The Week in Review: February 23, 2018

A rebound after the market pullback, and the recurring problem of wages growth.

Investment markets and key developments over the past week

- Share markets were mixed over the last week with the US share market giving up a bit of its rebound from the previous week as inflation and Fed concerns linger, Eurozone and Japanese shares rising slightly and Chinese and Australian shares seeing good gains with solid profit results helping support the Australian share market. US bond yields continued to trend higher with the ten-year yield reaching its highest level in four years, but bond yields were flat in Germany and fell in Australia. Commodity prices were mixed with oil and iron ore up, but metals down not helped by a bounce in the $US. The stronger US dollar also saw the $A fall.

- While we remain of the view that the pullback in share markets this month is a correction as opposed to the start of a new bear market it remains premature to conclude that its over as it will take a while for markets to adjust to higher inflation, a more aggressive Fed and higher bond yields. Meanwhile, a more aggressive Fed and strengthening growth in the US relative to the rest of the world (with US PMIs rising over the last week relative to Eurozone and Japanese PMIs) could at least drive a further bounce higher in the $US particularly with sentiment towards the $US so negative that its positive from a contrarian perspective. This at a time when the US Fed Funds rate is set to rise above the RBA's cash rate next month for the first time since the early 2000s is likely to push the $A lower.

- March 4 Italian election unlikely to threaten the euro for now (although markets might worry about it) but not likely to be good for economic reform either. Italian shares have been star performers over the last year reflecting an improvement in the Italian economy and banks. The coming election could threaten this. Polling indicates that no single party or existing coalition will reach the 40 per cent threshold to win government, so another election is possible. However, the incentive to build coalitions is strong and there are three potential coalition government outcomes: a populist right-wing coalition including Silvio Berlusconi's (no – he can't be PM again!) centre-right Forza Italia and the right wing Northern League (which looks the closest to the 40 per cent threshold); a “grand coalition” between Forza Italia and the centre-left Democratic Party with maybe the Northern League and formerly Eurosceptic Five Star Movement (5SM); and a centre-left coalition with the Democratic Party and 5SM.

- While 5SM (a lot) and Northern League (a bit) have toned down their Euroscepticism to the point that a Euro exit is no longer really on the agenda for now, all major parties are promising more government spending (which is not great given Italy's high public debt) and prospects for stepped up economic reforms are low. A populist right-wing coalition would be the most negative outcome as both Forza Italia and the Northern League have promised big spending and threatened to reverse economic reforms and it would run the risk of an attempt to leave the euro during the next economic downturn (with the Northern League arguably now the most Eurosceptic of the major parties, even though it has toned it down). A grand coalition would really just mean more muddling along in Italy with little economic reform and it would be the most unstable. A centre-left coalition would arguably be the most positive in terms of being a bit more fiscally sensible and 5SM is actually pro-reform, but it's also the least likely outcome. Overall, the Italian election is unlikely to threaten an Itexit (Italian exit from the euro) at least in the short term, but it does run the risk of making Italy's public finances worse than they already are (with increased conflict with Brussels as a result) and no progress in addressing Italy's long-term competitiveness problems. Not great – but probably not enough to threaten the greater European integration agenda that Germany (assuming the Merkel/SPD coalition is confirmed) and France are likely to pursue.

- RBA well aware of mortgage stress in setting interest rates, but it won't stop them raising rates when needed as it's not as bad often portrayed. The common impression given by various media reports in recent years is that mortgage stress is so bad that any rise in interest rates will cause mass defaults, a collapse in home prices and big problems for the banks. However, the RBA in a speech by Assistant Governor Michele Bullock points out that mortgage stress is in fact little changed and even down a bit over the last decade (with lower interest rates offsetting higher principle payments). While it is keeping a close eye on the issue it also notes that higher debt levels will be allowed for in setting rates. The bottom line is that the RBA does not see mortgage stress as a barrier to raising interest rates when the need arises, but higher debt levels than in the past likely mean that the next tightening cycle will be mild by past standards. This is simply because higher debt has made household spending more sensitive to rate moves and as a result rates simply won't need to go up as much as in the past to achieve a desired slowing in spending in order to contain inflation.

Major global economic events and implications

- US economic data was solid, and the Fed is more confident. While existing home sales fell in January this may have more to do with low supply and in any case Markit business conditions PMIs for February rose solidly, the Conference Board's index of leading indicators is surging and jobless claims remain ultra-low all pointing to continued strength in economic growth. Meanwhile, the minutes from the Fed's last meeting retained a bit of scepticism about whether inflation would rise, but overall indicated more confidence in the growth and inflation outlook. And note that this was before the recent data showing stronger wages growth and inflation and Congress' further fiscal stimulus. While the Fed may still be thinking in terms of three hikes this year, we remain of the view that it will end up hiking four (or possibly five) times, whereas the US money market is still factoring in three hikes.

