Sun shines on a new solar leader

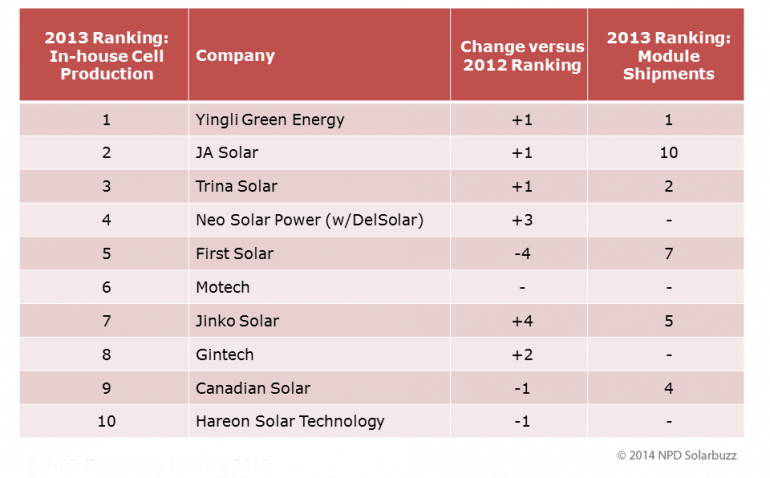

For the first time, Yingli Green Energy became the No.1 cell producer in the solar photovoltaic industry during 2013. Previously, Yingli had reached No.1 ranking for module shipments, but never before for the greatest amount of in-house cell production.

During the past 10 years, the title of leading solar cell producer had been the exclusive domain of five companies: Sharp Solar, Q-Cells, Suntech, First Solar and JA Solar. Now, Yingli can now be added to this list of leading solar cell producers. As has become the norm for Yingli of late, ranking leadership was achieved in style, with a new annual record for the most solar cells produced within any calendar year.

During the past couple of weeks, new checks through the upstream channels have been undertaken by analysts at NPD Solarbuzz, and we can now reveal who the top 10 solar PV cell producers for 2013.

It is worth highlighting that there are two key rankings lists to consider in the PV industry in terms of upstream companies. One relates to ‘who made the PV cells’: the other one is ‘who shipped the finished PV modules’. These two lists are very different.

This article reveals the top 10 list of solar PV cell producers for 2013. A recent PV-Tech blog revealed the top 10 module suppliers for the year, with Yingli Green Energy taking No.1 position again.

The following sections now describe what factors influenced solar cell production in 2013, and how this might evolve during 2014.

Analysing the data

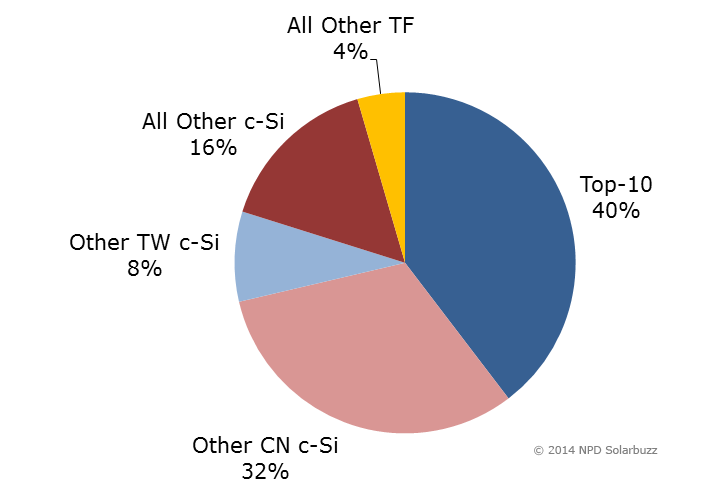

During 2013, the top 10 PV cell makers accounted for 40 per cent of production (compared to 42 per cent for the top 10 in 2012, due mainly to US based issues discussed below). Nine of the top 10 cell makers were based in either China or Taiwan, with six based in China. In fact, 76 per cent of 2013 production came from Chinese and Taiwan c-Si cell production last year.

The fortunes of First Solar characterised many of the industry’s manufacturing changes in 2013. First Solar had been top of the rankings in 2011 and 2012, but was effectively capacity constrained in 2013 (as it will be in 2014), and this went a long way to explain First Solar’s decline to fifth position. However, First Solar remains both the only thin-film maker in the top 10, and is also the only non-China/Taiwan producer in the rankings list now.

