The Global Slowdown, Australian Risks, Brexit, Bogle, and more

A Brexit Explainer

Global Slowdown

Bear Market Checklist

It’s All Greek

Australian Risks Are Rising

Jack Bogle

Research and Diversions

Facebook Live

Last Week

A Brexit Explainer

You’re probably wondering why both the pound and the London stock market failed to collapse after the Prime Minister Theresa May lost the Brexit vote in Parliament by the record margin of 230: 432 to 202. Indeed, as Dave Rosenberg of Gluskin Sheff remarked yesterday, sterling has no business being near US$1.29 with the risk of a no-deal Brexit there.

Well, I think it’s because the market now thinks Britain will most likely stay in the EU. Let me explain.

That vote, which in normal circumstances would bring down any government, means that Theresa May and her loyalists have lost control of the Brexit process. She won the subsequent vote of no confidence, but because only the Labour Party wants a general election - the 118 Tories who voted against her Brexit deal certainly don’t.

But it’s also hard to see any compromise that May could extract from Brussels that would persuade those 118 to change their vote. That is, there is nothing May can now do to get the Parliament to support her continuing to run the Brexit process; she’s trying to regain some control, but she is doomed to fail.

If that’s true, surely it means Parliament itself will have to take control. This would represent an unprecedented assertion of Parliamentary power over a sitting Westminster-style government, but it seems to me that’s where we are. May has the numbers to remain Prime Minister, but on the key issue of the day her opponents are effectively in charge, by 432 to 202 - a powerful majority in anyone’s language. It would probably be the biggest landslide election result in history.

So what does the Parliament do? I suspect a committee will be appointed to run the process, possibly with the speaker, John Bercow, in charge. And their first order of business will be to rule out any chance of a “no deal Brexit” on March 29. All Parliamentarians would know that their first responsibility is to protect the British economy from that.

There will be procedural problems with passing a law that is not supported by the Government, but while I’m no expert on British Parliamentary rules, I’d say the speaker could overcome that.

They simply would have to repeal the existing legislation – the European Union Withdrawal Act - that makes a “no deal Brexit” the default option, or at least that part of the Act. They would also have to persuade the EU leadership to extend the March 29 deadline, which might be more difficult.

There would then be an attempt to cobble together enough support for a softer Brexit deal that would be supported by the Labour Party or enough Tories to get a majority. Theresa May is already trying to do this, but without much success because, as discussed, her authority and credibility is shot to bits – a lame duck if ever there was one.

Any successful Parliamentary process on Brexit cannot involve her. Apart from anything else, she has previously ruled out the sort of compromises that would be needed as being a betrayal of the 2016 referendum, so she couldn’t credibly embrace them all of a sudden.

The “soft Brexit” would involve something like Norway’s situation: permanent membership of the European customs union and “close alignment” with EU single market regulation to overcome the Irish border problem. It would leave Britain subject to EU rules over which it has no control and would be far worse than the situation that 52% of the population voted against in 2016.

All of which is very messy and uncertain, and would also depend on the EU leadership agreeing to extend the March 29 deadline so the negotiations could start again.

So I think that the “default option” is now cancelling Brexit altogether, which is why the markets are doing OK. Last month the European Court confirmed that the UK has the right to unilaterally revoke its notification of withdrawal from the EU, and that must now be seen as the fall-back for the majority of MPs.

They might feel the need to have another referendum at the same time to avoid overruling the “will of the people”, but that is not necessary. Parliament is sovereign and is not bound by the 2016 referendum.

The polls suggest that a new referendum would vote “Remain”, but if it didn’t, and Brexit won a second time, well… then the markets would definitely tank. I think that is very unlikely.

Both of the most likely outcomes now – soft Brexit and no Brexit – mean that the UK is likely a “buy”. Sterling will continue to strengthen and UK stocks will rally, so a cautious position in a FTSE ETF might be worthwhile, bearing in mind that it’s still early days and anything could still happen. The Brits can always find ways to stuff things up.

Global Slowdown

As gruesomely interesting as the UK’s Brexit throes are, it’s not the main thing investors need to focus on. The main thing is a synchronised global slowdown, the first since 2008.

