The biggest risk investors are missing

The Delian League, founded in 478 BC, may sound like a regional Chinese football competition. It was in fact an association of Greek city states, united by a common cause. The Persians and Greeks had been fighting over territories in Asia Minor (now Turkey). The League, with its amalgamated navy, was formed to repel Persian ambitions.

The strategy, while successful, soon went off the rails. After banishing the threat of the Persians, Athens - the League's most powerful member - turned the navy to its own ends. Thus, began the Athenian Empire.

History, like physics, exhibits an almost Newtonian quality. As Athens established colonial-like rule over League members, resistance to it increased. Sparta, the supreme power of the era, looked upon Athens rise with growing suspicion. In 50 short years, the upstart had achieved great advances in philosophy, architecture and democracy. Its naval prowess was also mounting.

Sparta's response was to form an opposing force - the Peloponnesian League - which led to the 27-year-long Peloponnesian War. Sparta emerged victorious and Athens surrendered its cultural, economic and military might, never to regain its status.

In a few decades, an energetic emerging power had been crushed by the regional hegemon in a costly, protracted and ruinous war for both sides.

Yes, I know how people feel about ancient history; it's just so old, right? But there's a lesson here. The lesson is relevant to the current era in which two great powers, one arguably declining, the other unarguably rising, are beginning to clash. It is perhaps the biggest risk to your portfolio you haven't yet considered.

In 2011, The New York Times' David Sanger wrote that, "For a superpower, dealing with the fast rise of a rich, brash competitor has always been an iffy thing. Just ask the British..."

Thucydides, an eyewitness to the Peloponnesian War, wrote the book on the subject 2500 years beforehand. He put it thus: "What made war inevitable was the growth of Athenian power and the fear which this caused in Sparta".

Graham Allison, Harvard Professor and former Assistant Secretary of Defense under Bill Clinton, calls this the 'Thucydides Trap'. Writing in The Atlantic, Allison speculates whether the US and China might become ensnared by it. "When we say that war is 'inconceivable,' is this a statement about what is possible in the world-or only about what our limited minds can conceive?"

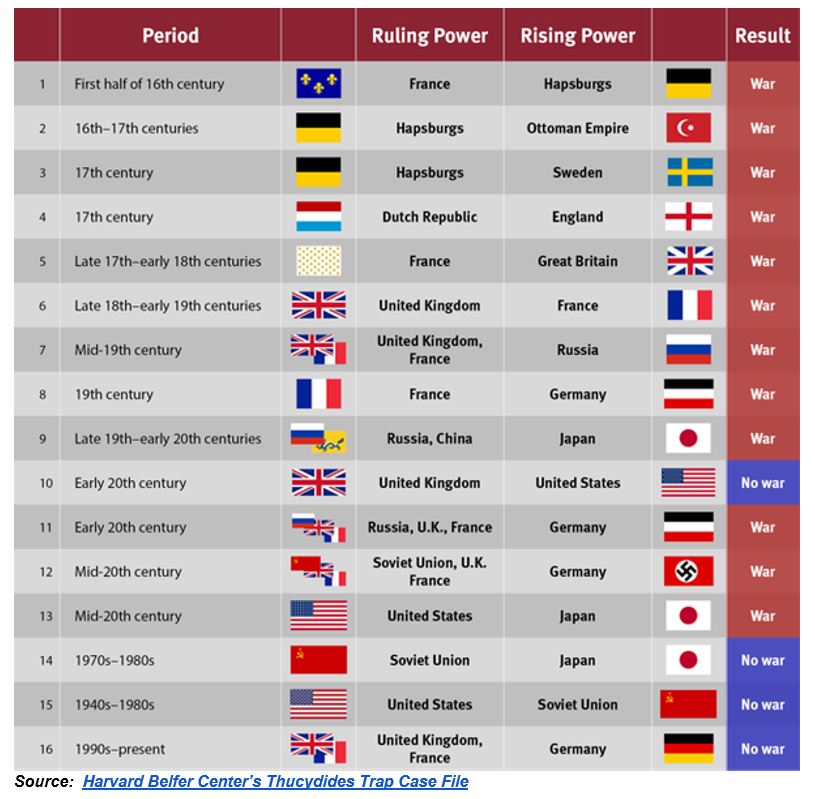

For investors, the table below adds alarming detail to Allison's rhetorical question:

As the world's two largest economies and first and third most powerful military forces, conflict between China is at once unimaginable and terrifying. The risk might be low, and the prospect farfetched, but who imagined the destruction and carnage of World War I in 1913?

Allison's team at Harvard Belfer Center for Science and International Affairs surveyed the past 500 years, looking for cases where a ruling power was faced by a rising one. They found that in 12 of 16 cases the outcome was military conflict. Not good odds.

Allison's conclusion: "When the parties avoided war, it required huge, painful adjustments in attitudes and actions on the part not just of the challenger but also the challenged. Based on the current trajectory, war between the United States and China in the decades ahead is not just possible, but much more likely than recognized at the moment".

It may be alarming to have a US President who thinks Ricardo's theory of comparative advantage is something to do with baseball and that US tariffs on Chinese goods hurt the Chinese rather than US importers and consumers, but this is to miss the point.

With a long historical perspective, the US/China trade war and territorial disputes in the South Pacific and South China Sea are an expression of China's rise and the US response to it. These incidents generate much media coverage but little historical or contextual understanding.

At the end of World War II, the US share of global GDP was barely 40 per cent. According to Noah Smith of Bloomberg, during the 20th century, it was typically less than 25 per cent. If China's growth persists at 6.5 per cent a year while the rest of the world grows at 3 per cent, by 2029 China's economy is likely to equal the same proportion of global GDP as the US had last century.

