The RBA's rate gamble

Behind the Reserve Bank’s “no change in interest rates” statement are three assumptions. If anyone of them proves wrong then Australia will change dramatically for the worse.

The first assumption is that the current American shutdown will be a temporary affair and that in two weeks the US government will not be forced to default on its debt, something that if it happened would cause world chaos (The Republic of Crazy, October 2). I believe that this is a reasonable assumption and it is the one being adopted by markets.

But the Republicans have gone much further than most predicted so no one can be sure. And my friends who publish bearish charts have been saying for some time that their long-term forecasts predict a major fall.

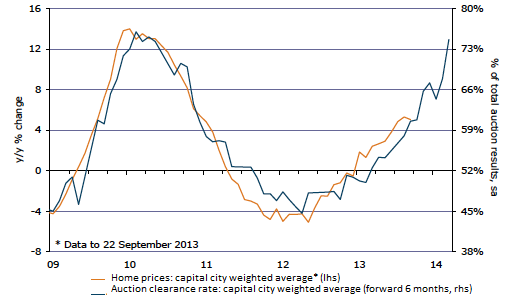

The second Reserve Bank assumption is that the graph my colleague Alan Kohler posted on last night’s ABC TV news has the wrong message. The Kohler graph showed that when there is a sharp upward spike in auction clearances in Sydney and Melbourne, there follows a big rise in house prices.

Source:ANZ

Given that our dwelling prices are already high by world standards, that translates into a looming bubble. In other words, while there is no bubble at the moment, all the ingredients for a bubble are in the mixing bowl – low interest rates and low demand from business for funds so banks have spare cash to hose at home buyers; supply constraints because of bank restrictions on finance for developers and hopeless regulations; and big latent demand from renters and investors (Beware the mother of all housing booms, August 13). If that Reserve Bank assumption is wrong then interest rates will need to rise not fall. And so does the dollar, which would create great damage to our employment creating industries.

The third assumption is that once the current American crisis is over the US Federal Reserve will begin to taper quantitative easing, which will lift the US dollar and US interest rates and take pressure off our currency. This, combined with a China that is stabilising and the confidence boost from the new Abbott government, will send Australia into a more prosperous environment. But it would also give the bank room to lift interest rates if a property bubble started to develop.

We shall watch the progress of the three assumptions.