(1).png)

Source: ANZ Research

Yesterday’s Wall Street Journal carried a story that a survey of 800 global CEOs has found that recession was their top concern in 2019 (mind you, it was also their top concern in January 2017 – last year’s was talent shortage).

China’s slowdown is showing no signs of abating, with corporate defaults rising, the German economy has stagnated and may be entering a recession, trade has fallen sharply, and in the United States 800,000 public servants aren’t being paid and now a million federal government contractors are out of work.

Meanwhile a firm called Consensus Economics, which polls 700 global economists, sees global growth below 3% in 2019 for the first since 2009.

Another straw in the wind: the volume of global bonds trading with a negative has actually gone up in the past three months, from less than US$6 trillion to US$8 trillion now.

The immediate reason for this is not hard to find: the US President’s dislike of trade, which has directly impacted some specific trade through tariffs and cast a pall over the rest.

But overlaying this is global debt, something I have been boring everyone about for a long time. The whole post-GFC cycle has been built on a new credit bubble, inflated by quantitative easing and zero interest rates.

The latest quarterly global debt monitor from the International Institute of Finance, released on Tuesday, reports that global debt has grown by 12%, or US$27 trillion, since 2016 to US$244 trillion, or 318% of GDP, which is “pushing at the boundaries of comfortably sustainable debt”.

It’s hard to imagine a normal cycle happening with this amount of debt weighing down consumers, corporates and governments, just as it’s hard to see the momentum of the post-Christmas global market rally being maintained in the face of a synchronised global slowdown of the global economy.

If there’s a global recession, then a proper bear market would be likely. If it remains just a slowdown, then it might turn out well because it would push the Fed to the sidelines and pause US rate hikes which, in turn, would be likely to produce a very decent rally.

So does that mean investing in 2019 is a flip of a coin? No, definitely not. As always: hope for the best, plan for the worst.

Bear Market Checklist

Citi’s global equity strategy team have updated their “red flag” Bear market Checklist to check the current status of global markets. They bring together 18 different measurements that reflect valuations, US yield curve, sentiment, profitability, corporate behaviour, balance sheet strength, and credit spreads.

The resulting table is below, with the current checklist on the far right. Out of 18 possible red flags, the score right now is only 3.5 – which is five amber flags (0.5 each) and one red flag (1 point). At the start of the previous bear markets, the scores were 17.5 (in March 200) and 13 (in October 2007).

.png)

It’s All Greek

A very nice extended analogy from the analysts at Macquarie Wealth arrived yesterday, likening today’s macro climate for investing with Greek mythology.

In Greek mythology, Zeus (leader of the Olympians) having defeated older Gods (Titans), divided the world amongst his allies. Zeus was recognized as the overlord and he ruled the sky and air. Poseidon was given the sea and waters, while Hades was given the underworld, or the realm of the dead.

The earth itself was left in common for all the gods, including minor ones, to share, play, and fight against humans & each other. Although Zeus was the most powerful, Poseidon and Hades were far more feared while some minor Gods like Aphrodite (goddess of love) and Hermes (messenger of Gods and later a token of luck for merchants, thieves and financiers) were more persuasive.

So what’s all this got to do with the economic climate and investing today? Quite a lot.

“…the Fed is today’s equivalent of Zeus, with rates & liquidity being its thunderbolt. China is probably a Poseidon, without which global flows, supply chains and output would grind to a halt, just as Poseidon connected the Ancients. Today’s underworld is unquestionably ruled by technology, with AI, computer trading, algos and ETFs capable of dragging anyone to the realm of the dead. However, the most powerful were Aphrodite and Hermes, who could seduce anyone, both mortal and divine; their today’s equivalents are communication policies by CBs & public sector.

“While in the past, communications were there to explain policies; today they are the policies. They create reality, or destroy it in seconds, with Hades diligently dragging ‘victims’ (whether companies, CEOs, analysts or investors) into the underworld. A misplaced word or a phrase can either freeze or open high yield markets. They can lead to sudden stock rotations, or steepening of the yield curve (after an inversion only 24 hours earlier), or to a collapse of mortgage applications. Messaging and seduction are working through ‘cloud of finance’ to create reality & real economy outcomes. Without Aphrodite and Hermes, neither Zeus (Fed) nor Poseidon (China) can any longer do their jobs.

