The year in economics: A dollar story

Summary: When analysing Australia's economic performance over 2017, all roads tend to link back to our currency in one way or another.

Key take-out: Throughout 2017, there have been a wide range of forecasts on where the Australian dollar will trend. Some point to it rising sharply, while others have predicted a slump. At this point, it's probably trading at fair value.

If you were to ask yourself what the Australian dollar had done in 2017, you would probably assume it had declined – and that is indeed the case for the last three months of this calendar year.

But, 2017 has actually been a positive year for our local currency, with several macro themes working in its favour.

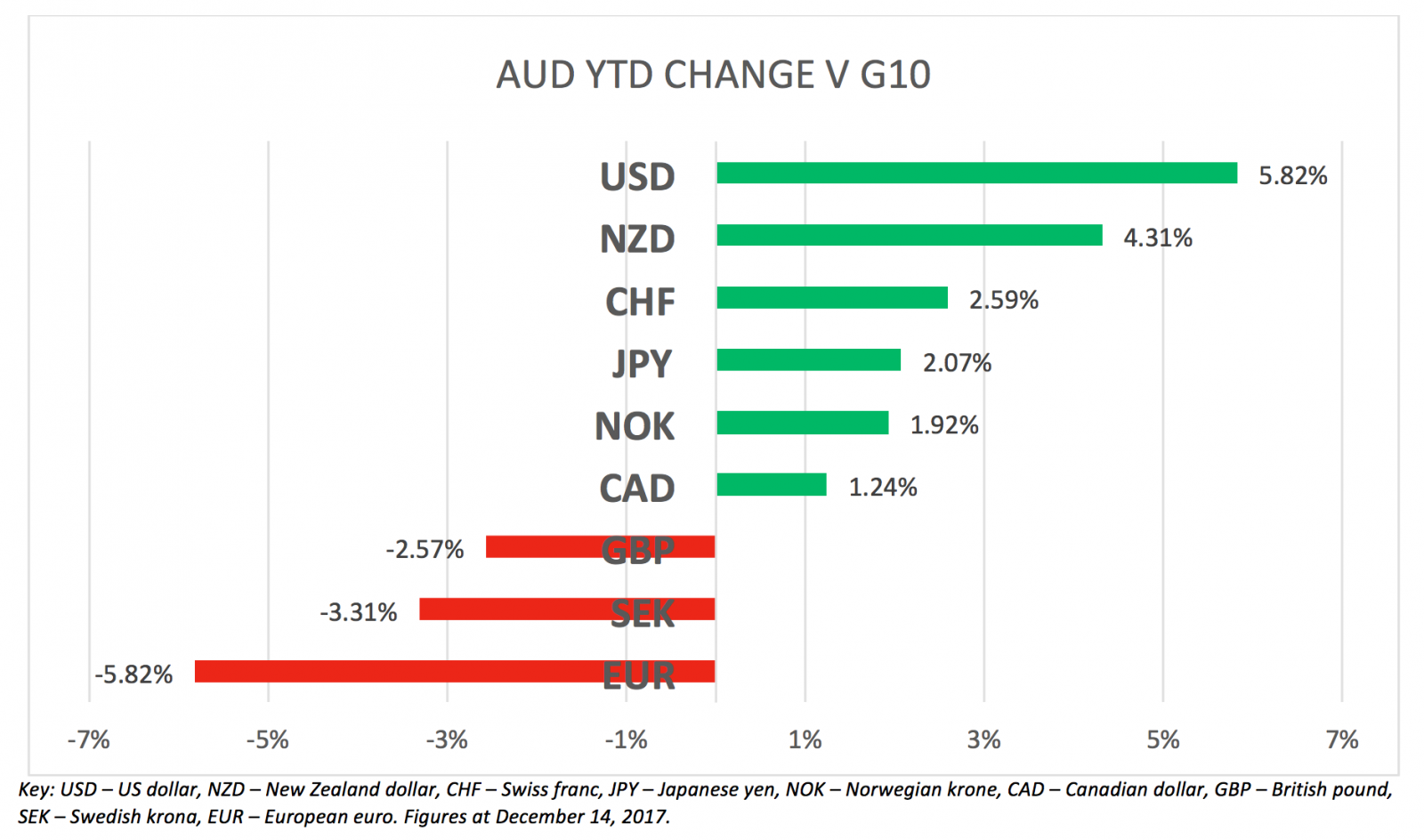

These thematics have both domestic and international origins. Drilling into the Australian dollar's performance against its G10 peers, one thing is clear – risk was switched ‘on' globally in 2017. Just look at the euro.

