New rays of sunshine for a dismal, dwindling science

This is the third article in a three-part series on the self-destruction of neoclassical economic theory. See part one here and part two here.

To say that the long self-destruction of the academic economic tradition was given a final push towards the cliff by the global financial crisis paints a pretty bleak picture of the future of the dismal science. But I can also see some rays of sunshine.

The first is to look outside the Academy, to formal economic bodies – to central banks and Treasuries in particular. In the past, these bodies uncritically reproduced whatever was the latest fad in academic economics (witness the rapid shift from IS-LM and AS-AD models to DSGE models when academic economists proclaimed that the former fell victim to the Lucas Critique).

But these bodies advise, report to, and provide economic projection numbers for, top-level bureaucrats and politicians. They in turn have to front journalists, where they announce policies and make forecasts. The continued failure of the policies to work as predicted, and the failure of the economy to recover its pre-crisis vigour, means that these bureaucrats and politicians frequently find themselves on the receiving end of journalistic and public derision, courtesy of what their economic advisors tell them.

Some of this public abuse is self-inflicted – for example, the political reliance on Reinhard and Rogoff was not a case of politicians being persuaded to follow a bad policy by bad economic theory, but one of cherry-picking academic research to find a case that supported the simplistic “household” vision of the economy that politicians tend to hold. But there is now a disconnect between economists in treasuries and central banks and their political masters. The politicians no longer expect economists to give them trustworthy (or at least non-controversial) numbers. Without fail, their predictions are rosier than reality.

This in turn is putting pressure on central banks and treasuries to be amenable to a wider range of economic thought than that which is sanctioned by academic economists. In response, central banks and treasuries are now showing more adventurism in economic modelling than are academic economists. I’ve seen this firsthand, with invitations to speak at central bank conferences (though so far only periphery ones – Argentina, Turkey, Malaysia), seminars with treasuries (New Zealand, Australia) and meetings with economists in central banks who are trying to develop stock-flow consistent monetary economic models (Bank of England, ECB). It’s early days yet, but I suggest that change in economics is more likely to come from these once conservative institutions than from academic economics itself.

The second is the media. The fourth estate is no longer completely compliant, and journalists who used to spout neoclassical orthodoxy are now amongst its strongest critics. Anatole Kaletsky, for example, as editor of The Economist and a columnist for The Times and the Financial Times, was a town crier for the Great Moderation and neoclassical economics. He is now a strident critic of the mainstream, and chairman of the Institute for New Economic Thinking. Non-neoclassical economists are no longer regarded as cranks by the “Mainstream Media”, and there is room for heterodox voices in its pages on a scale that was impossible before the economic crisis. John Harvey, for example, has a column in Forbes; I have my column in Business Spectator.

A third is the world of social media. Neoclassical economists are trying to dominate this arena, and certainly Krugman’s blog is far more influential than mine. But heterodox voices still get heard: they can’t be excluded as they can within the Academy. With blogs, Twitter and Facebook often the first resource that the public turns to these days, well-argued heterodox economics can have an influence that it can’t muster in University courses. The capacity for heterodox economists to communicate via social media far exceeds what was possible in Keynes’s day via pamphlets – see for example Dirk Bezemer’s excellent animated series “Debt: The Good, the Bad, and the Ugly”

A fourth factor is the rise of studies in Anthropology and Law in particular that challenge key elements of the neoclassical vision – especially the ‘loanable funds’ concept of money. Books like Debt: the first 5000 years and Money: the unauthorised biography, as well as work by legal scholars like Bob Hockett in the aftermath to the Subprime Crisis give a basis on which an explicitly non-neoclassical approach to economics can be developed by disciplines who are unafraid to tell would-be practitioners of economic imperialism to take a running jump.