“ECB’s Draghi, BoE’s Carney & BoJ’s Kuroda have emerged as experts in this new art of messaging while Fed’s Powell and China are still learning the ropes. Eurozone is lost in a maze of its regulations while Trump pursues his own toxic messaging. At the same time, economists are lost in their models, which have at best only a tenuous relationship with reality. It explains how Fed could go in two months from ‘economy is expanding at above average rate, which I expect to continue’ to yesterday’s ’a pause in the normalization would give us time to assess if economy is responding as expected’. Hence, we all moved en-masse from 4 to 2 tightening; all it took was a modest pick-up in volatilities.

“Greek Gods had a very flexible understanding of morality. They fought with or made love to each other and mortals. They were alternatively angry, vindictive and generous. They would have understood Draghi’s flexibility but would have been appalled by a stubborn desire to return to fundamentals.

“For investors, one should either join machines & help Hades or retreat to investment niches.”

I’m not entirely sure what that last bit means, to be honest, but the rest of it is both entertaining and to the point.

Australian Risks Are Rising

(A story in charts)

I hadn’t intended today’s note to be gloomy, but it’s turning out a bit that way.

With all the focus on Brexit, US Government shutdown, the Fed and trade wars, the fact that some gloom is settling over the Australian economy has been a bit lost.

It’s not yet showing up in what you might call the official consensus forecast of economists, which still sits at 2.7% GDP growth for 2019, the same as it was a year ago.

But in discussion with a few economists and watching the markets, it’s clear there is a growing view that risks are rising rapidly. For example, interest rate futures pricing has moved sharply lower, and is now halfway towards making Shane Oliver’s prediction of a rate cut in 2019 the consensus market view:

.png)

Obviously the big economic event in 2018 was the slump house prices, brought about by the credit squeeze engineered by APRA in pursuit of “unquestionably strong” banks, in turn sparked by the Murray Inquiry report of 2014.

.png)

That, in turn, has led to a big fall in dwelling starts, and an even bigger drop in the mood of the construction industry, as shown by the “Performance of Construction Index:

.png)

.png)

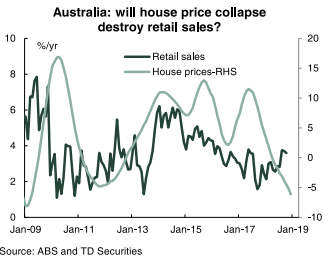

And the fall in house prices is also starting to dampen retail sales, although Kogan’s very upbeat trading update the other day suggests that the biggest losers are physical store retailers, with a lot of sales going online for bargains. That’s certainly the experience in my household.

And as with the world, what makes the Australian more vulnerable than most to shocks like a housing bust is the level of household debt.

.png)

Offsetting that are two things: exports are going great, led by LNG, and there is a big infrastructure spend going on. Those two things are adding about 2% p.a. to GDP, so housing construction and consumption need to detract more than that for there to be a recession – not impossible, but difficult.

AUSTRALIAN EXPORTS

.png)

.png)

.png)

The other positive is that we are in line for some stimulus, since this is an election year. Even if the RBA doesn’t cut rates, there’ll be tax cuts and extra government spending – some were already been announced in last year’s budget, and there’s more to come in the campaign.

.png)

Where does all this leave us? With low, below trend, growth in 2019, but probably not a formal recession, although there might be a “domestic recession”, that is a decline in activity apart from exports. And I am in the “rate cut in 2019” camp with Shane Oliver.

How should investors respond to this? Remain diversified and focus on quality: that is, sustainable dividends (which now includes mining companies don’t forget) and solid cash flow, with a particular eye on value and a “margin of safety” … but also with an allocation to disruption, which remains the most important growth theme, in my view.

