October enviro markets update - VEECs and ESCs

Victorian Energy Efficiency Certificates (VEECs)

The future of the VEET went down to the wire in October as the Napthine Government failed to pass legislation that would have brought the scheme to an end after 2015. With the unreliable state polls suggesting a Labor landslide, the future of the VEEC market is nonetheless looking considerably more positive than it has for some time.

October was always set to be an important time for the VEEC market with the final sitting days for the Parliament taking place mid-month. The Coalition was intending to pass its repeal legislation which would bring an end to the scheme following a reduced obligation of 2 million in the 2015 compliance year. Having seen the legislation through the Upper House in September, the numbers were always going to be tight for the final vote yet in the end it was time that stifled the government with the repeal act among a raft of other legislation that failed to be dealt with.

The news emerged via a government press release which, along with stating that the legislation would not pass, also reiterated the Coalition's intentions to reintroduce the legislation early next year should it win on November 29. Yet the press release also included what appears to be an updated version of the legal advice which the government had received about the status of the target in the event that no new obligation was outlined by 31st May. Rather than defaulting to zero which many had believed would be the case given the scheme was in between three-year phases, the release stated that the target would go back to 5.4m.

The Andrews Opposition has still not articulated precisely what target it will set should it win government, though most are presuming it will retain the 5.4m.

With Labor ahead in the polls by a hefty margin the outlook suddenly appears far brighter for the VEEC scheme and its many participants.

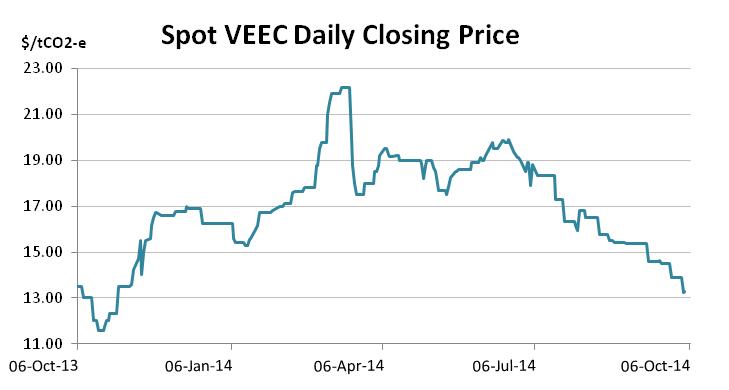

With the spot price having been in seemingly terminal decline across the middle of the year as oversupply and the likely end to the scheme dampened sentiment, the political developments in mid October saw the spot market jump from the low $13s to sit below the $15.00 following the Coalition's failure to pass its repeal bills.

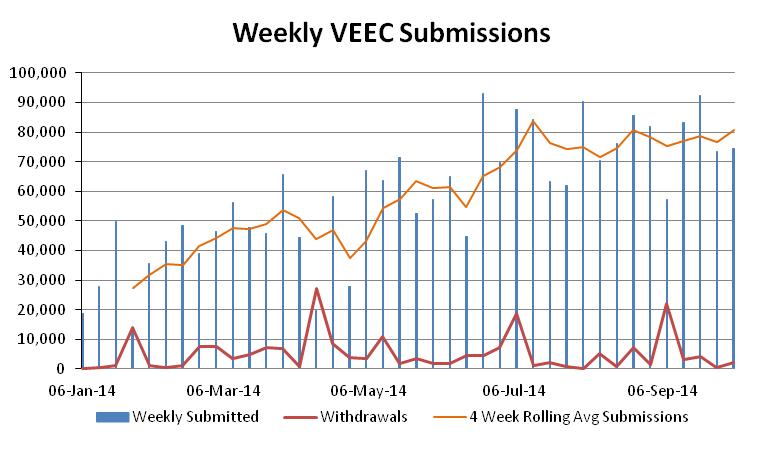

Interestingly October also saw VEEC submissions grow across the month with the four-week rolling average surpassing 80k. Should these levels be maintained, the market will be able to meet a 5.4m target for 2015 with a small surplus to boot.