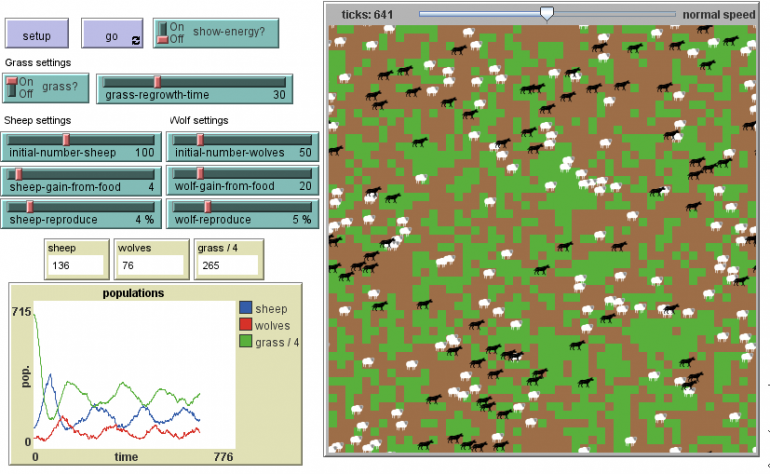

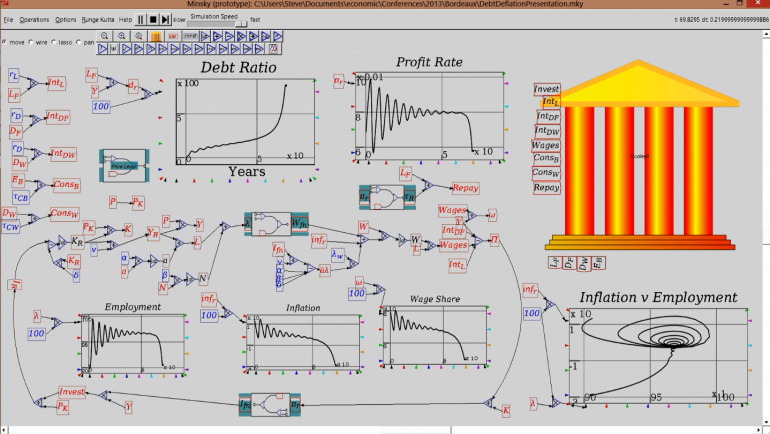

A fifth is the possibility of a technological fix, and the development of computer simulation systems, ranging from multi-agent platforms like NetLogo to my own explicitly monetary system dynamics platform Minsky. Hopefully the visual and simulation aspects of these programs will make them more exciting to would-be economists than a pair of intersecting IS and LM curves, or a set of trivial linearised DSGE difference equations. Since these programs are readily available and free, some new students will be familiar with them before they are exposed to – and bored by – a standard neoclassical university economics degree.

Figure 1: A predator-prey model in NetLogo

Figure 2: A monetary model of debt deflation in Minsky

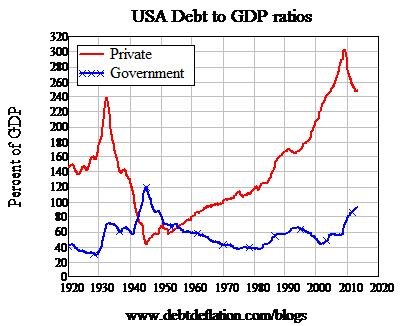

A final ray of sunshine is in fact a silver lining in what I expect to be a very long lived black cloud. This crisis was caused by the bursting of the biggest private debt bubble in human history – as research by INET-funded scholars Schularick and Taylor has confirmed. Yet even after four years of private sector deleveraging, the level of accumulated private debt still exceeds the peak reached during the Great Depression.

Figure 3: An unprecedented debt bubble

Government policy has also been trying to restore the pre-crisis rate of growth of the financial sector as a means to end this crisis – as if that rate of growth was sustainable in the first place. This has succeeded to some extent – there is now the slightest uptick in private debt in the US (see Figure 10) – but this will be short-lived, because there simply isn’t room for private debt to rise substantially relative to GDP when it is still in unprecedented territory. A renewal of private sector deleveraging – and hence a return to recession conditions – could easily be triggered by a policy shift back towards budget surpluses, and higher interest rates as QE is unwound.

