The trouble with banks. Property. Last week. Next week.

John Addis

The trouble with banks

The bank kabuki show got underway this week, the first of what will be an annual performance. Featuring jousting politicians and contrite bank bosses, it felt like a cultural crossover, part ritualised Japanese role play, part semi-Seinfeld, a show not quite about nothing but from which nothing much will come, which I'm guessing is the point.

Bank shareholders and customers are right to be concerned about the cultural failings behind the scandals, ripoffs and misdeeds. But to pin it all on bank bosses seems a bit rich. Governments of both persuasions have waved through competition-crushing acquisitions. They've let banks investigate their own misbehaviour, provided them with cheap funding denied to smaller banks and presided over lazy, compliant regulators. Politicians have granted banks their market power and now want to blame them for exercising it. As my kids would say: Well, derrr.

The one issue really worth discussing – what to do about a banking system where the big four are too big to fail – didn't rate a mention. In the US the big banks have submitted plans to regulators for an orderly break up in the event of insolvency, without taxpayer support. Here, taxpayers remain on the hook for someone else's mistakes.

To a banking issue of a little more substance. Deutsche Bank has now fallen nearly 60 per cent from its 52-week high with many Greek, Portuguese and Italian banks faring even worse. Its problems are manifold. Basel III requires banks to build their capital ratios but with Europe's economy moribund, Deutsche has struggled to do so. You can't save money when you're not making it. Then the US Department of Justice (DoJ) slugged the bank with a $US14 billion fine, equivalent to four-fifths of its then market capitalisation, prompting concerns of a “liquidity event”.

One can appreciate the concerns. At the end of May 2008, Lehman Brothers had $US639bn in assets and stockholders' equity of $26.3bn. At June 30, 2016, Deutsche Bank had assets of €1.8 trillion and stockholders' equity of €66.5bn, making it three times larger than Lehman Brothers.

The French, ever happy to stick it to the Germans, claimed it could spark the next crisis. More worryingly, the IMF, in the manner of a football manager getting full backing from the board, said it was confident German and European authorities were “working to ensure the financial system remains resilient".

All good then, except for the fact the IMF – presumably the same one – also released a report which, according to Reuters, warned that European banks need “urgent and comprehensive action” and that inefficient business models “will not allow them to earn enough profits to stay viable and support economic growth.” If the IMF can't make up its mind about Deutsche please don't expect any foolhardy guesses from us. The DoJ, keen to avoid a massive Lehman-sized own goal, is currently renegotiating the fine, downwards one presumes.

So the IMF can't get its story straight, the DoJ hits up a systemically important bank with a fine it can't afford, and Deutsche can't find one employee to blame for the mess, a remarkable state of affairs. Incidentally, the world's biggest banks have now coughed up over $US350bn in fines but almost no one has gone to jail.

Macro-Australia

On Wednesday there was good news. The Aussie dollar got a boost with the announcement that retail sales in August rose 0.4 per cent, the strongest result since January. Of particular note was a 3.5 per cent increase in department store sales, which would please our resident Myer expert James Greenhalgh, especially now the stock is trading below our Speculative Buy price. It was nice to see the company back on a thin looking Buy List. (For ideas on what to do when everything's expensive, check out this story).

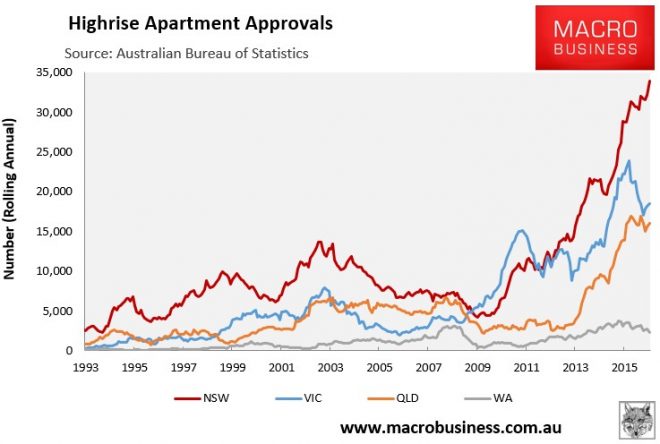

We'll have to wait and see if the figure will have an impact on the Reserve Bank's thinking next month – it held rates steady this month – but consumer confidence remains strong, as does the east coast apartment market. In fact, “strong” understates the situation by some margin. Total building approvals were up 6.5 per cent on the previous year but apartments surged 26 per cent, although down a little in August. This is a well-established trend as the chart shows.

