MARKETS SPECTATOR: Charting ways four-ward

- {{x.value}}

{{ twilioFailed ? 'SMS Code Failed to Send…' : 'Enter verification code' }}

{{ completedStep1 ? 'Authentication & Security' : content.trialHeading.replace('{0}', user.FirstName) }}

{{ content.upgradeHeading.replace('{0}', user.FirstName) }}

The email address you entered is registered with InvestSMART

Please login to continue

We have sent you an email with the details of your registration.

Looks you are already a member. Please enter your password to proceed

{{ upgradeCTAText }}

Updating information

Please wait ...

Your membership to InvestSMART Group recently failed to renew.

Please make sure your payment details are up to date to continue your membership.

Having trouble renewing?

Please contact Member Services on support@investsmart.com.au or 1300 880 160

You've recently updated your payment details.

It may take a few minutes to update your subscription details, during this time you will not be able to view locked content.

If you are still having trouble viewing content after 10 minutes, try logging out of your account and logging back in.

Still having trouble viewing content?

Please contact Member Services on support@investsmart.com.au or 1300 880 160

Please click on the ACTIVATE button to activate your Intelligent Investor 15-day free trial

Please click on the ACTIVATE button to finalise your membership

Unsuccessful registration

Registration for this event is available only to Eureka Report members. View our membership page for more information.

Registration for this event is available only to Intelligent Investor members. View our membership page for more information.

- You are already registered for this event.

- This event is already full.

- Please select a quantity for at least one ticket.

- {{ i }}

Forgotten password

Please enter your email address below to request a new password

- Verify your email address by clicking on the link we sent to {{user.Email}}

- You now have free access, we look forward to helping you on your financial journey.

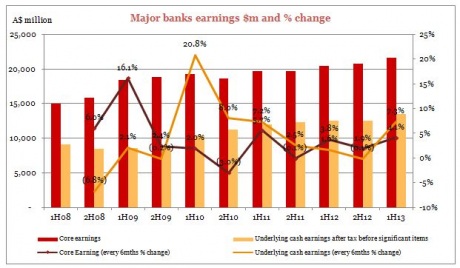

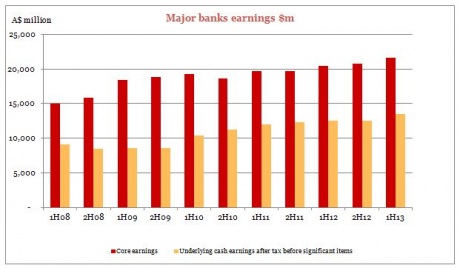

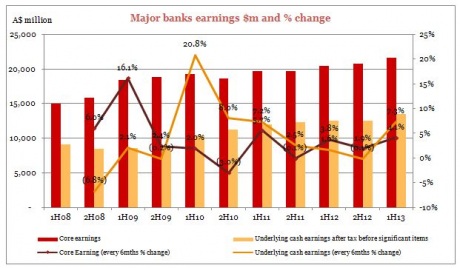

Research by PricewaterhouseCoopers shows Australia’s four major banks are flying, delivering combined underlying cash earnings of $13.4 billion for the first half, up 7.3 per cent half on half.

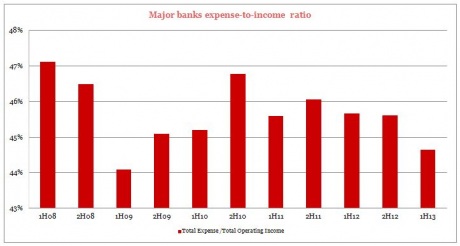

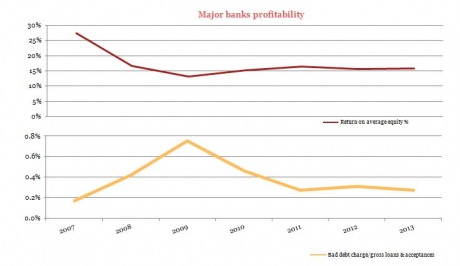

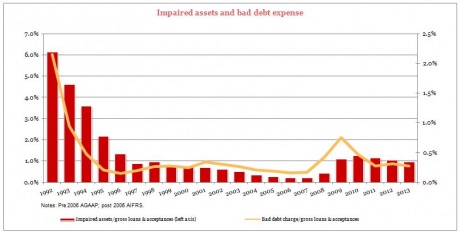

PwC Australia’s Banking leader Stuart Scoular said tight cost management, a focus on productivity and low bad debt expenses overcame the Australian economy’s weak credit growth to deliver the record result.

But Scoular said the outlook remained challenging with hurdles including the margin effect of Tuesday's Reserve Bank's interest rate cut and intense competition in some areas.

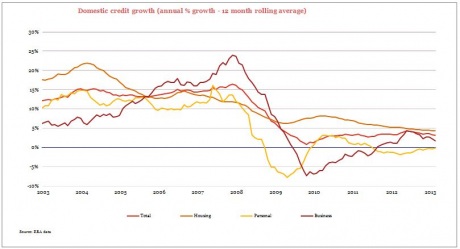

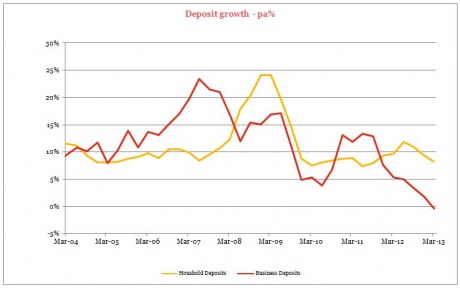

The PwC Major Banks analysis found for the year to March deposits grew by $115 billion while lending growth amounted to $87 billion. In the six months to March business credit fell 0.7 per cent, or about $5 billion, and business deposits shrunk 0.4 per cent, or by $2 billion.

The following eight charts show how the banks have achieved this growth and also measure some of the factors that have been, vainly, working against them, such as stagnant credit growth and flat margins.