Growth has been a major theme for this year, and it's helped drive up ‘risk' currencies across the board.

It has been an amazing year for growth markets – consider the tech-centric NASDAQ in the US, Hong Kong's Hang Seng, the Korean KOPSEI and the high-end European manufacturing markets, the German DAX and the French CAC.

Considering the Australian dollar is a risk currency, with a quasi-China/emerging market overlay, we can narrow it down to five key forces that have driven our local currency in 2017.

It may have been a wild ride, but the Australian dollar still looks likely to finish higher than where it started.

The China surprise

The China ‘hard landing' story has been getting rolled out since 2006. China's meteoric growth rates, high levels of debt, and possible overestimates of domestic turnover, fuels this bear argument.

There's a real catch to the bear case for China though. Through policy decisions, China is fast modernising itself, evolving financial spending and conditions to the changing economic environment.

When it comes to policy, China's end goal is to double its 2010 GDP figure by 2020. It is on track to reach this goal, but it does need to maintain current levels.

Here are the key points for the China surprise to the upside:

- Infrastructure spending in China was brought forward, increasing project values and speeds.

- Industrial production jumped off 25-year lows in March and expanded all year, helped by the return of Europe's demand for Chinese goods as its economic profile increased.

- Chinese growth continued to be above expectations as global growth increased.

- There has been an added layer of financial stability through increased regulation around debt and clampdowns on steel mills. The value of outputs has risen to three-year highs in some instances.