Perhaps most interesting of all was the very large volume of forward market activity which immediately followed the jump in price and persisted across the remainder of the month. Activity was concentrated within the February-August 2015 period and took place at a discount to the spot. Across this time there were two markets for VEECs. One being for the spot and short forwards out to January which traded at a premium and the other from February onwards, with the backwardation reflecting the fact that there were considerably more sellers of longer dated forwards.

The spike in forward activity for 2015 was indicative of the changing fortunes of the market as buyers began to take the prospect of a 5.4m target for 2.15 more seriously.

While there remains some uncertainty as to whether or not 2015 will in fact see a 5.4m target, the odds have swung dramatically in favour of this outcome. And while the market will be closely watching the November 29 election, the mood among creators is decidedly more optimistic given it appears their businesses will be able to continue operating beyond the middle of next year.

New South Wales Energy Savings Certificates (ESCs)

The counterintuitive continued to play out in the ESC market in October with registrations falling and prices following suit. There remains no further indication from the Baird Government as to its ongoing review and many participants have resigned themselves to the fact that it may now only be early next year that any will emerge.

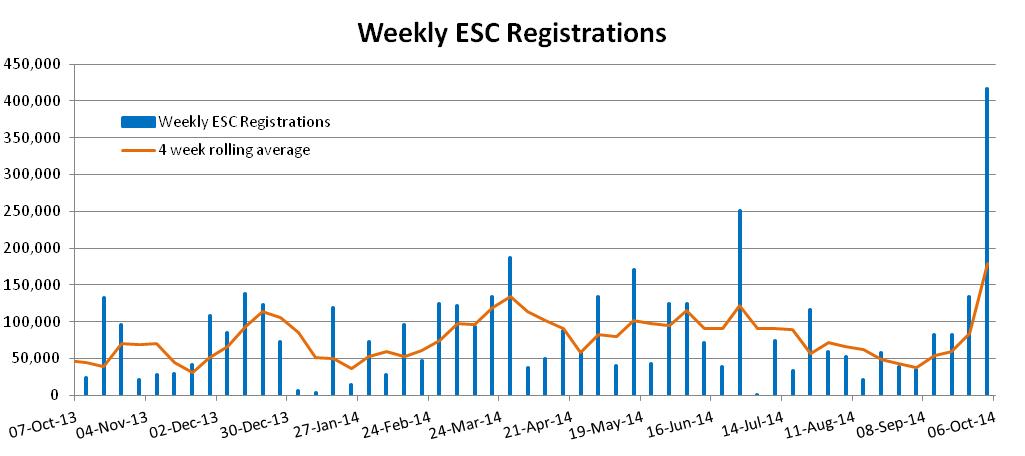

In September, record registration numbers coincided – quiet unusually – with a modest increase in the spot which made it above the $11.00 late in the month. The cut-off date of September 30 for ESC registrations under the old rule flushed out a surprisingly large number of ESCs (over 700k for the month), which combined with the pre-existing surplus has resulted in the 2015 target (of 2.3-2.6m) now being over 80% met.

Across October and in line with expectations, ESC registrations have fallen sharply with the last week in the month yielding little over 7k and bringing the four-week rolling average down to 27k. Yet rather than stimulating the spot price, the market has instead lost ground, softening to $10.80 by month's end.

While appearing counterintuitive, it seems the softening in prices is simply a lagged recognition of what September's registrations left of the 2015 target. Depending on what assumptions you make about the number of surplus ESC required in the system to ensure compliance takes place smoothly, with only 500k ESCs still needing to be registered for the 2015 target and more than 15 months in which to produce them, the run rate required now sits in the very modest region of 10-15k per week.

While the spot market was reasonably active across October, activity in the forwards was patchier. Notable among the trades was a 63k parcel for November at $10.98. While at the start of the month some cost of carry escalation existed in the market, as the spot began to fall this disappeared leaving the forward curve fairly flat.

As has been the case across most of the year participants are keen to hear from the NSW Government on the outcome of its review into the Energy Savings Scheme. Unfortunately the market is no closer to determining whether early suggestions under Premier O'Farrell that the scheme would be expanded are likely to materialise under Premier Baird, with radio silence continuing from a government that simply appears to have had bigger fish to fry. Any announcement to expand the scheme beyond its current peak of 2015 will be essential in impacting on the value of ESCs into the future.

Marco Stella is senior broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.