Risk ratings and portfolio weightings

There they sit, quietly urging fiscal rectitude, beneath every recommendation. An invocation to conservatism, to not get too greedy, and to accept that, yes, we might be wrong and should act with that possibility in mind; who could imagine that a single-digit number followed by a percentage sign could be the source of so much misunderstanding.

If the use of our recommended maximum portfolio weightings confuses, our fundamental and share price risk ratings can tip people over the edge. Throwing fog over the contested territory between business and share price risk, numbers that should be as objective and clear as possible that add additional flavour and colour to our recommendations, can obfuscate rather than clarify.

Even the system that indicates when we might change a recommendation (our price guides) can introduce confusion. Let's attempt to lift the fog and bring some clear-eyed explanations to our portfolio weightings and risk ratings.

Key Points

Business risk is an assessment of business quality

Share price risk an assessment of share price volatility

Watch max portfolio weighting as a share price changes

Like so much in investing, the starting point is to recognise the difference between price and value. We've said it a thousand times but it's worth repeating. Price is what you pay; value is what you get.

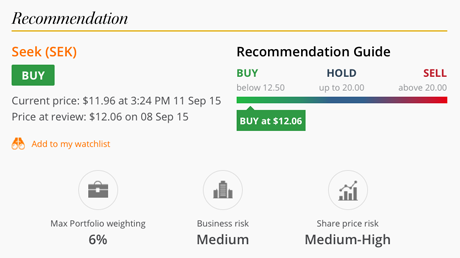

Our recommendation on a stock and the price guides attached to it – the prices at which we'd look to Buy, Hold or Sell (See Image 1) – are all about value. If a stock's share price is far higher than our estimate of its intrinsic value then we'd probably call it a Sell.

If the reverse is true, it's likely to be a Buy. If our estimate of intrinsic value approximates to the current share price it will be a Hold. And because the market is sort of efficient most of the time, most share prices do approximate to our estimate of intrinsic value, hence the many Hold recommendations.

That's easy enough, right? The tricky bit is working out intrinsic value, which is what Share Advisor is all about. In statistical parlance, the underlying value of a stock is its 'expected value' – the weighted average of all the potential outcomes. But for our purposes, think of intrinsic value as what we believe a stock to be worth.

Different types of risk

Having dealt with value and how it relates to our recommendation guides, let's now consider risk. The confusion stems from the fact that whilst there is only one form of value, there are many forms of risk. Our business risk assessment, share price risk rating and maximum portfolio weightings each address particular aspects of risk.

Let's take business risk first. This is the potential variance of a stock's value around our assessment of its intrinsic value. So this would take account of the geographic and sector diversity of a company's earnings streams, as well as any perceived risks to the competitive advantages it enjoys and the value that it adds to its customers.

Added to this would be risks from a company's management, business model and strategy – so the value of a highly acquisitive company might vary according to the successful or unsuccessful integration of its targets. Also considered here would be a company's 'operational gearing' due to relatively high fixed costs, and the potential departure of key employees. Business risks will also include financial gearing arising from debt, as well as risks from currency mismatches (revenues in one currency, for example, and expenses in another) and hedging.

Share price risk is altogether different, being our best guess at the likely volatility of a share price over the short to medium term (say one to five years). It naturally takes account of a stock's fundamental risk (in a perfect market it might take full account of it), but overlain onto this is our guess at the variability of market sentiment towards a stock.

Making guesses about market sentiment is very much not our style – but business risk is often a very long-term matter and we think it's important at least to try to give you an indication of how much a stock might swing around over a shorter timescale.

Bear in mind also that our assessments of risk are in the context of equities generally – so a medium rating means medium as regards to other shares, not other investment types, such as cash and bonds.

Risk ratings in practice

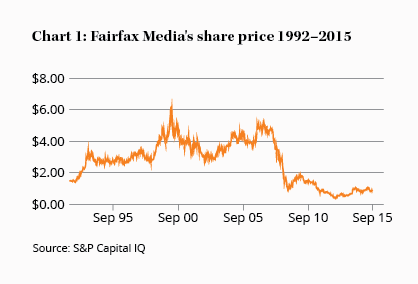

Some examples might help. Twenty years ago Fairfax Media was a monopoly-style business with a lock on classified advertising, the so-called rivers of gold. Its performance was relatively stable and so too, therefore, was its share price. Between January 1994 and January 1999, the share price hovered between $2.50 and $3.50. But the internet had already been born and during the late 1990s it became increasingly clear that – one way or another – it would have a profound effect on the media industry.

A smart assessment of Fairfax's bussiness risk back then would have taken account of the potential impacts of disruption – both positive and negative – even while its share price meandered along. As things turned out, when the market finally caught up, the initial assessment of the internet's likely effect was positive, and in 2000 the stock rose to over $6 before starting its long slide to below a dollar as the true impact has become clear.

So in 1997, Fairfax's business risk might have been considered higher than its share price risk, but the former has gradually fed into the latter as the market's short-term focus has rolled over to its longer-term prospects.

It can also happen the other way around. A good fund manager like Perpetual, for example, is a high-quality business in a cyclical industry. Whilst its long-term underlying value is relatively stable, being tied to its competitive advantages and the long-term growth in savings and sharemarkets, over the short-term the market might impose lots of swings in its share price due to sentiment surrounding the market's ups and downs. That explains why it has a 'Med-high' share price risk rating even while its business risk is considered 'Medium'.

Max portfolio weightings

Finally, to portfolio weightings and how best to use them. This is our best guess – yes, lots of guesses, we know – at the maximum weighting an average investor might want to have in a stock at any point in time.

The phrasing is important. We use the word 'weighting' rather than 'allocation' because this figure represents the most you should have in the stock at any point in time – not just when you first buy into a stock. Note also that it is 'maximum recommended' rather than 'recommended'. In most cases you'll want to have a bit less than our suggested figure.

In practice, what does this mean? When acting on a Buy recommendation, it makes sense not to fire all your bullets at once. Start with a weighting a bit below the maximum recommended. That way you give the stock a bit of room to rise before you hit the maximum recommended level and the opportunity to increase your holding at lower average prices if the stock falls (assuming the underlying value has fallen by less).

Taking profits

What this figure also implies is that when a stock does well you should be taking money off the table as the price rises, thus ensuring your holding doesn't breach the maximum recommended weighting.

Also note that the maximum recommended weighting, like the risk ratings, is intended to be independent of our feelings towards a stock's actual valuation – not least because it takes account of the very real possibility of our being wrong. So the maximum recommended portfolio weighting won't change even if we move a stock from Buy to Sell.

The question popping into your head right now is probably this: 'Does my portfolio include stocks, cash, managed funds and other investments or just stocks?' Glad you asked. To calculate weightings, include all the money you have allocated to equity investment. If some is currently held in cash awaiting investment, then include that too. In that way when you sell something and increase your cash holding, it doesn't mean all your other weightings go up.

One final point: There's a temptation in value investing to call all overpriced stocks 'risky' and those that are 'cheap' low risk. Our assessment of business and share price risk, the recommendation guide and maximum portfolio weighting offer a more extensive and useful interpretation of risk, a point we hope to have nailed home in this article.

Whilst we try to make these ratings as objective as possible, being human we will sometimes fall short. Also, if pushed to give an overall verdict, we'd probably concede that the maximum weightings in particular are on the conservative side of things, because our focus is to protect somewhat less savvy investors – we take the view that more experienced investors can, and no doubt will, make their own assessments.

Most of all, though, we hope our risk ratings and portfolio weightings get you thinking more deeply about the risks involved in owning shares, and encourage you to keep a keen eye on weightings as share prices move around.