The read on inflation

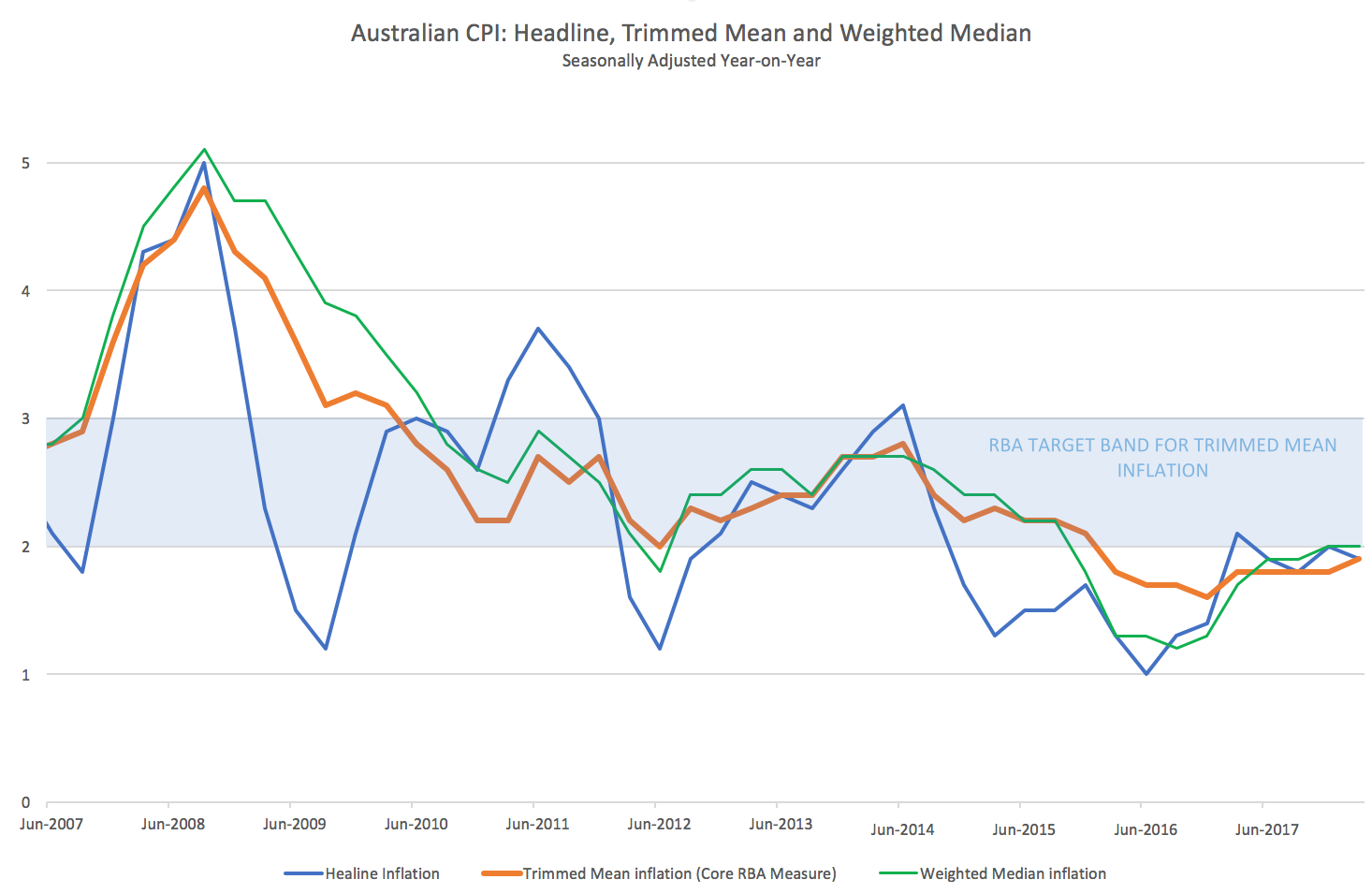

The Reserve Bank of Australia will likely have a wry smile as the core measure of inflation, the ‘trimmed mean' Consumer Price Index, rose 10 basis points to 1.9 per cent.

This was its highest read since the September quarter of 2015 and broke out of a four-quarter run at 1.8 per cent.

Core sub-sectors remain stable while the likes of health and education shifted up, pushing the CPI read back toward the RBA's target band of 2 per cent to 3 per cent. But it is still 10 basis points below.

The print is unlikely to shift monetary policy anytime soon, however its moving in the right direction.

The Granular

Headline CPI: March quarter 0.5 per cent versus consensus 0.5 per cent quarter-on-quarter (qoq) and 1.9 per cent versus 2 per cent year-on-year (yoy) headline slowed in the first quarter surprisingly.

The RBA's Core Metric Trimmed mean: March quarter 0.5 per cent versus consensus 0.5 per cent qoq and 1.9 per cent 1.8 per cent yoy. Broke out of the four consecutive quarters of malaise popping up 10 basis points (bps)

The RBA's Weighted median: March quarter 0.5 per cent versus consensus 0.5 per cent qoq and 2.0 per cent 1.9 per cent yoy also a 10bps beat and if we blend the two average measures of core inflation it sits at 1.95 per cent the close to the target band since the second quarter of 2015.

The keys

Housing continued to add points to inflation increasing 0.7 per cent over the quarter and 3.3 per cent on the previous year.

Health and Education continue to streak ahead with health up 4.2 per cent over the year and education by 2.6 per cent (this could have been higher however tertiary education fell 1.5 per cent offset the 3.3 per cent increase in secondary education).

Looking at the volatiles, alcohol and tobacco which surged 7 per cent yoy, fuel added 6.1 per cent over the same and then the big one power prices were up 11.7 per cent.

On the downside, travel and accommodation fell 2.4 per cent over the year electronics fell 6.1 per cent and furniture was off 28 per cent yoy.