Oil's spurt could spur takeovers

Summary: North Korea is providing the spark for a rise in the oil price, and that's setting tongues wagging on the takeovers front.

Key take-out: Nothing is on the table, but the Papua New Guinea Government's recent exit from the Oil Search register may be a prompter for the Australian oil and gas group's PNG/LNG partners.

Ongoing tensions between North Korea and the US have helped lift oil to its highest price in two years, potentially providing the spur to unleash a flow of deals in the oil and gas sector.

The latest name to be linked to corporate activity is Oil Search, the Papua New Guinea-focussed producer of liquefied natural gas.

Oil Search was added to the takeover list after the PNG Government sold the last of its shares in the company, long-viewed as the country's national oil and gas champion. As such, it joins a number of other oil targets named by Eureka Report earlier this month (The flows fuelling oil stocks, September 6).

With a market value of $10.5 billion, Oil Search would not be an easy acquisition for any Australian suitor. The most likely bidder would be one (or more) of its partners in the PNG/LNG project – Exxon Mobil from the US, or Total from France.

But whether a move is made to acquire Oil Search is not the important point about the exit of the PNG Government. It's more about a situation being created for a deal to occur that, until a few days ago, was highly unlikely.

When the number of potential corporate deals are combined with the rising oil price, it will probably only need one merger proposal to be made to unleash a flood of deals after three lean years.

The PNG Government's exit from the Oil Search share register has created a situation where the company lacks a major shareholder, making it look to be available in what appears to be the early stages of a sustainable oil-price recovery.

Oil is ‘rebalancing'

When Eureka Report last looked at the changes underway in oil, the price appeared to be stuck in a range of $US40-to-$US50 a barrel. The deals being hatched included the likely sale of Quadrant Energy, a WA-based gas producer, and Lattice Energy, the oil-production assets of Origin Energy.

A lot has changed in three weeks, partly as a result of rising political tension on the Korean Peninsula and because indications continue to emerge showing that the oil market is rebalancing. Stockpiles are starting to decline and demand is continuing to rise in tune with a stronger global economy.

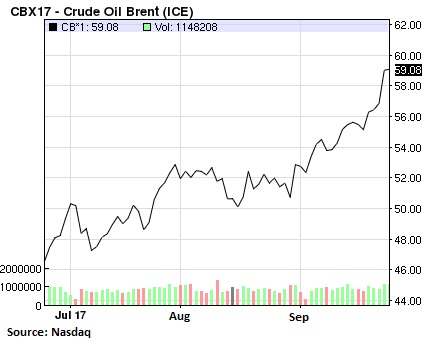

In the oil market Brent quality crude, the European standard, rose to $US59 per barrel on Monday. News from North Korea worried oil buyers, along with concern of an outbreak of trouble in the Kurdish region of northern Iraq, which could limit oil exports from that part of the world.

The head of oil trading for BP in Asia, Janet Kong, told London's Financial Times newspaper that a three-year oil price downturn was starting to reverse, with the market in “rebalancing” mode.

“We are at a juncture where we are going to see continued inventory drawdown,” Kong said.

In the US, where West Texas Intermediate quality crude oil is the common measure, the price has risen to $US52.22, up 18.5 per cent on the low price for the year of $US42.53 reached in late June.

What's happens next?

Whether oil will stay high or move higher is a tricky question for investors, though the indications are the most positive since the price collapsed in mid-2014.

It's the oil price outlook, coupled with pent-up demand for corporate action, which is behind events such as the planned sale of Lattice and Quadrant, and now the potential for Oil Search to become a takeover target.

Lattice has been identified as a business which would fit comfortably with Beach Energy, the Adelaide-based oil and gas producer effectively controlled by Seven Group. The group has earmarked oil as one of its preferred growth options, joining better known divisions which include industrial equipment and media.

Quadrant, which largely comprises WA oil and gas assets sold by US-based Apache Corporation, is seen as a possible target for Santos. Though once a troubled company, Santos is re-emerging under new management just in time to catch the wave of a rising oil price.

Oil Search's most recent suitor was Woodside Petroleum, which launched a takeover bid two years ago only to have its share-swap proposal rejected by the PNG Government within hours of it being made.

Whether Woodside is prepared to make a fresh move is one of the potential developments at Oil Search. But it is unlikely that Woodside management would enter into a bidding duel with Exxon Mobil or Total.

The appeal of Oil Search is that the PNG/LNG project has emerged as a low-cost leader in the LNG industry. This is thanks to its gas being sourced from prolific onshore gasfields, and the tight cost and operational controls of Exxon Mobil.

Unlike most Australian LNG projects which are struggling with costs and a highly competitive international gas market, the PNG/LNG project is on the cusp of a major expansion based on the development of the Elk-Antelope gasfields.

Exxon Mobil and Total are keen to expand the PNG/LNG project, with the PNG Government sell-out of Oil Search clearing the way for it to occur. The expansion will no longer require any financial input from the financially stretched PNG Government.

For investors, the oil and gas industry is showing signs of reclaiming a role as one of the leaders in the overall resource sector. Oil prices are rising just as there are signs of other commodities retreating elsewhere, especially iron ore, which is being hit by a slowdown in Chinese steel production and a flood of new supply.

Three years after oil crashed the scene is being prepared for a significant oil-sector revival.