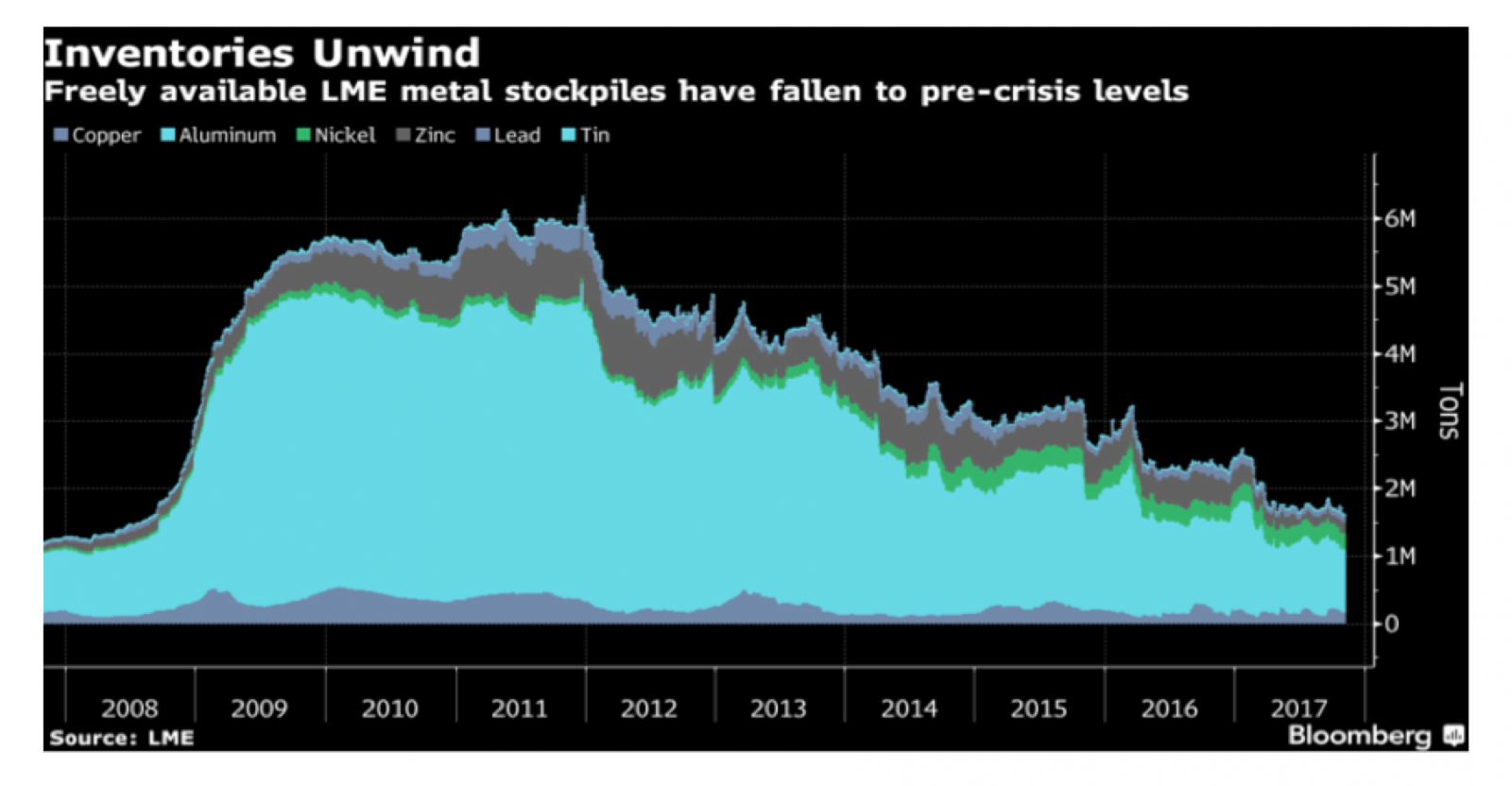

- As the chart below illustrates, global inventory levels of bulk commodities hit pre-GFC levels in 2017, with the key to this being copper. Chinese copper demand is experiencing a renaissance, and we've seen copper prices on the Chicago Mercantile Exchange and London Metals Exchange hit three-year highs.

Economic and policy changes coming out of China certainly added some good spice to the Australian dollar in the middle of the year, where we saw the Aussie shift from around US73 cents to a high of US81c.

