The big issues facing Australian CEOs

Summary: PwC's 21st CEO survey settles the China vs US argument, and the tax and tech issues that CEOs are facing.

Key take-out: Australia is losing its global investment appeal, but synchronised growth is boosting the spirits of CEOs.

There are a few things keeping Australian CEOs up at night, and their international attractiveness is likely to be one of them.

Australia, one of the highest taxing nations in the OECD, has officially dropped out of the top 10 destinations for global capital, according to PwC's 21st CEO survey. Just 5 per cent of almost 1300 CEOs surveyed worldwide pinpointed Australia as an important place for their company's overall growth prospects, ranking us behind Brazil, Canada and Russia.

Tax is partly the reason why. It's also the reason the US remains the most attractive nation for investment on the planet.

US trumps China

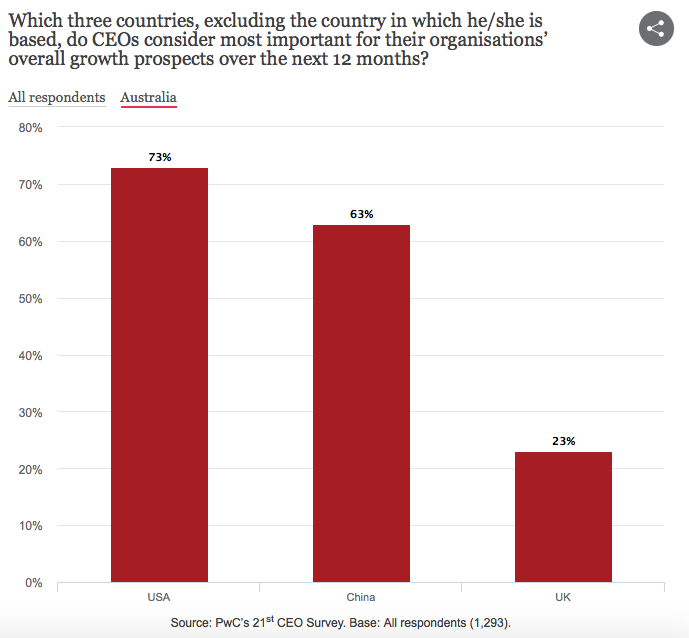

Once again, the US takes the cake as the top investment destination for Australian CEOs, trumping China.

The US is also the biggest investor in Australia, to the tune of $860 billion, which is $345 billion more than our second biggest investor, the UK, and more than 10 times that of China.

China has risen in prominence as an investment destination for Australian CEOs from last year – from 57 to 63 per cent – but the US leapt ahead to 73 per cent. China held this lead for local CEOs with sights set offshore until 2015.

A taxing matter

It largely comes back to tax reform and the ‘America First' political push, believes PwC, which has issued a warning to Australia related to this.

“With Australia now one of the highest taxing nations in the OECD, the concern is around inaction to embark on real and meaningful regulatory change and tax reform. Without reform, the risk is that Australia's global relevance will continue to decline,” says PwC in the report.

“These results ring another warning bell for Australia. If we want to remain globally competitive and attract investment, we need tax reform. Otherwise we are at serious risk of foreign direct investment flows slowing as organisations prioritise investment in the US.”