I’m thinking here of companies like Pushpay, whose CEO, Chris Heaslip I interviewed on Thursday, or Bidenergy, which was last year’s top performer on the ASX (a 15-bagger). I’ll be interviewing its CEO Guy Maine in a couple of weeks.

There are plenty more of these, and I see part of my job in 2019 as introducing them to you and grilling their CEOs for you. These interviews are neither deep analysis nor recommendations like those of the excellent team of InvestSMART analysts, merely ideas with enough information to start you thinking and exploring.

Jack Bogle

This week, John C (Jack) Bogle, the founder of Vanguard Group and the father of index investing, died at the age of 89. It’s hard to overstate his impact on the world of investing – I’d say it’s greater than that of Warren Buffett, since everyone can actually do what Bogle advocated (invest through ETFs), whereas the Buffett method is hard and requires expertise.

As Grant’s Almost Daily quoted yesterday, “In a 1999 New York Times opinion piece, Bogle dished out a dose of reality to the frenzied bull market masses, writing: ‘The market is simply a gambling casino. . . beating the market is a zero-sum game, but only after costs are deducted. In the stock market casino, it is the croupiers who win.’”

In 2012, Bogle explained to the Times: “My ideas are very simple; in investing, you get what you don’t pay for. Costs matter.”

That’s it – costs matter. That’s part of the reason I was so happy to join InvestSMART: it’s funds are low cost and it is now the first to cap fees at a dollar amount, so even the smallest fee doesn’t compound.

On the subject of fees and the market being a gambling casino, it’s worth noting that Mercer’s latest fund manager result for December 2018 show that in the fourth quarter of last year no fund produced a positive return after fees, including the long/short funds that are supposed to do well when the market goes down. The median decline for the quarter was 10%.

For the year to December 31, only 11 out of 102 long only funds produced a positive return after fees. They were, in order:

- Panther Trust Australian Shares 5.6%

- Selector High Conviction Equity Fund 5.5%

- Platypus Australian Equities 3.9%

- CFS Concentrated Aust Share 2.9%

- Bennelong Core Equities 2.4%

- CFS Wholesale Aust Share 2%

- Plato Aust Shares Income 1.9%

- Hyperion Australian Growth 1.7%

- ECP AM All Cap 1.1%

- Alleron Growth 0.9%

- Wavestone Wholesale Aust Share 0.4%

I’ll try to interview them all this year to find out how they did it.

Research and Diversions

Research

A fantastic dissertation on the power of dollar cost averaging.

A really good, long piece about Brexit, it’s lessons and mistakes. “Exiting the EU is a process in which the departing country holds very few cards, except for the money it owes. So Brexit was always going to be an unequal negotiation. But the British have handled their exit particularly badly, thereby exacerbating the weakness of their position, in at least three ways.”

This is very interesting: the psychology of Trump’s lying. “I’m convinced that his greatest ambitions are neither financial nor political — they’re psychological. He wants us never to take our eyes off him. A psychic imperialist, he aims to colonise our minds.”

A vision of the dark future of advertising: companies will know more about you than you can imagine.

The coming lost decade. “Deeply embedded human behaviours will ensure that everything in finance will always be cyclical. After a sustained period of good times, the cycle is turning, and investors should prepare for the bad times. Get ready for the upcoming lost decade.” Here’s what to do about it.

Re all the dead fish: “The river is like a piggy bank, if you keep taking money out without saving for the future you end up bankrupt – and just when you need it the most. At this time of drought, good water management ensures the resilience of rivers’ aquatic ecosystems. Clearly this has not happened along the Darling River.”

The United States was made by its frontier. Today it is being unmade by its border. In his recent national address aimed at building public support for a border wall, Donald Trump called the current moment “a crisis of the heart and a crisis of the soul.” He is at least right about that, and it is a crisis a long time coming.

When Chinese hackers declared war on the rest of us. Many thought the internet would bring democracy to China. Instead it empowered rampant government oppression, and now the censors are turning their attention to the rest of the world.

If we learned anything in 2018 it’s that algorithms and social platforms are under regulated, can easily be weaponized and that cybersecurity is an accelerating threat.

