Markets in Review: Why Australia's the lucky country

Chief Market Strategist Evan Lucas outlines why the RBA is excited about the Australian economy, and provides an update on the oil market.

- The RBA’s view of the Australian economy is getting stronger and stronger. The press statement from the November board meeting on Melbourne Cup Day showed that economic growth had been revised higher for both the short and longer-term views, while its outlook on the employment market had also improved. The RBA believes core inflation will remain, “low and stable”, and although there was no move in the cash rate, some believe this statement is setting up 2019 for a possible increase in the cash rate.

- The Statement on Monetary Policy (SoMP) on Friday confirmed the statement with actual figures: GDP for 2018 will be 3.5 per cent, the unemployment rate will be 5 per cent as opposed to 5.5 per cent, and headline inflation will hit 2 per cent. However, it is believed this will be mainly due to fuel (see table below). It’s the core inflation figures which need highlighting, and according to the SoMP, core inflation (the core mandate of the RBA and its reasoning for rate movements) won’t enter its target band until December 2019. Even when it does, it will only do so at 2.25 per cent. That would mean core inflation has taken 21 quarters to return to the RBA’s ‘sweet spot’. It should be noted that this is nowhere near ‘hyper’ levels which would require monetary policy intervention.

.png)

- However, the SoMP and November press release confirm one core belief held by the RBA: that Australia is ‘the lucky county’. This is because there is no sign of a recession (27 years and counting); employment is rising and ‘will’ bring wage growth in 2019; while the overall health of economy is on the up, even despite the potential instability caused by two looming state elections and the upcoming Federal election.

The Surprising Bear: Oil

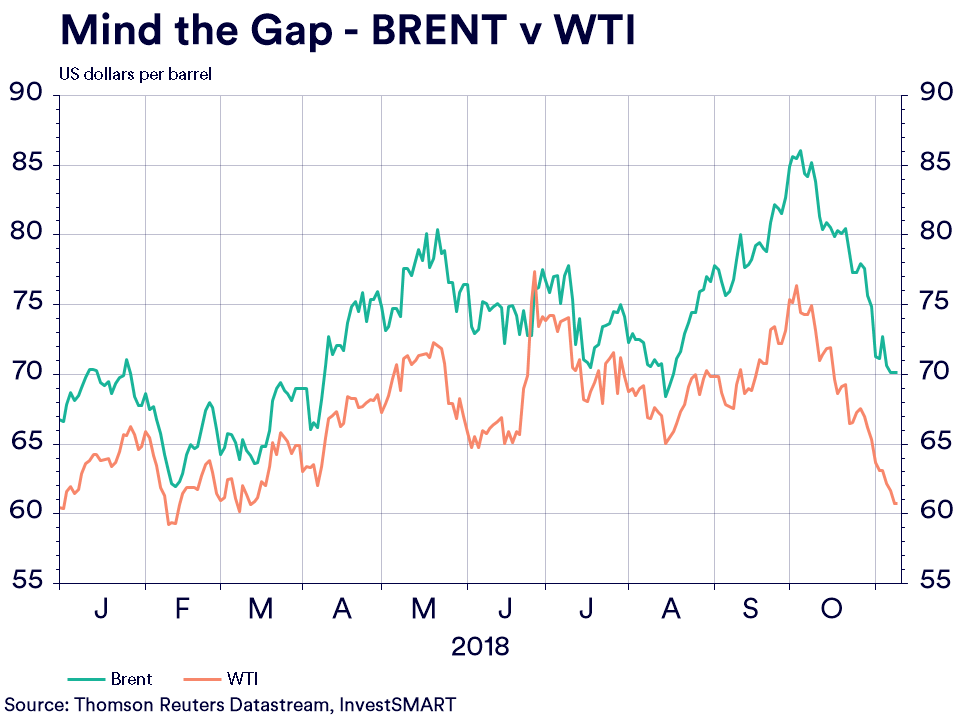

- West Texas Intermediate (WTI) moved into a bear market this week, having lost 21 per cent from its October high. The decline has been led by the mass increases in US stockpiling and rig count utilisation. This supply surge has taken the heat out of OPEC supply issues caused by Iran forcing the price lower.

- However, the bear market in WTI has not spread to Brent, and there is now a $US10 per barrel gap between the two contracts. Therefore, despite the fall in oil globally, the corresponding decline at the bowser may not be as strong as one would hope. Brent could reach a bear market quickly if non-OPEC continues on its current path.

- The role of non-OPEC (the US, Canada, Norway and Brazil) as major providers of global oil supply chains has been previously discussed. Since the 2014 oil price collapse, these nations have strategically hastened and slowed supply to take advantage of rising prices. However, each time this occurs, the supply-demand equilibrium is reached. This caps the oil price rise, and is likely to remain a factor in 2019.