Three reasons to stare down market fears

Forget the potential for a market correction, let's focus on the cold hard facts. Even if the market continues to lose ground, history suggests this is perfectly normal. There's always good reason to be optimistic.

1. Corrections are Natural

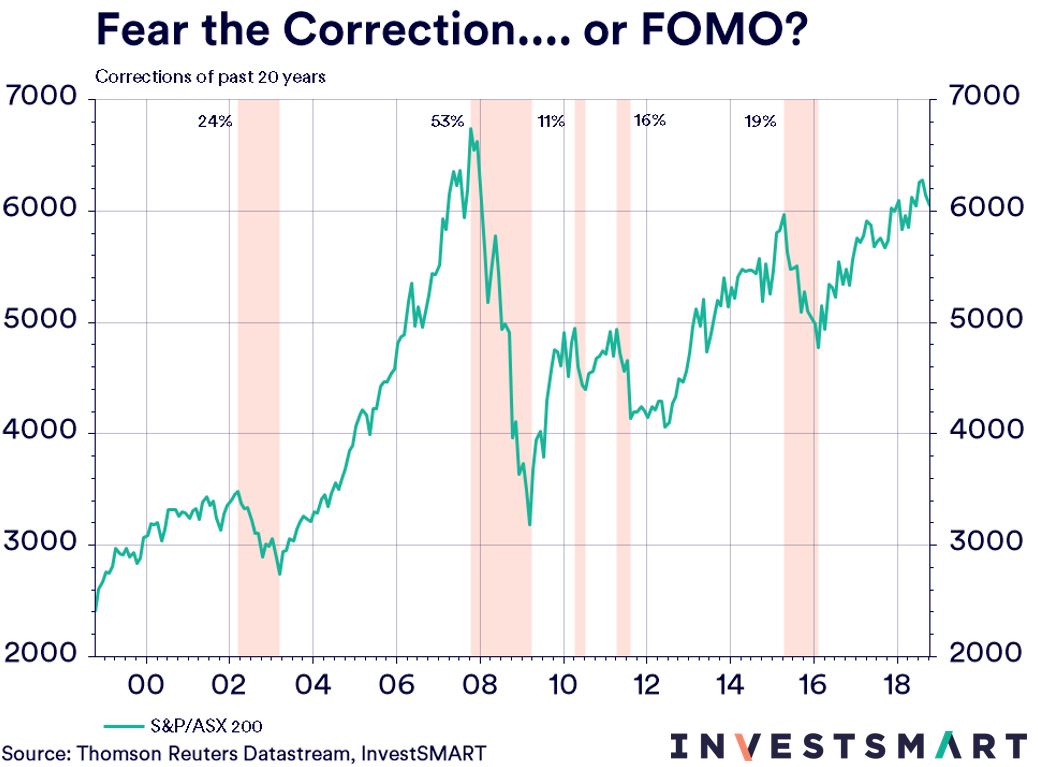

Over the last 20 years, the ASX has seen five corrections. That’s one correction every four years. (A correction is a decline of 10 per cent or more.)

On average, these corrections last nine months.

They are part of the natural market cycle.

Bull markets clearly don’t last forever either. But neither do corrections, which are essentially a dime a dozen.

A correction doesn’t always turn into a bear market. Only two of these corrections escalated into bear markets. (A bear market is a decline of 20 per cent or more, while a bull market is an appreciation of 20 per cent or more.)

