Short-sellers torpedo oil

|

Summary: OPEC is struggling to contain the oil price as short-sellers punt on a flood of crude hitting global markets, especially as the US ramps up production. |

|

Key take-out: Production cuts are having no effect on propping up oil, and another Middle East flare up could see prices fall much further than now. |

Oil is always slippery, but for investors with an interest in the world's most widely-traded commodity it has just become even more slippery.

The issue is not related to the natural properties of oil. It's to do with the advent of heavy duty short-selling, which has compounded the problem of a supply surplus.

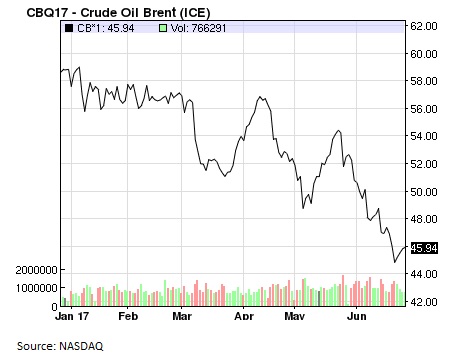

The net result of oil market and financial market pressure can be seen in the 20 per cent fall in the oil price since February, a drop which qualifies as a bear market.

A modest rise in the price on Monday has done little to restore confidence; an attempt by some of the world's biggest oil producers to stabilise the market by trimming output has taken the price for Brent quality crude oil back to where it was late last year.

The fall is a bitter pill for the Organisation of Petroleum Exporting Countries, a cartel led by Saudi Arabia, which is desperately keen to achieve a higher price to help balance national budgets that have plunged alarmingly into deficit.

The entry of the shorter-sellers, who are reported to have lifted their bets on the oil price falling further to 160 million barrels valued at around $US7.2 billion, has also weighed on the share prices of local producers.

Woodside Petroleum shares have fallen by 13 per cent over the past four weeks. Santos is down by 19 per cent.

An explosive situation

What happens next in a battle which is pitting commodity traders against a group of oil exporting countries has the potential to be more than a financial markets event, with the stability of the Middle East being questioned yet again.

The blockade of Qatar by other countries in the region is an example of what can happen when pressures bubble over. While the blockade is seen as a protest against Qatar's alleged support of terrorist groups, there is also a key commodity difference between Qatar and its principal critic, Saudi Arabia.

Qatar is the world's biggest exporter of liquefied natural gas, slightly ahead of Australia. Its sales of LNG on long-term contracts are protecting the country from the worst effects of the oil-price downturn, whereas its neighbours in the Gulf region are being squeezed dry.

The situation is already being described as the worst in the region since Iraq invaded Kuwait in 1990, and while Qatar appears safe from the same treatment it is deeply significant that Turkey has just bolstered a garrison it keeps in Qatar's capital, Doha.

With that background it's easy to understand why short-sellers have ratcheted up their bets on the oil price falling further.

The shorters are betting on OPEC's production cuts failing to curb a rising tide of US oil output, while financial pressure in OPEC countries could trigger a breakdown of the agreement to limit output.

A return to full-scale oil production by Saudi Arabia alone, because it produces more than 10 per cent of the world's oil, could be enough to drive the oil price below $US30 per barrel, a price last seen in early 2016.

The problem for the Saudis and other OPEC members is that competition from rivals such as the US is not the only challenge – the short-sellers have become a potent player in the game.

In trying to achieve a higher oil price OPEC has played into the hands of the US industry, which is developing increasingly sophisticated technologies to extract oil from rocks long considered uneconomic, and more US oil is negating the effect of the OPEC cuts.

Short-sellers sense that OPEC has lost control of the oil market, opening the way for an oil flood as cartel members and non-members rush to snatch market share before prices crash.

Danger zones

For most investors oil has become a dangerous place, with the potential for the price to fall sharply, followed by an equally sharp rise if trouble in the Middle East bubbles over into conflict between countries in the region. That's a routine event in one of the world's great trouble spots.

Analysed any way the only clear signal from the oil market is that a crisis is brewing with the most likely outcome being a sharp fall as the twin effects of excess production and short-selling weigh on the price.

After that the price is likely to rebound if production cuts are maintained or the Qatar situation boils over into full-blown Middle East crisis which effects shipping movements in the Gulf region.

Speculators are having field day as these events unfold. Other investors would be wise to stay on the sidelines.