By 2050, China would account for 40 per cent of global GDP. By the 2060s it would contribute more to global economic activity than the rest of the world combined.

There are constraints, of course. Low fertility rates, an ageing population and the economic arbitrage that is urbanisation is coming to an end. But with a population a quarter of China's, the US would need to be four times more productive to maintain its share.

That seems unlikely. China is already the world's largest trading nation - despite a trade war, Chinese exports grew 15.6 per cent last month - and is the world's biggest saver (and owner of US debt). It is also home to the world's biggest market for luxury goods, smartphones, energy and online commerce.

The economic power derived from a huge and urbanising population is being parlayed into a march up the value chain, with education at its base.

Last year, China produced 8 million college graduates. The World Economic Forum reports that, "between 2000 and 2014, the annual number of Chinese graduates in science and engineering went from about 359,000 to 1.65 million. Over the same period, the comparable number of US graduates went from about 483,000 to 742,000".

Even US-educated Chinese graduates who might have once found their way to Silicon Valley are returning home. So-called 'sea turtles' numbered over 400,000 in 2016, a rise of 22 per cent in three years. The reason is that, along with the food, the opportunities in China are more interesting.

China's surveillance state makes Google and Facebook look like hopeless amateurs. Creepy programs like the Social Credit System, where points are deducted from people's social credit score for anything from antisocial behaviour to declaring bankruptcy, can lead to being banned from high speed train travel and access to credit.

But think of the data. China leads the world in artificial intelligence (AI) and invented the world's fastest supercomputer in 2016 (the Sunway TaihuLight, since superseded by the IBM Summit). In this field, data volume is a competitive advantage and China is way out in front.

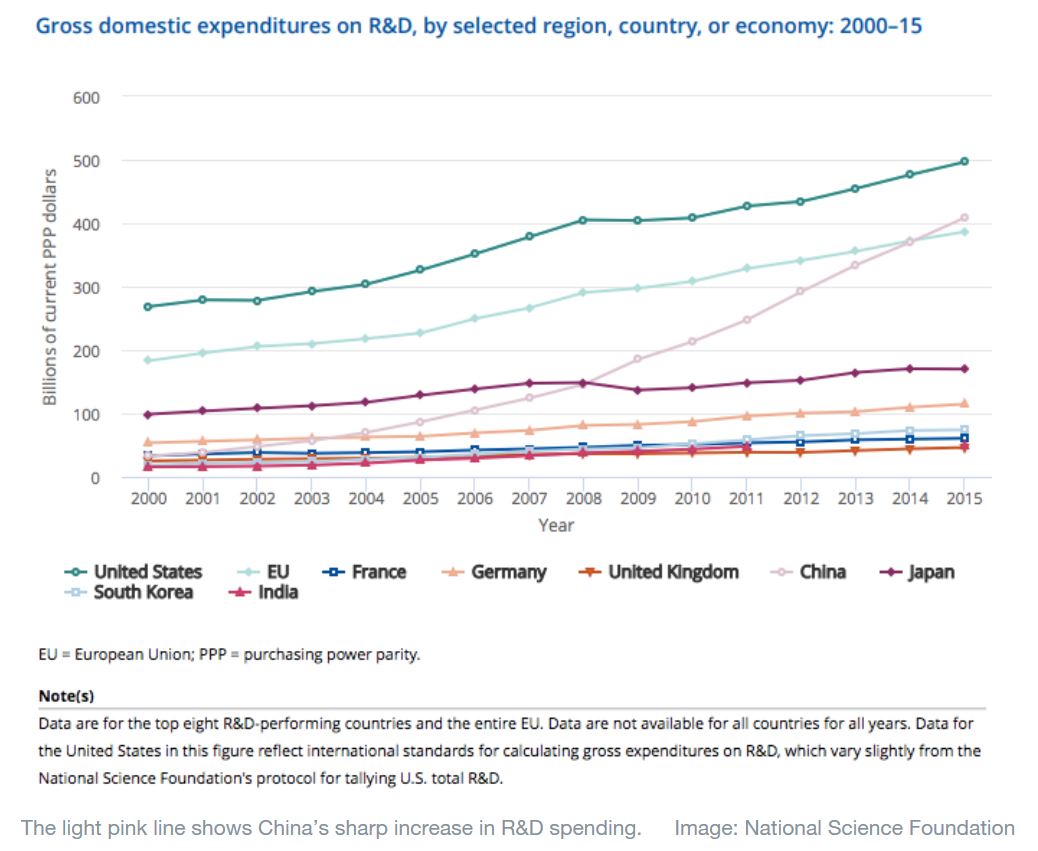

Money is pouring into research and development (R&D) to ram home the country's natural advantage in technology and other fields. Israel and Korea spend over 4 per cent of GDP a year on R&D - the highest in the world. China, like Australia, invests half that. But the law of large numbers works in its favour. Below is R&D spending by country in purchasing power parity terms:

With a huge population, millions of graduates and R&D spend (the pink, rapidly rising line on the chart) increasing at over 15 per cent a year, four times faster than in the US, there's an inevitability about China's economic rise, and growing military capability. This week, new photos emerged of China's H-20 nuclear bomber. With an 'operational range to 12,000 kilometres', this could reach US bases in Guam and Japan with ease.

In Seattle in 2015, Chinese president Xi Jinping said, "There is no such thing as the so-called Thucydides trap in the world. But should major countries time and again make the mistakes of strategic miscalculation, they might create such traps for themselves".

That's a diplomatic warning if ever there was one, and perhaps one that investors might heed. China's growing economic and military power is a given. The variable is whether these two great powers can make the necessary accommodations to avoid conflict:

"The defining question about the global order for this generation," says Allison, "is whether China and the United States can escape Thucydides's Trap."

Have a good weekend.

.JPG)