How vanity will save retail. “Nail and waxing salons, in addition to pet grooming shops, cosmetics stores, tattoo parlors and gyms, stand out as improbable avatars of the future of retail, surviving and thriving amid the decades-long annihilation of mom-and-pop apparel, book and hardware stores.”

John Mauldin on shaky China, Brexit and Europe.

It is unclear if Germany’s recent economic setbacks are a one-off or a more lasting phenomenon caused by structural problems, particularly in its car industry.

Entertaining guide to the very strange economics of megaprojects. Why do they ever get approved? Because they enrich and excite all those involved, creating strong incentives for insiders to connive in lying to taxpayers about utility and likely cost.

Stumped by the stock market slump? Start by picturing a used car dealership.

The cost-benefit of recycling has changed. The benefit — more participation and thus more material put forward for recycling — may have been overtaken by the cost — unrecyclable recyclables. “We get a lot of diapers…”

“The tech companies’ transformation of individuals into data sets has effectively moneyballed the entirety of human social reality. It seems this transformation, from physical object to vector of data, is a general and oft-repeated process in the history of technology…”

An overview of the exponential growth in computing power over the past sixty years, making the point that Jevons’s Paradox deserves to be at least as well-know as Moore’s Law. The 19C economist William Jevons noted that, if you increase the efficiency of an engine in order to decrease its energy consumption, then the effect will actually be an increase in energy consumption, because the more efficient engine will be more widely used.

France’s “yellow vest” movement is unstoppable. “Not only does peripheral France fare badly in the modern economy, it is also culturally misunderstood by the elite. The yellow-vest movement is a truly 21st-century movement in that it is cultural as well as political.”

I totally agree with this guy. It’s a piece on the superannuation system published in March 2017. It is “an innocent fraud. The system was introduced with the best of intentions, but it doesn’t do what it was supposed to do.”

How soon will climate change force you to move? (“more people are in danger of being climate refugees than you might think”).

Bolton's Syria snafu reveals oil's biggest risk. The Trump administration's unpredictable policy and personnel swings make dangerous misunderstandings more likely.

The internet of things data explosion – how big is it? Well, “The growth in terms of number of devices, revenue generated, and data produced has been stunning, but most predictions expect that growth to accelerate. The number of connected devices is expected to grow to 50 billion in 2020 (from 8.7 billion in 2012) and the annual revenue from IoT sales is forecast to hit $1.6 trillion by 2025 (from just $200 billion today).”

Peta Credlin’s preselection for Mallee could be the spark that blows up the Liberal Party.

Diversions

New Zealand is obsessed with a drunken, littering, rowdy tourist family. “For weeks, a terrible family of unruly tourists has wrought a trail of destruction from Auckland all the way to Hamilton. A large man in red shorts and a white tank top, a woman in a unicorn onesie, and a small, angry boy are the unwilling public faces of this terrible family who number about 12, according to multiple witnesses.”

“The Big Bang might have been the beginning of the universe. Or it might not have been; there could have been space and time before the Big Bang. We don’t really know.”

Everything seems to be getting “weaponised” these days. This piece is about how conspiracy theories are being weaponised. It’s quite interesting though.

“The internet is furnishing for us an endless catacomb, where everything will be buried and nothing will ever die. In this world there is no “the death of…”

“What if there was a simple calculation that could foretell when a company will go bankrupt, when artificial intelligence will become smarter than humans, and when human civilization will meet its eventual demise? William Poundstone, author of the upcoming book The Doomsday Calculation, explains that such an algorithm exists, and can predict all this and more, and why humans likely only have 760 years left in the universe.” (Podcast)

“Is Western Civilization even a thing? …the concept of Western Civilization would have us believe that “the Eurovision song contest, the cutouts of Matisse, the dialogues of Plato are all parts of a larger whole.” But is there really a single phenomenon that Aristotle and Eminem, McDonald’s and second-wave feminism, Darwinism and rococo, are all part of?”

