The two iron ore projects which could change the market

Summary: The worst appears to be far from over for iron ore producers despite the recent rise in the iron ore price. Not only are heavyweight players like BHP Billiton and Rio Tinto stamping out their patch for a long haul as they expand production, but big new mines are also being developed, with Gina Rinehart moving to within first sight of first exports at her Roy Hill mine and Baosteel proceeding with its mine in the Pilbara region. |

Key take-out: The outlook for iron ore is for an oversupplied market stretching well into the future. That means everyone in the business will have to survive in a sub-$US50/t market, and possibly for a time in the sub-$US40/t market – and that will not be easy. |

Key beneficiaries: General investors. Category: Iron ore. |

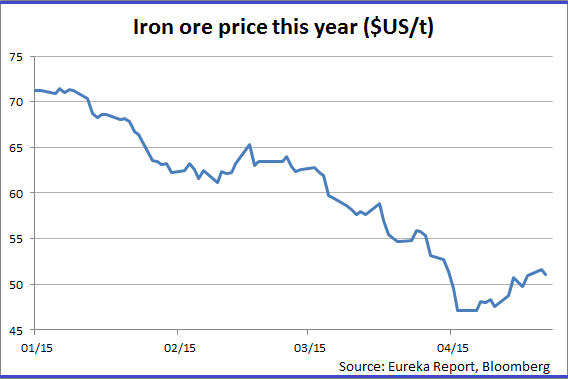

Welcome as it is, the recent rise in the iron ore price to around $US51 a tonne does not signal the end of what will be a protracted war of attrition ending only when there are a handful of survivors, none of them small.

Last week's mothballing of mines in WA, operated by Atlas Iron, was an example of how tough conditions have become, as was this week's admission by Arrium that it lost $8.90 on every tonne of iron ore mined in the March quarter at its South Australian operations.

The problem for higher-cost producers in a flooded market is that they have become the equivalent of road-kill in a high-risk game of race-to-the-bottom which is all about securing future market share and hoping that rivals cannot stomach the financial pain.

Heavyweight players in the iron ore business are stamping out their patch for a long haul that will see the industry revert to a structure similar to that before the China-boom kicked off in 2002.

The 60 per cent collapse in the iron ore price from $US130/t little more than 12-months ago is unlikely to be the end of the process with the potential for a fall through $US40/t over the next few months, a price at which even the biggest and lowest-cost miners are close to their break-even point.

Investors who ignore what's happening are also overlooking the fact that iron ore is merely returning to a time when it was dominated by big, low-cost producers with access to highly-efficient rail and port systems.

Look back 15 years and there was no such thing as a small iron ore producer.

Last year's collapse of Sherwin Iron, Western Desert Resources, Pluton Resources, and other small miners was both a reminder of past tough times and an early indication of a trend which has worsened with pressure now being felt by companies once considered safe from a sustained price fall, including Fortescue Metals.

The estimated $74bn wiped off the value of Australia's iron ore sector over the past 15 months could rise further if production continues to grow and demand slows, as has been evident in the declining rate of steel production in China.

The only Australian iron ore miners assured of emerging relatively unscathed are Rio Tinto and BHP Billiton, but even they will be under pressure as their biggest customer, China, demands lower prices and actively participates in the mining process to push prices down.

A number of developments over the past few weeks demonstrate how dangerous the iron ore business has become for everyone. Those events include:

- China's Baosteel pushing ahead with plans for a big new mine in WA's Pilbara region despite the iron ore price collapse;

- Gina Rinehart moving to within sight of first exports from her Roy Hill mine, and;

- Rio Tinto getting ready to develop at least one new mine in the Pilbara, Silvergrass, and persisting with planning for the giant Simandou mine in the West African country and Guinea.

Of those three mines only Roy Hill will start producing this year but the impact on the market will be substantial because of its size and the quality of its ore.

With an annual target of 55 million tonnes of premium-grade ore Roy Hill will deliver more into the market in a year than all of the small Australian mines which have closed over the past 12 months.

Three lessons for investors

Investors with an interest in iron ore can learn a number of important lessons by comparing Rinehart's single new mine with the eight small mines which have closed.

First, there is the issue of quality and the fact that iron ore is priced according to grade (the higher the iron content the higher the price) with hefty discounts applied on poorer quality material containing impurities such as silica, alumina and phosphorous.

Fortescue's major weakness is that it produces an ore which is lower quality than its big rivals whereas the small producers still in business, such as BC Iron and Mt Gibson, lack the economies of scale essential to survive in the long term.

Second, the size of Roy Hill and the fact that it has its own railway and port facilities means that it will be able to enjoy the economies of scale which can come with size – a critical issue in all bulk commodities.

Third, because all of the mine closures so far have been of small producers, the media headlines generated bear little relation to the effect on the total supply of iron ore which has continued to rise even as the price has been falling.

Rio Tinto and BHP Billiton alone produce more in a month than the collective total of all mines closed so far, and both of the big miners are lifting output through enhanced internal productivity.

Over the past two days both Rio Tinto and BHP Billiton have reported higher production on a March quarter to March quarter basis with Rio Tinto's output up 9 per cent, or 7.1 million tonnes and BHP Billiton's output up by 20 per cent, or 9.4 million tonnes.

What comes next is critical for everyone exposed to the industry because unless someone blinks (and BHP deferring infrastructure spending at Port Hedland is perhaps a taste of things to come), then the outlook for the iron ore price is awful.

Two projects changing the market

Two planned projects – Baosteel's Pilbara project and Rio's Guinea project – which might be unstoppable for political reasons, threaten to add more than 100m tonnes of extra supply onto an already over-supplied market.

Government backing at a Chinese and WA level is a disturbing indication of how political factors are creeping into the iron ore industry.

China, thanks to a long-stated plan, wants to see 50 per cent of all iron ore consumed in its steel mills come from Chinese-owned mines, a policy that includes mines in China and overseas mines controlled by Chinese companies.

The abject failure of the Karara and Sino mines, which are based on high-cost processing of low-grade ore, has not slowed the West Pilbara project which is being designed as a conventional “dig and deliver” business identical to those operated by BHP Billiton and Rio Tinto.

For the big two leaders there is a nasty government pincer squeeze developing, with the WA Government awarding Baosteel the equivalent of “most favoured project status” and the Chinese Government encouraging Baosteel to push ahead with its own mine.

In Guinea, the situation is even more complex. While the corruption cloud over Simandou is blowing away there is uncertainty over whether the $US20bn mine, rail and port system can be profitable at current prices.

Rio Tinto's challenge in Guinea also includes a political element because the often unstable government in that country is desperate to see its resources developed and after 20 years of waiting (complete with a series of self-inflicted delays) it is pushing hard for a firm timetable.

A go-ahead on Simandou was expected about now but has been delayed because of the need to evacuate workers during the outbreak of the deadly Ebola virus in Guinea, but that only means the decision has been shifted to later this year.

If Simandou gets a green light by Christmas it could enter the iron ore market in 2019, ensuring that the flood lasts longer.

Those potential developments are on top of the ongoing efficiency and productivity drives at existing Australian iron ore mines as BHP, Rio Tinto and Fortescue squeeze every last tonne out of their existing operations and from potential new mines such as Silvergrass and Koodaideri.

Painted anyway you like, the outlook for iron ore is for an over-supplied market stretching well into the future, perhaps by as much as 250m tonnes a year if new mines such as West Pilbara and Simandou can squeeze in on quality grounds.

That means everyone in the business will have to survive in a sub-$US50/t market, and possibly for a time in a sub-$US40/t market – and that will not be easy.