The positives of being mildly negative

John Addis

The positives of being mildly negative

The eldest son marched out into the long grass with a brush cutter last Saturday, temperatures nudging 36 degrees. “Is it global warming?” he asked. “Absolutely not. Global warming is a Chinese hoax. Now go and wake the snakes.”

Parenting responsibilities over, I flicked on the aircon to contemplate the worries of the young in comfort, knowing that it will be his generation that pays for my choice.

Humans don't deal well with long time frames but Blind Freddy can see that big changes are afoot; French elections loom as Germany dutifully imposes more austerity on its European partners, endangering the Union in the process; the 30,000 page Dodd-Frank Act, designed to avert another financial crisis, is on the edge of repeal; the NATO alliance is weakening; and many Western voters now believe that isolationism is a credible alternative to globalisation that will bring prosperity and freedom. It's the beginnings of something for sure, but impossible to say quite what.

China, in contrast, has been playing a long game, seducing its neighbours with ports and freeways, building infrastructure in places it seeks influence. Each week a freight train leaves Yiwu on China's eastern seaboard bound for Madrid, a kilometres-long emblem of a country reaching out into the world rather than turning away from it.

The country appears ready to take up the challenge of global leadership, if somewhat reluctantly. At Davos last month, Xi Jinping said, “Pursuing protectionism is like locking oneself in a dark room. While wind and rain may be kept outside, that dark room will also block light and air.” After his speech, The Economist – a mag not previously known for its admiration of authoritarian Leninists – called China, “the global grown-up”. Strange times alright.

This century has already been labelled Asia's but the West is working hard to hasten its arrival.

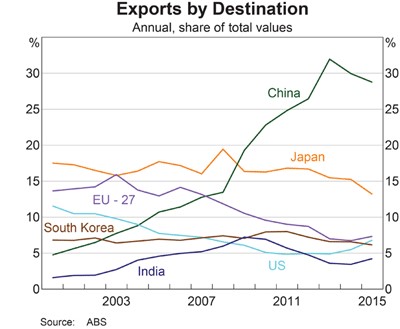

That need not be a bad thing for Australian investors (witness the growth in Chinese exports in the chart), although it may take some getting used to. Nevertheless, the current environment has some understandably worried.

After recounting the risks of a trade war a few weeks back, one subscriber asked us to deepen that analysis. What stocks and sectors should he avoid? Where were the safe havens? What about going to cash? These were the implications of his request.

The trouble is, as Howard Marks wrote in a recent memo, “the opinions of experts concerning the future are accorded great weight…but they're still just opinions”. A special report we wrote in late 2011 titled The Coming China Crash makes the point. After laying out the case for a China collapse we listed the top 20 stocks and their exposure to this risk.

That list saved members a lot of money, but not for the reasons we thought it would. The resources sector crashed but China didn't. We made the wrong decision but got the right result, because, y'know, even a blind pig finds an occasional truffle.

Making a judgement on how to protect your portfolio from the threat of a trade war is even harder. We were far more confident about the chance of a China crash six years ago than we are about a trade war now. And still we got it wrong. The contemporary environment offers even more challenging territory. Economies are complex enough but the interlocked, co-dependent nature of a globalised world is more so.

In Ian McEwan's Enduring Love, a couple is picnicking in a field. In the distance, a lowly hot air balloon approaches. Seeing a young boy in the basket, they run towards it, recognising the danger. Others gather, grabbing the ropes that once anchored the balloon. But a gust of wind suddenly carries it upwards, taking with it the boy and the people trying to save him. Fearing for their own safety, one by one they drop away. Together, they may have averted disaster. Apart, it became inevitable.

