The next AMP Capital China Growth Fund?

Now that AMP Capital China Growth Fund (AGF) is in liquidation, what other LICs could become the target of irate shareholders?

Although we generally advise against speculating in the stockmarket, some idle speculation every now and then doesn't hurt. At the very least, it's a bit of fun and as we'll see, it could even make you some money.

When it comes to listed investment companies (LICs), takeovers and shareholder activism are rare. However, every now and then feathers are ruffled, LICs wound up or their management changed as a result of irate shareholders pressing for change.

One recent example is the AMP Capital China Growth Fund (AGF), which as of last week had liquidated 95% of its portfolio of Chinese listed shares. This came in the wake of an extraordinary general meeting forced by a handful of fund managers.

They'd filled their boots after AGF's share price had fallen to more than a 20% discount to its net tangible assets per share (NTA). Even worse, its portfolio has consistently underperformed its benchmark.

No investor would be happy with this combination and so long-suffering shareholders supported the fund managers' push to wind up and liquidate the fund. Because they seized the opportunity to buy AGF at a big discount, the fund managers will profit nicely from the difference between what they paid and the proceeds returned to shareholders upon liquidation.

The right ingredients

AMP Capital China Growth Fund had all the right ingredients for a shareholder mutiny: underperformance compared to its benchmark, a share price at a discount to its net tangible assets per share and, to top it off, its management contract was about to expire.

When AGF's share price was $0.84 in June, the Supreme Court ruled that AMP (ASX:AMP) couldn't vote its holding against moves to wind up the fund. Today AGF closed at $0.94, showing the gains that can come from well-intentioned shareholder activism.

Another example was the recent attempt by Geoff Wilson and WAM Capital (WAM) to gain the management rights of Century Australia (CYA). His goal was to transform CYA into a LIC focussed on large capitalisation stocks to complement his stable of mid to small cap focussed LICs. He ultimately failed but after his intentions became public, CYA's share price promptly jumped by 10 cents or 13%. Undeterred, Wilson has since launched large-cap focussed WAM Leaders (WLE) instead.

More AGFs?

So are there any other AGF's out there?

These opportunities take time to find and even then there aren't any guarantees. It's the LIC equivalent of speculating on takeover targets and while we would never suggest that you invest in a LIC with expected shareholder activism as the primary justification, it's an interesting possibility to consider.

Our initial research has identified two potential opportunities.

The first is Templeton Global Growth Fund (TGG). Despite its management agreement recently being renewed, some of the ingredients necessary for activism are there. The key one is long term underperformance: you can see here that its performance has lagged behind its benchmark for an extended period.

As a result, TGG's share price has long trailed its NTA. Along with a decade of underperformance, this may mean shareholders are open to an activist shaking it up. In fact, whilst it's merely speculation on our part, we note that WAM Capital (WAM) and fellow Geoff Wilson-led LIC WAM Active (WAA) have recently joined the register.

.png)

Wilson believes Templeton Global Growth is undervalued given its discount to NTA, but as Chart 1 shows, the discount isn't new so why invest now?

Falling further into the speculative rabbit hole, one thing missing from Wilson Asset Management's (WAM) stable is an international fund. Reporting season has been favourable, with the team reporting great performance numbers across its stable of LICs. The WAM Leaders (WLE) IPO was a big success and so was the capital raising for WAM Capital. Why shouldn't WAM keep its good run going by completing its set of LICs with an international fund?

Ozgrowth

The other potential opportunity is Ozgrowth Limited (OZG), which is based in Western Australia and has a slant towards WA-based companies. Unsurprisingly, the significant slowdown in mining investment and resulting economic downturn in Western Australia has meant it's been a rough few years for Ozgrowth.

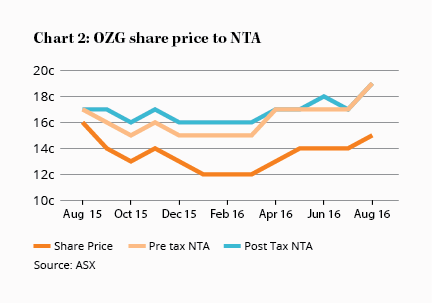

Its portfolio has underperformed and Ozgrowth shares are now selling at a 19% discount to NTA (see Chart 2).

Add the fact that its management agreement is up for renewal next year and it's no surprise there are some well-known investors on the share register. While our speculation may amount to nothing, it's a LIC to keep an eye on. Moreover, although Euroz Limited (the manager of the LIC) holds 38.8% of its shares, a similarly large shareholding didn't help AMP with AGF.

All of this is pure speculation of course. Nevertheless, anything is possible when there are shareholders to please, profits to be gained and management fees to be earned.