Crazy isn't it? Robert Gottliebsen this week took the unusual step of issuing a warning to avoid the sector. With developers struggling to complete highrise east coast apartment blocks (the banks, after funding the first 50 per cent, have wised up) they're approaching SMSF investors with returns of 10-15 per cent per annum in return for finance.

How did we get here? Much of the focus is on Chinese investors. They've been shifting money out of China, with much of it finding a home, literally, in Australia's east coast cities and Vancouver, for just 10 per cent deposit down. Now these investors are being asked to pony up the rest to get the darn things finished and are struggling to come up with the cash. Hence the knock on SMSF investors' doors.

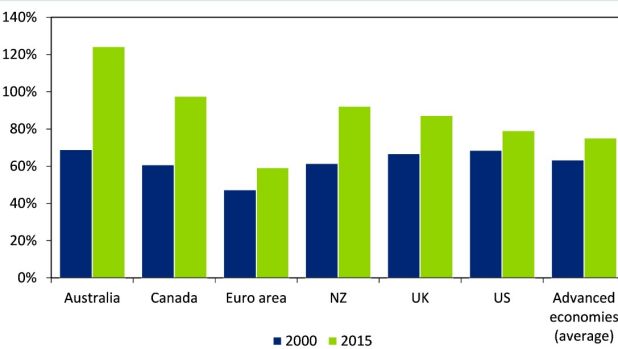

But this is more of a problem for us than Chinese investors, something the IMF – yes, them again – warned us of this week in its Fiscal Monitor. China was a particular focus of the report and Australia got only three mentions, but they were significant nonetheless. Most developed countries have paid down private sector debt since the GFC but in Australia, Canada and Singapore it has “continued to accumulate at a fast pace”.

Chart 2: Household debt relative to GDP

Source: Deloitte Access Economics, Bank for International Settlements, via smh.com.au

There's no disputing that. Australia has the highest private debt levels in the world and property prices have almost doubled since the GFC, an incredible stat to contemplate. Having gaily skipped from the end of the mining capex boom to an investment property binge, the country is now saddled with mortgage-fuelled household debt and a slew of unfinished highrise apartment blocks.

Home approvals are rapidly outstripping population growth so you'd think a day of reckoning isn't too far away, although that's a sentiment I've been hearing for years. Still, this is almost certainly the biggest challenge the banking sector faces. Interest rates wouldn't need to rise too far for bad loans to increase, to say nothing of the threat of a recession. Needless to say, the parliamentary inquiry failed to interrogate the banks on this vital issue but investors need to watch out for it. This is a risk best managed by not having no more than 20 per cent of your portfolio exposed to the banking sector.

Readings and Viewings

With lots happening around the world, here's some links to various articles and videos you may find interesting...

Warren Buffett is known as a patient investor, but his patience is being tested thanks to a $US2.5 billion loss since September on his stake in bank Wells Fargo.

But one bright side for Buffett is a sweet deal with Mars, which is buying out Berskhire Hathaway's minority stake in Wrigley.

While the IMF has said Deutsche Bank poses a risk to the global banking system, the chairman of rival UBS says he doesn't think the German lender will derail the system.

Opening gambit? A change in personnel? Why did the US Department of Justice try and levy a fine Deutsche Bank couldn't pay?

IMF chief Christine Lagarde has warned that Deutsche Bank must do a deal with US regulators over the potentially huge fine.

With the UK pound slumping to a 31-year low on Brexit fears, easyJet has warned a weakened pound will cost it £90 million. It's always tough in the business world. But how does a company develop a business model for a product that never fails and lasts a lifetime? By selling light rather than light bulbs.

One chart explains why Americans feel poorer than they did, even though many are not.

The word on the street is that Twitter will be sold by the end of the month – but the social media group may struggle find a buyer. If it does, watch out for the tweets.

Meanwhile, in Britain, a company has been told it's free to frack shale gas reserves in Lancashire.

But, further north, the Scottish Government has blocked plans by a company to begin underground coal gas extraction.

