Markets in Review: Utilising employment

The Reserve Bank of Australia (RBA) continues to see the world glass half-full. This week, RBA Assistant Governor (Financial System) Michele Bullock gave quite a poignant speech ahead of the 10-year anniversary of the Lehman Brothers collapse. The speech was on ‘The Evolution of Household Sector Risk' and the key themes were:

- The RBA has a sanguine outlook on short-term risks in Australia's residential housing market.

- Sees a low probability of a disorderly credit market i.e. a 'credit crunch'.

- Doesn't see a sharp decline in mortgage serviceability costs.

- RBA sees the ongoing improvement in Australia's economy and the recent macroprudential measures as providing buffers. The RBA believes this has improved the overall quality of bank and household balance sheets.

- RBA continues to monitor risks and respond if necessary.

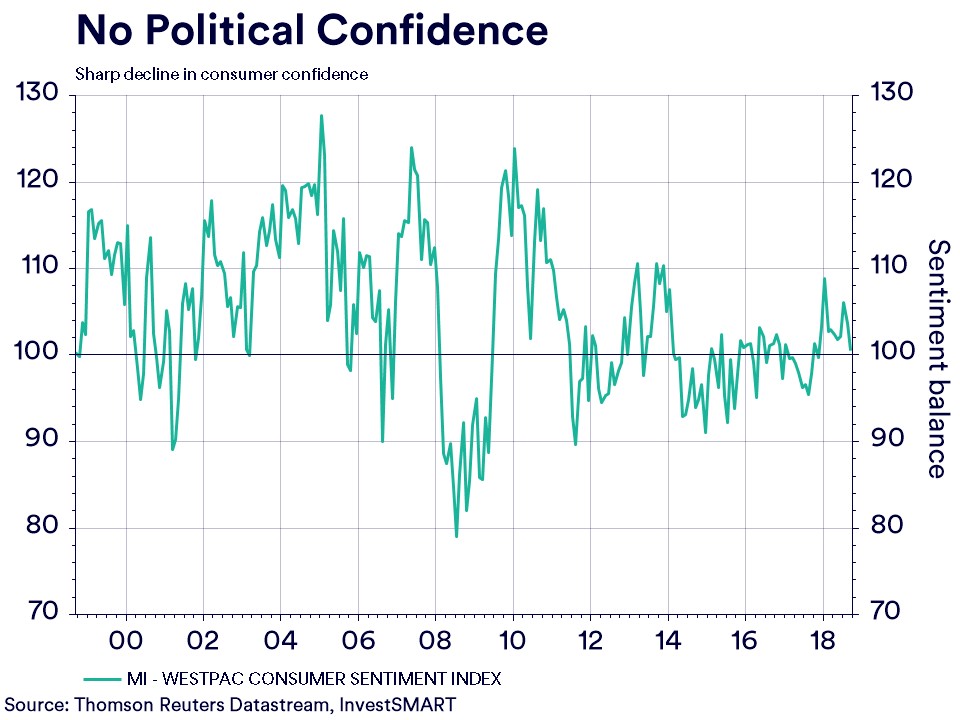

Although investment markets looked through the political issues that occurred in Canberra three weeks ago, consumer confidence did not. The revolving door that is the Prime Ministership of Australia saw the first consumer confidence read after the latest knifing falling 3 per cent month-on-month to 100.5 points ('optimism' is above 100). Confidence is still 2.7 per cent better than this time a year ago, but it has clearly had an impact. Perceptions of ‘economic conditions', ‘family finance', ‘buying a major household item' or ‘buying a new dwelling' all saw sharp declines year-on-year (as much as 4.6 per cent).

However, the fact this survey was conducted a week after the downing of former Prime Minister Malcom Turnbull suggests this read should be treated as an outlier. This should bounce in the short term.

