Red flags and avoiding disasters - Pt 1

Some years back, a few Intelligent Investor analysts returned from an AGM slack-jawed and bewildered. The meeting, they said, had a cultish, messianic tone, more revival gathering than sombre report to shareholders. One analyst thought there was a better-than-even chance of a fraud. Another said the company had the ‘most promotional management he had ever seen.' Big call that.

Intrigued, I set off to read the transcript, after which neither claim seemed hyperbolic. Further digging supported the initial impression. All the signs were there. In 2012, the chief executive was paid a salary of US$420,000. Stock awards and options pushed total remuneration over US$6m. That same year, the company generated US$5.52m in revenue.

Softly ringing in the background were more alarm bells. In a former life the CEO had sold ‘investment analysis software'. The Sydney Morning Herald reported in 2004 that he owned two Mercedes and a Bentley Continental GT, once clocked doing 231 km/h on the way to Canberra to ‘get to a meeting with the Prime Minister'. Neither is conclusive, but from such events a picture emerges.

Key Points

-

Red flags billowing

-

Always an opposing argument

-

Signals to avoid disasters

In 2006 the newly-floated company's CEO was sued by an ex-lover. During the case, a barrister claimed the company's largest shareholder, a Roger Williamson, was in fact an alias for the CEO. Then, in 2009, the company left Australia to list on the NASDAQ, whereupon the CEO's brother was recruited as a senior vice president. Shortly before listing, the company announced target revenues of U$400m by 2014. Table 1 shows the pinpoint inaccuracy of that forecast.

There aren't many cases where a CEO's remuneration exceeds the company's entire annual revenue. Not only did Alan Shortall, for that is who he is, CEO of retractable syringe company Unilife, manage it in 2012, two years earlier he came close.

| FY ended 30 June | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|---|

| Revenue (US$m) | 11.42 | 6.65 | 5.52 | 2.74 | 14.69 | 13.16 |

| Net Loss (US$m) | 29.75 | 40.68 | 52.3 | 63.2 | 57.9 | 90.85 |

| Long Term Debt, inc. current portion (US$m) | 2.74 | 22.69 | 28.77 | 23.87 | 55.45 | 80.44 |

| CEO Total Remuneration (US$m) | 11.09m | 0.90m | 6.11m | 0.69m | 0.70m | 8.45m |

At least the love was shared. In 2015, three executives received packages in excess of US$1m. In a year when revenue reached US$13.2m, the combined remuneration of the six top executives hit US$13.8m. Board fees added almost another US$1m. Everyone appeared to be in on the game. Shareholders suffered the kind of revenues a single, well-located McDonald's might manage, accompanied by remuneration packages and board fees becoming of a top 10 ASX-listed company.

On the edge

The losses mounted and debt grew. Unilife was on the edge. In the SEC 10-K for financial year 2013, the auditors said the company had ‘incurred recurring losses from operations and has limited cash resources, which raise substantial doubt about its ability to continue as a going concern.' In March 2014, chief financial officer Richard Wieland resigned without taking up another appointment.

The company stayed alive through the use of growing debt and constant capital raisings. Despite its obvious problems, Jeffries, the company's broker, would issue buy recommendations on Unilife and then raise capital for it, urging investors to have ‘continued patience'. The result was constant and horrendous dilution. Short seller Kerrisdale Capital reckoned that a shareholder from 2006 would have suffered an 83% dilution by 2013.

Another problem emerged. In 2013 Talbot Smith, a former Unilife employee turned whistleblower, had accused the company of fraud and Securities and Exchange Commission (SEC) rule violations.

This wasn't the only reason the SEC had reason to scrutinise the company. In March 2014, Unilife had secured a loan from OrbiMed. In an unconventional move, the SEC had granted the company confidential treatment of the loan's covenants. Shareholders were not to know its details. Two months later, Stone Street Advisors lodged a freedom of information request, claiming that ‘investors cannot assess when/if Unilife is or will be in technical default without this information.

