Microcap Conference 2016: Part 1

Named after the highest value chips in poker, 'blue chips' are the largest, most reliable shares on the market (most of the time), but they're never likely to provide quick gains. The real poker game is down at the other end of the market, among the microcaps. These are the smallest, least reliable shares on the market – they can blow up in a trice, but if you get it right they can reward you with many times your money.

So it was with a mix of excitement and trepidation that I headed down to the 7th annual Australian Microcap Conference in Melbourne last week. Over two days more than 24 companies presented and we're going to pick out the six we found most interesting: three today and three more in part two later in the week.

Please note that these ideas haven't been fully researched and aren't formal recommendations. However, they may prove fruitful if you're prepared to do your own research.

APN Property Group (APD)

APN Property is a commercial property fund manager that manages funds – usually also co-investing in them – with the goal of ‘property for income'. That is, it avoids taking development or significant leasing risk and instead invests in well located properties that are leased for many years to quality tenants, all the while using reasonable levels of gearing.

Management and directors own around 40% of its shares and the company now has $2.3bn of funds under management (FUM), up from $1.3bn in 2013. This increase is all the more impressive given these numbers exclude its health division, the management rights for which were sold in June 2016.

$1.6bn in FUM is in unlisted funds managed by its real estate securities funds business. The APN AREIT Fund, which takes stakes in other listed property trusts, comprises 75% of this amount. Another $550m in FUM is represented by APN Property's remaining listed property trust Industria REIT – which owns industrial property in Brisbane, Sydney, Melbourne and Adelaide – and another $205m is invested in direct property.

Ever lower interest rates have contributed to growth in FUM, but we're now at a point where the resulting higher property values are making it more difficult for APN Property to grow. High commercial property prices are a major reason why it sold its health division.

The failure of Charter Hall to float its Long WALE REIT and rising interest rate expectations suggest we may be at a turning point in terms of the tailwinds that have so benefited listed property trusts in recent years.

All is not lost for APN, however, as it recently received its first institutional mandate: namely, $50m from Colonial First State. This should lead to further institutional mandates and rising FUM in coming years, while it also plans on floating a petrol station trust in 2017 to join recently floated Viva Energy REIT.

The sale of its health business and subsequent 10 cent fully franked dividend mean its net tangible assets stand at around 33 cents per share. With a market capitalisation of about $130m, this means you're paying around $30m for the funds management business itself, perhaps representing good value for those who believe its FUM will continue to rise.

Genetic Signatures (GSS)

Genetic Signatures hopes to drastically reduce the 3m deaths from infections in hospitals each year through its molecular diagnostic test solutions, which rapidly identify diseases and infections using its patented ‘3base' technology.

The ‘base' in 3base refers to the four primary nucleobases in DNA: cytosine, guanine, adenine and thymine, often abbreviated to C, G, A, T, respectively.

Microbial genomes are comprised of sequences of C, G, A and T, with various strains of, say, influenza (such as bird flu or swine flu) having slightly different sequences. Unfortunately, a 10-digit number containing four different bases has over 1m possible permutations.

However, Genetic Signatures's test converts the four bases into three bases by simply converting any occurrences of C in a sequence to a T through the application of sodium bisulphite to microbial DNA. This dramatically reduces the number of permutations needed to test for – a 10-digit number containing three different bases has ‘only' around 59,049 different permutations – while also maintaining or even improving the accuracy of these tests.

The company's tests also obtain results in 4–5 hours compared to up to 4–5 days for competitors, while its tests can more accurately test for a larger number of diseases. Other benefits to hospitals include lower costs in evaluating samples, shorter stays in hospital and potentially fewer sick days for hospital workers.

Genetic Signatures's initial products include tests for 22 different types of gastro along with 15 of the most common respiratory diseases, representing 80% and 20% of 2016 revenue respectively.

| $m | Australia | Europe | US |

| Gastro | 6 | 80 | 228 |

| Respiratory | 4 | 61 | 174 |

| STIs | 8 | 116 | 330 |

The company is still in the commercialisation phase and so is still burning cash. However, it recently raised $15m to help it obtain regulatory approval in the US and Europe, whose markets are far larger than Australia's (see Table 1). Genetic Signatures hopes to be cash flow breakeven by 2018.

The opportunity here is not only in the expansion of its existing tests to Europe and the United States – and initial revenue from both is expected in 2017 – but also in the development and commercialisation of further tests such as in the detection of many of the most common sexually transmitted diseases (STIs). As you can see from Table 1, should the company successfully expand, its future market capitalisation could dwarf its current $50m market cap.

Money 3 (MNY)

After successfully steering AMA Group to outstanding shareholder returns in recent years through the consolidation of the Australian panel-beating market, Chairman Ray Malone has a new project in Money3.

The company provides credit to customers who are unable to obtain loans from traditional lenders due to blotches in their credit history. Money3 is also benefitting from the withdrawal by the big banks from this sector due to regulatory capital requirements.

Its products include secured auto loans, unsecured personal loans and cheque cashing. The average interest rate on its loans is (gulp) 28% and its products are now primarily distributed by brokers, although it also has an online presence and still maintains a (reduced) branch network.

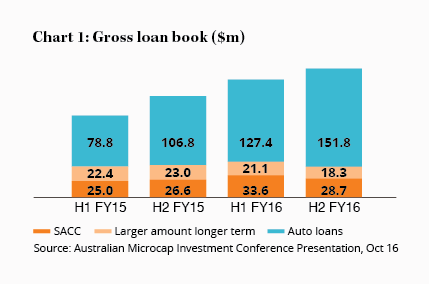

As you can see from Chart 1, auto loans represent around 75% of its $200m in gross loans at 30 June 2016. Importantly given the proposed regulatory changes to Small Amount Credit Contracts (SACC), SACC loans are less than 15% and should keep declining as a percentage of the total.

Management will need to ensure it continues with good control over its brokers to minimise any principal-agent problems – it has final sign-off on all loans and currently rejects around 70% of applications – whilst also staying in regulators' good books. As the personal loan market is inherently cyclical, the company is also potentially exposed to slowing economic growth, rising petrol prices and/or rising interest rates which will likely reduce the ability of its customers to repay their loans.

However, its auto loans are secured and in any case borrowers are less likely to default on auto loans compared to rent or housing repayments in times of economic stress as they need cars to get to work and perform other chores. Money3 should continue to benefit from economies of scale from its distribution network. After raising capital in 2016, it's trying to obtain medium-to-longer term debt funding to finance further growth.

Management has guided to net profit of $26m in 2017, an increase of 30%. This places it on a historical price-earnings ratio of 14 and a forward price-earnings ratio of 11.