- The US December quarter US earnings reporting season is now 90 per cent done and has continued to impress. 78 per cent of results have beaten earnings expectations and 77 per cent have beaten on sales. Earnings growth for the quarter is up 15 per cent year on year and revenue is up 8 per cent yoy.

- Eurozone business conditions PMIs and consumer confidence slipped in February, but remain very strong pointing to continuing strong growth.

- Japan's Nikkei manufacturing conditions index fell slightly in February but remains solid indicating continued good growth. Core inflation rose slightly in January which is good but at 0.4 per cent year on year its still a long way below the 2 per cent inflation target, so the Bank of Japan is still a long way from starting to wind back monetary stimulus.

Australian economic events and implications

- Yet again, Australian economic data was mixed over the last week. On the one hand, an uptick in December quarter wages growth is not quite as good as it looks – it was trivial with annual wages growth still just 2.1 per cent year on year, likely to reflect the ongoing flow through of last year's minimum wage rise with underlying wages growth stuck around 1.9 per cent year on year and was focussed on the public sector with no uplift in private sector wages growth. The best that can really be said is that wages growth has stabilised. With significant spare capacity remaining in the labour market and enterprise agreements still showing falling wages growth it's premature to expect much of a lift in wages growth just yet. So there is nothing in this or the minutes from the RBA's last board meeting to change our expectation that interest rates won't be increased until late this year at the earliest.

- On the other hand, a sharp slump in construction activity in the December quarter is nowhere near as bad as it looks. In fact, it just reflects the removal of a technicality that saw imported LNG installations artificially boost engineering construction in the prior two quarters, that as with the previous quarters will have no impact on GDP growth. Estimates of underlying construction were around flat for the quarter with a rise in non-residential building but a fall in residential and public construction.

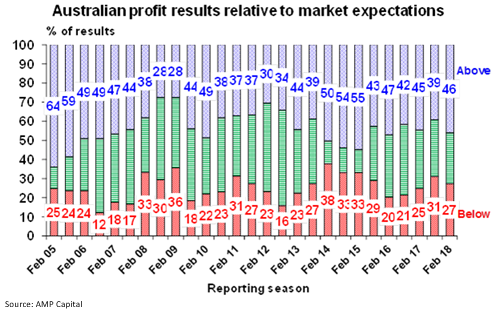

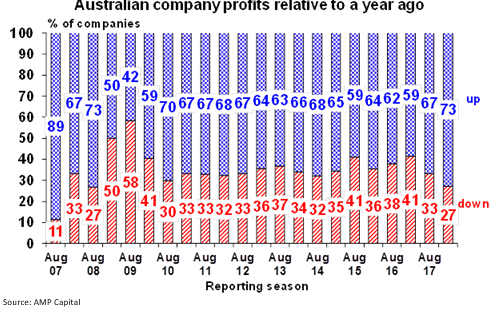

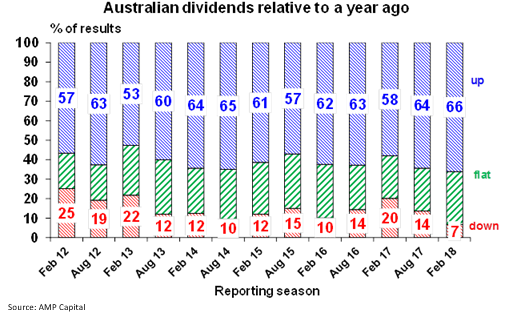

- The highest share of Australian companies seeing profit gains since the GFC, but profit growth still lagging globally where profit growth is running around 14 per cent. The December half profit reporting season is around 90 per cent done and has been pretty good. 46 per cent of results have exceeded expectations (against a norm of 44 per cent), 73 per cent of companies have seen profits rise from a year ago (compared to a norm of 65 per cent) which is the strongest since the GFC and 66 per cent have increased dividends from a year ago with 27 per cent keeping them flat which is a sign of ongoing confidence in the outlook. Reflecting the reasonable quality of results 57 per cent of companies have seen their share price outperform the market the day results were released (against a norm of 54 per cent). Partly reflecting the uncertainty around the global correction in share prices, good beats were greeted with sharp share price gains particularly when PEs were low (eg Nine and Qantas) and misses were hit hard (eg Blackmores). Consensus profit growth expectations for this financial year remain around 7 per cent, with resources upgraded slightly to 15 per cent and the rest of the market downgraded to 5 per cent (from 6 per cent) owing to a downgrade to banks. Profit expectations for 2018-19 were actually upgraded to 5 per cent (from 4 per cent) thanks to resources.

Shane Oliver is the Chief Economist at AMP Capital

Share this article and show your support