Iron ore

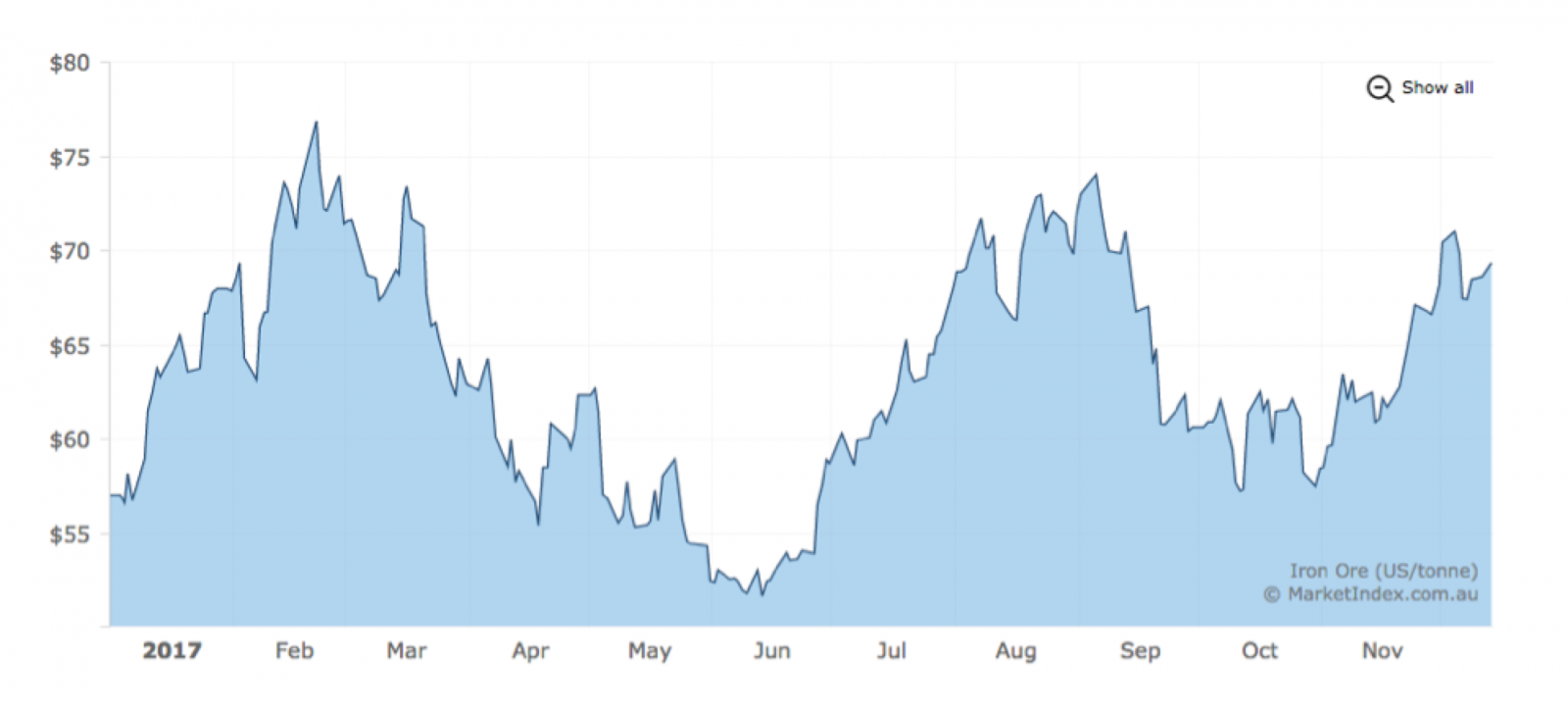

A picture tells a thousand words.

The above iron ore chart shows the risk appetite coming out China and the demand created on the back of global growth from June.

Iron ore was singled out as a reason the Australian economy could lag, with some long-term forecasts pricing iron ore at around $US40 a tonne.

However, with stockpiling at Chinese ports hitting their lowest levels in five years, and steel mill closures on the back of new environmental policies, demand for Australian iron ore has hit its highest level on record. More than 100 mega tonnes were shipped out from Australia, with this peaking in September.

The steep decline in the iron ore price in September, illustrated in the chart above, essentially charts the lead-up to the National People's Congress in China. The speed of recovery following the Congress shows China is positioning towards a new growth cycle. That encourages risk currency bids – particularly the Australian dollar.

