Reconciling the taper and MYEFO

| Summary: The tapering of the US stimulus program is a pointer to strong economic growth. While our own Federal Government has painted a weak domestic budget picture, underscored by a higher deficit, lower revenue, and rising debt, economic conditions should actual be on the improve. |

| Key take-out: At the very least, there is no crisis here, no doomsday scenario, and nothing to justify the hype. |

| Key beneficiaries: General investors. Category: Economics and investment strategy. |

It was a big week for investors this week. On the one hand, the US Federal Reserve felt confident enough to start the taper, if only modestly, and the Fed itself upgraded its growth outlook.

At the moment, markets seem to be taking this as a positive message. All we really know though is that the taper is very modest so far – $10 billion less per month than the $85 billion it was printing, which still leaves a considerable $75 billion every month.

That leaves us with a US economy that even the Fed is forecasting will be well above trend in 2014 – and a still enormous sum of money that is being printed. It’s no wonder stocks surged – even crude oil has pushed higher. It’s a very bullish combination of events and it bodes well for equities in 2014.

We don’t know too much more than that. We can speculate as to how aggressive the Fed will be in further tapers, and I suspect it won't be very aggressive at all – the truth is, the action it took this week was monetarily irrelevant. So it’s the signal that matters more, and the signal was that economic prospects are improving.

On the other hand, our Federal Government’s budget update this week caused a bit of a stir. It was definitely at the crisis end of the spectrum, which isn’t great just prior to the main retail sales period of the year. Retailers must be grinding their teeth. Yet it was very bearish stuff, and it stands in stark contrast to what we saw out of the US. So how do domestic investors reconcile these two seemingly irreconcilable events?

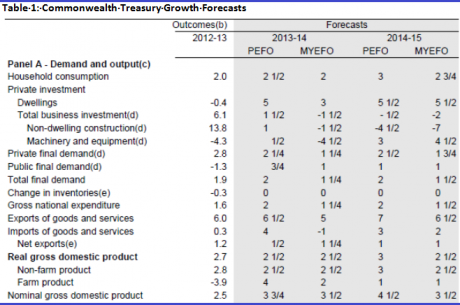

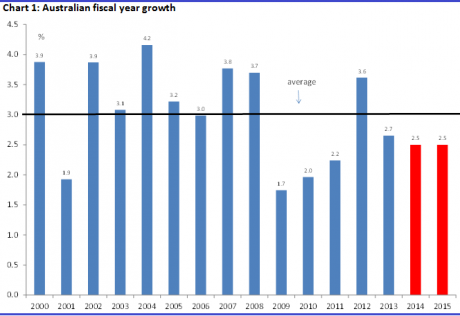

The best way to start is by taking a look at what the budget update is really telling us. In doing so, we need to take our political hats off and discard whatever club we belong to. Investing takes no sides. The bottom line looks bad – the budget deficit has blown out to $47 billion from an expected $18 billion deficit at the time of the last budget, and the expected surplus of $3.7 billion (on an accruals basis) at the time of the 2012-13 budget. Everywhere you are reading about an urgent structural deficit that needs to be resolved – the deficit will hit $123 billion over the next four years! The sense of crisis is palpable and is reinforced by Treasury’s growth forecasts. They show below-trend growth over the next two years at 2.5% for 2013-14 and 2014-15.

To put that into some perspective, that would leave annual growth, on a fiscal basis, as one of the weakest periods of non-recessionary growth on record.

That is a very clear “sell Australia” message right there. Everywhere you look there is crisis in Australia – it’s no wonder international investors are actually steering clear. But is that really what we should take from the budget? I don’t think so.

Consider that the budget deficit at the moment is estimated to be 2.7% on an accruals basis, falling to 1.1% in 2015-16 – these are low figures, although in my opinion, the government accounts should be a lot better than they are. Objectively no crisis, but not as good as they could have been – and I’m not making that as a political statement. It’s a fact.

