The Week in Review: May 4, 2018

Investment markets and key developments over the past week

US shares fell over the last week – not helped by profit taking and inflation fears, but Eurozone, Japanese, Chinese and Australian shares rose. Bond yields fell, particularly in Europe on the back of low April inflation. The oil price rose as worries about the return of sanctions on Iran continue to build, but the US dollar continued to rise, and this weighed on metal prices and the Australian dollar.

Why have Australian shares rebounded? From their early April low Australian shares are up 5.5 per cent and have been helped by reasonable earnings news from Australian companies, solid commodity prices, a fall in the Australian dollar, which makes Australian companies more competitive, and some fading in trade war fears. But it's not just the Australian share market. Eurozone and Japanese shares have had even stronger rebounds from their lows, helped by a fall in their currencies. But the rebound in the $US has constrained the US share market.

Geopolitical risks heating up again, but so far so good. May is going to be a big month on the geopolitical front with various US allies' exemptions to the steel and aluminium tariffs having expired on May 1, the US deadline to fix the Iran nuclear deal expiring on May 12, the public consultation period for tariffs on China due to expire on May 21 and the US Treasury Secretary due to report on proposed restrictions on Chinese investment in the US by May 21. So far so good, with the US reaching deals with Australia, Argentina and Brazil on the steel and aluminium tariffs and extending the exemption for Canada, Mexico and the EU until June 1. Negotiations between the US and China have also started on trade – but while they have been said to be off to a “positive” start with a “very good conversation” they have a long way to go and we will see a lot of posturing and near-death moments. Ultimately a deal will likely be reached – that's been the whole point of the US threats and China is open to negotiation – but it likely won't be resolved until after May 21, and so we may see a brief start up to tariffs or a delay to their start up. On the Iran nuclear deal, it's likely President Trump will not waive trade sanctions against Iran – this will mean that around 0.7 million barrels a day of Iranian oil exports will be lost to the market (against total global production of around 100mbd) which could result in some further upwards pressure on the world oil price. But it's likely to be minimal as oil prices have already moved up in anticipation. Finally, risks around the Mueller inquiry for Trump are continuing to hot up. All of which points to ongoing potential for volatility in markets.

There were no surprises from the Fed, which remained on hold but is on track for more hikes. The Fed is upbeat on growth and recognises that inflation is close to its 2 per cent target and will soon run above it. Its new reference to the inflation target being “symmetric” indicates it won't slam on the brakes just because inflation is above 2 per cent. But it remains on track for more “gradual” rate hikes. We expect three more hikes this year with the next move to come next month at which point the “dot plot” will move up to three more hikes this year too.

There were also no surprises from the Reserve Bank of Australia, which also left rates on hold – for a record 21 months and is set to leave them on hold for much longer. While the global backdrop, business conditions, non-mining investment and infrastructure activity are positive and will lead to some acceleration in growth, uncertainty remains around the outlook for consumer spending, household debt is high, banks are tightening lending standards, wage growth and inflation remain low and will pick up only gradually, and house prices are falling. As a result, the RBA is likely to remain on hold for a long time yet and we don't see a rate hike until 2020 at the earliest. While the RBA's latest Statement on Monetary Policy revised up slightly its underlying inflation forecast for this year to 2 per cent, and revised up its unemployment forecast to 5.5 per cent, the moves are not enough to change the interest rate outlook. It still doesn't see inflation getting back to the mid-point of the 2 to 3 per cent target over the two years of its forecast horizon and we remain of the view that its forecasts for 3.25 per cent growth are too optimistic.

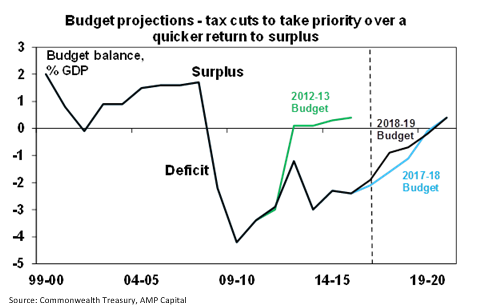

The 2018 Australian Federal Budget to be handed down on Tuesday 8 May will be a pre-election budget made possible by a revenue windfall. A big improvement in in the underlying budget position on the back of increased corporate tax revenue, strong employment growth and lower spending is expected to see the deficit for this financial year fall to $17 billion from the $29 billion projected in last year's Budget. This would allow the projected return to surplus to be brought forward a year to 2019-20 but the Government is likely to “spend” much of the revenue windfall as a pre-election sweetener and leave the return to surplus in place for 2020-21. The key elements of this pre-election budget stimulus - which will amount to around $7-8bn a year or 0.3 per cent of GDP - are likely to be personal tax cuts for low and middle-income earners possibly starting as early as July this year but more likely in July 2019, the dropping of the 0.5 per cent increase in the Medicare levy, more infrastructure projects and maybe some increase in health spending. Financial sector regulation may also get a boost in view of the Royal Commission. And the Government may announce a cut to its immigration intake. Key Budget numbers for 2018-19 are expected to be: a Budget deficit of $13 billion (assuming the tax cuts kick in from July 2019), real GDP growth of 3 per cent, inflation of 2.25 per cent, wages growth of 2.5 per cent and unemployment of 5.5 per cent.

The upside of the Australian Government's Budget strategy is that consumers will be given a shot in the arm at a time of soft wages growth, falling home prices in Sydney and Melbourne and tightening bank lending standards. And the budget stimulus of around 0.3 per cent of GDP will be nowhere near the 2 per cent of GDP seen recently in the US. The downside is that we will still be seeing a record 11 or 12 years of budget deficits with nothing put aside for the next rainy day and there is a risk that the revenue surprise seen lately will prove ephemeral if global growth is threatened and/or employment slows.

Major global economic events and implications

US data was mostly strong. Construction activity fell in March and the ISM business conditions indexes slipped. However, the ISM indexes remain at very strong levels, personal spending rose solidly in March after a soft patch, pending home sales rose, the trade deficit narrowed in March and labour market indicators remain strong. The core private consumption deflator rose to 1.9 per cent year on year in March and has risen at an annual pace of 2.3 per cent over the last six months. It looks like it's going to be at 2 per cent faster than the Fed was forecasting. US March quarter earnings results are now 80 per cent done, with 77 per cent beating on profits and earnings running up 24 per cent on a year ago.

Eurozone GDP growth slowed to 0.4 per cent in the March quarter or 2.5 per cent year on year and April core inflation slowed to just 0.7 per cent yoy (from 1 per cent yoy). While we expect growth to remain around 2.5 per cent and the fall in core inflation looks related to the early timing of Easter and so should prove temporary, the ECB is likely to remain in wait and see mode for a while yet with the risk that QE gets stretched out longer.

Japanese business conditions PMIs rose in April pointing to stronger GDP growth.

Chinese business conditions PMIs were little changed in April suggesting that economic growth is continuing to hold up well.

Australian economic events and implications

Australian data was a bit better than expected. Residential building approvals rose more than expected in March, April business conditions PMIs fell on average but remain strong and the trade surplus was much stronger than expected in March with net exports likely to provide a solid boost to March quarter GDP growth and business credit growth picked up. But against this home prices continued to fall in April and new home sales continue to trend down. The tightening in bank lending standards was highlighted by ANZ CEO Shayne Elliot who said it “…will probably make it harder for people to be successful in their [loan] applications. It is more likely we will say no when in the past on balance we would have said yes.”

Shane Oliver is the Chief Economist at AMP Capital