Growth

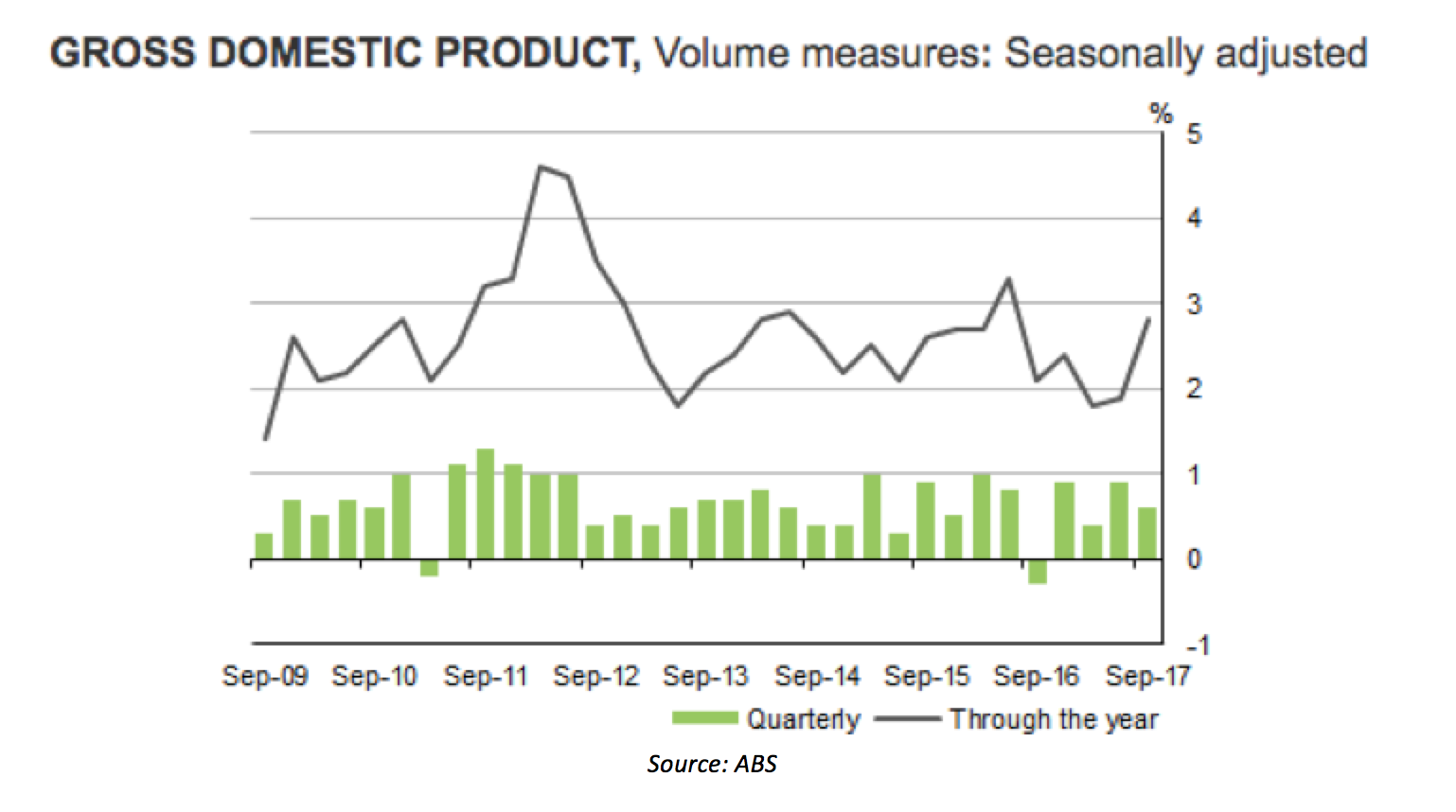

Despite the figures, GDP's effect on our local currency has been rather inverted. Growth has been solid throughout 2017 and the releases to date have been ahead of forecasts.

There were expectations for a decline in the annual growth rate, and the quarter-on-quarter decline at the second quarter mark suggested that might be the case.

However, as explored above, the ‘China surprise' and bulk commodities renaissance, driven by China's demand for base metals, could actually add points to GDP. Public spending held firm and even private expenditure began to increase at the end of the year.

The Australian dollar has been agitated by the consumption figures in this year's data drops. Consumption has been on a fairly sustained decline, but debt-to-income ratios have increased, and the issues around wages and disposable income continue to mount.

This means the market's conclusion about Australia's projected growth rates is a two-speed issue, and one that could reverse when net exports slow down. Currencies tend to react to events faster, and despite growth being championed in equity markets the Australian dollar wasn't as impressed in 2017.