Moving to the US, a dozen big-name business leaders, including lifelong Republicans and independents, say Donald Trump is bad for the US economy.

We've resorted to satirical news site The Onion for American politics coverage: ‘Voters tune into VP debate to find out what race would look like if this was normal election year.'

And in case you missed it; yes, the Republicans did publish post-debate analysis on Kaine v Pence before it had started.

Venezuela is suffering a mental health crisis after a broad nationalisation of drugmakers under Hugo Chávez.

Could the war in Syria lead to World War III, the UK Spectator asks.

Here's Mitchell Sneddon's recipe of the week: “This week analyst Phil Bish's wife, Tracey, became an office favourite when she prepared this ‘Dutch Continental Chocolate Hazelnut Cake' for the office on Thursday.”

And it's happy birthday to two (septuagenarian!) comic icons today – Australia's Paul Hogan and America's Chevy Chase. Somes 80s throwbacks ... Short but sweet, Croc Dundee arrives in NY. And Chase as an undercover journalist in 1985's ‘Fletch', trying to pass off as an aviation engineer.

Last Week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

Shares rose over the last week helped by a combination of good economic data and a further rise in oil prices. Bond yields rebounded on ECB taper talk and increasing expectations for a December Fed rate hike. As a result of the latter the US dollar rose and appears to be breaking higher which pushed the Australian dollar lower. This was despite a further rise in the oil price on the back of falling US crude stockpiles and worries about the impact of Hurricane Matthew.

Source: Bloomberg, AMP Capital

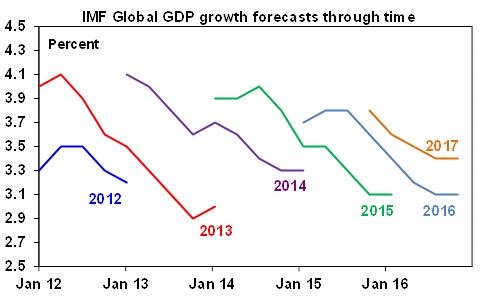

- Consistent with this, the IMF's global growth forecasts have stabilised. After the usual downwards revisions to the IMF's 2016 and 2017 global growth forecasts they have now stabilised relative to the IMF's last update in July at 3.1 per cent and 3.4 per cent respectively. The IMF's 2016 growth forecast has followed the same pattern of the last few years – starting towards 4% and then ending around 3 per cent. The 2017 forecast may have a bit more downside to go though. Three per cent global growth is okay for investors as it's enough to support modest profit growth, but not so strong as to invite aggressive monetary tightening.

Source: IMF, AMP Capital

While Hilary Clinton enjoyed a bit of a poll boost post the first presidential debate taking her lead to around 3-4 per cent, the vice-presidential debate looks to have been won by Mike Pence, albeit its impact is usually minor, and the election outcome remains close. The focus now shifts to the next presidential election debate on Sunday. Our view remains that a November 8 victory by Clinton would simply mean more of the same in the US as Democrats would not control Congress but a Trump victory (or anticipation of it) would be initially negative for shares on policy uncertainty and trade war worries, push up bond yields as the US budget deficit is likely to widen and US interest rates move higher and therefore positive for the US dollar. After an initial negative reaction shares are likely to rebound if Trump's Reaganesque policies (tax cuts, increased infrastructure and defence spending, and deregulation) predominate over his protectionist policies. For Australian assets a Trump victory would mean an initial share sell-off followed by a rebound, potentially higher bond yields and a lower Australian dollar.

RBA on hold and neutral – we still see another rate cut but it's a very close call. With no major economic developments in the last month, September quarter inflation due later this month and new Governor Philip Lowe presumably wanting to demonstrate a degree of policy continuity it was no surprise to see the Reserve Bank of Australia leave rates on hold at 1.5 per cent at its October meeting. We remain of the view that the RBA will cut rates again at its November meeting when it reviews its economic forecasts after the release of the September quarter inflation data in late October, particularly with the Australian dollar remaining too high. However, with economic growth holding up very well, commodity prices and national income looking like they have bottomed and the new Governor perhaps preferring a period of stability, this is a close call and is critically dependent on seeing a lower than expected September quarter inflation result.

