The gold stocks bounce

Summary: The share prices of gold stocks have risen this year on the back of corporate deals and a positive currency story. But the gold price has barely moved. It's logical to see gold as an insurance policy, but gold company shares are much riskier. Investment banks have widely divergent views on the future prospects of Australian gold stocks, which highlights the uncertainty about the outlook. |

Key take-out: The conflict in opinion about gold's prospects shows why a wise investor would never become too exposed to a commodity which sometimes behaves like a currency. The prospect of a US rate rise is a negative for gold, so treat it with care unless investing for insurance purposes or unless there is a clear price trend. |

Key beneficiaries: General investors. Category: Gold. |

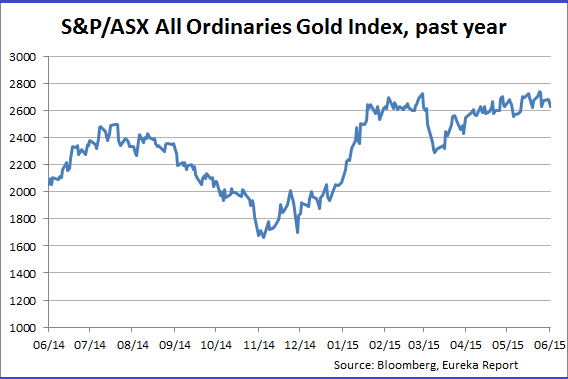

What's the hottest stock sector on the ASX this year? It's gold stocks led by market leader Newcrest up by a third in six months. The problem is the lift does not come from higher gold prices – or indeed higher earnings at gold companies. Rather the lift is largely due to a positive currency story and a blitz of merger activity across the sector.

The gold deals are certainly happening with 26 this year valued at $1.7 billion led by action at Evolution and Northern Star. The recent activity is almost as much as the previous two years when gold mergers and acquisitions were valued at $2.2 billion.

The gold price lift though is simply not happening, yet, though well-qualified market observers such as our Adam Carr (An inflection point for gold, May 20) believe that the price is more likely to rise than fall thanks to a growing need for wealth preservation and volatility protection.

Meanwhile, more corporate deals are probably on the way which will maintain interest in local stocks with the Australian gold mining landscape being re-shaped, largely as a result of North American companies quitting high-cost Australia for greater certainty closer to home.

The exiting international miners tell a story about Australia's declining appeal as a mining investment destination while the flat gold price tells another story, whether expressed in US or Australian dollars.

What's happened with Newcrest, easily the biggest Australian gold producer, is an example of what seems to be a disconnection between share prices and gold prices.

Since the start of 2015 Newcrest shares have risen by 31 per cent making it one of the top performers in any sector. From an opening trade on January 2 of $10.80 Newcrest reached a 12-month high of $15.34 on April 29, drifting back to close yesterday at $14.19.

Over the same time gold, in US dollars, has barely moved, up $US9 (0.76 per cent) an ounce from a 2015 opening price of $US1184/oz to $US1193/oz.

In Australian dollars it's almost the same result, a modest rise of $A12/oz (0.79 per cent) to $A1536/oz – thanks to the dollar opening 2015 at US76.84 and now being valued at US77.68.

A lot has happened between those opening values for gold and the dollar but the net result is that the commodity and the currency are back where they started the year which means there is an awful lot of “expectation” built into gold mining company share prices.

Better things are expected and I have certainly been keen on the idea of gold as an insurance policy against a future steep fall in the value of the Australian dollar.

Earlier this year I put that theory to the test, buying a 1oz gold bar in mid-January on a day when the gold price was $US1256/oz and the exchange rate was US82.19c – to produce an Australian gold price of $A1528/oz (see Golden moment: It's time to top up, January 21).

Almost six months later I am $8 ahead, which is certainly not an impressive gain, but neither is it a loss and the main purpose of the gold-buying exercise was to play the exchange rate against the gold price.

What's happening now and what's likely to happen next are the questions investors ask of everything they own or are thinking of owning and with gold there are a number of key matters to consider.

The first, and most important, is that gold remains an investment sheet anchor for any portfolio thanks to the international nature of its market and its status as an independent currency which is largely free of government manipulation.

The second issue, and this is when the risk factor rises, is to recognise that gold is a commodity/currency prone to speculation by investors concerned about international problems such as European financial instability, US interest rate moves, and the threat of conflict in critical parts of the world, such as the oil-producing countries of the Middle East.

Betting on a global catastrophe is an interesting investment plan, but certainly not one that most people would make.

A more logical approach is to see gold as an insurance policy, worth holding in its physical form, or through an exchange-traded product where each dollar invested is backed by an equivalent amount of gold.

Gold company shares are in a different category, and much riskier.

It's when you look at the movement, or lack of movement to be correct, in gold and currency values that it's hard to see what's happened with gold companies as anything but an outbreak of irrational exuberance about future events which might, or might not, happen – and that's not investing, that's speculation.

One way of testing that comment is to offset optimistic comments about gold and gold companies with pessimistic comments, a game which produces a draw.

Newcrest, for example, has one investment bank, Citi, rating it as neutral (hold) with a 12-month price target of $14.80. Another investment bank, UBS, says Newcrest is a sell with a 12-month target of $10.60.

But, way out in front and in a league of its own is Goldman Sachs which reckons Newcrest is heading towards a 12-month price of $17 thanks to the appointment of a new chief executive, the benefits of heavy-duty cost cutting and the possible one-off gain from the possible sale of the Telfer goldmine for an estimated $500 million.

The gloomy view of UBS and the optimistic view of Goldman Sachs cannot both be right, obviously, though where those widely divergent views serve a purpose is in highlighting the uncertainty about the outlook for gold and gold mining companies.

Evolution, another recent gold sector newsmaker after its acquisitions of the La Mancha and Cowal gold assets which have catapulted it up to second position in the gold-production pecking order, is the subject of equally conflicting bank advice.

UBS, which is bullish on most gold stocks other than Newcrest and Independence, sees Evolution as a buy, heading towards $1.30 (up 15c from its current $1.15) whereas Morgan Stanley sees it as a sell, heading back down to 90c.

That sort of conflict in opinion speaks loudly about gold and why a wise investor would never become too exposed to a commodity which sometimes behaves like a currency, a status which implies you're doubling your risk by exposing yourself to two global forces.

Speculate, by all means, in gold miners but don't lose sight of the fact that while the underlying commodity might rise strongly in the future it has been flat-lining all year and needs a catalyst to get it moving.

Unfortunately, one of the catalysts on the horizon is a big negative for gold and that's the prospect of higher US interest rates at some point later this year or early next.

When the US does start raising rates that could see the value of the US dollar rise, and a higher US dollar could weigh heavily on the gold price – which is a potent reason to treat gold with care unless you're investing for insurance purposes, or unless there is a clear price trend.