Someone with motor neurone disease writing frankly, beautifully about it, six years after diagnosis. “Six years is a series of losses and losses. Of wiggling toes and functioning fingers, of standing legs and moving arms, of indiscriminate swallowing and intelligible speech, of head-supporting neck muscles and unassisted breathing…. Six years is a richness of loving and living. It’s a fantastic crew of family and friends who surround us with love and visits and meals and lifts and solutions and messages and enjoyable conversation and understanding and humour and innovative 500 games and more.”

“Life is short, as everyone knows. When I was a kid I used to wonder about this. Is life actually short, or are we really complaining about its finiteness? Would we be just as likely to feel life was short if we lived 10 times as long? Since there didn't seem any way to answer this question, I stopped wondering about it. Then I had kids. That gave me a way to answer the question, and the answer is that life actually is short.”

What has the space race ever done for us? Trips to the moon are profoundly undemocratic.

An account of the life and thought of Thomas Hobbes, “The Monster of Malmesbury”, who horrified gentler minds in 17C England with his argument that human beings were “self-serving, rapacious predators” whose “state of nature” was perpetual warfare. He can be seen now as a forerunner of Darwin and Freud, and perhaps the greatest student of human nature since Aristotle.

Mr Five Percent. Calouste Gulbenkian, who on the eve of the First World War negotiated a 5% stake in all of the oil found beneath the Asian territories of the Ottoman Empire, and soon became the world’s richest man. He dodged taxes everywhere, and the Second World War in neutral Portugal, where he “leaned towards whichever side looked like winning”. He was “clearly not an easy person to like, and fell out with almost everyone he came across.”

Profile of Jacques Vergès, French defence lawyer for some of history’s greatest monsters, including Carlos the Jackal, Khmer Rouge leader Khieu Samphan, Nazi torturer Klaus Barbie, Slobodan Milosevic, Saddam Hussein, and serial killer Charles Sobraj. “…the capacity for transgression is what distinguishes humans from animals. There are no indefensible clients — just indefensible arguments”.

Happy Birthday Janis Joplin. She should be turning 76 today, but she’s 49 years dead. Here she is doing “Piece of My Heart” in 1968, at the age of 25, two years before she died.

And here’s Leonard Cohen singing about her, when they had a session on an unmade bed in the Chelsea Hotel.

This is a map of all the volcanoes in Indonesia.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Facebook Live

If you missed #AskAlan on our Facebook group this week (or if you don’t have access to Facebook) you can catch up here. And we’ve just given the Facebook Livestream its own page where you can also opt to just listen to the questions and answers.

If you’re not on Facebook and would like to #AskAlan a question, please email it to hello@theconstantinvestor.com then keep an eye out for the Facebook Live video in next week’s Overview.

Last Week

By Shane Oliver, Head of Investment Strategy and Chief Economist, AMP Capital.

Investment markets and key developments over the past week

- Share markets continued to rise over the last week helped by talk of policy stimulus (notably in China) and optimism of a resolution to the US/China trade dispute. Bond yields rose in the US but were little changed elsewhere, commodity prices including oil rose and the $US rose slightly which saw the $A fall slightly.

- After a great rally since Christmas with US shares up 11%, global shares up 10% and Australian shares up 8% some sort of pull back or retest of the December lows remains a high risk. Major share market falls as we saw last year rarely end with a V bottom, shares are now overbought and there is a long list of uncertainties over the next few months that could trip markets. The list includes: soft data in the short term with the March quarter in the US renowned for soft growth, earnings reporting seasons, trade negotiations, the US government shutdown, the need to raise the US debt ceiling, the Mueller inquiry, Brexit, the Australian election, etc. But looking beyond the near-term uncertainties we are upbeat on shares for the year as a whole as valuations remain much improved from last year’s highs, the trade dispute is likely to be resolved before too long, global growth is likely to stabilise and improve which should help support modest profit growth and policy stimulus should help growth. Speaking of which…

- Shares fall, economic data softens, policy makers respond…The past week has seen more signs of a supportive policy shift globally with: Chinese officials promising more aggressive policy stimulus focussing on tax cuts and the PBOC undertaking a record money market cash injection; Angela Merkel’s political party calling for tax cuts in Germany; ECB President Draghi acknowledging that recent economic news has been weaker than expected and that significant monetary stimulus is still needed; and more Fed officials supporting a pause on rate hikes with former Fed Chair Yellen saying we may have seen the last hike for this cycle. An easing in global policy is one big reason why we expect the global growth slowdown to be limited as it was around 2012 and 2015-16 and why we see a better year for shares this year.