Perhaps of more interest was the RBA's view on the housing market. While it remains relatively sanguine it has acknowledged a strengthening in some markets recently, suggesting that it may be becoming a bit less relaxed. The RBA seems to remain comfortable in waiting for the surge in apartment supply to cool property prices. But given the recent rebound in auction clearance rates, Sydney and Melbourne property prices continuing to grow solidly and the risk that the apartment building boom will go way beyond the point of being healthy, my view remains that the RBA is a bit too relaxed about home prices and at least a bit of “jawboning” would be appropriate at present if not a further tightening by APRA.

Major global economic events and implication

US economic data was mostly good leaving the Fed on track for a December rate hike. The ISM business conditions indexes rebounded in September to reasonable levels, particularly for non-manufacturing which is strong, durable goods orders were revised up and employment indicators were generally good (with better employment readings in the ISM surveys and lower jobless claims offsetting a slightly slower ADP employment survey). The trade deficit widened in August though.

Japanese data was mixed with lacklustre conditions according to the Bank of Japan Tankan's survey, a slight improvement in September's manufacturing conditions PMI but a worsening in the services PMI and stronger consumer confidence.

The Reserve Bank of India surprised with a 0.25 per cent rate cut highlighting that global monetary conditions are still easing.

Australian economic events and implications

Australian economic data was mostly solid with a stronger than expected gain in August retail sales after three soft months, building approvals remaining around record levels pointing to a stronger for longer housing construction cycle, a rebound in September business conditions PMIs albeit to still soft levels and a further decline in Australia's trade deficit (which now looks to have seen the worst). Home prices continued to rise solidly in September with Sydney and Melbourne remaining uncomfortably strong (particularly with the supply of units surging). Finally, the Melbourne Institute's Inflation Gauge rose solidly in September but has been soft in the quarter as a whole with the trimmed mean measure of underlying inflation falling to just 0.8 per cent year-on-year.

What to watch over the next week?

In the US, expect the minutes from the Fed's last meeting (Wednesday) and a speech by Fed Chair Yellen (Friday) to repeat the message that the Fed will remain gradual in raising rates and expects to hike rates again at its December meeting. On this front, an expected 0.4 per cent month-on-month gain in September retail sales after two weak months will be important in indicating whether the Fed is on track or not. Data on job openings (Tuesday), small business optimism (Wednesday) and producer prices (Friday) is also due.

The US third quarter earnings reporting season will also kick off with Alcoa reporting Monday. While total earnings for S&P 500 companies are expected to be down 1.5 per cent from a year ago, they are expected to be up slightly on the June quarter continuing an earnings recovery that has been helped by a stabilisation in the US dollar and rising trend in the oil price.

In China, expect September export growth to remain negative but import growth to slow slightly (Thursday), consumer price inflation to remain low at around 1.6 per cent year-on-year, producer price deflation to continue to fade (both Friday) and total credit to slow after the August surge.

In Australia, expect the NAB business survey (Tuesday) to show business confidence and conditions remaining above long term average levels, housing finance (also Tuesday) to bounce back after a fall in July and the Westpac/MI survey (Wednesday) to show that consumer confidence remains around average levels. The RBA's six monthly Financial Stability Review (Friday) will be watched mostly for more colour around the state of the housing market.

Outlook for markets

While the period for seasonal share market weakness (August to October) so far has passed without a major mishap, we remain cautious on shares in the short term as event risk remains high for the months ahead including ongoing debate around the Fed and ECB, issues around eurozone banks, the US election on November 8 and the Italian Senate referendum and Austrian presidential election re-run (both on December 4). However, after any short term weakness, we anticipate shares to trend higher over the next 12 months helped by okay valuations, continuing easy global monetary conditions and moderate global economic growth.

Ultra-low bond yields point to a soft medium term return potential from them, but it's hard to get too bearish on bonds in a world of fragile growth, spare capacity, low inflation and ongoing shocks.

Commercial property and infrastructure are likely to continue benefitting from the ongoing search for yield by investors.

Dwelling price gains are expected to slow, as the heat comes out of Sydney and Melbourne thanks to poor affordability, tougher lending standards and as apartment supply ramps up.

Cash and bank deposits offer poor returns.