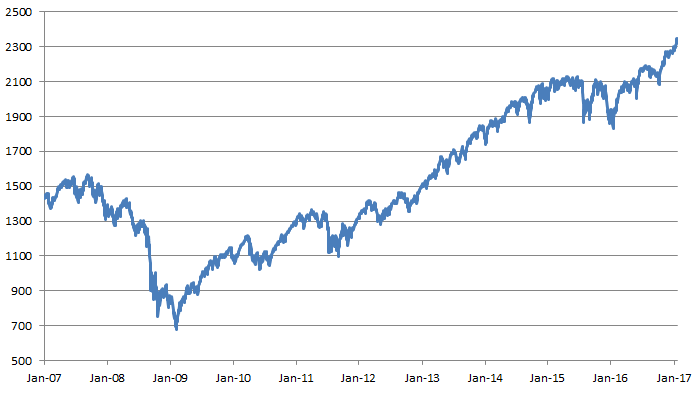

Global trade is a bit like that. A nation cannot punish one of its trading partners without harming itself and everyone else. And yet here we are, facing a threat that's almost impossible to manage. Personally, I have no plans to go to cash, not that I ever have. For me, being out of the market looks like a bigger risk than being in it. Neither am I increasing my cash holdings, although I wouldn't be investing much in US equities right now, which seem to be perfectly priced.

Chart: S&P 500, past 10 years

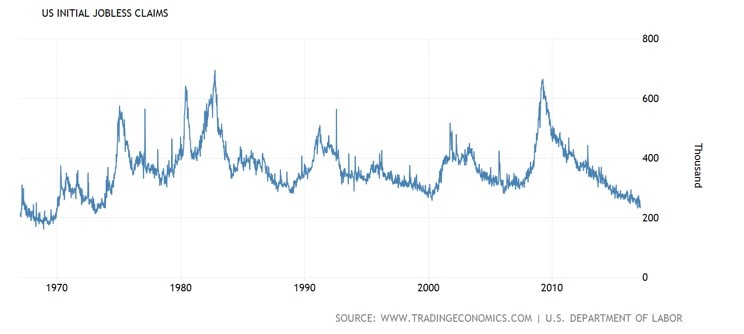

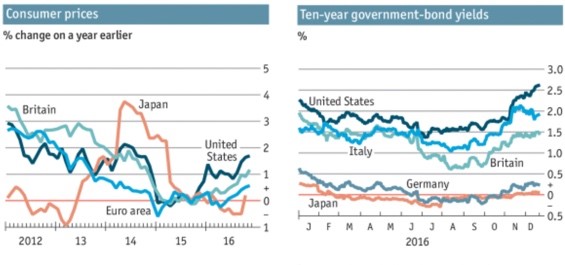

And yet the numbers suggest there is at least some justification for the buoyancy. The latest weekly unemployment claim figures approached a 43-year low recently, although admittedly wages growth is non-existent, a subject we'll eventually get to. Inventories are low, business confidence is high, retail spending is up and US inflation, up 2.3 per cent over the last 12 months, is in reach of the Fed's target rate for the first time in almost a decade, confirming that the threat of deflation is receding.

Even in Australia, there isn't much hint of trouble. Last month, the unemployment rate fell to 5.7 per cent, although most of the jobs growth was in part-time work. RBA Governor Philip Lowe expects economic growth of around 3 per cent over the next few years, assisted by higher commodity prices and a strengthening Chinese economy. If it carries on like this, we can expect interest rates to rise for the first time in six years while in the US, Janet Yellen has repeatedly stated an intention to increase rates later in the year. In the distance, normality.

Source: The Economist

Even the chat around Japan and China being dastardly currency manipulators isn't getting much traction, with Citigroup chief economist Willem Buiter calling it “hogwash" and “hot air". So why bang on about risks that might never eventuate, especially when there's not much we can do about them?

Well, for a start it's a fascinating world right now and who wouldn't want to bring a critical eye to it? But there's another reason – that humans don't make their best decisions when they're optimistic. If you've ever felt that rush to act as the price of the stock you want to purchase moves away from you, you'll know what I mean.

This week the ABC's Future Tense radio show made a long overdue attack on the cult of happiness, which has been making me miserable for quite a while. Joseph Forgas, a social psychology professor at the University of NSW, has developed something called the affect infusion model which indicates that that “when we induce people into a mild negative mood before performing a judgement, they typically are going to be more accurate, and they get it right more often.”