Inflation

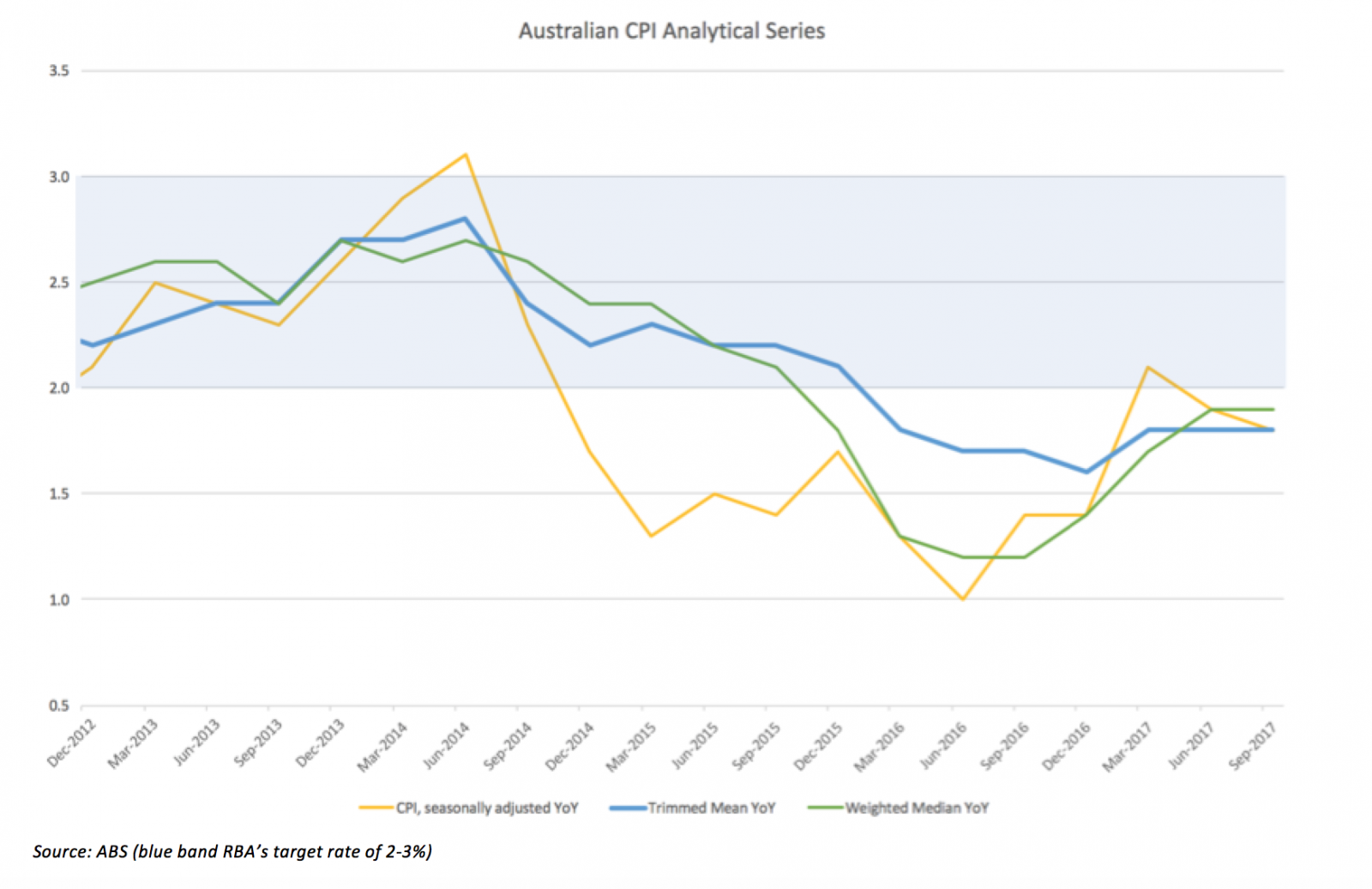

Anaemic and unresponsive inflation figures were a flow-on effect from the domestic growth rate onto the Australian dollar.

The most important figure from the inflation reads is the trimmed mean, which has been below the Resere Bank's target band for more than 20 months now. If you strip out housing from the trimmed mean, inflation would be more in the order of 1.4 per cent than 1.8 per cent.

There has been an increased emphasis on the consumer. For years now, the RBA has been talking about high consumer debt levels and pointing to issues with income.

Feeding into inflation, in the second quarter of 2017, wages growth stands at a record low. It is clearly stagnating. More concerning, real wages are just 0.1 per cent above the current inflation level. Low wages growth has filtered into lower levels of consumption this year and set inflation on a declining path to disinflation.

Wages growth was one of the biggest drags on the Australian dollar in October and is probably why some people think our local currency had a shocker year (when it didn't).