Increasing confidence that the Fed will hike rates again by year end has taken some pressure off the Australian dollar in the short term and we continue to see the longer term trend remaining down as the interest rate differential in favour of Australia narrows as the RBA continues cutting rates and the Fed eventually resumes hiking, commodity prices remain low and the Australian dollar sees its usual undershoot of fair value.

Shane Oliver is head of investment strategy and chief economist at AMP Capital.

Next Week

Craig James, CommSec

Lending data & confidence

A plethora of economic data is released in Australia, the US and China in the coming week. In Australia, lending and confidence data dominates.

In Australia, the week kicks off on Monday with the Australian Bureau of Statistics (ABS) releasing the Overseas Arrivals and Departures publication for August. The data includes not only tourism arrivals and departures but also migration flows.

On Tuesday the ABS releases the August home loan figures. Based on data from the Bankers Association, it is expected that the number of commitments for those wanting a home to live in fell by 4 per cent in the month. And the value of investor and owner occupied loans may have eased by 1 per cent.

Also on Tuesday National Australia Bank releases the monthly survey of business confidence and conditions.

And finally on Tuesday, ANZ and Roy Morgan issue the weekly consumer confidence data. Consumers believe their finances are in good shape, auguring well for spending.

On Wednesday, the monthly measure of consumer confidence is released by Westpac and the Melbourne Institute – more of a check on the weekly readings released by ANZ and Roy Morgan.

Also on Wednesday, the ABS issues the June quarter Building Activity publication that includes data on dwelling starts or commencements. Dwelling starts are at record highs, pointing to a significant increase of new housing supply in the next year or so.

And the Reserve Bank also releases the August data on credit and debit card lending on Wednesday. Many observers may be surprised – but the average credit card balance actually hit a 7-year low in July.

On Friday, the Reserve Bank releases the half-yearly Financial Stability Review. Expect plenty of comments on the conditions in the new housing market and the potential risks that lie ahead.

Also on Friday the ABS releases lending finance data. These are the broader statistics on new lending, covering lease, personal, commercial and housing finance commitments. Total lending has been soft in recent months before lifting 4.4 per cent in July.

Overseas: US employment data hogs the spotlight

There is plenty to watch on overseas markets. In the US, data on producer prices and retail sales are released while the Federal Reserve Chair delivers a speech. Also the US reporting season kicks off with Alcoa reporting on Monday. And trade and inflation data is released in China.

The week kicks off on Monday in the US with the Employment Trends report for September.

On Tuesday in the US, the National Federal of Independent Business (NFIB) releases the September business optimism index while the usual weekly data on chain store sales is also issued.

On Wednesday a key forward-looking measure of the job market is released – the Job Openings and Labor turnover Survey (JOLTS). In July, the JOLTS survey indicated there were almost 5.9 million jobs available in the US. On the same day the weekly mortgage lending data is released.

On Thursday in the US, the usual weekly data on claims for unemployment insurance is released together with September estimates on the Federal Budget as well as import and export prices.

In China on Thursday the monthly trade data for September is released – that is, the data on exports and imports. The August data proved to be better-than-expected with exports down 2.8 per cent over the year and imports up by 1.5 per cent.

And on Friday in the US, the September data on producer prices (business inflation) is released with the retail sales data for the same month and preliminary consumer sentiment data for October. Economists expect that non-auto retail sales rose by 0.4 per cent in September after a 0.1 per cent decline August.

On Friday, The US Federal Reserve Chair, Janet Yellen, is also scheduled to speak at the Elusive "Great" Recovery: Causes and Implications for Future Business Cycle Dynamics" conference.

In China on Friday, monthly inflation data (consumer and producer prices) for September is released. As is the case elsewhere in the world, inflation is contained with consumer prices up 1.3 per cent over the year.

Sharemarket, interest rates, currencies & commodities

This year has been a reversal of fortunes for the Materials sector of the sharemarket, tracing the recovery of metal prices. The S&P/ASX 200 Materials index fell by 19.5 per cent in 2015. But so far this year the Materials index has lifted by 30.5 per cent.

And the performance of the Materials sector makes sense when you consider the changes in mining/metal prices. Iron ore has lifted just over 28 per cent so far in 2016 with zinc up 50 per cent, nickel up 17 per cent, lead up 16 per cent and aluminium up 11 per cent. And thermal coal – using the current futures contact – is up 71 per cent this year.

Craig James is chief economist at CommSec.