- The US partial government shutdown posing a bigger risk. While its only partial it’s now gone on for four weeks with a reported 800,000 public servants missing out on pay. The longer it goes on the more it will impact and add to trade as a factor worrying US companies. So far American’s are mostly blaming Trump and the Republicans. Trump is dug in over the wall. But like the trade war he won’t want this to drag on for too long given the threat it would pose to US growth ahead of his desired re-election in 2020. So, expect some sort of compromise in the next few weeks.

- Out of interest, 2019 is the third year in the four-year US presidential cycle and historically its normally the strongest as can be seen in the next chart as the president does his best to ensure the economy is in good shape for his re-election year (ie next year for Trump). Of course, it doesn’t always work. But for this year it would be consistent with Trump seeking to support growth and this would include solving the trade war and ending the shutdown.

Source: Bloomberg, AMP Capital

- The Brexit comedy rolls on, but could be heading towards a softer Brexit or even no Brexit. It was no surprise to see UK PM May’s Brexit plan defeated but one would be forgiven for expecting that it would have been greeted with a plunge in British pound. But it held up, so how? The focus is now on cross party discussions to find a solution and with Parliament biased towards the EU this is likely to push towards a soft Brexit. Failing that (and the risk of no solution is high given May’s “red lines”) another referendum is likely and with the difficulties associated with Brexit now readily apparent, Bremain is likely to win. In the meantime, the EU is likely to agree to delay the Brexit date. It should also be remembered though that while Brexit uncertainty is bad for the UK and a no-deal Brexit could knock it into recession it’s a second order issue globally as its implications for the survival of the Euro are minimal as support across Europe for the Euro remains solid. Hence global markets payed little attention to it over the last week.

- My favourite quote from Vanguard founder John Bogle who passed away in the last week: “Don’t look for the needle in the haystack, just buy the haystack!” While actively managing a portfolio of shares has its merits, its not easy to pick winners consistently particularly for individual investors who risk ending up way underperforming the market as a whole. The first priority is to get a broad exposure to the market and let compound interest do its job…picking managers and stocks is always second order.

Major global economic events and implications

- US data was disrupted over the last week thanks to the partial government shutdown but there were some positive signs of a soft landing. On the weak side the Fed’s Beige Book of anecdotal evidence was less upbeat on the growth front and manufacturing conditions in the New York region deteriorated again in January. Against this though manufacturing conditions in the Philadelphia regional improved, jobless claims fell and the NAHB’s home builder conditions index rose slightly in January possibly helped by lower mortgage rates which helped drive a 27% rise in mortgage applications over the last two weeks all of which supports the view that the housing sector will have a soft landing. Producer price and import price inflation were relatively benign consistent with the Fed being on hold.

- The US December quarter earnings reporting season is off to an okay start. 49 S&P 500 companies have reported so far with 79% beating on earnings with an average beat of 0.8% and 54% beating on sales. But its early days & the focus is likely to be on outlook comments which are likely to be cautious given the tight labour market and uncertainties about growth & trade.

- Japanese headline and core inflation was just 0.3% year on year in December highlighting the pressure on the Bank of Japan to stay ultra-easy or even ease further (if that’s possible).

- Eurozone industrial production fell sharply in November, but annual growth data for 2018 as a whole implies that the German economy grew in the December quarter albeit very slowly. That said it will still put pressure on the ECB to ease.

- Chinese exports and imports both fell in December supporting the view that the Chinese economy slowed further late last year, but against this home price gains remained solid and credit growth came in stronger than expected with the latter possibly reflecting policy easing.

Australian economic events and implications

- Australian data releases over the last week continued the weak run seen since Christmas with falls in housing finance, new home sales, housing starts and consumer confidence. Sure, the Melbourne Institute’s Inflation Gauge perked up a bit in December but it’s a bit volatile month to month and in any case both on a headline and underlying basis is running below the RBA’s 2-3% inflation target.