Forgas goes on to say that, “people in a mild negative mood tend to look at the environment in a more careful and attentive way and they tend to remember a little bit better what they see around them.”

So forget all that happiness guff, there are positives to being negative. That's our excuse anyway. Enjoy the weekend.

Readings and Viewings

In our review of interesting news, it's definitely a case of Snap, crackle and pop.

So what value would you place on a company that lost $US514.64 million in 2016, and another $US372.89 million a year earlier? The answer, of course, is $US20 billion. That's the revised, slightly lower listing value for Snap, which goes out to investors on Monday.

Also in the online sphere, this isn't a particularly good review – for travel reviews site TripAdvisor that is. Its revenues have just taken a hit.

At least Freddie Mac is paying dividends, to the US Government.

Over in the UK, a report from Prudential has found a quarter of people will be retiring in debt.

Could this be a worry for Uber? The moneysaving taxi app ‘is killing a fine romantic tradition'.

The EU is to make a WTO challenge against US border tax.

Is this feisty, protectionist populism? NZ has tried that.

Africa is set to have a new numero uno, in terms of the biggest economy.

Could Delhi, Tokyo and Canberra fill any vacuum created by an unreliable US?

China is considering stepping up its war on smog – with implications for coal and, possibly, iron ore.

Is history repeating itself, yet again? It seems some things never change, and this problem is particularly scary for all investors.

Meanwhile, there are cracks appearing in Australia's huge private debt pile, says Bloomberg.

This is an interesting video explaining the dark arts of misdirection as seemingly mastered by Trump spokeswoman Kellyanne Conway.

Lastly, energy market specialist Hugh Saddler provides some answers about what caused the recent and much debated SA blackout.

Last Week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

Most major share markets continued to move higher over the past week helped by more good economic and profit news and anticipation of President Trump's pro-business policies. Bond yields generally rose as the reflation trade continued but commodity prices were mixed with oil and metal prices down a bit but the iron ore price surging higher. The Australian dollar rose a bit presumably helped by further gains in iron ore prices and slight falls in the US dollar.

The resignation of President Trump's National Security Adviser Mike Flynn and the ongoing investigations into links between Trump's campaign and Russia highlights the political risks around this unusual Administration. But as long as Trump continues on the path to implementing his pro-business agenda and assuming Trump himself is not implicated it's just ongoing noise that investors have to get used to.

The focus on Eurozone break up risk is continuing to hot up with elections approaching in the Netherlands on March 15, France in late April/May and Germany in September. Our view remains that such risks are overstated, but any related market panic should provide an opportunity for investors. Looking at each in turn, based on current polling:

The populist Euroskeptic Party for Freedom will get more than any other party in the Dutch parliamentary elections, but at around 30 per cent of the vote and seats won't be able to form government, with that likely to come from some combination of roughly ten centrist parties.

Similarly Marine Le Pen whose policy is to leave the Eurozone will “win” the first round of the French presidential election with around 25-30 per cent of the vote but will lose the second round to either the Republican Party's Francois Fillon (by 15-20 per cent) or more likely to the independent Emmanuel Macron (by 20-30 per cent). Both Fillon and Macron are economic reformists which is exactly what France needs.

It's a long way away but, German Chancellor Angela Merkel is at some risk of losing to the centre-left Social Democrat Party whose new leader Martin Schulz is polling well. But Schulz is more pro Europe than Merkel so even if he does win it could actually mean a stronger Eurozone as he and the SPD are likely to end austerity in favour of some German fiscal reflation (which could help both Germany and peripheral Eurozone countries). The populist Alternative for Deutschland seems to be stuck at around 10 per cent support.

Ahhh, you say – but what about Brexit and Trump? Surely there is a risk of a populist upset. Yes there is – particularly in the Netherlands or France. But the polling against a populist forming government in these three countries is far more decisive than was the case prior to the Brexit vote and US presidential election (where the polling was actually very close). More fundamentally it can be argued that Europe is different. Support for the Euro remains high and inequality is far less of an issue in most of Europe than in the UK or the US. And an abatement of the migration crisis is helping too.

