Speculator rush signals something more

Summary: After three years of neglect, a handful of small-cap miners like nickel miner Mirabela Nickel are delivering exceptional returns to speculators as a recovery in base metals including nickel, zinc and copper stir them back into life. |

Key take-out: The rise of base-metal miners signals a wider resurgence amid mounting M&A activity and the revival of old companies and projects. |

Key beneficiaries: General investors. Category: Shares. |

No-one has dared, yet, to say there’s a boom underway at the bottom end of the resources sector, but when more than a fistful of small mining stocks deliver a double-your-money-in-a-day experience for a few lucky speculators it’s an event which is hard to ignore.

Trading among stocks widely-regarded as penny dreadfuls has been doing just that over the past few weeks, not that most serious investors have noted what appears to be a sea-change in micro-miner sentiment.

Rising prices for a complex of minerals known as the base metals is the force behind some of the action with zinc (see A new dawn for zinc?) joining nickel as an interesting revival story, and copper chiming in last week with its best performance since February.

An early hint that something was happening among the small miners was contained in Brendon Lau’s Small miners: the unexpected outperformers when he noted that while the overall market was “languishing” the small resources index had risen by 3% since early May. When gold stocks were eliminated, the rise hit 6%.

Some punters have enjoyed rises well beyond the 6% noted last month, especially those willing to take the plunge into the nickel and zinc sectors where a number of stocks stand-out thanks to their remarkable price recoveries after years in the sin bin.

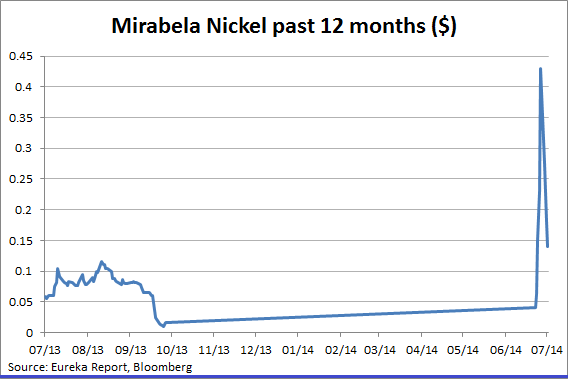

Mirabela Nickel (MBN), suspended last October when the price of nickel was sitting around $US6.20 a pound (and poised to fall to $US6/lb), has roared back to life thanks to a combination of recapitalisation and the nickel price rising by 45% to $US8.70/lb.

Anyone who courageously acquired Mirabela shares at their pre-suspension price of 1.6c (and there was huge turnover in the few days before the suspension) is now looking at 14-times return on their punt with the stock trading at 23.7c, and having hit a high last Friday of 44c.

Mirabela is a special case, but it is not alone in enjoying the benefits of an improving market for base metals – a group of commodities with widespread use in basic industrial processes such as making stainless steel (nickel), galvanised steel (zinc), electronics and construction (copper), steel hardening (tungsten), and titanium (paint pigment).

Tin, tungsten are other industrial metals are sharing in what appears to be a widespread recovery being driven by an end to fears that China’s growth will slow significantly, that the U.S. recovery will stall, and that shadow-banking and dirty deals done in China’s commodity-trading sector will corrupt the entire metal industry.

Concern about rotten loans in China, which saw traders use the same stockpile of metal for multiple loans from multiple banks, has acted as a dead weight on the minerals sector for the past six months, though it now seems bank losses from being defrauded will amount to a relatively benign $US500 million – a fraction of the $U8.9 billion fine being paid to the U.S. Government by the French bank, BNP, for sanction-busting deals.

It is the combination of rising real demand for metals and an easing of uncertainties about China’s metal market which is triggered a mini-rush back into base metal stocks with recent moves including:

- Mungana Goldfields (MUX), up rising by 10.8c (207%) to 16c after announcing a deal to by zinc assets from the administrators of the failed Kagara Zinc.

- Red River Resources (RVR) up by 7.2c (124%) after it also acquired zinc assets from the Kagara shell.

- Stavely Minerals (SVY) up by 24c (80%) after announcing promising exploration results from drilling at its namesake copper project in Victoria, and

- TNG (TNG), up by 10c (66%) to 25c after announcing marketing deals covering its proposed production of vanadium and titanium.

Of the four examples cited only TNG has a market capitalisation of more than $100 million with its recent price rise lifting the stock to $138 million.

The others are below $30 million. Mungana and Stavely at $26 million each, and Red River at $10 million.

The low market values are a warning to would-be speculators that while the percentage moves look seductive, companies which can correctly be called penny dreadfuls carry above average risk and can be hard to buy in reasonable quantities and even harder to sell.

What’s significant about events at the bottom end of the resources sector is that an “it’s time” factor appears to be at work.

Three years of neglect has left several hundred small explorer/miners with minimal cash in the bank, if they have actually managed to survive the resource world’s equivalent of a drought.

Rising metal prices are one factor in the new-found optimism, along with an expectation of widespread merger and acquisition activity which often occurs at this stage of the cycle, plus outright takeovers if the target has a project worth acquiring.

Chinese investors have been first to play the takeover card, snapping up the iron ore project developer, Aquila Resources (AQA), and the moribund gold explorer, Bullabulling (BAB), in deals which management of both target companies described as opportunistic and under-valued – but which investors thought represented good value, which is why they took the cash.

Entry into the micro-end of the mining market, where some stocks have are valued at less than $1 million and around 600 are valued at less than $5 million, is not investing. It is outright speculation, with all the risks attached to that description.

But, for anyone who enjoys an afternoon at Flemington or Randwick, the penny dreadful revival on the stock market might provide an amusing diversion. Rather than to pick a winning nag just as much fun can be hard putting a bet on a small exploration stock.

On a more serious note, the process which seems to have started at the bottom of the market should now run a natural course with M&A activity picking up, old companies undergoing a re-birthing process, and old projects being dusted off and offered to investors.

Most of the deals to emerge will fail, but a handful will deliver stellar returns – though mainly to punters who remember that selling can be more important than buying when it comes to micro-caps.