Figure 4: From deleveraging to very slight releveraging

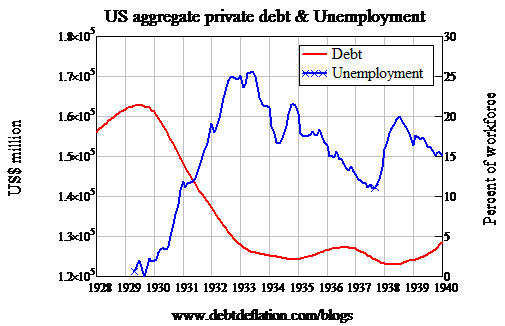

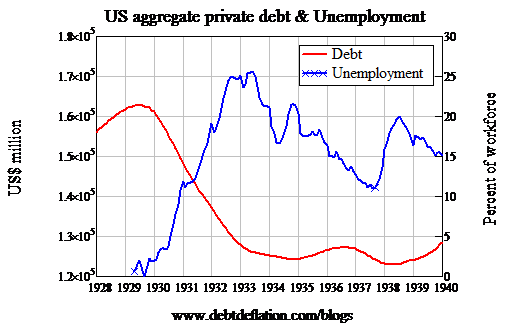

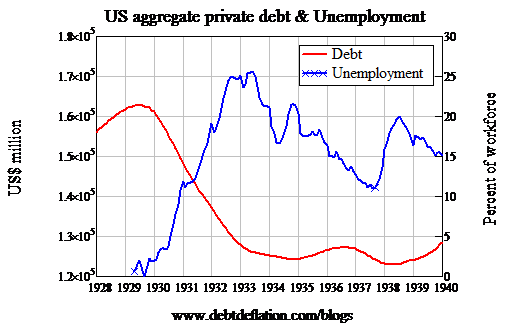

A similar phenomenon played out during the Great Depression itself. The Roosevelt administration’s attempt to return the budget to surplus triggered a renewed bout of private sector deleveraging, resulting in a return to a Depression level of unemployment of 20 per cent in 1938-39, after it had fallen from 25 per cent to 11 per cent between 1933 and 1937.

Figure 5: The Roosevelt Depression as Fiscal Stimulus unwound too early

It is feasible that this fall back into Depression after the worst had seemed to be over played a role in the overwhelming success of Keynes’s General Theory. The paradigm shift itself was aborted by Hicks’s IS-LM interpretation, but the willingness to embrace one was there.

A similar possibility could await modern-day critics of neoclassical economics. This crisis isn’t over – far from it. The longer it continues, the more neoclassical economists will come to be regarded as “Euclidean geometers in a non-Euclidean world”.

So the neoclassical citadel of academic economics is under attack from the outside, and it could be that in the next decade or so, the neoclassical hegemony over academic economics could be ended. That in turn is, I believe, the only chance for academic economics to undergo a revival. Even though many heterodox economists are critics of capitalism, heterodox approaches to economics are inherently closer to those of other business and social science disciplines than neoclassical economics. If economics departments offer non-neoclassical courses that are compatible with sociology and history in Arts Faculties, and management and accounting in economics ones, there is some chance that economics might regain some of academic ground that it has ceded to more realistic disciplines in the last 40 years.

But if the neoclassical hegemony over academic economics is maintained, then even the survival of neoclassical economists will be under threat. The University of Western Sydney is an outlier in abolishing its economics degree, but even there it is not alone: the Australian Catholic University did the same thing – though with far less visibility. If economics is reduced to a rump discipline teaching one unit only because the official accreditation of accountants requires it, how long will it be before accountants decide that, if economics as taught is so obviously irrelevant to the real world, then even that one unit isn’t worth maintaining? Or that maybe they can teach their own economics unit, which would be more realistic about the role of money in a market economy, and more compatible with accounting itself?

To survive, economics needs the revolution in thought that it has been ardently trying to prevent from as long ago as when Veblen first penned 'Why is Economics not an evolutionary science?' The only alternative to this revolution from equilibrium to evolution is extinction. And economists should know that – after all, they’re already 90 per cent of the way there.

Steve Keen is author of Debunking Economics and the blog Debtwatch and developer of the Minsky software program.