Perhaps the country at greatest risk is Italy but even here if the Eurosceptic Five State Movement wins in their next election (possibly this year) it is likely to end up going down the path of Greece's Syriza which has become just another European centrist party after it realised the cost to Greece of exiting the Euro. Speaking of which Greece is at risk again facing tough negotiations with its creditors. These will probably be resolved but even if not and an early election ensues it's noteworthy that the pro-Euro pro-reform New Democracy party is polling well.

The bottom line is that Eurozone break up risks are overstated and if they intensify in the months ahead hitting Eurozone shares, bonds and other assets it should be seen as a buying opportunity.

Major global economic events and implication

US economic data continues on the strong side with a solid gain in retail sales, small business confidence remaining strong, very strong readings in the New York and Philadelphia regional manufacturing conditions surveys, continued strength in home builder conditions, strong readings for housing starts and permits and continuing ultra-low unemployment claims . Meanwhile, core consumer price inflation edged up more than expected to 2.3 per cent year on year. Fed Chair Janet Yellen's Congressional testimony on the rates front provided nothing new signalling an intention to make haste gradually in raising rates this year and that all coming meetings are live for the next move providing the data behaves as expected. Our base case remains that the next hike will be in May or June but the past week's run of strong data points to a rising risk of a March hike (with the market current putting the probability of such a move at 36 per cent.) 80 per cent of US S&P 500 companies have now reported December quarter profits with 74 per cent beating earnings expectations with an average surprise of 2.6 per cent and 52 per cent beating on revenue.

Japanese December quarter GDP growth disappointed at 0.2 per cent quarter on quarter or 1.6 per cent year on year. But it marked four straight quarters of positive growth and business conditions indicators point to some acceleration ahead.

Chinese consumer and producer price inflation rose more than expected in January and combined with a surged in credit underpin the PBOC's move to gradually tighten monetary policy. While a range of infrastructure projects should support growth in the near term and the Chinese Government is unlikely to allow growth to slow much, the move to policy tightening and threat to growth will no doubt worry investors at some point later this year

Australian economic events and implications

Australian economic data was good with a further gain in business conditions and confidence in January according to the NAB survey, a rise in consumer confidence to around its long term average, stronger than expected jobs growth in January and a fall in unemployment. The main drag was a return to weakness in full time jobs highlighting that the quality of jobs growth remains poor. This is partly structural reflecting the growing importance of the services sector in the economy and its preponderance towards part time jobs but it's also partly cyclical and on this front it's worth noting that job vacancies and business employment plans point to stronger employment growth ahead which should help full time jobs.

Another big positive is the ongoing rise in the iron ore price which broke $US90/tonne in the last week for the first time since 2014. Softer structural growth in China and stronger supply warn this is not the start of a re-run of last decade's commodity boom. But its nevertheless a big positive for national income in Australia. The iron ore price at $US90 if sustained will add around $9bn annually to Federal taxation revenue.

Source: Bloomberg, AMP Capital

At this stage our view remains that the RBA will cut rates again this year as inflation takes longer to move back to target. But if the positive news on growth and national income continues at a time when the Sydney and Melbourne property markets remain too hot then we will have to concede that the next move in rates is up – albeit not till later in 2018 – rather than down.

