Markets in Review: Themes from earnings season

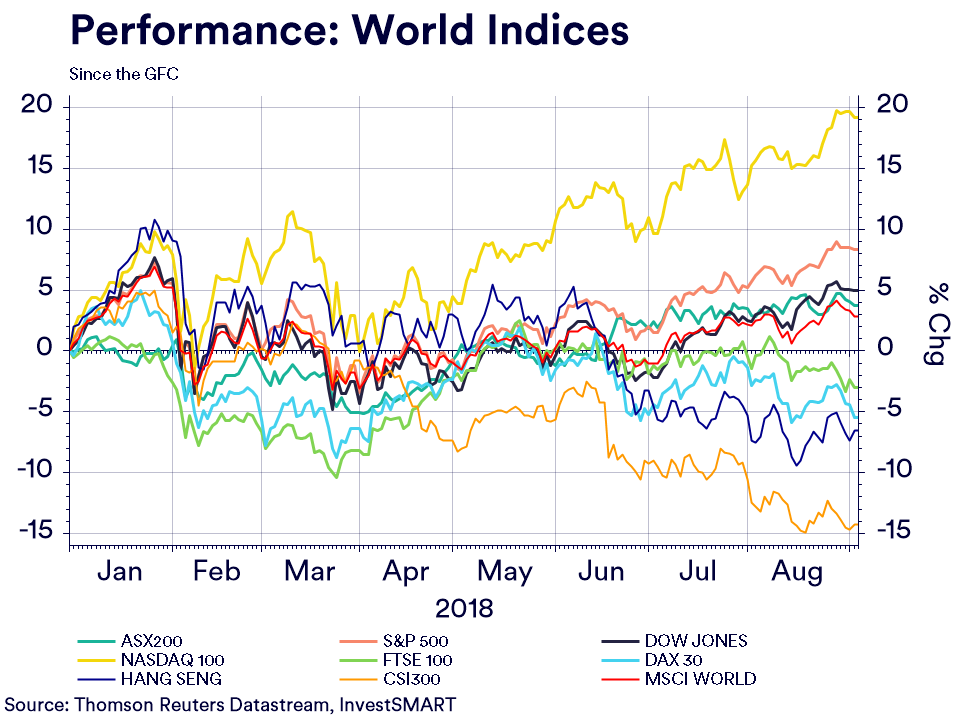

Leading into earning season the ASX, on a capital basis, had added 4.8 per cent year-to-date, it's up 5.7 per cent on a total return basis. Interestingly, on a global comparison basis the ASX is the fourth best performing market of the 23 development markets and is the second best performer by country considering the NASDAQ, S&P 500 and DOW are the three best performing markets in the world.

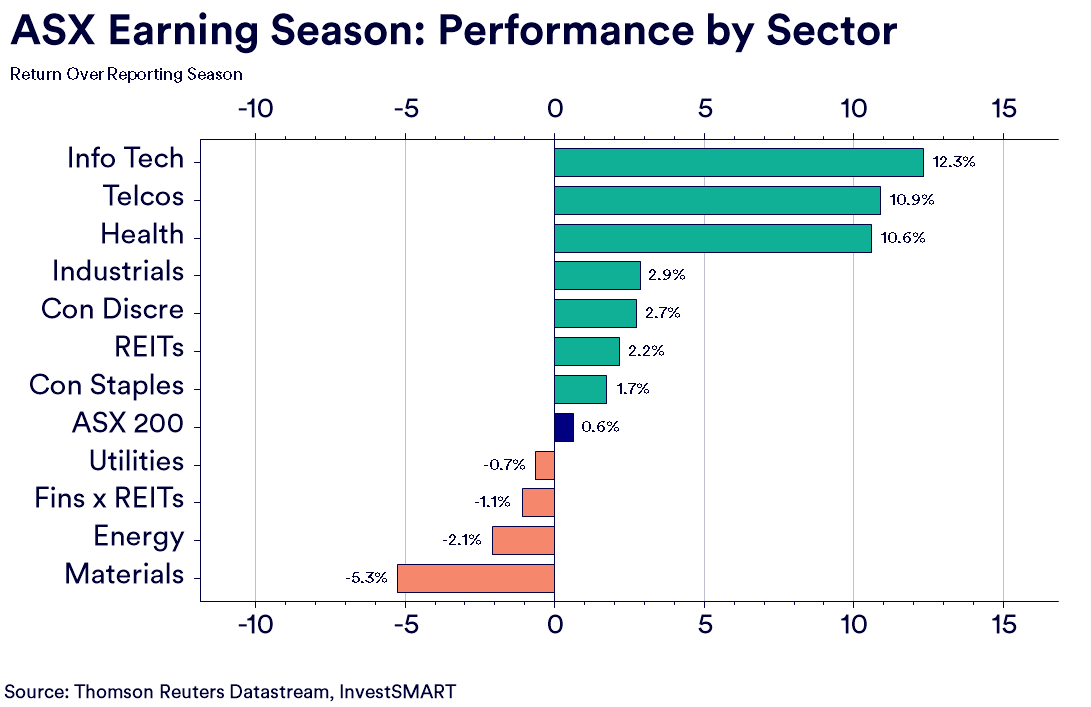

Over the month of August (earnings season), the ASX managed to add a further 0.6 per cent, however the variance over the season between sectors was large and slightly nonsensical considering the results delivered, and the multiples some firms are trading on.

Telcos are a case in point delivering anaemic or negative results but added 10.6 per cent over the month (mainly due to Telstra adding almost 20 per cent since its August low). Materials in the main delivered results above consensus results but dragged considerably. Now, one could argue telcos are coming from a low base and the reverse for materials but on the actuals alone these moves are interesting.