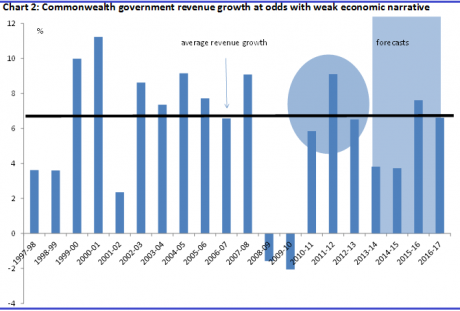

The bigger point though is that the government’s revenue numbers show quite strong growth – a fact that is at odds with this weak growth narrative. It’s not that revenue is surging or anything relative to history. But it is growing at a solid clip, as you can see in Chart 2 below.

Why are so many concerned about it then? I think the problem started when the super profits tax and its subsequent incarnation was introduced and then watered down. At the time, revenue was forecast to be $380 billion now. That it’s tuned out to be only $20 billion lower than that now isn’t much of a problem when you consider the bulk of that shortfall reflects the failed mineral resource rent tax.

Under the circumstances, I don’t think we could be concerned with the forecast drop in revenue – growth to a decade low (ex the GFC) – because it’s not a credible forecast. Growth could just as easily be double what the government expects, and it has certainly got an incentive to lowball the figure and then pat itself on the back when estimates are better than the very low expectations shown above.

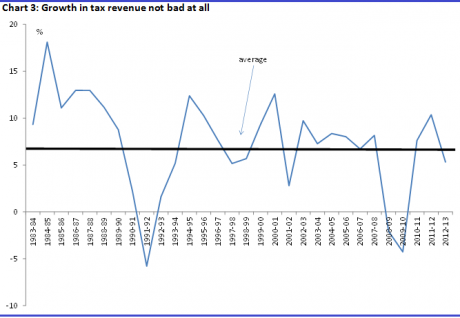

Now look at the nominal tax take in chart 4 below. What does that say about growth? Well, over the last three years tax receipts have been growing at an annual rate of about 7.8%. This is only just below the average of the boom years from 2003 to 2007-08 of about 8%. Note that this average doesn’t include the GFC. If I did that, the recent average would in fact be higher than the past.

Fair to say that in the latest year (2012-13) growth in tax receipts has been lower at 5.3%. But this partly reflects a base effect after a very strong tax year in 2011-12 of 10.4%. In any case, a 5.3% lift in tax receipts is not weak growth – it does not suggest the economy is weak at all in fact. Again, the Treasury is forecasting a much lower tax intake over the forecast period – 4.8% on average for the next two years. Not something we’ve seen since post-recession recoveries. The question is though, whether those forecasts are reasonable? And they’re not. What Treasury doesn’t offer is a reason as to why tax growth will be lower. I mean, it’s not like the end of the mining boom is going to see tax receipts fall dramatically – mining investment is not a big tax earner for the government. Conversely, the surge in exports over the next two years is a large tax earner – and that’s only just started. Housing activity, which has just started to pick up, is another big tax earner.

We also have to consider that if the government is right and growth over the next two years is going to broadly the same as the last three – on average – then why would tax receipts be so much lower? It doesn’t make sense given the two other factors I mentioned. They won’t be, in my view. I have to agree with the view that the government is merely fluffing the numbers for some 2014 heroics. This whole MYEFO has to be seen against that narrative. What about Treasury’s forecasts? Don’t take them too seriously at this point. Consider:

- The government’s forecast implies that record low interest rates and the 13%-odd decline in the exchange rate will have NO IMPACT ON GROWTH – ZERO. In fact, it is forecasting weaker growth following this enormous stimulus.

- It is forecasting lower growth at a time when global growth is getting stronger – when crisis economies like the US and UK are forecasting better growth.

- The government’s own weak growth/budget crisis narrative doesn’t quite sit – well it doesn’t sit at all well – with rising revenue and expenditure numbers, or even the fiscal balance.

For me then, the way to reconcile the Fed taper and heightened optimism against our own governments growing pessimism is to think of the political imperatives which guide the government at the moment. Certainly the budget is nowhere near as bad as is being made out.

Investors don't need to worry. If you want to reconcile the Fed taper with the MYEFO, we have to look through the politics. So the RBA and Treasury might argue that the economy is growing at a below-trend rate. This is the consensus, and it’s also what the ABS national accounts data show.

The government’s budget data, tax receipts and revenue figures raise some questions about this view however. Both of these measures – cash and accruals – point to an economy growing around trend.

At the very least, there is no crisis here, no doomsday scenario, and nothing to justify the hype.