Minefield: Three new names to watch

*Small mining stocks are highly speculative. Those subscribers following this research do so at their own risk. The companies covered in the column below do not form part of the official share recommendations provided by Intelligent Investor and Eureka Report.

Minefield returns today for a fresh look at the small-to-medium end of the resources sector after a successful launch on July 6 when the four stocks mentioned performed as expected.

It will not always be smooth sailing at the bottom end of the market, and readers are advised to not chase prices up as it doesn't take many buyers to have a big impact.

Sometimes it's best to wait for prices to settle, using this column as a generator of ideas rather than see it as recommending investments. For advice, speak to your licensed adviser.

Before my latest thoughts, though, a flashback is in order.

OreCorp, top of the last list with a green light to signal 'positive sentiment', moved up from 38c at the time of the last edition of Minefield, to 51c, before settling to close yesterday at 48c. Western Areas (also green) rose from $2.40 to $3.01 before settling at $2.65. Beach Energy (amber, for 'showing potential') rose from 61c to 66c before settling down at 60c. Pilbara (red for 'warning'), fell from 63c to 48c.

Moving on... here are three new names for your watch list:

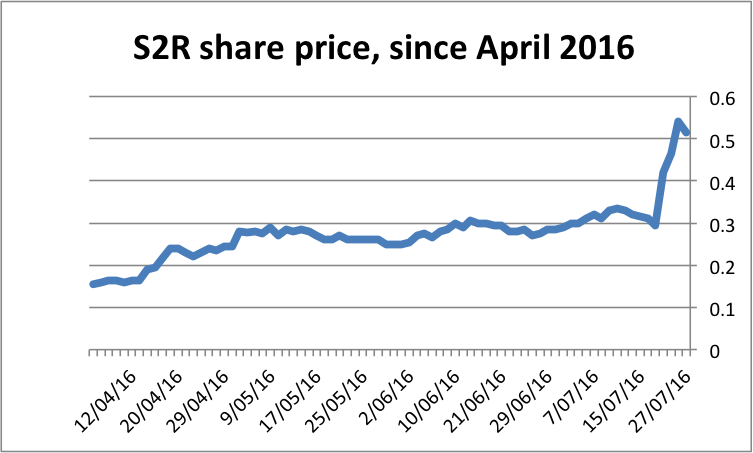

S2 Resources (S2R)

S2 Resources (S2R)

As the name suggests, S2 is a comeback company modelled on its successful predecessor, Sirius Resources, discoverer of the Nova-Bollinger nickel mine in Western Australia which is now part of Independence Group after a high-priced takeover of Sirius.

Like Sirius, S2 is off to a flying start with what looks to be a significant gold discovery, also in WA.

Four factors make S2's flaship Polar Bear project near the historic goldmining centre of Norseman (about 150km south of Kalgoorlie) worth a close look. They are:

- The richly mineralised nature of the regional geology and history of Norseman as home to mines which have yielded more than 10 million ounces of gold over the past 100 years;

- The skillset of S2's management, led by chief executive Mark Bennett, who has the Nova-Bollinger nickel project to his credit as the most recent discovery in a distinguished career as an exploration geologist;

- The early drill results from a number of targets within the Polar Bear project area, and;

- High-grade drill intersections reported late last week from the Monsoon target within Polar Bear, with the best being an eye-catching 11.4 grams of gold per tonne over a thick 66-metre zone, starting at a depth of 74m.

One drill hole is not sufficient reason to get carried away. More drilling is required for the discovery to be better understood.

However, the location is promising with Polar Bear close to a major 'shear' zone, a geological feature that cuts through outback WA and home to the mines of Kalgoorlie to the north, Norseman to the south and the nickel and goldmines around Kambalda in the middle.

On the market, S2 has jumped from 29.5c before the Monsoon drill results were reported to an all-time high of 56c on Thursday. They last traded at 54c, valuing the company at $116 million.

S2 management has been quick to capitalise on the Monsoon assays, this week raising a fresh $9.1m through a placement at 46.5c a share to professional investors, as well as seeking $3m from shareholders via a share purchase plan.

When the fundraising is complete S2 will have $27.5m in cash, more than enough for an accelerated drilling program starting in late August which should provide a useful flow of news from the field.

What investors should look for are similar result from the first round of drilling which, as well as that broad zone 66m at 11.4g/t, included richer but narrower areas of mineralisation such as 8m at 70.5g/t, and 4m at 139g/t starting at a depth of 77m.

