Three forecasts for the year ahead

Summary: Three unusual forecasts can tell us something about key sectors in the year ahead. As consumers start spending again, retailers have a chance for a good Christmas. In mining, the iron ore price could fall a lot further, which would weigh on resources stocks. Innovators in financial services and health are set to take advantage of interest from global entrepreneurs. |

Key take out: It's good news for the Australian share market that there are companies seeking to expand in areas of interest to US financiers. |

Key beneficiaries: General Investors. Category: Shares. |

All of us are familiar with the regular broker forecasts that the market is going to rise between 10% and 15% in the year ahead and the endless forecasting gyrations from economists covering growth and interest rates.

But this week three unusual forecasts crossed my desk and I want to take you through those forecasts and discuss what they are telling us. Each one has an important implication for the Australian share market and economy.

Retail set to shine

The first is from Charlie Nelson, managing director of Foreseechange. Nelson specialises in asking consumers a set of questions that enables him to pick directional changes in consumer spending. For the last two or three years Nelson has had very little to say because Australian consumers have not been spending and have been concentrating on saving. But the Nelson survey in October picked a significant change, with a strong rise in consumers' willingness to spend and at the same time in their willingness to reduce payments on their home mortgages to reflect lower interest rates.

The trigger for this is the combination of the elimination of the carbon tax and lower petrol prices. Reasonable petrol prices are already helping consumer wallets and while the carbon tax elimination has not yet put money in consumers' pockets, they know it is coming because the energy companies have written to them.

Like all forecasts Nelson can be wrong but he has an excellent record stretching back for a decade or two. Assuming Nelson is right that means that retailers now have a chance to chalk up a good Christmas. The retail market is now much more diversified and not all retailers will get it right, but those that do are set for good times.

A surge in consumer spending will be a wonderful tonic for the non-mining part of the stock market and will enable a lot of people to get part-time employment. The biggest factor influencing interest rates at the moment is the housing market but if consumers start spending it is most unlikely that interest rates will fall.

Mining may struggle

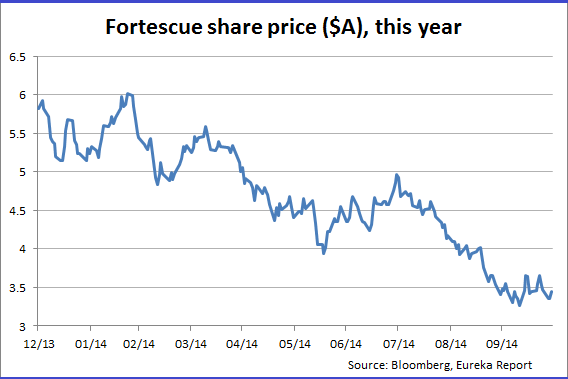

The second forecast that caught my eye was the warning from BlueScope chief executive Paul O'Malley who says that the period of high growth in Chinese steel demand is over as more and more industries switch to the US because of lower energy costs and better labour. O'Malley has been bearish about Chinese steel growth for a year or two but he has now firmed his forecasts and it looks like he is correct. What's more, this China growth rate decline is happening just as the iron ore producers are beginning to flood the market with material.

If O'Malley is right then the iron ore price could fall a lot further unless the big miners BHP, Rio Tinto and Vale change their strategy and reduce production. There is no sign of that at the moment. If Chinese steel growth is curbed it will also affect coking coal and probably demand for energy.

Shares in Australian miners have been among our worst performers in recent times so it looks like the market has gotten a whiff of what is ahead.

Innovators to win big

The third forecast comes from my colleague Jackson Hewett who recently returned from a technology conference in the US. At these sorts of conferences you can work out where the growth is going to take place in the coming years because the entrepreneurial financiers chase businesses in the fashionable areas.

At the top of the financial entrepreneurs' list at the moment is financial services and health. Anyone with an idea to launch a product that undercuts banking prices and takes market share from the major banks will immediately attract the attention of the US financiers. Australian banks are among the world's most profitable so they are high on the list of potential targets.

I don't think our banks have any concept of the varied array of attacks they will encounter over the next four or five years. Shareholders and banks don't need to be worried about their dividends in the short to medium term and I think the bank results due in the coming days (NAB on October 30, ANZ on October 31 and Westpac on November 3) will give them a warm inner feeling that their dividends are safe.

But in the longer term these high dividends are sapping the ability of banks to move into new areas and leaving a much clearer run for those looking to challenge them.

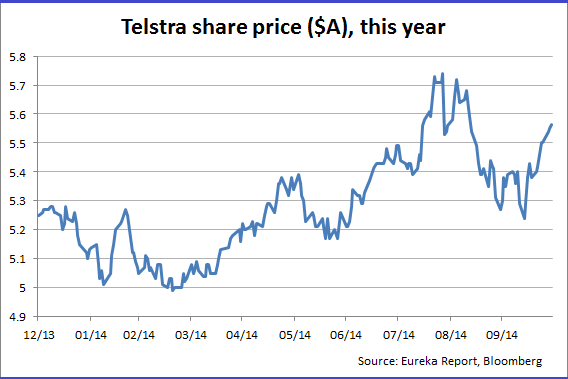

The second area that the entrepreneurial financiers are chasing is health. Telstra has obviously picked up the scent and is planning to use its network to facilitate a much better communication system between patients and medical practitioners. If it goes all the way Telstra can substantially reduce the cost of medicine in Australia. I am not sure if Telstra is ready for that. Nevertheless it has the potential to be a major growth play.

CSL has become a global growth stock partly as a result of a very low-cost acquisition in plasma. Now it's looking to duplicate at least some of its plasma success in vaccines. The US financial entrepreneurs who are bidding up the price of health assets did not find the Novartis flu vaccine business to their liking. So CSL was able to pick it up for just $US275 million and suddenly became a global flu vaccine player. The Novartis business was on the market because GlaxoSmithKline was swapping its cancer assets for Novartis vaccines but couldn't take flu because GlaxoSmithKline is already a major flu vaccine producer.

CSL has become a global flu operator for a song and it now has the capacity to produce vast quantities of flu vaccine should another pandemic arise. Governments want to deal with companies that have that capacity.

It's good for the Australian share market that we have stocks looking to grow in the growth sectors of global capital.