The new energy pecking order

| Summary: It’s a case of one down, two up, as LNG exposure drives changes in the oil and gas sector pecking order. Oil Search has moved into second place on the oil and gas ladder, overtaking Santos after receiving an injection from its stake in the PNG LNG project. Meanwhile, Woodside appears to be standing still after backing out of another LNG development on offer. |

| Key take-out: For investors, it’s largely about going with the oil and gas flow, particularly the flow of the world’s hottest fuel, liquefied natural gas (LNG). Oil Search has received a massive injection from the early stages of the PNG LNG project in Papua New Guinea, and Santos will from the Gladstone (GLNG) coal-seam gas project. |

| Key beneficiaries: General investors. Category: Shares. |

Australia’s oil and gas sector has a new pecking order, with Oil Search (OSH) overtaking Santos (STO)to claim the title of second-biggest pure-play petroleum stock. And, while Woodside (WPL) remains a clear leader there is no guarantee that it will retain top spot.

What drove Oil Search up to a market capitalisation yesterday of $14.5 billion is the same force which could drive Santos, now at $14 billion, higher next year, and Woodside, at $34.2 billion, down over the next few years.

The issue is simple. Oil Search and Santos are expanding their exposure to the world’s hottest fuel, liquefied natural gas (LNG). Woodside is effectively standing still, having shelved most of its immediate growth options.

The problem with Woodside was explained in Wednesday’s edition of Eureka Report by the team from Stocks in Value (Woodside’s weak growth pipeline), which recommended the stock as a sell with a project price of $31.87, more than $10 less than the ruling price of $41.93.

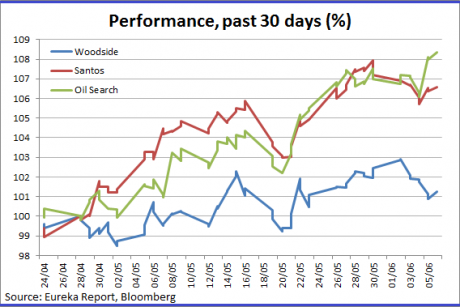

Since that Stocks in Value report was circulated Woodside shares have slipped modestly to around $41.51, a fall of roughly 1%, whereas Oil Search has risen by 1.6% and Santos is up by 0.7%.

Given that all three companies are in the same business of oil and gas production, the one down, two up market movement might be seen as significant given that the oil price fell yesterday by about 0.25% to $US108.11 a barrel (Brent price).

The share-price movements tell a story of two oil stocks, Oil Search and Santos, benefiting from their increasing exposure to LNG while the third, Woodside, has stepped back from expanding its immediate LNG exposure by walking away from an investment in the big Leviathan development off the coast of Israel.

The Leviathan withdrawal, after more than 12 months of negotiating terms with other participants and the Israeli government, means that Woodside has mothballed three potential LNG developments, with Leviathan joining the Sunrise and Browse gas deposits off northern Australia in the too hard basket, and a keenly-awaited expansion of the Pluto project in the “need to find more gas” basket.

In Woodside’s favour, and perhaps the primary reason why it retains investor support given its poor project development pipeline, is a generous dividend policy, which means an investment today generates a yield of 5%, slightly more than the 4.7% on offer from an investment in Commonwealth Bank.

Oil companies, given the nature of their business, are rarely (if ever) seen as yield plays, which is one interesting aspect of the Woodside situation.

However, the real interest in the pecking-order shuffle underway in an industry which always carries a higher-risk profile than most is the impact of LNG on the three top Australian oil stocks – and the rising importance of gas as a globally traded commodity.

Oil Search, once seen as a stock too heavily exposed to Papua New Guinea and its sometimes erratic government, is now benefiting from owning a 29% stake in the PNG LNG project operated by the one of the world’s top oil companies, ExxonMobil.

Two weeks ago PNG LNG made its first shipment of gas in what was a remarkable event in the resources world – it was ahead of schedule.

Over the next few months PNG LNG will accelerate deliveries as it rises to an annual target of 6.9 million tonnes of liquefied gas.

The success of the PNG project has helped boost Oil Search’s share price by 16% since the start of the year. Woodside, over the same time, has risen by 6.8% thanks largely to that 5% yield, while Santos’ share price has fallen by 2.2%.

What happens next will be interesting to watch.

Woodside management will step up the search for growth options, in a geological sense by accelerating its exploration effort, and in a financial sense by running a ruler over corporate targets (possibly including Oil Search).

Oil Search will enjoy a rising revenue stream from its PNG exposure and Santos, while seen as the loser in the LNG-exposed sector, should have more to talk about than the other two because it already has a substantial exposure to LNG, with more to come.

While Oil Search won most of the headline as the Australian-listed stock with the biggest exposure to PNG LNG, Santos was also a winner thanks to its 13.5% stake in the project, a holding which adds to a longer-term 11.5% stake in the Bayu Undan LNG project off Darwin.

Next year, according to the current construction schedule, Santos will add a third LNG-production interest to its inventory with the start-up of the Gladstone (GLNG) coal-seam gas project, in which it has a 30% stake.

GLNG, while using a different and almost certainly more expensive gas feedstock, has an annual production target of 7 million tonnes of liquefied gas, which is effectively the same as PNG LNG.

What will be watched carefully by oil industry participants is:

- How Woodside digs itself out of a no-growth hole that has resulted from an inability to develop the Sunrise project, a failure to find sufficient gas to expand the Pluto project, a long-term delay and change of design at the Browse project, and now the decision to walk away from the Leviathan project.

- How Oil Search rewards shareholders with its share of the PNG LNG project and whether it becomes the focus of corporate activity given its current lack of a dominant shareholder, and

- How Santos performs after the start-up of the third LNG project (GLNG) in which it has an interest.

As an interesting aside, and assuming the Stocks in Value assessment of Woodside is correct, the market capitalisation of the company could drop to as low as $26.3 billion (823.9 million shares on issue) based on a projected price of $31.87.

Neither Oil Search at its current $14.5 billion, nor Santos at $14 billion, are an immediate threat. But the trend of one LNG-exposed stock falling and two others rising is interesting, as is the fact that most investors prefer their oil investments to be growth focused, not yield driven.