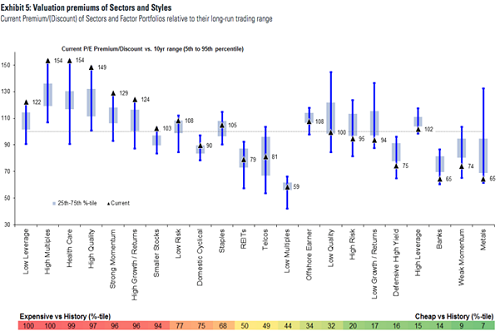

Earnings season galvanised the drive into high multiple stocks even though the average EPS upgrade was only 1.5 per cent. Of the best 15 stocks over the earnings season the majority had elevated fundamentals (the average P/E of these firms was 25x). Investors continue to gravitate to the high momentum, high quality and healthcare plays even though these categories are at eye-watering multiples.

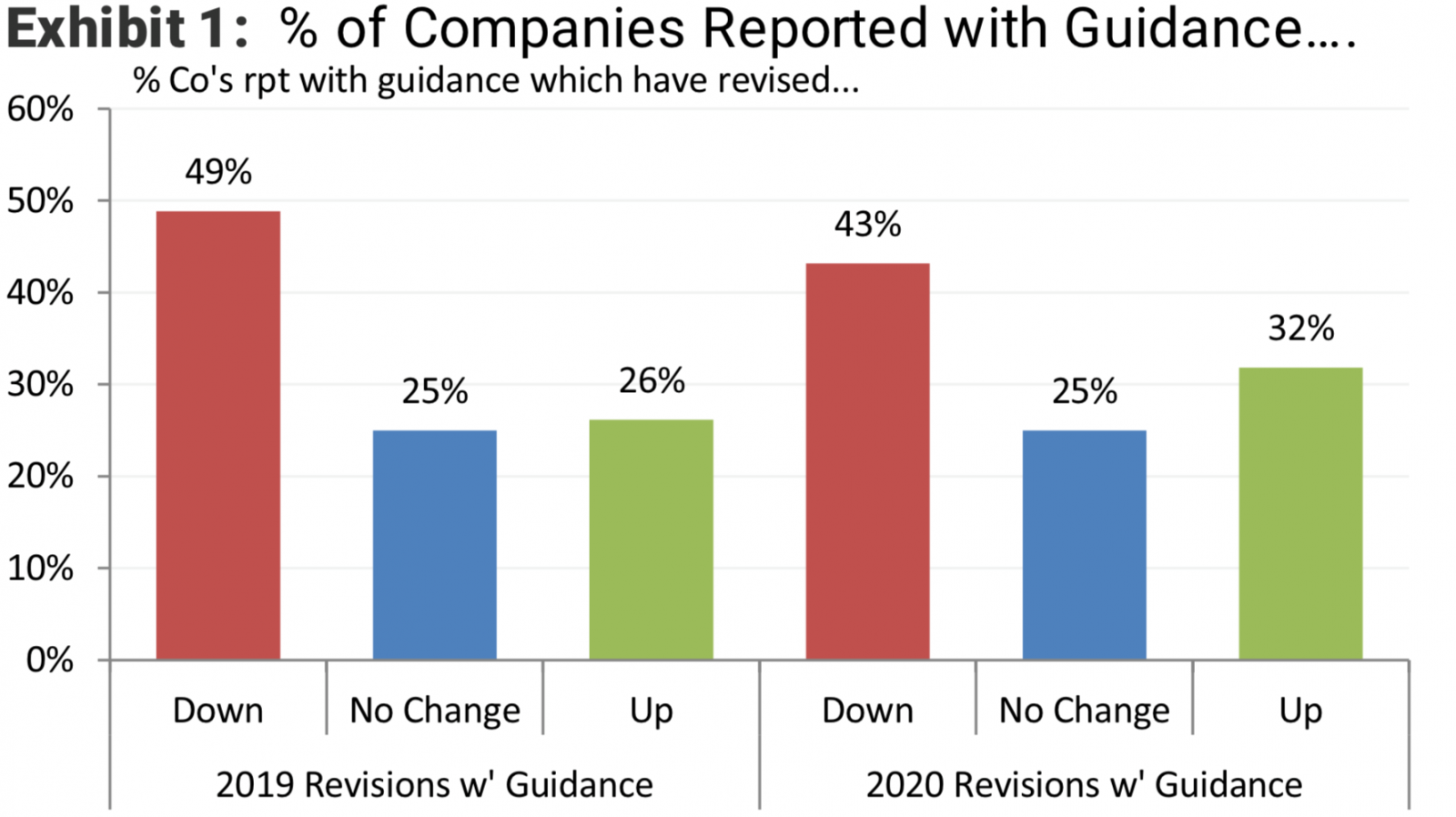

The outlook from firms was also a little more downbeat compared to their initial guidance at the half year reporting season in February. Almost 50 per cent of firms that report forward guidance downgrade their outlook.

(Source: Morgan Stanley)

Reasoning for the guidance changes came down to four key outlook themes.

- Developed world activity has begun to show signs of fatigue and slowed 0.5 per cent to 3 per cent in the final half of FY18.

- World oil prices are up 20 per cent and has impacted on operational costings

- Cost inflation growth is at its highest rate in a decade, which weighed on actuals and is filtering into guidance. Examples include: QAN and VAH on things like jet fuel. ANN saw a price jump in synthetic latex and BHP and those that import goods based in $US.

- Geopolitical risk firms alluded to the impacts of tariffing and other macro event risks as impacting growth and future revenues most evident in materials and energy.

.png)