The RBA is stuck in policy limbo

The Reserve Bank of Australia continues to take a neutral stance on policy but by acknowledging that there is “a significant degree of uncertainty about the outlook”, it is clear that our central bank has a lot to think about over the remainder of the year.

The RBA monthly board minutes are often a mixed bag. They occasionally provide additional insight into the central bank’s thinking but, more often than not, they communicate a dated view of the economy.

The minutes this month were mostly of the latter variety. The big shift compared with the board statement was the acknowledgement of considerable uncertainty facing the domestic outlook. But that view was discussed in depth in the RBA’s Statement on Monetary Policy.

As I noted earlier this month, the RBA has downgraded its outlook by 0.25 percentage points over the year to June 2015 and June 2016 (The big question mark hanging over the RBA’s outlook, August 8). This follows a similar downgrade at the May SMP.

Low interest rates continue to support activity, with residential construction set to rise strongly over the next couple of years. The household sector improved over 2013 but has faltered more recently, with retail trade volumes declining in the June quarter.

Bank lending remains elevated, resulting in strong house price growth “albeit at a slower pace than was the case a year earlier”. Fixed mortgage rates have eased somewhat in recent months, despite no move in the official cash rate. Meanwhile, refinancing and deleveraging remains in vogue for a number of businesses.

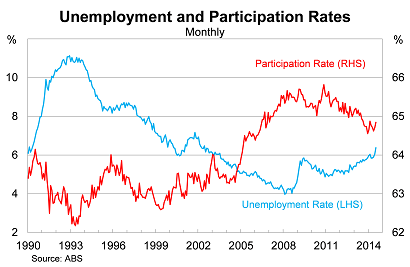

The biggest piece of new information since the RBA board meeting was a fairly nasty set of labour data. The unemployment rate rose to 6.4 per cent in July and, although it might be a rogue outcome, the broader set of data suggests that the labour market has softened further (Disastrous jobs data will create more work for the RBA, August 7).

The near to medium-term outlook for employment remains subdued. ANZ and NAB recently estimated that the resource sector could cut between 75,000 and 100,000 jobs over the next couple of years. More importantly, the broader economy may struggle to absorb this excess supply of workers as many will share similar skill-sets and experience.

This is particularly concerning since our economy is already struggling to absorb current population growth. Recent estimates from the Department of Employment based on the 2014-15 budget suggest that job growth will be outstripped by population growth over the next five years (Abbott must abandon his misguided war on the young and poor, August 18).

Employment in non-mining construction will pick up, as will jobs in health and aged-care services, but will that be enough to return the economy to full-employment?

Inflationary pressures appear to have peaked at an annual rate of 3 per cent and will begin to ease on the back of poor wage growth, the end of the carbon tax and a stubbornly high Australian dollar. The RBA said that “inflation, despite recent higher readings, was likely to be consistent with the 2 – 3 per cent target over the next couple of years”.

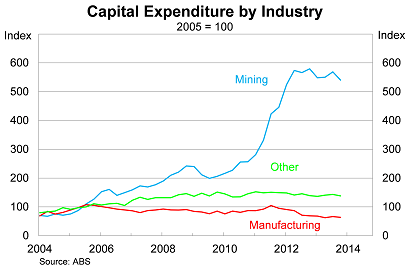

The biggest immediate challenge for the Australian economy remains the collapse in mining investment; it is also the area creating considerable uncertainty for the economic outlook.

The RBA noted in the August SMP that ‘there is no guarantee that the rebalancing of spending will be a smooth process”, and that it may prove highly disruptive to the Australian economy, resulting in either “excess demand for, or supply of, particular labour skills or types of capital”.

While mining investment still has a long way to fall, “it is unclear by just how much, and how quickly this will occur”. That largely sums up the RBA’s predicament: how do you set policy to deal with a shock that is certain to arrive but nevertheless involves considerable uncertainty?

To a large extent a person’s view on that issue will dictate how it sees the cash rate evolving over the next couple of years.

Based on current evidence, mining investment should decline by at least 4 to 5 percentage points as a share of nominal GDP. But that estimate may be on the conservative side, with mounting evidence that the resource sector over-invested during the boom, which could result in mining investment falling below its long-run average (Prepare for more Australian miners to crumble, August 11).

If that scenario eventuates, then the RBA will be left with little choice but to cut rates further. But for now it appears happy to leave rates unchanged and wait for new information to provide greater certainty.

That could arrive as soon as next week, with the ABS releasing new estimates for capital expenditure for 2014-15. These figures will provide a better indication of investment intentions for both the mining and non-mining sectors and could fundamentally change the way the RBA views the domestic economy, for better or for worse.