Three types of bonds - which one is best for you?

Summary: We look at the three types of bonds that work best under different economic conditions and how you can start building a bond portfolio.

Key take-out: Find out how to build a defensive portfolio, tailored to your economic expectations.

Bonds are a great diversifier and come in all shapes and sizes. They can help protect your wealth and income throughout different stages of the economic cycle, while providing better returns than term deposits. If you are new to bond investments, you might be asking which types best suit your goals.

We begin by looking at three bond types – fixed, floating and inflation linked – that work to protect your portfolio under different economic conditions. Then show how you can build a portfolio based on your needs.

1. Fixed rate bonds

Fixed rate bonds pay a fixed pre-determined rate of interest called a ‘coupon' which is set at the time of issue and does not change during the life of the bond. So, the only way the bond can reflect changes in market expectations of interest rates is through its price. If interest rates fall, fixed rate bond prices will rise and the opposite is also true, if interest rates rise, fixed rate bond prices will fall.

Fixed rate bonds are attractive when interest rates are high and start to contract and also in a low interest rate environment. When an economy starts to contract then interest rate start to fall and property and shares usually underperform, these bonds outperform under those conditions and help smooth overall portfolio returns.

One of the benefits of bonds compared to term deposits is that they are tradeable. Bond prices will go up and down for a number of reasons and if sold prior to maturity, can provide higher than expected returns.

If fixed rate bond prices rise because interest rates move lower, investors can sell the bonds and make a higher than expected return. Fixed rate bonds are attractive income seeking investors.

2. Floating rate notes (FRNs)

A floating rate note pays a set margin over a variable benchmark and in Australia the benchmark is usually the bank bill swap rate (BBSW). The underlying benchmark rate will rise and fall over time based on prevailing interest rates. The margin over the benchmark is usually fixed and will be set at the time of issue. A narrow margin implies a low risk entity, while a wide margin is added compensation for a higher risk investment.

Floating rate notes typically protect a portfolio when interest rates are rising. That is, as the Reserve Bank increases the cash rate, the BBSW rate increases and by adding on the margin, FRN interest payments will also increase. So, FRNs typically outperform fixed rate investments such as term deposits and fixed rate bonds when interest rates are moving higher. FRNs also make great alternatives to deposits as interest is adjusted on a quarterly basis, largely removing interest rate risk.

FRNs are also more capital stable than fixed rate bonds, in that their prices do not move up and down to the same extent. Assuming a company survives, whatever happens to the price of a bond over its term, investors

would still expect to be repaid the face value (the value at first issue) which in most cases is $100 – this is true for any bond.

3. Inflation linked bonds (ILBs)

An inflation linked bond is the only security that provides a direct hedge against inflation, so they should have a place in most investment portfolios.

These securities can be attractive in low interest rate environments when the government will try to stimulate economic activity, which can lead to upward inflationary pressures. This is a good time to buy ILBs before the risk of inflation heightens. ILBs can also be excellent investments in a low growth economy.

There are two major types of inflation linked bonds:

- Capital indexed bonds (CIBs, most common)

- Index annuity bonds (IABs)

The two types of bonds work in different ways and one may be more suitable to your goals than the other.

We often find the CIBs are more suitable to investors in the accumulation phase as they are seeking to meet longer term expenses. With a CIB, capital is indexed to the Consumer Price Index (CPI) and interest payments are based on the capital value, so assuming inflation is positive, the $100 capital value of the bond will increase and the interest payments would also increase over the life of the bond.

However, the IABs, which return both interest and principal quarterly, find favour with investors in retirement that need the ongoing cashflow.

So, which bond should you invest in?

The answer is, it is important to hold an allocation to all three bonds for protection, as investors can never be sure that interest rates will not move higher or lower or that inflation will spiral. However, the portfolio weighting may change depending on your view of interest rates.

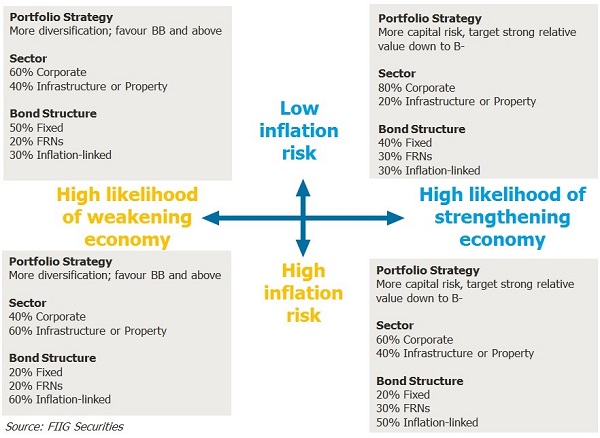

The diagram below acts as a suggested framework tool for investors to build an investment portfolio that matches their future expectations and provides protection in the event that the unexpected occurs. For example, you may expect rates to rise so you invest accordingly but rates are then cut instead. An allocation to fixed rate bonds would provide some protection if this scenario unfolded.

Building a defensive portfolio, tailored to your economic expectations

How to use this chart:

1. This is all about risk and the future. That is, do you think it is more likely that the economy will strengthen or weaken?

2. Percentage weightings are the target weights, but only if that category offers good relative value.

3. Realistic targets should therefore be plus or minus 10 per cent around these allocations. For example, if the target allocation is 40 per cent, investors should aim for 40 per cent but settle for 30 per cent to 50 per cent depending on availability.

4. FRNs and ILBs have similar hedging qualities, so can be substitutes if good value isn't available at the time. For example, in the low inflation risk/ strengthening economy scenario, 40 per cent fixed and 60 per cent in some combination of FRNs and inflation-linked bonds is better than increasing the 40 per cent allocation to fixed.

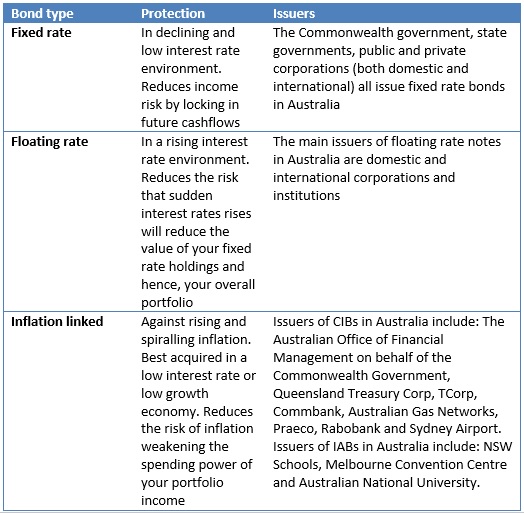

The table below summarises the three types of bonds: