NVR has built an incredible track record

Note: This is the first in a two-part series explaining the investment case for a couple of overseas-listed stocks for those who like to do their own homework.

In his book The Outsiders, William Thorndike analyses eight chief executives who produced extraordinary returns for investors. The common thread was how well they reinvested company profits.

Paul Saville, chief executive of US homebuilder NVR, didn't grace Thorndike's book. But he's a prime candidate for a second edition.

Saville was a senior executive at the original incarnation of NVR when it went broke following NVR Homes' poorly timed leveraged buyout of Ryan Homes in 1987, which drove the company into Chapter 11 bankruptcy in the 1990 recession.

Key Points

-

Share buyback cannibal

-

Shareholder friendly

-

Lots of industry tailwinds

Saville became chief executive in 2005. Unlike virtually every other listed homebuilder on the planet, he learned from the experience and constructed a way to protect NVR from recessions.

Instead of dangerously leveraging the balance sheet by accumulating land for development, NVR deposits up to 10 per cent of the purchase price for an option on future development.

NVR sticks to areas where it's dominant, including the Washington, D.C. and Baltimore metro areas, where it enjoys 20% and 30% market share, respectively. As the leading builder, developers will accept options rather than outright purchases.

This means NVR's balance sheet isn't highly geared, allowing the company to buy back nearly 80% of its shares on issue over the past 20 years. That's a remarkable feat for any company, let alone a homebuilder.

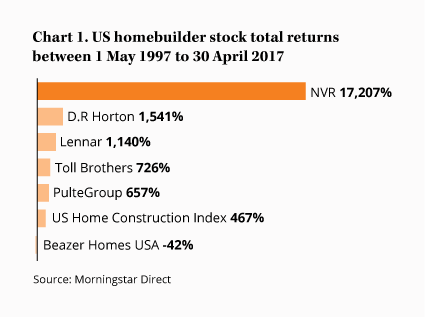

That's led to unheard of returns for a homebuilder operating in such a cyclical industry. NVR's total return over the 20 years to April 2017 is 17,207% (see Chart 1 for comparison to its peers). In 2009, NVR was the only listed US homebuilder to make a profit and post respectable shareholder returns through the GFC.

Chief executive, Paul Saville, may shun quarterly earnings discussions with analysts, but we don't need his help identifying favourable long-term industry trends.

Weak recovery

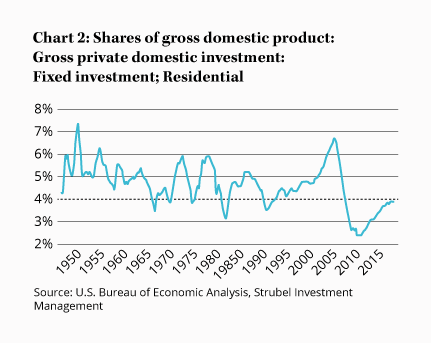

First, after being decimated during the GFC, annual new builds haven't even recovered to the long-term average of ~1.4m. In fact, new starts have only recovered to a level consistent with historical lows (Chart 2). This suggests America will need plenty of new homes in future as the population grows.

Fears about higher interest rates, and therefore affordability, also seem over done in light of history, as Bill Smead of Smead Capital Management explains, 'Stand-alone residences were the most affordable to buy in 2011 as in any year of my adult life. We built 320,000 in the year 2011. They were the least affordable in the 1970s and 1980s, and we built 1m homes many of those years with 65% of the existing population base. There is an inverse correlation between home building and affordability.'

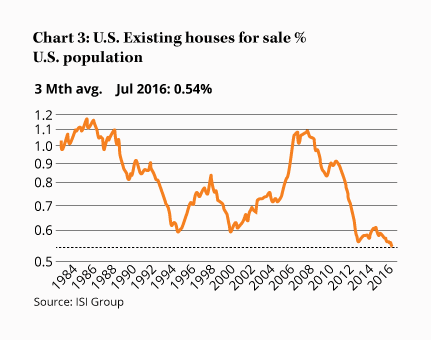

'From 2009 to 2013, homes were the most affordable in my lifetime (60 years). As you can see from the chart below, the availability of homes for sale, coming off five years of negligible home building, was the lowest in 60 years:'

'This chart shows that there is a severe lack of supply in homes and the owners (primarily boomers) are staying in their home much longer than prior generations. How would you have done if you bought home builders at the low points on this chart in 1994 and in 2000?

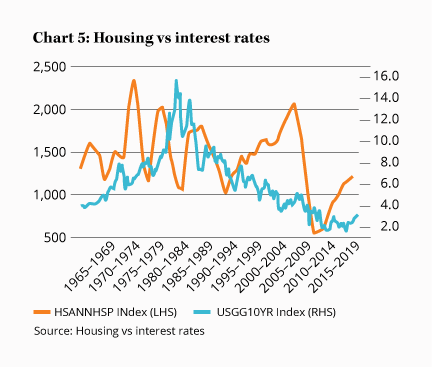

'In fact, the biggest home building phases outside of the 2003-2006 mania were in the early 1970s, the late 1970s and the mid-1980s. Two of those intervals peaked at ten-year Treasury rates above 10% and everything on this chart happened at mortgage rates far higher than today's rates. What was the cause of this huge demand in the face of high mortgage rates and very unaffordable homes? We had the largest population group hitting first-time home buyer status constantly from 1970 to 1986!'

'In fact, the biggest home building phases outside of the 2003-2006 mania were in the early 1970s, the late 1970s and the mid-1980s. Two of those intervals peaked at ten-year Treasury rates above 10% and everything on this chart happened at mortgage rates far higher than today's rates. What was the cause of this huge demand in the face of high mortgage rates and very unaffordable homes? We had the largest population group hitting first-time home buyer status constantly from 1970 to 1986!'

'The chart of housing starts versus Treasury interest rates is not population adjusted the way the prior chart was. There were 180m people in the U.S. in the early 1960s, 225m in the 1980s and America is approaching 330m residents now. Don't 330m people need more homes than 225m did?'

'The chart of housing starts versus Treasury interest rates is not population adjusted the way the prior chart was. There were 180m people in the U.S. in the early 1960s, 225m in the 1980s and America is approaching 330m residents now. Don't 330m people need more homes than 225m did?'

Millennials

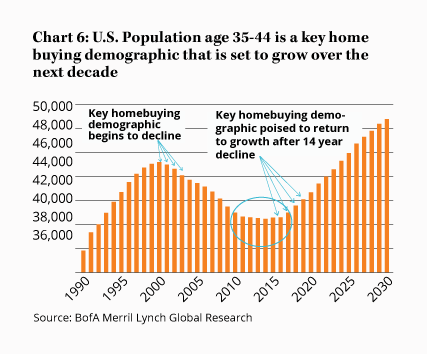

Lastly, unlike many ageing nations, America's millennial population is the country's largest ever population cohort.

Handing back to Smead. 'Among our 330m residents are 86m people between 24 and 42 years old, with their group peak population year at 27 years old, currently. They marry, on average, in their late twenties and early thirties and have their children between the ages of 28-40. Their full force is not yet into the housing start data.'

'At 5% mortgage rates and with today's level of affordability, history shows that there is nothing in the way from having a home building boom over the next ten years to satisfy this demographic demand.'

'Some believe that a larger number of the millennial group will not do what prior groups did-buy houses, build families, etc. If that amounts to 5-10% of them, it means that there will still be between 17 to 23.5% more home and car buyers on average in the next ten years than the last ten years.'

Summary

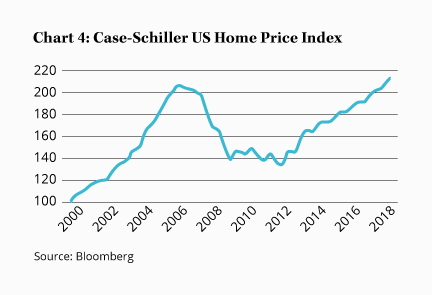

NVR's share price has increased 64% recently after valuations across the homebuilding sector dropped sharply last year. But as Smead explains, we should still be in the very early innings of a long, slow recovery in US homebuilding.

Plan A is that NVR builds lots more homes and increases its earnings. But our confidence in a satisfactory outcome is increased by Plan B, which is that the share price languishes and the company buys back shares hand over fist, having recently announced yet another share buyback for up to almost 10% of the company's shares on issue.

We also note that homebuilders currently represent 0.1% of the S&P 500 index, which means their stocks aren't influenced by value-agnostic ETFs that are currently dominating market movements.

In summary, this is a remarkable company operating in an unpopular sector with insiders that have some skin in the game, albeit not as much as they used to. That's a promising trio of starting points for any investment.