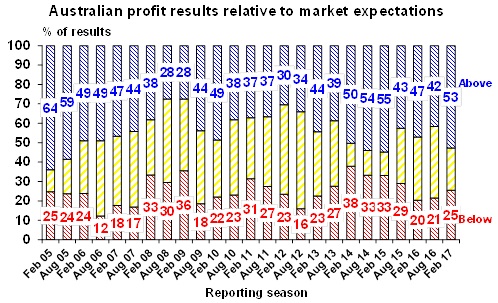

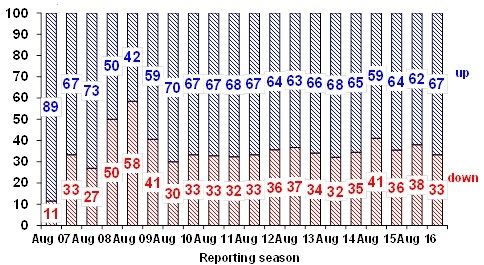

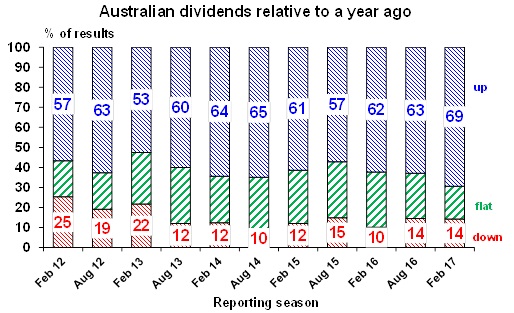

We are now a bit over 40 per cent through the Australian December half profit reporting season. As is often the case after an initial flurry of good results we have seen a few more misses over the last week. But so far the overall results remain good. 53 per cent of companies to report so far have exceeded earnings expectations compared to a norm of 44 per cent, 70 per cent of companies have seen profits up from a year ago and 69 per cent have increased their dividends from a year ago. But reflecting the strong rally in the market in anticipation of the results only 44 per cent have seen their share price outperform the market on the day they reported as a lot of good news was already priced in. Resource profits are on track to more than double this financial year and this is driving a return to overall profit growth for the market.

Source: AMP Capital

Shane Oliver is chief economist at AMP Capital.

Next Week

Savanth Sebastian, CommSec

Economic growth estimates start to be compiled; Reserve Bank in the limelight

The December quarter economic growth data is released on March 1. But in the coming week, pieces of the puzzle start to be put together. The other data focus domestically is on wages. But once again it will be the Reserve Bank that draws the most attention, with a speech by the Governor on Wednesday before he fronts the House of Representatives Economics Committee on Friday.

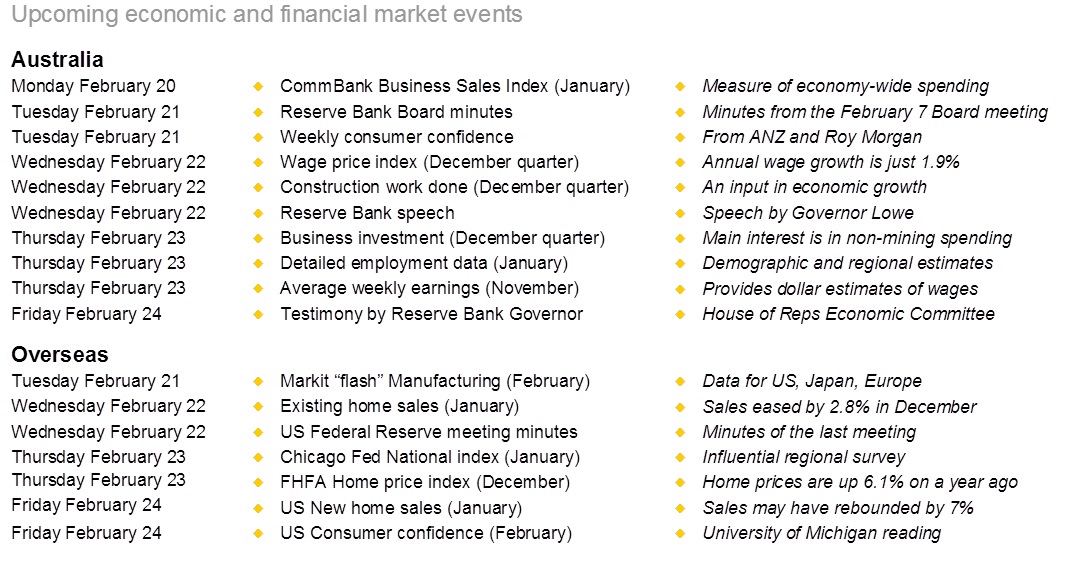

The week kicks off on Monday with the release of the business sales index from Commonwealth Bank. In contrast to the retail trade data from the Bureau of Statistics (ABS), the BSI is a measure of economy-wide spending.

