Minefield: Four stocks to watch

*Small mining stocks are highly speculative. Those subscribers following this research do so at their own risk. The companies covered in the column below do not form part of the official share recommendations provided by Intelligent Investor and Eureka Report.

Welcome back to Minefield, a column which explores for good and not-so-good mid-tier and smaller resource stocks.

A regular feature in Eureka a few years ago Minefield took a break when the mining and oil sectors of the ASX fell into a hole.

The good old days have not returned, yet, but it's impossible to ignore the revival in the gold market, the early signs of recovery in energy and base metal stocks, and the spectacular showing of companies exposed to lithium, the metal hailed as “the new petroleum”.

Minefield will not provide specific buy/sell recommendations. They're for you and your adviser. But it will draw your attention to three or four stocks worth a closer look (highlighted in green), or those which require great care (in amber), and some to avoid - in red!

If in any doubt about the awakening underway in the smaller end of the resources sector consider the result of a survey that has come across my desk recently of "total shareholder returns" over the past 12 months, due to be published next week.

Of 750 ASX companies analysed 150 generated a return of 100 per cent, or more. Of that group which at least doubled in value in 12 months, 112 were resource stocks. Most were small but four have a value of more than $1 billion and another 15 are capitalised at more than $100 million.

Resource stocks are not an asset class which suits all investors, but they certainly add speculative spice to a portfolio, especially at a time of low returns elsewhere.

Stocks to consider in this return edition of Minefield are:

OreCorp (ORR)

OreCorp (ORR)

A gold explorer with impeccable credentials, OreCorp is the comeback vehicle of Craig Williams, a geologist who turned a $US5m copper prospect in Africa into a business sold for $US7bn.

Equinox Minerals was the company which made a fortune for Williams. OreCorp could easily be called 'Son of Equinox' with a number of former Equinox executives joining Williams in a return to Africa, this time with gold the primary target.

The key to OreCorp, apart from the people, is a deal struck last September with the big African goldmining specialist Acacia Mining to convert the promising Nyanzaga gold discovery in Tanzania into a mine.

London-listed Acacia already has its hands full with three goldmines in the same region as Nyanzaga and turned to Williams with his Equinox experience to see if it could add a fourth.

OreCorp is off to a flying start because Acacia's early work had outlined a resource of 2.8 million ounces of gold in ore assaying an attractive 4.1 grams a tonne.

The work underway today is to finalise a scoping study over the next six months, moving into a pre-feasibility study in the December quarter.

As with all 'farm-in' deals OreCorp's future interest in Nyanzaga could vary from 51 per cent if it spends more on the project, or drop to 25 per cent if Acacia exercises its rights, at which point it pays OreCorp up to six-times what it invests in the feasibility phase.

While the analysis phase could last another 18 to 24 months, OreCorp is already enjoying the benefits of exposure to a known gold resource that could become a world-class goldmine, as well as a $US200/oz increase in the gold price since it teamed up with Acacia.

ORR share price ($), past 12 months

On the market, OreCorp shares have risen from 5c at this time last year to all-time high of 34c this week, capitalising the stock at $59m.

Western Areas (WSA)

Western Areas (WSA)

WSA share price ($), past 12 months

Like all nickel miners Western Areas was hammered flat by the collapse in the price of its primary metal, but with signs of a nickel revival underway the share price of Western Areas is slowly responding.

The key to the share-price rise from $2 on June 29 to latest sales around $2.47 is renewed speculation about a squeeze on the supply of nickel, an essential component in stainless steel.

Over the past month the nickel price on the London Metal Exchange has risen from $US3.87 a pound to $US4.38/lb, with a nine-month high of $US4.53/lb reached on Monday.

Nickel is not currently in short supply but could be headed that way thanks to a number of mine closures over the past three years of depressed prices and the prospect of a ban on the export of unprocessed nickel ore from the Philippines, a move which would replicate an earlier ban by the government of Indonesia.

But even before political pressure developed on nickel in the Philippines with the appointment of an anti-mining environment minister, there were signs emerging of a supply surplus flipping into a deficit.

Macquarie Bank estimated last month that the world nickel balance shifted from a surplus of 86,000 tonnes in 2015 to a deficit of 72,000 tonnes this year and a deficit of 58,000 tonnes next year.

Encouraging as that sounds, there are large stockpiles of nickel to be consumed with the key measure being the number of 'weeks consumption in storage' which stood at 25.3 weeks at the end of last year and should be down to 20 weeks by the end of next year ... but really needs to get down to the long-run average of 13-weeks.

While the stockpile indicates ongoing tough times for most nickel miners Western Areas is one of the lowest cost miners of the metal in the world, producing nickel in the March quarter (the latest data available) at $2.27/lb ($US1.64/lb).

The company estimates that each $1/lb increase in the nickel price adds around $35 million to its pre-tax earnings – so the recent increase in the nickel price could have a material impact on earnings.

Beach Energy (BPT)

Beach Energy (BPT)

While Sydney and Melbourne shiver through a cold winter, management at Beach Energy is celebrating a higher gas price caused by increased household consumption and the increasing consumption of gas by Queensland's LNG export projects.

