Oil's slippery outlook

Summary: Ahead of the OPEC meeting, the next two weeks promise to be significant for oil.

Key take-out: Many producers are generating more free cash flow than when oil was higher.

Too far, too fast. That's the latest view of oil which has moved up strongly over the past 12-months, but could now be entering a market-equivalent of no-man's land, struggling to climb past $US80 a barrel and potentially looking to slip back into the $US60/bbl range.

Whatever the direction of the next move, there is another aspect to oil-producing companies which should interest investors, and that's the effect of a significant reduction in costs – arguably more important than daily fluctuations on commodity markets.

Some big oil stocks which struggled to trade profitably when oil was closer to $US100/bbl are now able to spin off free cash even at a price as low as $US50/bbl.

Costs, in the resources sector, are all that an oil or mining company can control. The price of the commodity being produced is invariably dictated by global market forces and in oil, that means a mix of demand, which is solid, and supply, which has become a dangerous unknown.

The next two weeks look to be particularly interesting for oil, with conflicting signals in a number of areas. Areas such as pressure for members of the Organization of the Petroleum Exporting Countries (OPEC), an oil-producers cartel, to lift a self-imposed embargo and start pumping more, and for US exports to be increased.

Some of the questions which could determine the oil price over the rest of the year are likely to be answered on June 22 when OPEC ministers meet in Vienna to discuss production quotas.

But in the days before that formal meeting, OPEC will hold a seminar on ‘cooperation in the petroleum sector' where an indication of the formal decision about quotas is likely to be revealed.

Shifting confidence

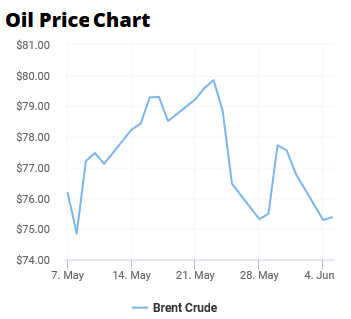

Uncertainty is never comfortable for investors. And the oil shift from optimism to uncertainty was always going to be reached after the international (Brent) price rose by 56.5 per cent from $US51/bbl at this time last year to a four-year high last week of $US79.84/bbl.

The pullback in the oil price over the past few days has been attributed to investment funds adjusting their exposure to oil in the lead up to the OPEC meeting, and concern that cartel members and Russia could ease their production cutbacks.

More oil from some big producers could lead to a lower price, but it's also possible that the market needs the extra oil to make up for production shortfalls in Venezuela and Iran.

Looking back to look forward

Measuring the changing mood of the oil sector can be done in a number of ways, including a look back at Minefield: Heading to the oilfields, which analysed three small ASX-listed oil stocks.

One of those stocks, Aurora Oil & Gas has moved up from 39 cents to recent trades at 46 cents, while the other two, Carnarvon and Buru, have slipped. Carnarvon by 1 cents to 14 cents and Buru by 5 cents to 35 cents.

Another example of the uncertainty factor prevalent in oil today, is that a record gap that has opened in the two main ways of pricing oil – Brent, which is set in London and West Texas Intermediate, the US price.

Because of their different qualities and availability, Brent and WTI are often separated by a few dollars. Last week, the gap blew out to $US11/bbl, and remains at around $US10.40/bbl with Brent last night quoted at $US75.37/bbl and WTI at $US64.99/bbl.

The wide gap between the two benchmark prices is largely a result of the US being unable, because of pipeline and shipping bottlenecks, to deliver an oil surplus to the global market. An added complication is also discovered in that the US oil is very light whereas the market wants more heavy, Middle East quality crude, to meet a shortfall in supplies of diesel and jet fuel.

Whatever price is used, an interesting point emerged last week in a story carried by London's Financial Times. Research analyst from Barclays Bank, was quoted as describing the recent conditions in the oil market as delivering “windfall” profits for the world's biggest oil companies.

By keeping a tight rein on costs, and rejecting proposals to invest in new projects, the oil majors – a group that includes Chevron, ExxonMobil, BP and Royal Dutch Shell, were enjoying their “strongest financial performance in decades”.

Lydia Rainforth told the Financial Times that the oil majors were “on course to deliver excess free cash flow for the first time since 2008”.

Financial direction

Many oil producers are generating more free cash flow at recent prices than they did when oil was last at $US100/bbl thanks to heavy-duty cost cutting which has reduced average operating expenses by one-third.

Big oil companies are now able to cover dividends and capital expenditure requirements at an oil price of $US50/bbl meaning that the current price of around $US25/bbl is being retained.

Even lower costs are expected in the future with BP targeting a breakeven oil price of $US40/bbl.

If the immediate outlook for the oil price was not weaker in the lead up to the June 22 OPEC meeting it seems likely that some analysts would be looking at oil stocks as a form of yield play, in the same way, some mining companies have become attractive after two years of strong mineral prices and debt retirement.

Oil stocks started traveling in the same financial direction as mining companies two years later, which means they have more ground to make up before they can also be seen as stocks with the potential to boost dividends or launch share buy-back programs.

Shell is the company being watched most closely for a return to generous shareholder rewards with a plan revealed last month to buy-back $US25 billion in shares when the company's debt-to-equity ratio drops to 20 per cent. It is currently at 25 per cent but falling quickly thanks to debt repayments which include the return of $US10 billion last year.

Local movements in the spotlight

Locally, movements in international oil prices are not as important for some of the biggest producers because they are dominated by gas, either through pipeline sales, or after conversion to liquefied natural gas (LNG).

The oil price forms the basis of gas prices, but there is a time lag in setting the gas price.

Over the past month, the four leading local oil stocks, Woodside, Oil Search, Santos, and Beach, have barely moved. Santos has dropped to $5.64 (close of trade June 5) largely as a result of a failed takeover bid.

As per close of trade on June 5, Woodside, which is considering several LNG expansion possibilities, has slipped 26 cents to $32.02. Oil Search is up 23 cents to $8.17 and Beach is down 2 cents to $1.60.

For investors with an appetite for oil, the next two weeks should be an interesting time as the oil price jerks around ahead of the OPEC meeting.

What happens in Vienna is important if only because it is a key to investment bank oil-price forecasts which remain wide apart.

UBS, for example, is using $US70/bbl as its oil price yardstick. Citi is using $US55/bbl, with those forward oil-price assumptions explaining why Citi has a sell tip on Woodside and Oil Search whereas UBS has a hold tip.

Always interesting, the next two weeks promise to be the most significant in the oil sector since the price recovery took hold last year.