On Tuesday, minutes of the last Reserve Bank Board meeting are released. The RBA has a ‘neutral stance”, but the focus is more likely to be on a number of the “hot button” issues like homes sales and prices.

Also on Tuesday the weekly consumer confidence data is released. Consumer sentiment eased by 0.9 per cent last week.

On Wednesday, the ABS releases the Wage Price Index – the main measure of wage costs in Australia. Lower growth of wages has encouraged employers to take on more staff. And while low nominal growth of wages is positive for employers, wages are still growing at a faster pace than prices – positive for consumers. In fact inflation is just 1.5 per cent and wages are growing at a 1.9 per cent annual rate. It is clear that real wage gains are still boosting consumer purchasing power. For the record we expect that wages remained tame growth in the December quarter, lifting by 0.5 per cent in the quarter and by around 2 per cent on the year.

Also on Wednesday, preliminary data on construction work is released for the December quarter. The data on residential work completed is an input into the calculation of economic growth.

The Reserve Bank Governor Philip Lowe will deliver a speech to the Australia-Canada Economic Leadership Forum on Wednesday (8:30am AEDT).

On Thursday, the ABS will release the December quarter estimates on business investment. This data is also an input into the calculation of economic growth. But also insightful are the estimates of planned investment for the coming year.

Overall we expect that investment rose by 1 per cent in the quarter, reflecting the improvement in the global economic outlook and lift in business conditions. The Reserve Bank will be interested in estimates of non-mining investment. In addition, the ABS will release more detailed demographic and regional estimates on employment alongside the semi-annual estimates of average weekly earnings – the dollar estimates of wages in the economy.

On Friday the Reserve Bank Governor is scheduled to appear before the House of Representatives Economics Committee. There are a number of ‘hot button' issues at present and it is likely committee members will in particular ask the Governor's views on the housing sector, Australian dollar and inflation outcomes.

US housing sector under the spotlight

In the US, there is the usual bevy of economic indicators to be released with the focus on the housing sector. The only data of note in China are the January estimates of home prices, released on Wednesday.

The week kicks off on Tuesday with the Markit “flash” estimates of manufacturing activity in US, Japan and Europe.

On Wednesday, in the US, existing home sales data is issued alongside the minutes of the last Federal Reserve meeting. Most interest will be in the timing of rate hikes. A number of Fed officials haven't essentially confirmed that the upcoming March meeting is a “live option” and even economists are divided on a March rate hike, so the commentary will be closely dissected. Existing home sales may have risen by 1.1 per cent in January after easing by 2.8 per cent in December.

On Thursday, the influential Chicago Federal Reserve National Activity index is released together with the usual weekly data on new claims for unemployment insurance (jobless claims) and a number of home price measures are slated for release. The most interest will be on the FHFA home price index. The annual growth rate of home prices may have edged up from 6.1 per cent to 6.2 per cent in December.

And on Friday, new home sales data is issued alongside the University of Michigan consumer confidence reading.

Sharemarkets, interest rates, exchange rates and commodities

The Australian profit reporting season lifts into top gear in the coming week. On Monday, earnings are scheduled to be released by BlueScope Steel, Brambles, Charter Hall, GWA, NIB and Worley Parsons.

On Tuesday earnings announcements are expected from Altium, BHP Billiton, FlexiGroup, Monadelphous, Oil Search, Seek, Seven Group, and Senex.

Among those expected to report earnings on Wednesday are APA Group, Coca-Cola Amatil, Fletcher Building, Fortescue Metals, Fairfax Media, G8 Education, Healthscope, IAG, Iress, Stockland, Woolworths and Woodside Petroleum.

On Thursday, a raft of companies is expected to issue results including: Ardent Leisure, Adelaide Brighton, Aconex, Alumina, Cardno, Crown Resorts, Flight Centre, InvoCare, MYOB, Nine Entertainment, Perpetual, Qantas and Southern Cross Media.

On Friday, Automotive Holdings is among those listed to issue earnings with Billabong, Super Retail Group, Link and Charter Hall.

Savanth Sebastian is a senior economist at CommSec.