Miner's switch a warning sign

Summary: Lanka Graphite is switching from mining to computer retailing.

Key take-out: Falling commodity prices may prompt other miners to move out of the industry.

With a stock market value of under $3 million, it's unlikely many investors have heard of Lanka Graphite – a micro-cap which has spent much of its life trying to develop high-grade but narrow-veined graphite deposits in Sri Lanka for use in batteries.

However, what Lanka has just proposed might earn it a higher profile because it is the first of the current crop of small explorers to shift focus from resources to retail.

The proposed change is dramatic, but it is not the first time management of a small resources company has switched into something believed to be more lucrative, and it will not be the last.

Throughout the dot-com boom of the late 1990s, many small miners quit an industry hit by low commodity prices to try their hand at internet-oriented technology. Not many succeeded.

Lanka's move – which will see it buy a computer retailer with 28 shops in six states – may prove to be a one-off event, but that seems unlikely given the changing nature of the resources sector, where a 30-month period of rising metal prices appears to have peaked.

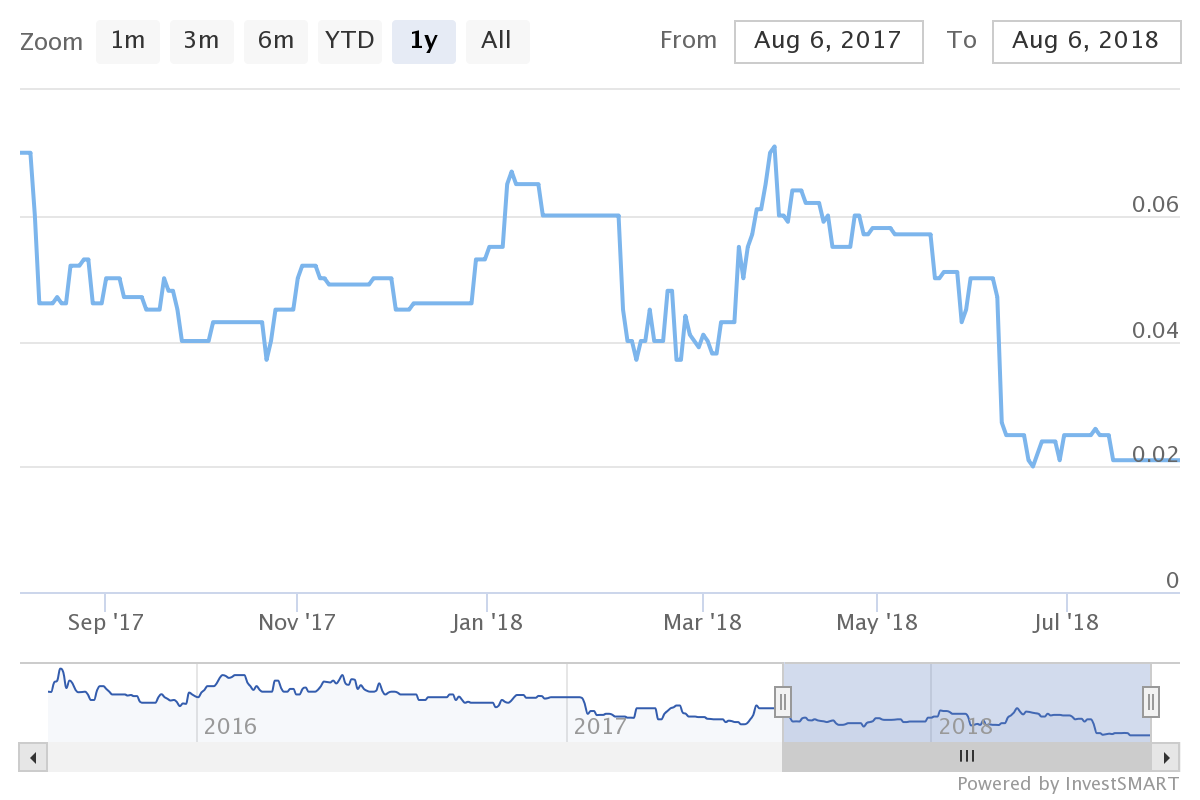

Lanka Graphite share price

For investors with an interest in resources, the Lanka move is a fresh warning that conditions in resources are toughening – partly due to the worsening trade war – but also because of increasing evidence of oversupply in battery-metal commodities such as graphite, lithium and cobalt, and a sharp price correction in more traditional minerals.