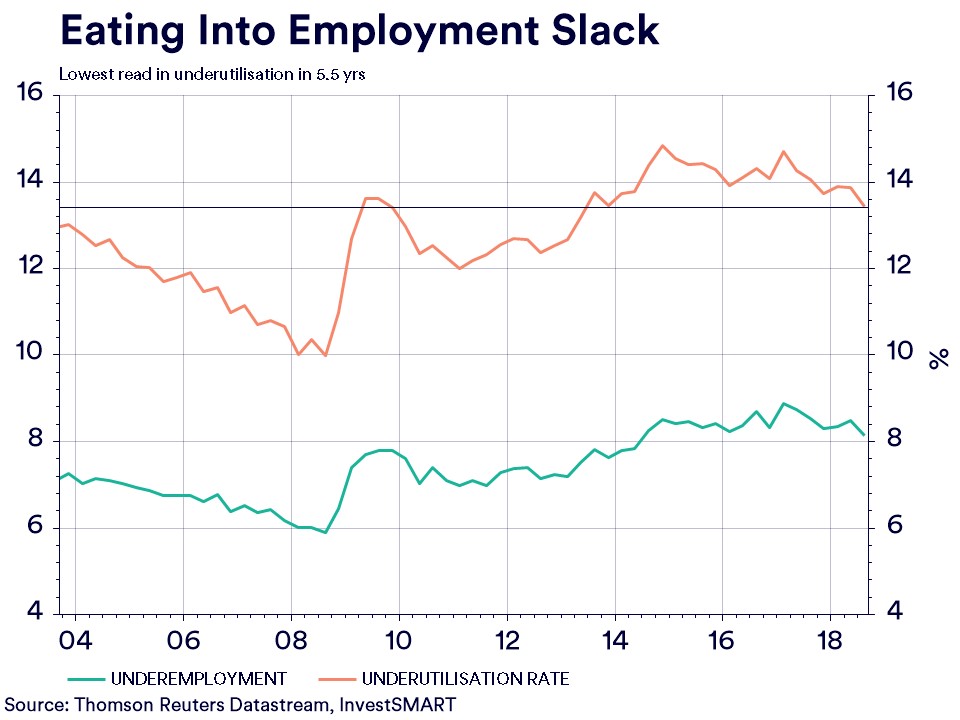

The major bright spot of the week was Australia's employment read, which showed that finally the mass jobs creation of the past 24 months is eating into the slack. The underutilisation rate fell to its lowest read in five years.

This change in employment smashed expectations, adding 44,000 jobs in August, while consensus was for 18,000 jobs to be added. More importantly though, it's the quality of jobs being created, and Australia has now seen approximately 105,000 full-time jobs created in 2018, following on from the 271,000 full-time jobs created in 2017. On top of this, we are finally seeing some positive news on underemployment and underutilisation – but will all of this translate into wages?

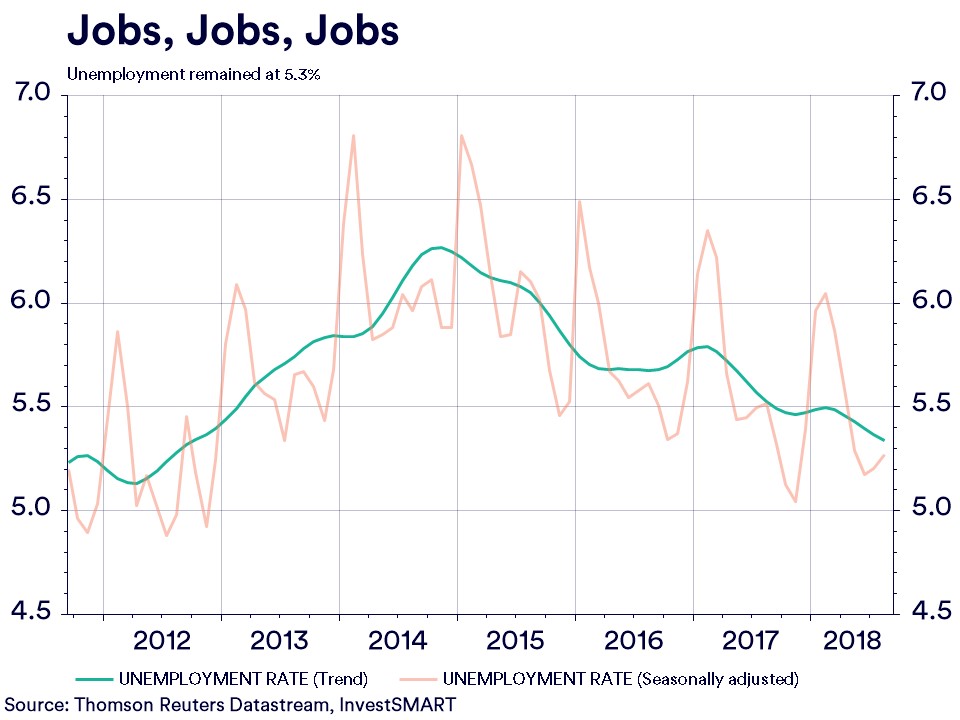

The unemployment rate held at 5.3 per cent on both a seasonal and trend basis. If prints like the one just seen in August continue, then unemployment is likely to head to 5 per cent over the coming six months.