- House prices risk falling further than we are allowing for. For some time we have been of the view that Sydney and Melbourne home prices will have a top to bottom fall of around 20% out to 2020 translating into a fall in national average prices of around 10% (as other cities are in better shape). The plunge in clearance rates and acceleration in the pace of house price falls late last year along with the ongoing credit tightening, the record pipeline of units yet to be completed, reduced foreign demand, investor uncertainty over potential changes to negative gearing and capital gains tax along with price falls feeding on themselves suggest that the risks to Sydney and Melbourne prices are on the downside of our 20% forecast falls. The threat this poses to consumer spending along with rising bank funding costs and out of cycle mortgage rate hikes reinforces our view that the RBA will cut interest rates this year but the cuts could come earlier than the second half that we have been allowing for.

What to watch over the next week?

- US data releases are likely to continue to be affected by the shutdown but in terms of what is scheduled to be released expect to see a pullback in existing home sales (Tuesday), continued modest gains in home prices (Wednesday), a slight further fall in business conditions PMIs for January (Thursday) and a slight improvement in underlying durable goods orders (Friday). If the shutdown ends data already delayed for retail sales and housing starts may also be released.

- The US earnings reporting season will also ramp up a notch with companies such as Johnson & Johnson, Proctor & Gamble, Microsoft and Starbucks due to report.

- The European Central Bank meets Thursday and is not expected to make any changes to monetary policy but could flag that another round of cheap bank financing or LTRO (which is a short-term form of quantitative easing) is on the way or being considered. Eurozone business conditions PMIs for January (also Thursday) are expected to remain weak.

- The Brexit comedy will roll on with PM May due to present Plan B on Monday.

- The Bank of Japan is also expected to leave monetary policy on hold (Wednesday) and remain dovish.

- Chinese December quarter GDP data due Monday is expected to confirm a further slowing in growth to 6.4% year on year from 6.5% in the September quarter. This will leave growth for 2018 as a whole at 6.6% which is slightly stronger than the 6.5% we had expected. Meanwhile December data is expected to show a slight improvement in growth in retail sales and investment but a slight slowing in growth in industrial production.

- In Australia expect jobs data on Thursday to show employment growth slowing to a gain of around 15,000 with unemployment falling to remaining at 5%. Growth in skilled vacancies (Wednesday) is expected to remain soft and the CBA’s business conditions PMIs will released Thursday.

Outlook for investment markets

- With uncertainty likely to remain high around the Fed, US politics, trade and growth, volatility is likely to remain high in 2019 but ultimately reasonable global growth and still easy global monetary policy should drive better overall returns than in 2018 as investors realise that recession is not imminent:

- Global shares could still make new lows early in 2019 (much as occurred in 2016) and volatility is likely to remain high but valuations are now improved and reasonable growth and profits should decent gains through 2019 helped by more policy stimulus in China and Europe and the Fed having a pause.

- Emerging markets are likely to outperform if the $US is more constrained as we expect.

- Australian shares are likely to do okay but with returns constrained to around 8% with moderate earnings growth.

- Low yields are likely to see low returns from bonds, but they continue to provide an excellent portfolio diversifier.

- Unlisted commercial property and infrastructure are likely to see a slowing in returns over the year ahead. This is likely to be particularly the case for Australian retail property.

- National capital city house prices are expected to fall another 5% or so this year led again by 10% or so price falls in Sydney and Melbourne on the back of tight credit, rising supply, reduced foreign demand and uncertainty around the impact of tax changes under a Labor Government. The risk is on the downside.

- Cash and bank deposits are likely to provide poor returns as the RBA cuts the official cash rate to 1% by end 2019.

- Beyond any further near-term bounce as the Fed moves towards a pause on rate hikes, the $A is likely to fall into the $US0.60s as the gap between the RBA’s cash rate and the US Fed Funds rate will still likely push further into negative territory as the RBA moves to cut rates. Being short the $A remains a good hedge against things going wrong globally.