Out before the flood?

Summary: Rivals and shareholders are expressing dissatisfaction with the market flooding tactics of major iron ore miners BHP Billiton and Rio Tinto. Share prices for the major miners have fallen sharply over the last fortnight. Other critics of the miners include the WA premier, the union movement and HSBC. |

Key take-out: The outlook for the iron ore price is weak as China's steel consumption peaks and starts to decline. |

Key beneficiaries: General investors. Category: Mining stocks. |

First signs have appeared of shareholders rejecting claims by management at BHP Billiton and Rio Tinto that increasing iron ore production at a time of falling prices will not harm the companies. Some shareholders are heading for the exits as a war of words heats up.

Over the past two weeks, and most noticeably after an attack on the “market flooding” tactics of BHP Billiton and Rio Tinto by one of America's biggest iron ore producers, the share prices of the two Australian miners have fallen faster than the overall market.

It is impossible to prove conclusively that the recent sell-off in BHP Billiton and Rio Tinto, as well as the biggest pure-play producer of the steel-making material, Fortescue Metals, is directly connected to the flooding controversy, but there is circumstantial evidence.

BHP Billiton has also been hit by the falling price of oil, and both companies have recently paid handsome dividends to their shareholders.

But in the period between February 27 (the last trading day of the month) and last Friday March 13, a two-week period which incorporated the dividend payment dates, and the Global Iron & Steel Forecast Conference in Perth, the biggest of Australia's iron ore producers fell sharply.

The heaviest falls came in the days after Lourenco Goncalves, chief executive of US-based Cliffs Natural Resources, launched a blistering attack on market flooding saying it could “ruin Australia” because it was destroying the country's biggest export industry.

In the two week share-trading period which included the iron ore and steel conference the ASX200 index, which measures the performance of Australia's top 200 listed companies, fell by 1.9 per cent.

Over the same two week period BHP Billiton fell by 10.5 per cent from $33.26 to $29.76, or by 9.2 per cent after allowing for an interim dividend of US62c (A79c).

Rio Tinto in the two weeks to March 13 fell by 11 per cent from $64.41 to $57.30, or by 8.7 per cent after allowing for a final dividend of US96c ($A1.53).

Fortescue was hit even harder after the Goncalves assault, dropping by 19.7 per cent from $2.49 to $2, or by 18.5 per cent after allowing for an interim dividend of A3c. Earlier today, March 18, Fortescue came under renewed selling pressure, dropping to a fresh multi-year low of $1.79.

Those falls are modest compared with the 90 per cent fall (and worse) in the prices of smaller iron ore miners such as Atlas Iron, BC Iron and Mt Gibson Mining, and the outright failure of some other miners unable to survive at lower prices, including Sherwin, Western Desert, Termite Resources and Pluton Resources.

The pressure on Fortescue has continued into this week with reports circulating today, March 18 that it has withdrawn a $US2.5 billion bond issue which was being offered at a highly attractive yield of 9 per cent, and after a syndicated loan also failed to raise the target amount at an acceptable price.

Fortescue's problems, which saw its share price drop last week to a then 12-month low of $1.89 on the day Goncalves spoke at the Perth conference, are magnified by its high debt levels and its status as a pure-play iron ore stock which is fully exposed to declining growth in China's steel industry.

The attack by the Cliffs chief executive on the iron ore market flooding tactics of BHP Billiton and Rio Tinto is not the first criticism of the policy, but it was the sharpest and carried extra weight because it came from a man with a deep understanding of the business.

Before Goncalves the flooding policy was criticised by:

• WA Premier, Colin Barnett, who said if the policy damaged one of the state's most important industries (and state tax revenue) he would consider an increase in royalties, while also warning that both big miners should remember that the state Government is their “landlord”, a reference to the issuing of all-important exploration tenements and mining licences.

• Glencore chief executive, Ivan Glasenberg, who has likened high rates of iron ore and coal production as a form of corporate cannibalism, and

• The union movement which is worried about job losses, with that concern reflected in a motion passed earlier this month at the national conference of the Australian Workers Union describing market flooding as “bullying” and a “scorched earth” policy designed to drive competitors out of business.

Management at both BHP Billiton and Rio Tinto have consistently defended their high (and rising) rates of production which they say are possible because both companies have very low costs of production, an advantage which means they can expand when other miners are forced to cut back.