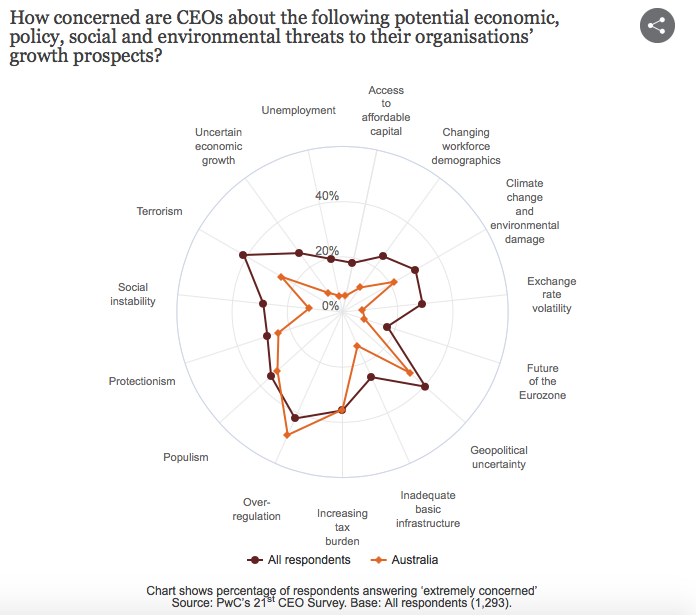

Interestingly, Australian CEOs perceived the threat of increasing tax burdens as the same to other CEOs around the world. And, even considering the big swings in the Australian dollar in recent times, they labelled exchange rate volatility as comparably very insignificant.

The tech threat

Separate from the chart above, local CEOs have called out the speed of tech change as the top threat to company growth.

In Australia, 77 per cent of CEOs surveyed believe artificial intelligence, robotics and blockchain technologies will be the most disruptive force to their business in the next half-decade. Only 10 per cent strongly agreed they were clear on how these technologies could enhance customer experiences.

Cyber attacks are probably a more immediate threat, in any case, and PwC thinks there “could be a rude awakening” on that note because the underinvestment “in preventing these attacks is startling”.

Last year Australia was second only to the US in security threats. CEOs from both countries have grown more concerned, and those in China are significantly more concerned, with PwC thinking new regulation for cybersecurity and the handling of personal data may have done the trick.

Alarmingly, almost nine out of every ten (89 per cent) Australian CEOs are concerned about cybersecurity, but less than half (46 per cent) are investing more heavily in protection.

Troubles scaling up

All that said, around 59 per cent of Australian CEOs surveyed expected global economic growth to improve over the next 12 months, slightly above the global average of 57 per cent.

Compare this to the 31-38 per cent who reported feeling that way in the three years prior, and you seem to have a very optimistic Australian C-suite.

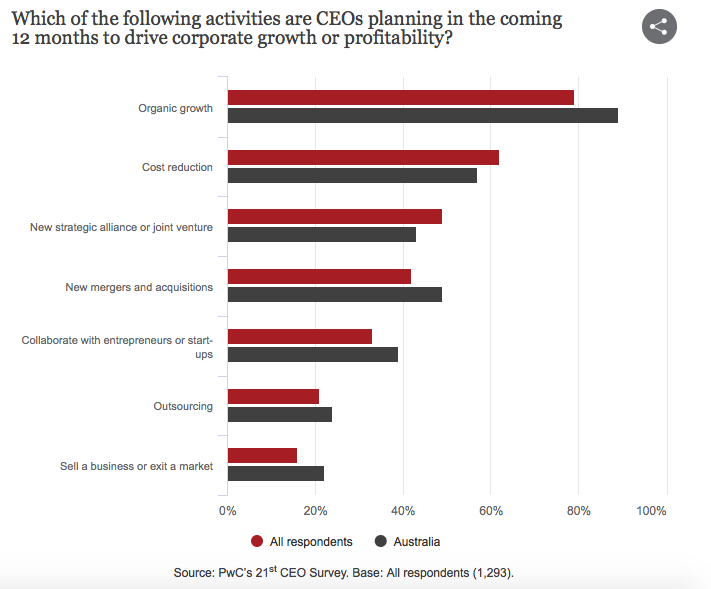

But a lot of this seems to come back to the notion of global synchronised growth, and might be why organic growth ranks so highly as the growth driver.

It may read like our CEOs are riding high on optimism, but they're probably more confident about the broader environment than their own growth prospects.

“When Australia's CEOs and CEOs globally are asked about their own organisation's growth prospects over the next three years, the bandwagon slows down. While still generally confident (more CEOs say they are ‘very confident' rather than ‘somewhat confident') there are diminished levels of confidence compared with recent years,” reads the PwC report.