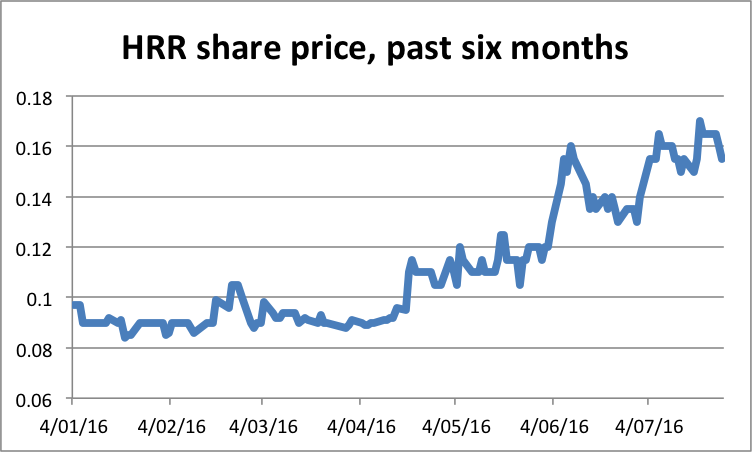

Heron Resources (HRR)

Heron Resources (HRR)

Once a nickel hopeful in WA, Heron has moved across the country to NSW, and swapped nickel for the most promising of the base metals, zinc.

Over the past six months zinc has been a star in the metals market, even outperforming gold with a 50 per cent price increase from around US66c per pound to $US1/lb, up US10c/lb than the last time I wrote about the metal (read more here: Zinc is back on the radar, June 8).

Driving zinc are the basic forces of demand and supply. Demand remains reasonable for a metal mainly consumed in galvanising steel while supply has been dropping thanks to mine closures and limited exploration or mine development.

Most analysis of the zinc market points to a growing deficit of freshly-mined material which can be seen in shrinking stockpiles such as those at the London Metal Exchange, where zinc in storage has dropped from 1.25 million tonnes three years ago to 436,000 tonnes yesterday.

The biggest beneficiary of what has been a remarkably obvious trend that most investors have ignored is the Swiss-based mining and commodities trading giant, Glencore.

Its chief executive, Ivan Glasenberg, has been a zinc bull for the past decade and has levered Glencore into a market-controlling position, which is one reason why Glencore's share price has rocketed up by 160 per cent (off a low base) on the London stock exchange over the past six months.

Australian investors have few entry points into the zinc market, which is ironic as one of the roots of the country's mining industry can be traced to Broken Hill, home of rich silver, lead and zinc mines, and birthplace of BHP Billiton and the Australian arm of Rio Tinto (when trading as Consolidated Zinc).

The jewel in Heron's crown is a project which might be familiar to older investors, the Woodlawn project near Goulburn in western NSW.

Last worked 20 years ago by Denehurst Ltd, Woodlawn was a moderately successful producer of zinc, plus a range of other metals including copper, lead, silver and gold.

Heron has just completed an $11m study into redeveloping Woodlawn at a capital cost of $144m with a “starter” case that envisages a mine life of 9.3 years for the generation of $402m in net cash flow, a capital-cost payback in 2.3 years, while generating a 32 per cent post-tax internal rate of return.

The project is highly leveraged to the zinc price and funding needs to be arranged, though some speculators have already moved into the stock lifting it from a 12-month low of 8c as recently as April to recent trades at 16c (up 1c on its last mention on June 8).

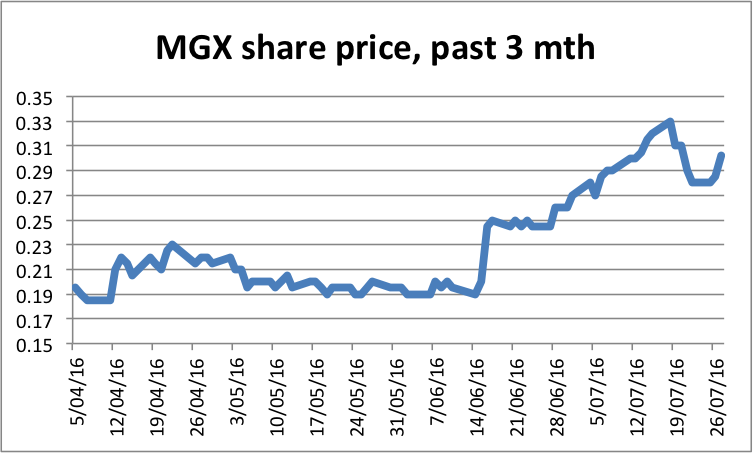

Mt Gibson Iron (MGX)

Mt Gibson Iron (MGX)

Iron ore is likely to be a mineral under pricing pressure for some time as big producers crank up output to ensure an overfull market, which is why Mt Gibson's name, which includes the word iron, might not be a guide to its future.

The reason for keeping an eye on Mt Gibson is the $400m it has marshalled from its historic iron ore mining (plus a small ongoing project) and a recent $86m insurance settlement from a mine closure after the flooding of the company's best mine on WA's Koolan Island.

Money in the bank at a time of a resources recovery can be quite handy, though how management chooses to deploy the cash is the key to what happens next.

Investors are wary of Mt Gibson and the opportunity it might represent, a point demonstrated by the fact that the company's share price, at its current 28.5c, values the business at $311m – $89m less than the cash, term deposits and tradeable investments held at June 30.

In the short term Mt Gibson seems likely to continue generating modest levels of cash from its rapidly-depleting second iron ore mine, Extension Hill, while plans are finalised for a move to a small replacement project called Iron Hill.

Those historic mines are likely to do little more than meet Mt Gibson's day-to-day costs. The real interest is the $400m in cash and the point that the stock today is trading at less than 80c in the dollar.