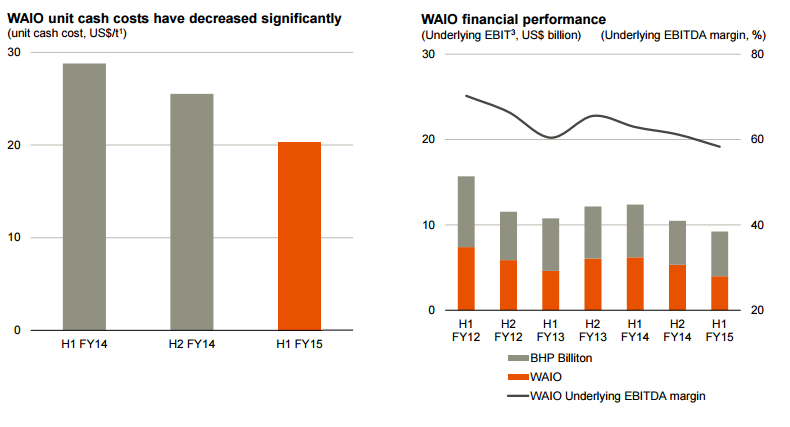

Figure 1: BHP Billiton's WA Iron Ore costs and performance

Source: BHP Billiton

A standard comment, which was made by spokesmen for both companies at the Perth conference, is that if BHP Billiton and Rio Tinto did not produce the tonnes of iron ore to fill the market someone else would, with the inference being that miners in South America or Africa would do the job.

Until a week ago it seemed that shareholders in both BHP Billiton and Rio Tinto accepted management's argument, but after the Goncalves assault and as the iron ore price continued its fall, some shareholders have decided that iron ore is becoming too risky, even for the lowest-cost producers.

Where Goncalves might have landed his most telling blows was in describing excess production of iron ore as a case which could be prosecuted by the World Trade Organisation, and in describing the tactic as “a zero-sum game that nobody wins” and “a madness” which will come to an end.

Cliffs is one of the biggest and oldest iron ore producers in North America and also owns the Koolyanobbing mine in WA, a project originally developed by BHP but likely to close within the next few years thanks to the collapsing price of iron ore which fell another 3.3 per cent overnight to a fresh six-year low of $US56.95 a tonne, a fall of more than 50 per cent in 12 months.

The outlook is for further price weakness as demand for the steel-making material hits a peak and regresses back to a long period of slow growth.

Just how serious the regression could be for the iron ore industry was illustrated at the Perth conference in a presentation by the China Iron and Steel Association, an industry lobby group close to the Chinese Government.

It used a graph to show that China's steel consumption peaked last year at 700 million tonnes and will slip slightly this year, before beginning a long decline to less than 600 million tonnes by the year 2027.

Whether declining domestic consumption translates into a reduction in China's total rate of steel production is an unknown because the country has recently been stepping up its rate of steel exports, triggering complaints from US steel producers who allege a resumption of dumping in their backyard, raising the prospect of a trade war over steel.

Adding to the problem of Chinese iron ore demand is an expectation that one of the most commonly used forms of iron ore called “fines” could be banned in China because it requires a highly-polluting interim processing stage (sintering) before being used to make steel.

China's crackdown on low-grade coal is an early warning that other industrial processes, such as sintering, could be next on the country's environmental clean-up agenda.

It is into this cocktail of claim and counter-claim, of falling prices and rising production, that a well-connected bank, HSBC, this week produced a damning report on the outlook for iron ore.

According to HSBC's analysis (March 16: “No more iron awe”) the combination of relentless oversupply and falling unit costs will suppress the price of the material for years causing it to downgrade both BHP Billiton and Rio Tinto from overweight recommendations to neutral.

The critical forecast from the bank is that total global demand for steel is returning to an annual rate of growth last seen in the 1980s and 90s.

Rather than rocket along at an annual growth rate of 5.2 per cent to meet Chinese demand in the period from 1999 to 2011 the outlook is for a compound annual growth rate (CAGR) of 0.5 per cent – a spectacular retreat.

“We estimate net global iron ore supply growth of 143 million tonnes over the three years to 2017, with the four majors (Rio Tinto, BHP Billiton, Vale and Anglo American) adding 213 million tonnes,” HSBC said – with the 70 million tonne difference being higher-cost producers forced out of the market.

Unfortunately for all iron ore producers, HSBC reckons less than half of the 143 million extra tonnes “is needed to balance the market”.

“Rio Tinto and BHP Billiton have attractive dividend yields, and we maintain our view that these are defendable,” HSBC said.

“However, we struggle to see the compelling case for sustainable earnings momentum.”

The bank is mild in its criticism of the market flooding tactics of the BHP Billiton and Rio Tinto, but it is just the most recent demonstration of growing concern about a policy which is proving to be controversial for rival miners, politicians and most recently for some investors.