The top 3 (all Chinese) produced over 15 per cent of industry cells in 2013, with each of these producers making in excess of 2GW during the year. And just for the record also, before 2013, no cell maker had ever made more than 2GW of cells in a single year.

Having completed its merger during 2013, Neo Solar Power (including DelSolar) increased by three ranking positions compared to 2012, having undertaken the consolidation of capacities previously assigned to each company. Similar to the production output of most Taiwan cell makers (both within and outside the top 10), demand for Taiwanese cells was driven by final module deployment in Japan and the US.

Gintech and Jinko Solar each increased ranking positions compared to 2012, with Jinko Solar the only new entrant in 2013. Jinko Solar replaced Suntech in the 2013 listings. While the dynamics of Suntech’s decline are somewhat different to Sharp Solar – in terms of cell production – any historic scan will also show Suntech’s regular participation at, or near, the top of the PV cell production tables.

Factoring in the US Issue

What is particularly humbling for all the challenging cell makers, from the ranking list for 2013, is that when we add up the US-specific module shipments of all the Chinese companies in the top 10 cell production ranking, there was in excess of 1.7GW of modules shipped to the US. Therefore, the Chinese contribution could have been even higher had Taiwanese cells not been used in so many US-bound modules.

This represented one of the key highlights of 2013: the fact that Chinese module suppliers could adapt quickly – and with volume – to the US market, under the cell manufacturing restrictions that were imposed by the US ITC back in 2012. Virtually all of this 1.7GW was outsourced to Taiwan cell makers, several of whom feature prominently in the 2013 rankings list.

Making or simply shipping?

One of the fascinating perspectives comes when comparing the top 10 cell makers (this blog) with the top 10 module suppliers (from Ray Lian’s blog on PV-Tech.org a couple of weeks ago).

Only six of the top 10 solar PV module suppliers of 2013 feature in the top 10 cell production lists, with Yingli and Trina occupying the top two positions for both rankings – another sign of how much these companies have increased market share in the past 12 months.

Third-placed in the module supplier ranking, Sharp Solar did not even feature in the top 10 cell production table. A decade ago, Sharp Solar dominated cell production in the PV industry. But as the PV industry has changed, so has the strategy of Sharp Solar. Sharp Solar’s omission from the top 10 cell makers for 2013 is the most vivid example of the new fab-lite (or even fabless) route that many have been forced to take during 2013.

Other top 10 module suppliers – not featuring in the top 10 cell production ranking – include ReneSola, Hanwha SolarOne and Kyocera. Right now, we are still treating Hanwha SolarOne and Hanwha Q-Cells as separate entities. If they were grouped together, however, Hanwha’s cell production level would have comfortably garnered a top 10 ranking place.

What to expect in 2014

Forecasted cell production analysis from NPD Solarbuzz currently reveals a similar outcome for 2014 cell production, with Yingli remaining on top and some jostling of positions below. The only major change may come from the inclusion of Shunfeng (benefiting from ramping up part of Suntech’s legacy cell lines). On a similar theme, the acquisition of Topoint’s cell capacity by Jinko Solar from the start of 2014 will almost certainly help propel Jinko 2-3 places higher up this year.

One of the reasons driving the somewhat status quo for 2014 is the lack of cell capex through 2013. However, there are two key swing factors that could impact the analysis in 12 months. First, any consolidation activity in China, whereby leading tier 1 cell makers can increase in-house cell capacity quickly, would provide immediate productivity gains. And second, the US ITC findings may also have a short-term effect – or merely caused by market uncertainty before the final ruling – that could result in the Taiwanese having to shift US-bound cells to Japanese designation.

Interestingly, neither the initial US ITC ruling in 2012 nor the Brussels/Beijing agreement of 2013 had any positive impact on US or European based solar cell producers. Cell production from each of these regions would have been almost identical, had the trade cases not existed.

Figure 1: Top 10 solar PV cell producers in 2013

Source: NPD Solarbuzz PV Equipment Quarterly, January 2013 and NPD Solarbuzz Module Tracker Quarterly, January 2013

Figure 2: solar PV cell production in 2013

Source: NPD Solarbuzz PV Equipment Quarterly, January 2013

Finlay Colville is NPD SolarBuzz vice president. Originally published on NPD Solarbuzz. Reproduced with permission.