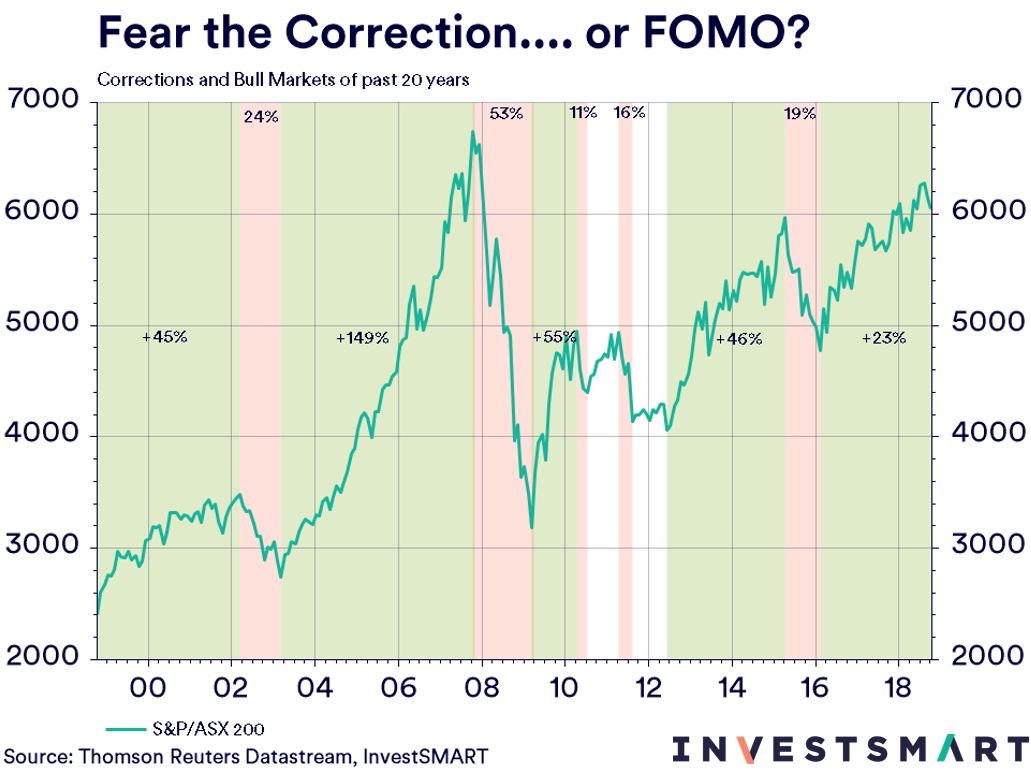

2. Remember, bears always become bulls

Over the past 20 years, the ASX has added 152 per cent despite the five corrections it has experienced over this timeframe.

Put the other way around, the ASX has seen five bull markets over the same period.

3. If you're lucky...

A ‘lucky’ investor would have bought the market 20 years ago and held on, keeping their head above water, through all the ebbs and flows.

Going further, a very lucky investor would have bought the ASX on October 14, 1998 – 20 years ago, to this week – to make a very solid return of 153 per cent.

Note, on a total return basis, that already solid return becomes a stellar 488 per cent.

But anyone can get lucky here. Hindsight helps, and reflections like these will remind how easy it can be.

Meanwhile the ‘average’ investor, who bought the market at any point, has in all likelihood still done well by most metrics in the returns department.

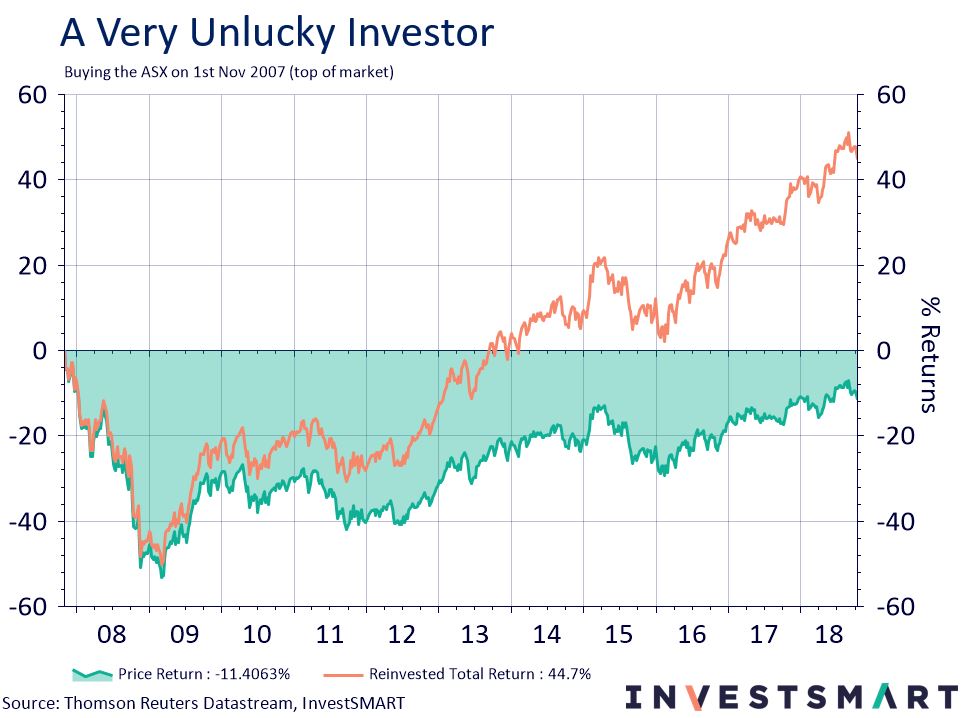

And what about the ‘unluckiest’ investor during that period? If you had invested in the ASX on November 1, 2007, at the very top of the market, you would be down 11 per cent. But that’s only on face value. Let’s apply market principles. On a total returns basis, including dividends, even this ‘unlucky’ investor is up 44 per cent.

It’s a reminder to keep your head above the doom and gloom and eyes fixed on total returns.