Solar and wind surge while demand slumps

Electricity consumption in the National Electricity Market (NEM) states continues to fall. Consumption for the first six months of 2013 was 2.5 per cent lower than the same time last year. On a financial year basis electricity consumption was 2.6 per cent lower in the last 12 months compared to the previous 12 months ending June 30, 2012.

This research note analyses the changes in electricity generation and consumption in the NEM for the first six months this year and compares it to the same period in 2012.

All states, with the exception of Tasmania, experienced reductions in electricity consumption. The most significant reduction was in NSW, where consumption fell 4.3 per cent on 2012 levels. Consumption fell in Victoria, Queensland and South Australia by 2.0, 1.8 and 1.3 per cent respectively. Tasmania bucked this trend with an increase of 3.5 per cent.

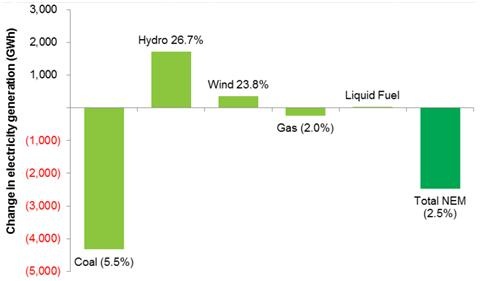

Coal-fired generation reduced by 5.5 per cent (4,332 GWh) and experienced a drop in market share from 80.0 per cent for the first half of 2012 to 77.6 per cent in 2013. Scheduled hydro increased its generation by 26.7 per cent, scheduled wind increased by 23.8 per cent and gas reduced slightly by 2 per cent.

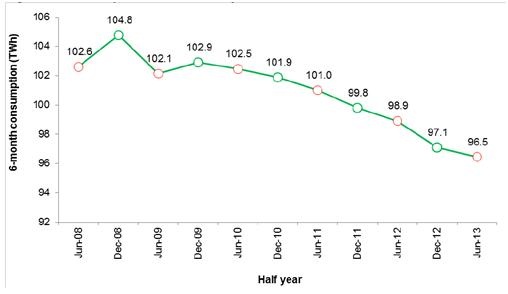

NEM electricity consumption

Electricity consumption has continued the decline that commenced in 2009 (refer to Figure 1) and fell by 2,456 GWh for the first six months of this year compared to the same time last year. Approximately 0.5 per cent of the reduction (541 GWh) can be explained by 2012 being a leap year and having an extra day. NSW experienced the largest reduction (1,572 GWh), a significant portion of which was attributable to the closure of the Kurri Kurri aluminium smelter.

Figure 1. Consumption on a six-monthly basis from 2008 to end of June 2013

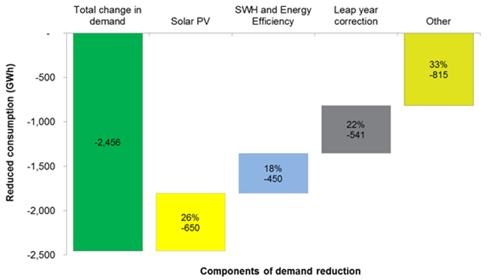

Figure 2. Change in electricity consumption (first half 2013 cf: first half 2012)

Table 1. Electricity consumption by state (first half 2013 cf: first half 2012)

More than 910 MW of roof-top solar PV was installed in NEM states during 2012, and is estimated to have generated approximately 650 GWh for the first half of 2013. This accounts for 26 per cent of the reduction in consumption. The contribution of solar hot water and an array of energy efficiency activities supported by the NSW and Victorian Energy Savings Schemes will also have contributed to lower electricity consumption.

These activities, supported through government legislated market-based schemes, is estimated to account for a further 450 GWh of the overall reduction in consumption. In total, distributed energy activities could reasonably account for 1,100 GWh of demand reduction equivalent to 44 per cent (refer to Figure 3).

Figure 3. Reduction in electricity consumption (first half 2013 cf: first half 2012)

Power generation in the NEM

Coal-fired generation, as a proportion of total NEM-wide generation, has fallen from 80 percent in the first six months of 2012 to 77.6 per cent for the first six months of this year.

Coal generation, which fell 5.5 per cent, has borne the brunt of the reduction in electricity consumption. It has also been further squeezed by the increase in output from renewables. Gas-fired generation accounts for 12 per cent of scheduled generation and reduced by 2 per cent in the first six months of this year.

Scheduled-wind generation accounted for 1.9 per cent of generation for the six months to June 2013 compared with 1.5 per cent for the same period in 2012. Scheduled wind output increased by 24 per cent compared to the first half of 2012. The increase has been largely due to the commissioning of the 420 MW Macarthur wind farm in Victoria. Hydro generation also increased significantly (26.7 per cent) due to increases in output from the Snowy and Tasmanian hydro systems.

Overall renewables increased its market share of scheduled generation from 7.9 per cent in the first six months of 2012 to 10.3 per cent in the first six months of this year.

Figure 4. NEM generation by fuel (first half 2013 cf: first half 2012)

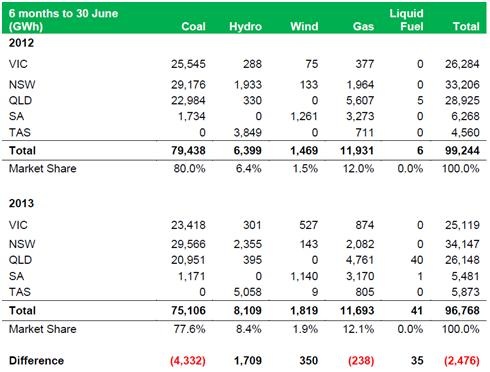

Table 2. Change in electricity generation (first half 2013 cf: first half 2012)

Electricity generated by fuel source and by state is included as Table 3. Some key observations on changes in generation mix are as follows:

-- NSW – NSW was one of two states where generation for the first half of 2013 was higher than the first half of 2012 (2.8 per cent higher). NSW was also the only state where coal-fired generation actually increased, rising 1.3 per cent.

-- QLD – Queensland experienced the most marked decline in total generation, falling 9.6 per cent (2,778 GWh). Generation from coal-fired plant reduced by 8.8 per cent (2,032 GWh) and generation from gas reduced by 15.1 per cent (845 GWh)

-- SA – Generation from South Australia fell 12.5 per cent (786 GWh) with the majority of the decline due to a fall in coal-fired generation (largely the Northern Power Station).

-- TAS – Along with NSW, Tasmania was the only the other state to have increased its scheduled generation, rising 29 per cent (1,313 GWh). The increase in Tasmania was largely due to running down water storage levels. Water storages at the end of June were at 33 per cent of capacity compared to 55 per cent at the start of 2013 and 54 per cent at 30 June 2012.

-- VIC — Victoria’s generation fell by 4.4 per cent (1,166 GWh) in the six months to June 30 compared to the same period in 2012. Coal-fired generation dropped by 8.3 per cent and was offset to some degree by increases in scheduled wind and gas generation.

Table 3. Electricity generation by state and fuel (six months to 30 June)

Ric Brazzale is Managing Director of Green Energy Markets.