The myth of pay for performance

Over the past 15 years, Commonwealth Bank shares have gone from $16 each to $74, an increase of $58, while NAB shares have gone up by $12, from $19 to $31. In that time, CBA has paid $35.19 in dividends and NAB has paid $22.29.

That works out to be additional wealth of about $93 per share to CBA owners and $34 to NAB, or 13.7 per cent compound return per annum for CBA and 7.2 per cent for NAB. Big difference. (By the way, the compound annual return of the all ordinaries accumulation index, including dividends, has been 8.75 per cent per annum – CBA has killed it, NAB has done worse).

Over that same period, NAB has paid its succession of chief executives $108 million and CBA paid its CEOs $98 million.

In other words, the pay of the CEO made no difference to shareholder returns; in fact the bigger payer between those two banks performed the worst.

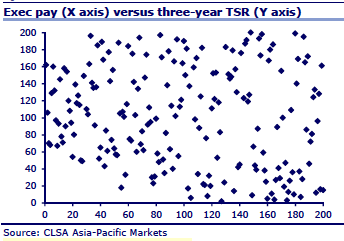

A few months ago, investment bank CLSA plotted the executive pay of Australia’s top 200 companies against total shareholder return. Here’s the rather amusing result:

No relationship whatsoever. The scatter chart for executive pay and return on equity looks exactly the same. The only factor with which executive salaries bear any relationship is the size of the company: big companies pay more, but it doesn’t make any difference to their performance.

Should CEOs of big companies get paid more than those in charge of smaller ones? Definitely not, in fact large company CEOs are surrounded by more support staff, analysts and direct reports so arguably their job is easier.

And in fact no one argues that they should get more. In remuneration reports, and public comments by directors, it’s all about performance – that you need to pay well to get the best people. The remuneration consultants insist on it and the board remuneration committees fall into line. The mind-numbingly complex remuneration structures of large companies are all designed to reward performance, not the size of the company.

Except that it’s perfectly clear that salary size makes no difference to performance. The thing guaranteed to get a CEO’s pay up is to make the company bigger and the things that hurt a company’s performance the most are mergers and acquisitions. Demergers, which are almost always great for shareholders, are resisted because they result in smaller companies and therefore smaller salaries for the boss.

So the question is: when are Australia’s industry funds going to start flexing their muscle on this subject?

Traditionally the largest shareholders in Australia’s listed companies have been AMP and the bank-owned wealth businesses – Colonial, MLC and BT – and they are never going to rock the boat because they are in on the same racket of paying big salaries just because they’re big companies.

Industry funds now have more than $100 billion invested in Australian equities, most of it in the top 100 companies. Their funds are increasing rapidly (although self-managed funds are increasing more rapidly) and this will accelerate in the years ahead as the super contributions go from 9 per cent towards 12 per cent.

Most of the big industry funds are located within a few blocks of each other in Melbourne: Australian Super, UniSuper, Cbus, Hesta, Hostplus among others. Recently they have begun calling in the votes on their shareholdings from the fund managers who look after choices of companies and the timing of the trades.

There’s not much doubt that a handful of industry funds could soon control most, if not all, of Australia’s largest listed companies if they voted together.

The industry funds are half union controlled, but the unions and the funds have always been scrupulous about not using the money to pursue union-type goals and to focus only on members’ interests. The last thing the industry funds need is to be seen as nothing more than the investment wing of the union movement.

But executive salaries may be where members’ and unions’ interests and passions intersect. There are rumblings that the time is approaching for industry funds to do something about the pillaging of companies by the executive classes in the name of performance that doesn’t exist.

Alan Kohler will be debating Malcolm Turnbull on Coalition NBN policy at a business lunch at the Sheraton Wentworth in Sydney on August 1. To book a ticket click here.