The end of Australia's virtual telco boom?

With Telstra, Optus and Vodafone constantly dominating the headlines, it's easy to forget that there are a number of virtual telcos providing services across the country.

Beneath the trinity of the tier one operators lies a bevy of virtual mobile operators; businesses that buy wholesale services from the major telcos and then make their offerings to consumers.

Living in the shadow of the big three, many of these operations rarely see any limelight unless they are embroiled in some sort of snafu or they are launching a new service.

In the past fortnight, we’ve seen both. While the substantial price hike on international calls at Virgin Mobile generated the headlines this week, virtual operator Yatango made its debut last week with a distinct lack of fanfare or hype.

Yatango joins Kogan.com as one of the new virtual telco on the block. And the space could get a lot more crowded with Australia Post mulling its future as a mobile virtual network operator.

So, just how many MVNOs are plying their trade in Australia to begin with?

A quick Google search of the phrase “MVNO Australia” yields lists upon lists of operators; none of which are fully complete or accurate due to the ever-shifting nature of the space. Even the telco savvy contributors on Whirlpool struggled to name every single Australian MVMO.

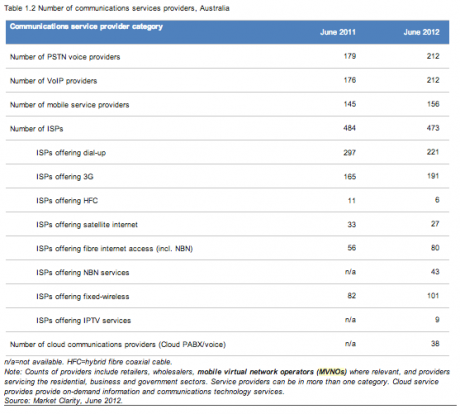

As a result, the exact number of MVMOs in Australia is difficult to deduce. When prompted on the issue Australian Media and Communications Authority provided an exert of its 2011/12 communications report, tallying all communication providers including MVNOs. The total number of operators are represented by the "number of mobile service provider" column in the table below.

(Click to enlarge)

If these numbers are anything to go by, the sheer number of operators seems to be in line with what analyst firm Ovum first pointed out in 2010; the Australian telco market was set to be swept up in the MVNO trend.

Going through the lists, there were some names (with hefty marketing budgets) that stand out, like Virgin Mobile, iiNet and Amaysim. Meanwhile, there were many that don't ring a bell, like SavvyTel or Vaya.

MVMO’s opt for Optus’s network

Another thing that stands out in the lists is that most of these telcos operate on Optus’ network.

Aside from persistent musings from the MVNO community that Optus is simply easier to deal with than Telstra, there’s also the fact that Optus is willing to wholesale it’s most current technology, its 4G network.

This was a crucial point in Yatango founder, Andy Taylor’s decision to sign up with the telco. According to Taylor, while 4G LTE is shaping up as the next major battleground for the tier 1 operators it is also the next major avenue for growth for virtual telcos.

Despite his enthusiasm for his company’s success, Taylor says that he’s really only aiming to churn rival MVNO VIrgin Mobile’s customers, not steal anyone from his network provider Optus.

Open business or slave to the telcos?

Taylor's comments hint at the weakness inherent in the MVMO space: while there is money to be made as a virtual operator it is only done so at the whim of the major telcos.

Onselling somebody’s else's network pits MVMO’s at the mercy of their suppliers and as we’ve seen with the termination of Boost’s mobile licensing agreement with Optus, the telco’s judgement can be wildly unpredictable.

Buddecom founder Paul Budde says its been getting progressively tougher to make ends meet as a virtual telco.

“This (MVNO) market has always been struggling because of the ongoing strategic changes that the operators make to these arrangements,” Budde says.

“Most importantly margins have dropped over the last 20 years from 35 per cent to five per cent and even less, forcing the MVNOs to rely on the sale of other (hardware) products.”

Ovum telco analyst, Nicole McCormick adds that over the next 12 months we may see MVMO’s cut back on their aggressive discounting strategies that has so far seen many of them cut out a niche in Australia’s telco market.

“I expect there could be some consolidation of purely discount MVMOs in the market,” she says.

This consolidation will more than likely weed out many of the smaller players, possibly creating room for bigger companies like Australia Post.

It’s somewhat of a shame that this is the way the market will go because as well as being discounters, many of the lower-end MVMOs are pursuing innovation in telco services as as a point of difference and a means to expand their customer base.

But sadly, as this industry still only operates in the shadow of Australia's major telcos many of the businesses that die out probably won’t be missed.