Taking a regional (bank) tour - part 2

The British corporate rampager, investor and writer Jim Slater once explained his penchant for smaller companies by noting that 'elephants don't gallop' – and a few moments googling will confirm that he was right (although they can walk very fast if you annoy them enough).

Any kind of forward movement would have been welcome in the sharemarket over the past year, but what little there was occurred at the smaller end, with the S&P/ASX Small Ordinaries Index ending up exactly flat, while the S&P/ASX 50 (comprised of the ASX's 50 biggest stocks) has fallen 16%.

Most of that fall can be blamed on the big four banks, which account for about a third of the top 50 and have fallen an average of 29%. You'd be forgiven for wondering then, if there might be any respite in the smaller, regional banks.

Key Points

-

Lower capital requirements a plus for regionals

-

BEN's Homesafe product a big success

-

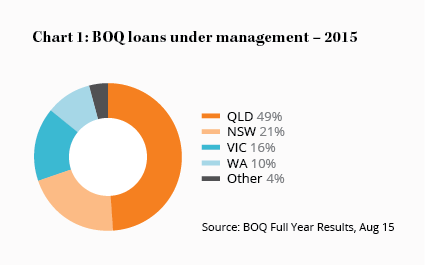

BOQ has large exposure to QLD and WA

The short answer is that it wouldn't have helped much over the past year, with Bendigo and Adelaide Bank and Bank of Queensland falling 30% and 12% respectively. There are good reasons, too, why Slater might have it wrong about banks, with the big ones enjoying multiple benefits including greater economies of scale, lower funding costs and lower capital requirements.

As we explained in Taking a regional (bank) tour – part I, regulatory changes are set to reduce the advantage of lower capital requirements, although economies of scale might continue to rise due to an increasing dependence on technology. Overall, we think the larger banks will continue to have considerable advantages, but there's a price for everything, so let's take a deeper look at the two regionals.

Bendigo and Adelaide Bank

Selling for 80% of book value, Bendigo and Adelaide Bank (BEN) appears to be good value. Adding to its attractions is a more stable funding position than the major banks: 81% of its funding comes from deposits compared to around 60–65% for the likes of CBA and Westpac.

In recent times the bank has also benefitted greatly from its unique Homesafe product, which offers homeowners the opportunity to sell up to 50% of the future sale proceeds of their homes. When a homeowner enters into a contract, BEN pays the homeowner based on the estimated current value of its share of the property less a discount for the homeowner retaining the right to live in the home or rent it out until its sold.

The bank benefits from the unwinding of this discount over time as well as from gains in the property's value. As you can see from Table 1, Homesafe income as a percentage of cash earnings has increased significantly in recent years, helped by 60% of the portfolio being located in Melbourne and the remainder in Sydney.

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 1H 2016 |

|

|---|---|---|---|---|---|---|---|---|---|---|

| Homesafe ($m) | 2 | 5 | 9 | 11 | 22 | 3 | 25 | 50 | 63 | 55 |

| Cash earnings ($m) | 119 | 240 | 182 | 291 | 336 | 323 | 348 | 348 | 382 | 224 |

| Percentage (%) | 2 | 2 | 5 | 4 | 7 | 1 | 7 | 14 | 16 | 25 |

Homesafe gains are included in 'cash earnings' and are also included in the company's cash ROE, which has hovered around 9% in recent years. This is significantly below the mid-teens ROEs of the major banks and of course would be even lower if we excluded the Homesafe gains to make a more like-for-like comparison. BEN's community-based banking model, lower economies of scale and a resulting 56% cost-to-income ratio are some of the reasons for this difference.

The bank believes its Homesafe portfolio provides 'earnings diversification' but we'd argue the opposite: residential loans are 69% of the bank's assets so Homesafe, in fact, increases its dependence on the Australian housing market.

Excluding Homesafe income, 2015 cash earnings have barely changed since 2011 and actually fell in the first half of 2016 compared to the first half of 2015. While the bank will benefit from the changes in capital requirements detailed in part 1, additional software costs required to become an 'advanced' bank (and thereby reduce capital requirements as explained in part 1) will provide further headwinds to cash earnings: software amortisation will nearly double in coming years.

As such, we believe this is an example of a stock being cheap for a reason and recommend members avoid the bank. We'll continue to monitor BEN but for the time being we are CEASING COVERAGE.

Bank of Queensland

By contrast, Bank of Queensland (BOQ) appears fully priced, if not expensive, compared to some of its major bank peers. Despite an ROE around 4% lower than NAB and ANZ, it's similarly priced to these two majors on a price-to-book basis.

Although BOQ has expanded outside Queensland since 2004, Queensland still represents 49% of loans whilst Western Australia represents another 10% (see Chart 1). With both states likely to grow more slowly than NSW and Victoria in coming years as a result of the resources downturn (some of the big banks are starting to report higher provisions from their resources exposure), BOQ's large business in these two states makes us nervous – all the more so because the bank's 2015 provision expense represented just 0.18% of gross loans, which is just over half its 0.33% average over the past ten years and far below the 0.59% and 1.16% recorded in 2011 and 2012 respectively.

The potential impact of geographical concentration can be seen in the dramatic rise in BOQ's provisions in 2011 and 2012 as a result of the Queensland floods and their subsequent impact on the broader Queensland economy. While a new chief executive likely contributed to this rise through an 'asset quality review' that led to 'more conservative' provisioning in 2012, the exposure to the states most hit by the mining and energy downturns remains a concern.

To increase growth, the bank is once again using mortgage brokers after discontinuing their use in 2005. 23% of its home loans were originated through brokers in August 2015 and the figure should only rise if the company successfully increases the number of accredited brokers from 2,500 to 4,000 in 2016.

Like BEN, software costs are increasing, with the $17m in software amortisation in 2015 expected to double over the next two years (to around 10% of 2015 cash earnings). Further investment in systems and technology necessary to gain 'advanced' status will also provide headwinds to earnings growth in coming years.

Yet with a cost to income ratio in the mid-40s and a stronger capital position than BEN, BOQ is in better shape than its Victorian-based rival. Nevertheless, we'd need to see the stock priced at a significant discount to the big four to get us interested, given the ongoing competitive disadvantages of smaller banks, as detailed in part 1.

Also like BEN, we'll continue to monitor the stock in case it offers better value, but for the time being we are CEASING COVERAGE.