Although the request was denied, pressure was mounting. The company fought back, urging the SEC to rein in the malicious short sellers, one of whom may have been famed value investor Whitney Tilson. On Seeking Alpha he echoed the comments of your analysts, claiming Unilife to be ‘a pure promotion and likely a total fraud'. In one email to Jeffries, Tilson asked, ‘At what point are you going to wake up and stop being snookered by a master con man????'. It was as if the CEO's very name was a harbinger.

Although the request was denied, pressure was mounting. The company fought back, urging the SEC to rein in the malicious short sellers, one of whom may have been famed value investor Whitney Tilson. On Seeking Alpha he echoed the comments of your analysts, claiming Unilife to be ‘a pure promotion and likely a total fraud'. In one email to Jeffries, Tilson asked, ‘At what point are you going to wake up and stop being snookered by a master con man????'. It was as if the CEO's very name was a harbinger.

Class action

Soon after, everyone did wake up. In early 2014, Unilife shareholder Cambridge Retirement Systems filed suit over ‘excessive and wasteful' compensation. Despite winning an EY Entrepreneur Award last year, in March of this year Alan Shortall resigned as CEO, taking a lump sum cash payment of $420,000. Chief operating officer Ramin Mojdeh also departed. In May, the company fell foul of NASDAQ listing rules in its failure to file a 10-Q and announced that its third-quarter earnings call would be delayed. Last week, a class action against the company was announced.

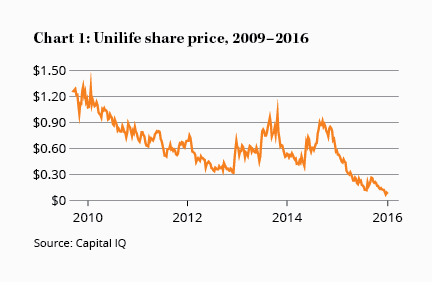

For shareholders, it was all too late. On 27 Apr 10, Unilife hit $1.31 a share. It closed last week at 8 cents. Aside from Unilife's management, broker and board, the only people to have profited from the adventure were short sellers.

For over a decade more red flags were flying over the company than a 1960s communist rally. Unilife's eventual failure was so obvious, so predictable, that Graham Witcomb nominated it as one of the few short sell recommendations we've made in our 18 year history (see our special report Jim Chanos Masterclass: The Fundamental Short Seller).

One of the problems with the human brain is its tendency to choose facts and opinions to make sense of the past. It would be easy to see Unilife in this light, an obvious disaster in waiting. But there is always a counter-argument.

Despite the claims of Tilson and others, no proof of fraud has ever emerged. As for the whistleblower, in August last year he withdrew his claims, apologised and paid an undisclosed amount to the company.

Management enrichment

Unilife may have been a management enrichment vehicle but that is not illegal (the case bought by Cambridge Retirement Systems was dropped in April of this year). Nor is repeatedly demonstrating the gullibility of investors and the compromised nature of brokers.

Moreover, Unilife is no paper tiger. In October last year, when Shortall was still CEO, OrbiMed stumped up another US$10m in debt financing. And in February this year Amgen injected US$50m into the business in return for access to the company's product portfolio.

Against this backdrop, Unilife's eventual demise doesn't seem so clear-cut. One poster wrote on Hotcopper that the entire episode was a ‘typical hedge fund approach. Short the stock, get an article in print or appear on TV, spread fear and destroy a company's credibility.' He went on to say that ‘Amgen's wealth is a formidable opponent and Unilife's success is assured going forward'. In January this year, when the stock was trading at much lower prices, Griffin Securities called it a Buy.

When examining the history of this stock – one screaming trouble for years – what seems clear-cut now wasn't quite so obvious at the time. This is not to say there was ever a case to view Unilife favourably, but it does highlight the problems inherent in a ‘red flags' approach to avoiding future losers.

Whilst avoiding speculative stocks like Unilife will reduce your chances of a blow up, it also means missing out on big winners like Sirtex, up almost 500% since our Speculative Buy call in 2010. And if excessive CEO pay is a red flag maybe you should think about your holdings in Ramsay Healthcare, where Chris Rex took home over $30m in the 2014 financial year, and the big banks.

Even in a disaster-in-waiting like Unilife, there exists a seductive grey area into which our desire to see things work is naturally drawn. The skills and signals that might help us resist this pull will be the focus of part two on Friday.