Politicians eye off mining's recovery

| Summary: From Western Australia to South Africa and the Philippines, politicians are looking at miners for a budget fix. |

Key take-out: When it comes to risk, even if it has high taxes, there is no jurisdiction that is more mining friendly than Australia. |

Key beneficiaries: General investors. Category: Commodities, shares |

Rising commodity prices have delivered some spectacular share price gains for investors in mining companies over the past eight months, but they have also brought the return of a wealth-destroying problem that most investors overlook – sovereign risk.

Australia is not immune to the phenomena which manifests itself here as higher taxes, and while the threat of a super-tax on coal and iron ore conceived by a previous Labor government has faded there is a return bout being fought in Western Australia over a company-specific iron ore tax.

BHP Billiton and Rio Tinto are the target of a proposed 1900 per cent increase in a state levy on iron ore which was set at 25 cents per tonne more than 40 years ago and never increased, an oversight according to the junior partner in WA's coalition government which wants $5/tonne.

If implemented as proposed by the National Party, which seems unlikely, the two mining giants would collectively be handing over about an extra $3 billion a year to the WA Government, wiping out much of their profit from iron ore.

What triggered the suggestion of a massive increase in a state tax was the parlous condition of the WA budget, which has been driven deep into deficit by the collapse in commodity prices and a resulting sharp fall in income from mineral royalties.

It is potentially a lot worse overseas as governments which are also battling depleted budgets see the commodity-price recovery as a perfect time to hit their natural resource sector with higher taxes, and even the nationalisation of assets.

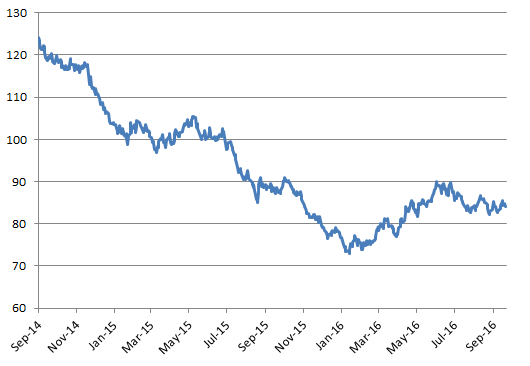

Chart: Bloomberg Commodity Index - past 24 months

Source: Bloomberg, Eureka Report

Australia remains attractive

In South Africa, the youth wing of the ruling African National Congress has revived calls to nationalise mines, banks and private land largely because a rival political party, Economic Freedom Fighters, has been campaigning on the same proposal and stealing votes from the ANC.

In the Philippines, sovereign risk is rising in a different form, the closure of nickel mines which do not meet the environmental standards set by a new president. While that trend has benefited Australian nickel producers, it is a warning shot that investors should not ignore.

The most important lesson from the deteriorating conditions for mining companies in many countries is that when it comes to risk, even if it has high taxes, there is no jurisdiction that is more mining friendly than Australia.

The coal industry might dispute that point, and BHP and Rio are not happy with the proposed iron ore tax slug in WA. But repeated surveys have found that Australia is the most attractive location for mining – though that might also be interpreted as there being some pretty lousy places which make Australia look good, and not just on the sovereign risk issue.

An emerging example of Australia being more attractive than other locations can be found in the mineral which has become the speculator's flavour of the month, lithium.

Until recently there was a view that the best opportunities in lithium could be found in the dry salt (brine) lakes of South America, but that might not be the case with Australian lithium potentially offering quicker and fatter profits.

Morgan Stanley, an investment bank, broke with the popular view in a recent research report into lithium and graphite which questioned: “the ability of the incumbent South American brine producers to adequately address the potential gap in (lithium) supply and demand”.

Australia, rather than South America, offered the best entry point into lithium with Australian “hard rock” resources being “the most efficient and economic resources to develop in the near term”.

The situation with lithium is a perfect example of why it can be better to look close to home for investment opportunities and not be swayed by the appeal of a foreign project that has problems which can be less obvious, until they wipe out your capital.

Copper, the metal earmarked by BHP and Rio as their favored investment for future growth, is another example of risk rising with the price, especially in Africa which is home to some of the highest-grade copper mines, and worst governments.

The key risks ahead

Political risk, resource nationalism and legislative uncertainty were nominated by a panel of risk experts from firms Control Risk, Price Forbes, Critical Resource and Verisk Maplecroft, as major future risks for mining companies.

Verisk Maplecroft, a British-based risk assessment consultancy, said the risk of a return of resource nationalism could coincide with a return of higher commodity prices.

“This is particularly the case given that many companies have successfully cut their costs right back and can hope for higher margins when prices eventually recover,” Verisk Maplecroft said.

“This may prove tempting to governments that have struggled for several years with lower natural resources revenue and significant budget deficits.”

The proposed 1900 per cent increase in WA's iron ore mining charge is an example close to home, but at least it's in the open and BHP and Rio have an opportunity to fight the tax hike – which does not often happen in other countries when taxes are boosted.

There is considerable irony in higher mineral prices bringing a higher level of risk but the situation is one that investors should not ignore, especially when choosing between an Australian mining company working at home and one working abroad.