICs) for the Eureka Report. If I had to pick one from the near 100 out there to stick in the bottom drawer and pull out in three years and be pleasantly surprised it would have to be Thorney Opportunities Limited. Led by Alex Waislitz, Thorney Opportunities Limited is a highly concentrated portfolio of small ASX listed companies. At first glance most investors would look elsewhere to a more undervalued LIC. Thorney isn't undervalued at all. It's sitting approximately at value right now. But what Thorney has shown over its short life is the team's ability to create value through careful stock selection and using the experience that sits within the LIC to play the role of an activist investor when needed.'

Phillip Bish

Finally, Phil Bish has gone a tastier route and selected Retail Food Group.

'Retail Food Group is a food and beverage company that owns a large number of food franchise systems, including Gloria Jeans, Michel's Patisserie, Donut King and Brumby's. It is also in the coffee business owning four coffee roasting facilities and a number of coffee franchises.

'The company listed in 2006 at $1.00 per share and has seen a steady rise in both its profits and share price over the last 10 years. The shares are currently trading at $6.23. With earnings per share at around $0.41, the company has a price-earnings ratio of around 15. With the recent acquisition of Hudson Pacific Corporation, the company expects underlying profit growth for 2017 of 20%.

'The company has a long history of successfully acquiring and integrating franchise systems. It has also bought food and coffee roasting businesses that it uses to supply the various franchise systems, enabling vertical integration and lower costs.

'As the company is in the food and coffee business, I believe Retail Food Group will be very resilient in the event of an economic downturn, and with management constantly looking for new opportunities should continue to grow well into the future.'

Disclosure: Phil Bish owns shares in Retail Food Group.