The dollar's weakness is mining's strength

Summary: Currency movements are having an impact on commodity markets.

Key take-out: The weak Aussie dollar is helping export businesses.

The weakening Australian dollar is handing back, in part at least, what commodity and equity markets are taking away. This is why mining and oil stocks are proving yet again to be a useful hedge against volatile currency moves.

Other exporters selling in US dollars – such as farmers, inbound tourism operators, and a handful of manufacturers – are also benefiting from the same currency effect when they convert their international income into Australian dollars.

What is currently unknown – and likely to remain that way for some time – is just how far the Aussie currency will fall or conversely, how high the US dollar might rise.

Events far beyond Australia's control, plus some which are purely local, are morphing to produce a dangerous currency cocktail which could last well into next year, and perhaps much longer.

International currency pressures include the trade wars launched by the US against a number of other countries, especially China. While Australia is not directly involved, China is Australia's major trading partner, which means the freely traded Aussie currency has become a proxy for the Chinese currency – the renminbi.

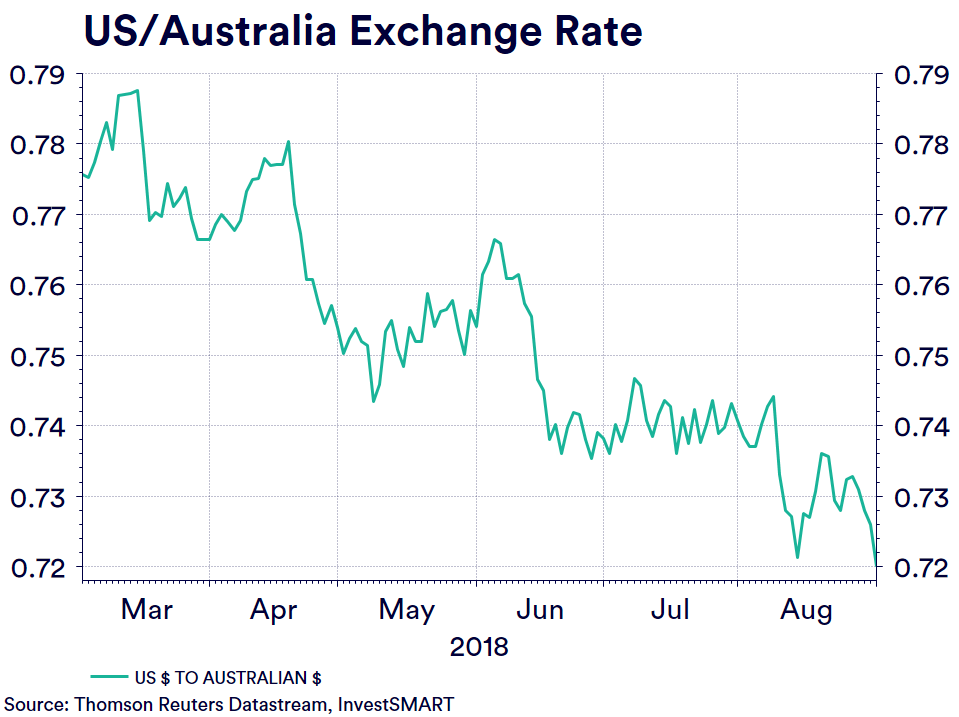

The local pressures include a slowing economy – as seen in retail sales and house prices – plus political uncertainty relating to government leadership and energy policy (or lack, thereof). These factors are combining to pile up against the Australian dollar, which has fallen by 9.5 per cent against the US dollar this year, including 2.7 per cent in the past month.

However, the domestic factor likely to cause the most pain to the Australian economy is the tight squeeze of rising business and mortgage lending rates, combined with falling property prices – particularly in Sydney and Melbourne.

Official interest rates – on hold for two years – might not need to be increased soon because Australia's commercial banks are doing the job for the Reserve Bank. They are currently being forced to pay higher interest rates for deposits in the international market, especially in the US, where prime rates are higher than those on offer in Australia, which is an unusual occurrence.

The interest rate differential is encouraging a flow of funds across the Pacific in pursuit of a better return. Also on offer is the prospect of even higher returns next year, as the US ratchets up rates in a drive to normalise the economy after the cash surge which followed the Global Financial Crisis.

The next milestone in the Australian dollar's slide looks to be an exchange rate of US70c, but that forecast could easily be blown away if the US commercial attack on China worsens, and Australia is dragged deeper into the dispute.

Pressure builds on the Australian dollar each time the US raises its official interest rates. This is particularly the case if the Reserve Bank does not respond with a rise of its own – a move which would be loaded with political implications in the lead-up to a federal election expected by next May.

Local bank economists are cautious about the currency outlook. The Commonwealth's view is for continued, “modest depreciation” against the US dollar.

On commodity markets, the benefits of recent currency moves can be clearly seen in the commodity which can act as a substitute for government paper – gold.

Over the past week, as the Australian dollar dived from close to US74c to a latest reading of US71.9c, there has been a positive effect on the local gold price.

As gold has slipped from $US1,206 an ounce last Thursday to almost exactly $US1,200/oz, the Australian dollar gold price has risen from $A1,653/oz to $A1,667/oz.

Gold is the easiest and cleanest way to measure the currency effect on metal prices, but the same effect can be seen in the prices for base metals, such as copper and nickel. It can also be observed in the markets for ferrous metals, such as iron ore.

Copper – an important metal for most of Australia's big miners, including BHP and Rio Tinto – has eased in US dollar terms from $US2.76 a pound a week ago to $2.70 a pound. This is largely thanks to concern about demand in China as the tit-for-tat trade war with the US rumbles along.

However, on conversion to Australian dollars, the copper price has actually crept up from $A3.72/lb to $A3.75/lb.

Commsec chief economist Craig James said this week in an interview with the ABC that the weaker Australian dollar might help protect the local economy from the uncertainties of trade disputes.

“Globally focussed businesses are benefiting from the weaker Aussie dollar and good global demand,” he said.

“The issue to watch is the U.S. versus everyone trade wars.”

That comment from James goes to the heart of the problem – the potential for the trade war to get out of hand as competing countries engage in an exchange of ever wider tariffs, with the potential for the “war” to become an exchange of depreciating currencies to aid exports.

If the US does do what President Trump has threatened by trying to “weaponise” the US dollar by forcing it down, a new front will be opened in his war with China. In this situation, Australian investors would have a fresh set of worries because the positive currency effect will turn negative.

However, if that happens, gold could reclaim its lost lustre in US dollar terms as a hedge against financial instability, and as an investment safe-haven.

If there is a theme at work in the currency story, it can be found today in the overall positive flowing from a falling Australian dollar for exporters selling in US dollars – which includes most miners and all oil producers.

Gold however, is the commodity that some investors (and countries) are turning to as the trade situation deteriorates. Russia provides an interesting example of what to do in a trade and currency war – buy gold.

In July, even as US sanctions bruised its economy, Russia bought an extra 26.1 tonnes of gold, taking its stockpile of the “currency” to 2,170 tonnes – the sixth largest position in the world.

The editor of an investment newsletter entitled Strategic Intelligence, Jim Rickards, said Russia's gold buying was a “very smart move”.

“Russia is in a financial war. It's getting out of U.S. dollars and into gold. This insulates the country a U.S. dollar freeze and sanctions,” he said.

London-based investment banker John Meyer said that because the US was weaponising the dollar, it was “absolutely right for Russia to diversify its foreign currency holdings”.