The RBA

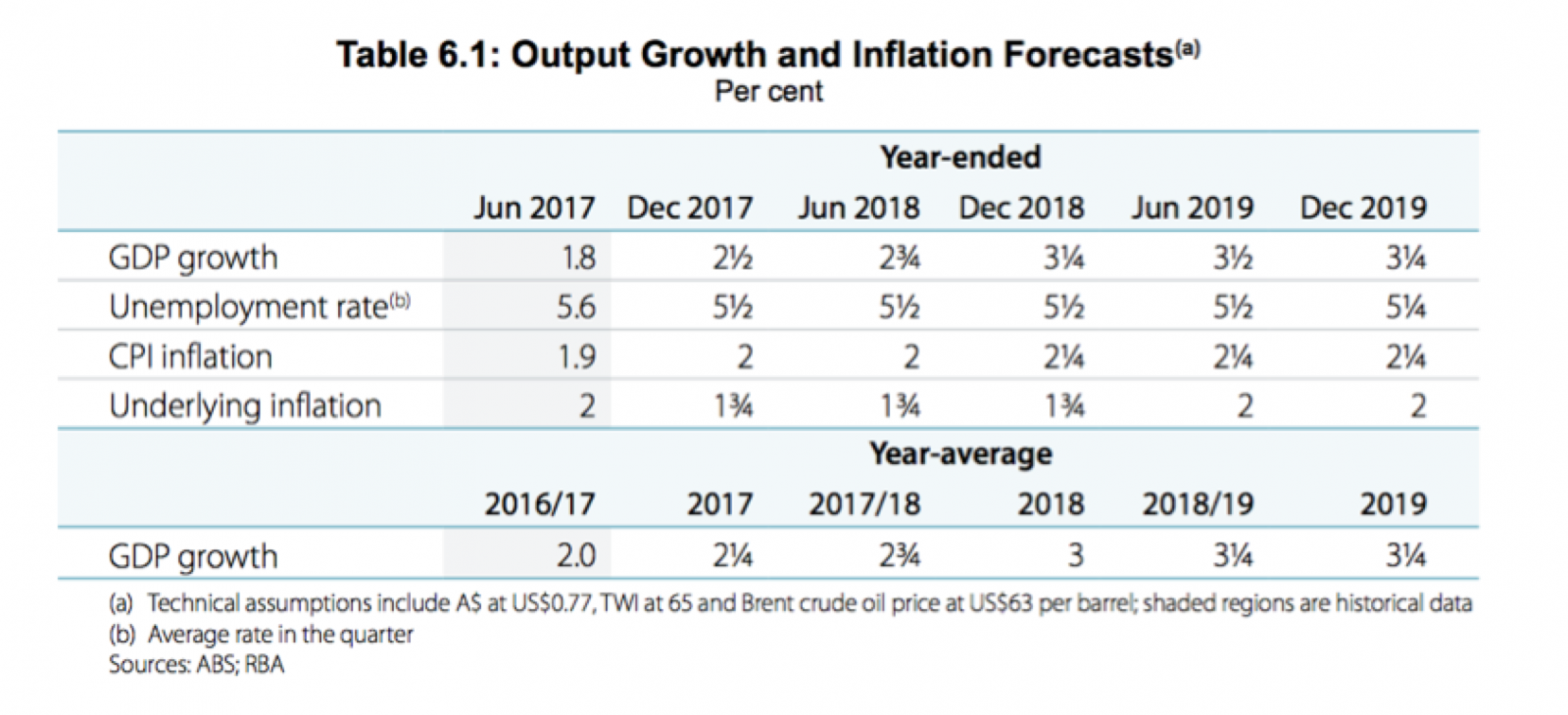

The four key themes above have instigated a push-pull effect on the Australian dollar and future economic forecasting. The latter is illustrated in the RBA's final 2017 release of the Statement of Monetary Policy:

GDP was revised slightly higher as the year progressed, and unemployment revised lower as private spending increased and the China story developed. However, the Consumer Price Index was also revised lower and now looks like it won't be breaking the RBA's target band over the forecasted period – it will only touch it.

There was a prevailing belief in 2017 that the RBA would have to raise rates as the housing-led recovery turned frothy and debt hit record levels. This fear reached a peak in September when peers such as the Bank of Canada and Bank of New Zealand raised rates.

However, as the table above shows, the central bank is likely to remain in its current position, sitting on its hands for the foreseeable future, with the Australian economic environment so evenly posed.

With the RBA essentially ‘out' of the market, the Australian dollar is now trading on market factors alone. As RBA Governor Philip Lowe commented in late December, the currency is “probably trading at fair value” – suggesting 75c is now the neutral point.