The disaster of the 2010 election

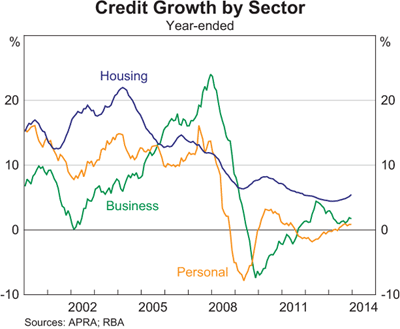

If there’s one statistic that explains both the rise in unemployment back up to 6 per cent and the fall in real wages revealed yesterday, it’s the collapse in business credit growth in 2012.

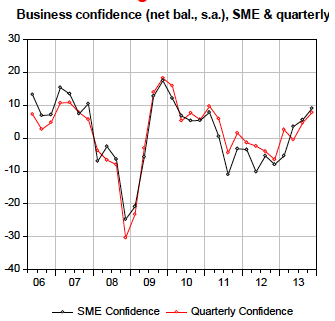

That followed a decline in business confidence in 2011 that didn’t go quite as deep as in late 2008, but was just as sharp and in many ways was more insidious because it lasted longer – there was no bounce back in 2012 as there was in 2009.

Specifically, SME confidence, as measured by the NAB quarterly survey, started falling from late 2009, plateaued in late 2010, fell off a cliff in 2011 and then stayed down until the end of 2012. See the chart:

Business lending peaked in mid-2012 at a bit less than 5 per cent and then fell back to zero over the following 12 months, just as personal and housing and housing credit was picking up.

Anecdotally, bankers report that the statistics don’t really do justice to what happened: small businesses simply stopped borrowing money from about 2010 onwards. The increase in credit growth shown in the chart through 2011 and 2012 related mainly to deals previously done in the mining and energy sectors. At the small end of town, it was a different story: business banking was very competitive at the time, and private bankers were pounding the pavement trying to grow their books, but doors were being slammed in their faces.

To be even more specific, Australia’s family businesses, which employ the most Australian workers, went into their shell between 2010 and 2013 and stopped investing. Cash was taken out and invested in property or equities, or simply kept in the bank.

Why did it happen? One word: politics. Or rather three: the 2010 election. With the benefit of hindsight a minority Labor Government ruling with the support of the Greens and two rural independents, and an Opposition with a sniff of power prepared to say anything to get there, was the worst possible election result for business.

The 2010 election will go down as one of the worst outcomes in history, and the result of it is now showing up now in high unemployment and negative real wages for only the third time in 15 years. Productivity growth, leading to employment and wages growth, requires business owners to invest.

After that 2010 election, Australia’s legion of small family businesses decided to keep their powder dry – to keep their cash to themselves for a while, because suddenly they didn’t know how things were going to turn out.

Government policy had become erratic, policy was being made on the run, a huge amount of legislation was being passed as if the ALP and the Greens were rushing to change the country while they could, environmental regulations were proliferating and unions had become much more powerful. Obviously the carbon tax, however justified it might have been in scientific terms, was a business and economic disaster. The botched mining tax had a much wider impact than the mining industry because of what it said about the Labor Government’s approach to business policy. And the industrial relations reforms were enormously damaging.

Tony Abbott and the Coalition in Opposition are not off the hook either: their hysterically confrontational behaviour and constant negativity made the situation more feverish and seem more uncertain than it already was.

The resulting hiatus in business investment is the main reason the Australian economy is now suffering a shortfall of productivity, competitiveness and employment. Business confidence is now rising again following the 2013 election but it will take a while for this flow through to investment again, especially with the delayed impact of the 2010 election now showing up in big closure announcements and redundancies, which are having their own secondary impact on business confidence.

What the Australian economy needs now is not more reform, but consistent, sensible decision-making, preferably pro-business and preferably less of it. Less change, fewer announcements and most of all, less politics.