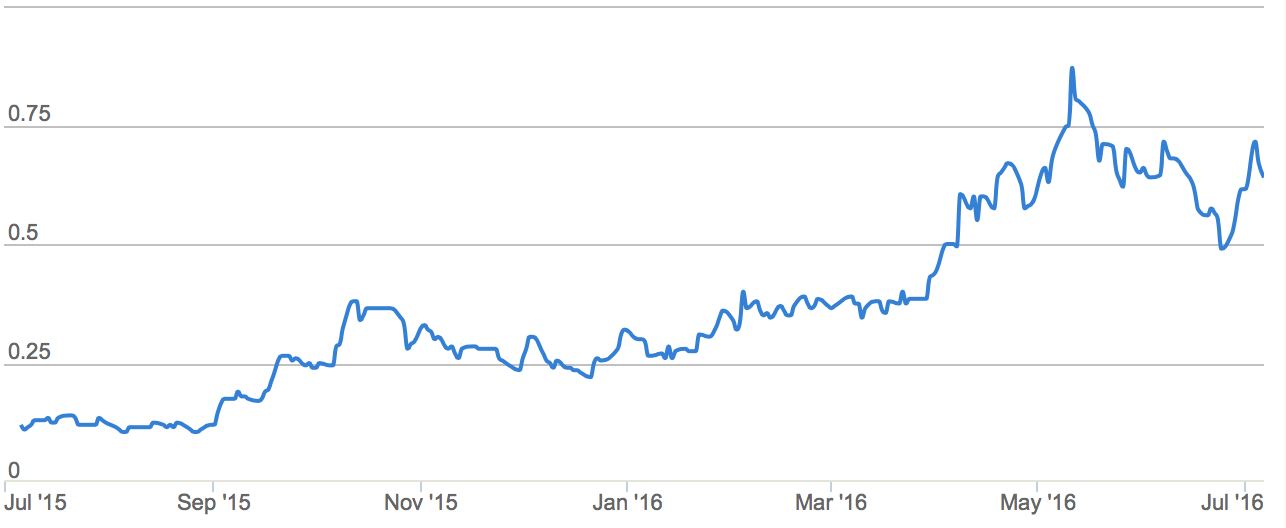

Aided by a worldwide recovery in the price of oil and gas Beach's share price has risen from a multi-year low of 35c in mid-January to around 61.5c.

BPT share price ($), past 12 months

It could continue to appreciate as an energy crisis brews along Australia's east coast, the result of a gas shortage and growing LNG exports.

A whiff of what's to come was evident last week when gas prices in Sydney hit $29 per gigajoule, 60 per cent higher than the previous peak in 2012.

Beach, which is effectively controlled by media baron Kerry Stokes, is a key player in the Cooper Basin gasfields of central Australia and the owner of strategic infrastructure linking energy markets.

Stokes, guided by a former chief executive of Woodside Petroleum, Don Voelte, has built a 23 per cent stake in Beach in the belief that an energy squeeze in Sydney and Melbourne will deliver a windfall win.

Pilbara Minerals (PLS)

Pilbara Minerals (PLS)

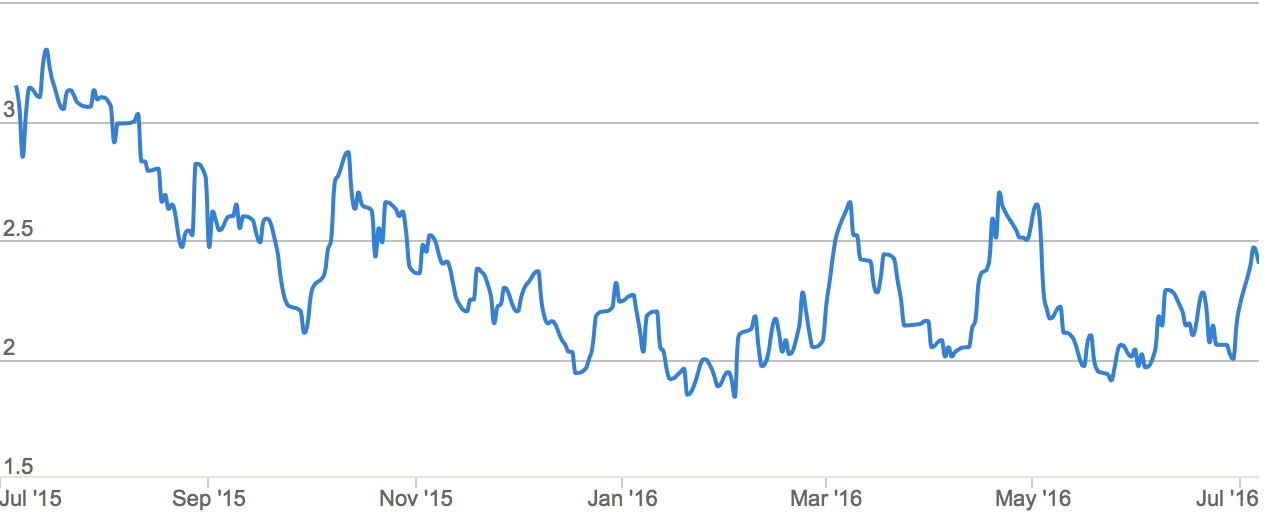

One of the big winners from Australia's lithium boom, Pilbara has run hard for the past 12-months – perhaps too hard.

From 12c at this time last year, the stock hit an all-time high of 87c in mid-May before commencing a slide back to its current price of 67c.

Holding on to that price, and a market capitalisation of $770m, will be difficult as the challenge of funding a lithium mine at the company's Pilgangoora discovery in WA is digested by the market and other potential miners of the metal move towards development.

Appealing as lithium is thanks to its use in long-life electricity storage batteries, the world does not use a lot, there is no shortage of supply and even double-digit growth rates in consumption should not tax supplies.

A warning shot was fired at Pilbara earlier this week when Macquarie Bank put it at 46c (21c below the market price) and gave the stock an underperform rating.

PLS share price ($), past 12 months