Markets in Review: Two faces of economics

Painting a picture of the two faces of Australian economics, which reared their heads this week.

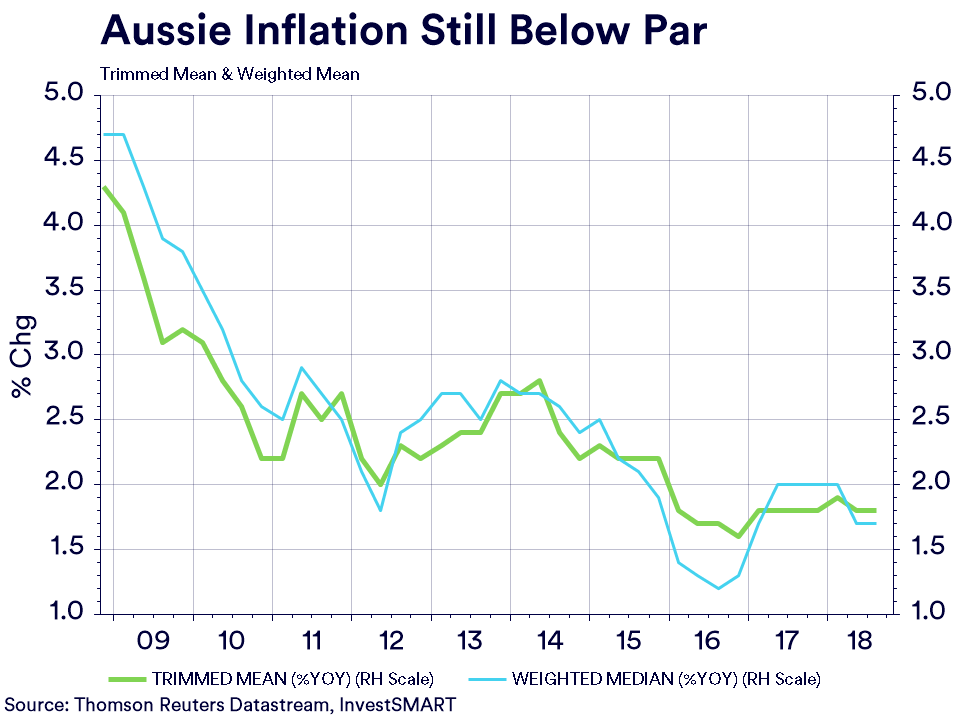

Inflation: The bad face

- Headline inflation year-on-year (YoY) increased 1.9 per cent in the September quarter. As expected, the main driver was the quarterly price surge in fuel which increased 1.4 per cent quarter-on-quarter (QoQ). This actually had a double impact, as transport inflation also increased 0.8 per cent QoQ. However, from a Reserve Bank of Australia (RBA) perspective, it’s core inflation that matters – which means stripping out volatile items, such as fuel and food, which both contributed heavily to the headline figure.

- Core inflation, as measured by the RBA, is trimmed mean (TM) CPI as well as weighted mean (WM) CPI. Both fell this quarter, but TM and WM are up 1.75 per cent and 1.7 per cent YoY respectively. It means, for the 16th consecutive quarter, TM hasn’t touched the RBA’s target band of 2-3 per cent, let alone even been inside it. The RBA will argue this was to be expected, as it forecasted in its latest Statement of Monetary Policy (SoMP) that ‘underlying inflation’ would be 1.75 per cent come the December quarter.

- The slowdown in housing. In the calendar year 2018, YoY housing has grown at 3.8% per cent in Q1, 3.2 per cent in Q2, and in the most recent quarter, 1.6 per cent – that marks quite the change. The Australian Bureau of Statistics (ABS) noted this: “The rise in the housing group is the lowest September quarter rise since 1998”. Housing over the past three years is the main reason CPI has come within an earshot of this band, so this trend is a concern.

- If this slowdown in housing inflation continues, and the cost of capital equally continues to increase, how will the RBA maintain its ‘glass ¾ full’ view of the economy? Remember, its core mandate is maintaining inflation in that band. Therefore, the further away CPI gets, the louder the call for the RBA to act and support inflation. Does that mean rate cuts? Unlikely, but it’s still becoming an issue.

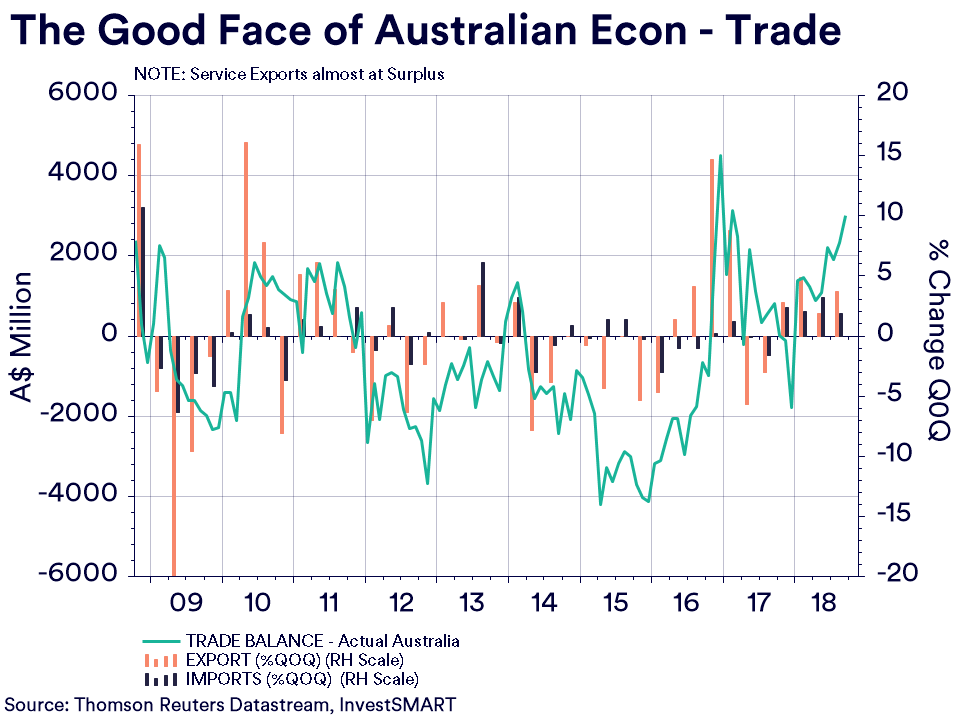

Trade: The good face

- Once again, trade has come to the rescue. The September read was the strongest surplus read since last year and the third biggest surplus of the past 10 years. The $3.017 billion surplus shows just how strong Australian exports currently are.

- Exports increased 3.2 per cent YoY as iron ore, copper, LNG and coal surged. Interestingly, the average price in iron ore and coal fell in September but was countered by the sheer volume exported. Chinese demand for Australian exports reached another record showing that Beijing is continuing to power ahead.

- It must also be noted the 30 per cent fall in the Australian dollar since its 2013 peak is having a strong positive effect. All four of these key export drivers (iron ore, copper, LNG and coal) are priced and transacted in US dollars. The Australian dollar tailwind has been a bonus to the value of trade and is creating a tourism boom – tourism surged 16.2 per cent YoY, so international travellers are clearly cashing in.

- The overall net export result is likely to be another big tick in the GDP read. Considering that, the RBA will likely ‘keep on keeping on’ in its current direction, despite inflation.