This week, Macquarie became the latest investment bank to warn of a flood of lithium which is likely to severely depress the price, while graphite is facing similar conditions as a boom in demand for electric cars proves slower to arrive than forecast.

“Whichever way you look at it, this market is sleepwalking into a tsunami of over-supply,” Macquarie said of lithium.

If the bank is right (delegates at this week's Diggers & Dealers mining forum in the WA goldfields city of Kalgoorlie dispute the comments about oversupply), then the price of lithium could drop by more than 40 per cent next year from an average this year of $US12,625 a tonne for lithium carbonate to $US7,375/t.

Lanka's challenge with graphite – which is used in steel-making as well as in batteries – is the same as that confronting lithium producers; particularly small stocks in what is essentially a bulk-commodity business in which size is important in keeping costs low.

Sri Lanka has a long history of high-grade graphite production from veins ranging in thickness from one millimeter to one metre. This however, is a fraction of the size of the vast deposits being developed by companies such as Syrah Resources in the African country of Mozambique, where graphite deposits have an aggregate thickness of up to 240 metres.

Lanka told shareholders late last week that it proposed to buy MSY Group and make the switch to “retail e-commerce business”, with the Sri Lankan graphite assets being spun-out into a separate business or sold.

What happened in the dot-com boom of two decades ago might not be repeated, but for investors in small mining stocks, the shift by Lanka could be an early hint of what might happen as mining gets tougher and other business possibilities become more attractive.

Technical price corrections rife in commodity markets

Though it has not been widely reported, a number of important commodities have recently entered technical price corrections – the point at which the price dips by more than 10 per cent from its 52-week peak.

Copper, nickel and gold have all slipped into a correction thanks to uncertainty in global financial markets, and iron ore has been forecast by RBC Capital Markets to follow.

The fall in the copper price from around $US3.30 a pound in early June to latest sales at $US2.76/lb represents a correction of 16.4 per cent in under two months. Big copper producers such as BHP and Rio Tinto can ride out such a fall, but it will hurt smaller miners and raise concern about plans to finance the development of new mines.

Copper price over the last six months

Copper has the nickname, ‘Dr Copper' because it can be a useful early indicator of future manufacturing activity due to its use in everything from electronics to construction. A falling copper price is a warning that the China v US trade war is starting to bite.

The price of nickel – an important metal in steel-making and battery production – has dropped by 13.4 per cent since early June. Iron ore is tipped by RBC Capital Markets to soon fall from $US66/t to $US49/t (down 25 per cent) thanks to China's steel industry coming under pressure from higher US tariffs.

In something of a surprise, gold has also entered a technical correction, with a 10.7 per cent fall from its 12-month high of $US1,354 an ounce to recent sales at $US1,209/oz. In uncertain economic times, the gold price is expected to increase, but with US interest rates rising, gold is under pressure because it does not pay interest in its bullion form.

Gold price over the last six months

Developments in global markets and at the top of the mining sector are generally disconnected from events at the bottom end of the resources sector.

However, with hundreds of small mining companies struggling to fund their exploration programs or raise fresh capital in a more risk-averse market, the temptation to do something different grows greater by the month.

Lanka's shift from graphite to e-commerce is both an interesting switch and potentially the start of a widespread shift away from resources, especially if the electric car revolution is postponed, leaving stockpiles of unsold graphite and lithium.